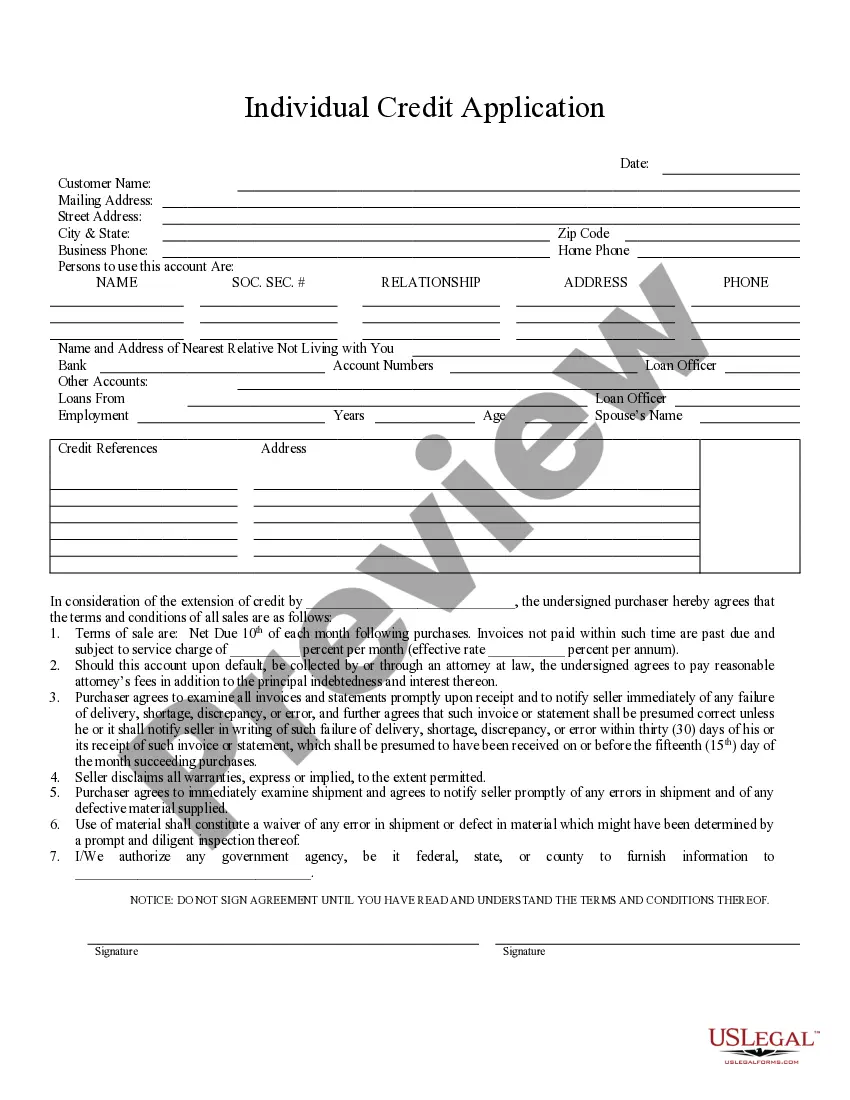

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Springfield Missouri Individual Credit Application

Description

How to fill out Missouri Individual Credit Application?

Locating validated templates relevant to your local laws can be challenging unless you utilize the US Legal Forms repository.

It is an online database of over 85,000 legal documents for both personal and business purposes and various real-world scenarios.

All the forms are accurately organized by category and jurisdiction, making it as quick and simple as ABC to find the Springfield Missouri Individual Credit Application.

Maintaining organized paperwork that adheres to legal standards is highly significant. Utilize the US Legal Forms library to consistently have crucial document templates for any requirements at your fingertips!

- Review the Preview mode and form description.

- Ensure you’ve selected the correct one that fulfills your requirements and aligns completely with your local jurisdiction standards.

- Look for an alternative template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next step.

- Complete the purchase of the document.

Form popularity

FAQ

The 2/3/4 rule for credit cards refers to a guideline for managing multiple credit accounts. It suggests that you maintain two credit cards with no balances, use three cards regularly, and avoid using more than four credit accounts at one time. Understanding this rule can enhance your credit score, which can positively impact your Springfield Missouri Individual Credit Application.

A personal credit application is a formal request for credit that gathers relevant financial information, including income, expenses, and credit history. This application helps lenders evaluate your ability to repay borrowed funds. When you utilize the Springfield Missouri Individual Credit Application, you ensure that all necessary details are included for a smoother approval process.

When writing a letter to request credit, start by clearly stating your intent and including your personal details. Specify the amount you are requesting and provide a brief rationale for your application, such as your repayment ability. Using the Springfield Missouri Individual Credit Application as a template may help streamline this process.

Getting approved for a personal line of credit can vary based on several factors, including your credit score and income. Generally, if you maintain a good credit history and demonstrate stable income, your chances of approval increase. Consider using our Springfield Missouri Individual Credit Application to understand better what information is needed for your application.

To request a Springfield Missouri Individual Credit Application, you can visit our website and navigate to the credit application section. There, you will find a simple form to fill out with your information. Once you submit your request, we will process it promptly and provide you with all necessary instructions.

To file the Missouri Property Tax Credit (mo.ptc), start by gathering all necessary documents, such as proof of income and property ownership details. Then, complete the appropriate application form, either online or by mail, ensuring you meet the submission deadlines. Don’t forget, detailed guidance can be found through the Springfield Missouri Individual Credit Application, aiding you in this filing process.

Yes, you can file the Missouri Property Tax Credit (mo.ptc) online, which simplifies the submission process. By following the online instructions, you can easily complete and submit your application from the comfort of your home. This efficient method helps streamline your tax filing. Refer to the Springfield Missouri Individual Credit Application for assistance if needed.

To claim your Missouri tax credit, you must submit the appropriate application to the Missouri Department of Revenue. Ensure that all required documents are included to avoid delays in processing. It is also crucial to adhere to application deadlines, as they can vary based on the credit type. For specific instructions, the Springfield Missouri Individual Credit Application provides comprehensive details.

Yes, you can obtain a Missouri tax waiver online, making the process convenient for residents. This option allows you to submit necessary documents without the need to visit an office in person. Utilizing the online system can save you time and effort. For further clarity, the Springfield Missouri Individual Credit Application can also help you navigate this process smoothly.

Similar to the Missouri Property Tax Credit (PTC), the income limit for property tax credits is important for homeowners to understand. Individuals can claim up to $30,000, while married couples filing jointly can claim up to $34,000. Knowing these limits will greatly aid in your financial planning and benefit calculation. Accessing resources related to the Springfield Missouri Individual Credit Application can provide you with detailed guidance.