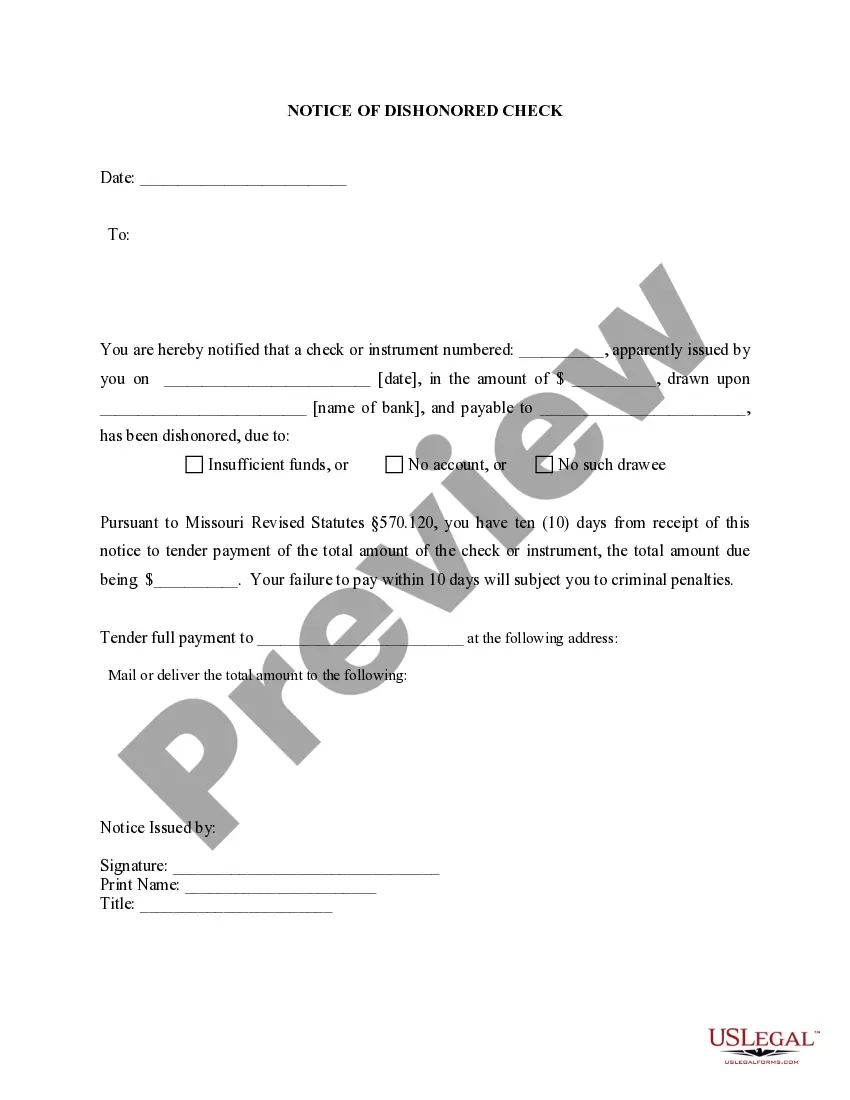

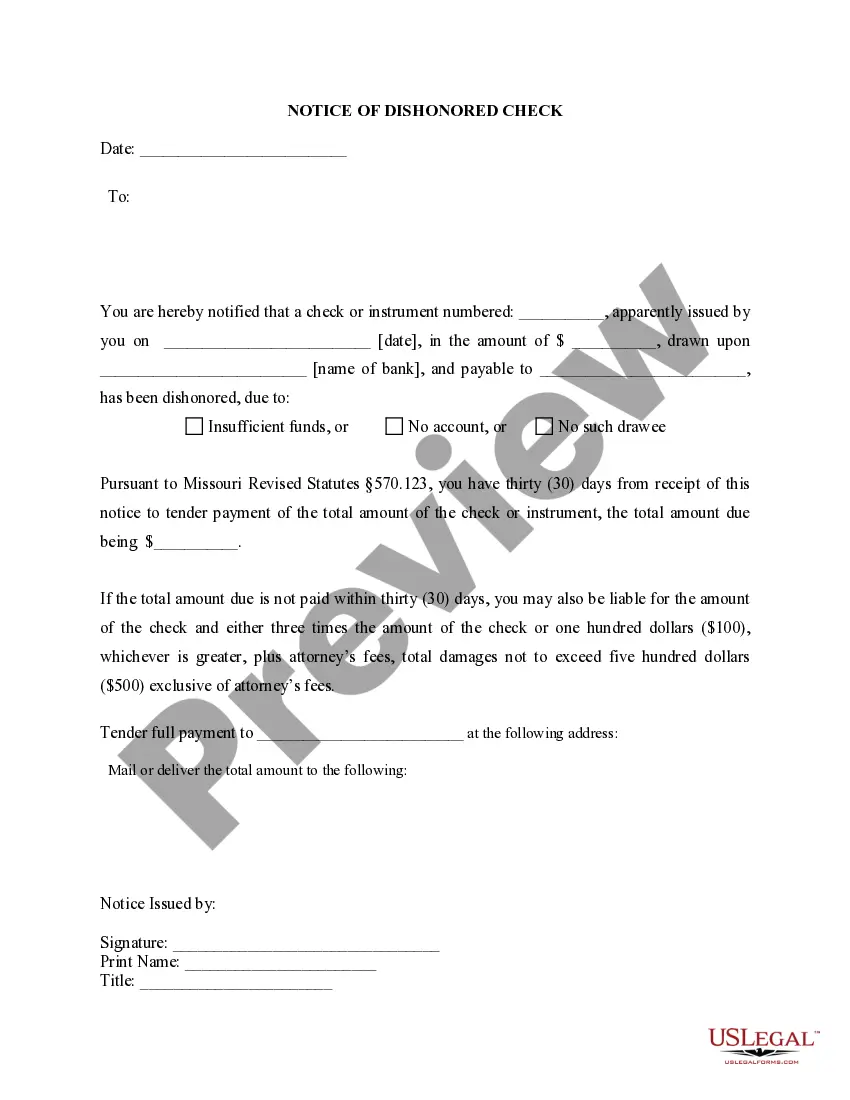

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Springfield Missouri Notice of Dishonored Check — Civil: Dealing with Bad or Bounced Checks If you have recently issued or received a check that has been returned unpaid due to insufficient funds, then you may be familiar with the Springfield Missouri Notice of Dishonored Check — Civil process. This legal procedure is initiated when a check writer's bank refuses payment, leaving the recipient with a bad or bounced check. In Springfield, Missouri, this notice serves as an official warning to the check writer, informing them of their defaulted payment and setting the stage for potential legal action to recover the funds owed. A bad check, also referred to as an NSF (non-sufficient funds) check, is a check that is returned by the bank because the account holder doesn't have enough money to cover the payment. On the other hand, a bounced check typically refers to a check that is returned unpaid due to various reasons, such as a closed account, an expired check, or a mismatched signature. When dealing with a bad or bounced check in Springfield, Missouri, it is important to understand the different types of Springfield Missouri Notice of Dishonored Check — Civil that can be involved: 1. Informal Notice: In many cases, the recipient of a dishonored check may initially opt for informal measures, such as contacting the check writer directly, alerting them of the returned check, and requesting immediate payment. This informal notice serves as an initial opportunity for the check writer to rectify the situation voluntarily without escalating to formal legal action. 2. Formal Notice of Dishonored Check: If the check writer fails to respond or resolve the issue after the informal notice, the recipient may proceed to issue a formal Notice of Dishonored Check. This document outlines the details of the bounced check, including the check amount, date, and the bank's reason for dishonor. It also specifies a deadline, usually within 30 days, by which the check writer must make full payment to avoid further legal consequences. 3. Potential Legal Action: If the check writer disregards the formal notice or fails to comply with the payment deadline, the recipient has the right to pursue legal action. This can involve filing a lawsuit in a civil court to recover the amount owed, plus any associated fees, penalties, or attorney costs. In such cases, additional legal documents may come into play, such as a Complaint or a Summons, which further formalize the legal process. It's crucial to note that laws and regulations regarding dishonored checks may vary from jurisdiction to jurisdiction. Therefore, it is advisable to consult with an attorney specializing in this area to ensure that you are following the correct legal procedures when dealing with a Springfield Missouri Notice of Dishonored Check — Civil. If you find yourself in a situation where you have received a bad or bounced check in Springfield, Missouri, it's important to act promptly. By understanding the process of the Notice of Dishonored Check — Civil and the available legal options, you can make informed decisions to protect your rights and seek the appropriate resolution.Springfield Missouri Notice of Dishonored Check — Civil: Dealing with Bad or Bounced Checks If you have recently issued or received a check that has been returned unpaid due to insufficient funds, then you may be familiar with the Springfield Missouri Notice of Dishonored Check — Civil process. This legal procedure is initiated when a check writer's bank refuses payment, leaving the recipient with a bad or bounced check. In Springfield, Missouri, this notice serves as an official warning to the check writer, informing them of their defaulted payment and setting the stage for potential legal action to recover the funds owed. A bad check, also referred to as an NSF (non-sufficient funds) check, is a check that is returned by the bank because the account holder doesn't have enough money to cover the payment. On the other hand, a bounced check typically refers to a check that is returned unpaid due to various reasons, such as a closed account, an expired check, or a mismatched signature. When dealing with a bad or bounced check in Springfield, Missouri, it is important to understand the different types of Springfield Missouri Notice of Dishonored Check — Civil that can be involved: 1. Informal Notice: In many cases, the recipient of a dishonored check may initially opt for informal measures, such as contacting the check writer directly, alerting them of the returned check, and requesting immediate payment. This informal notice serves as an initial opportunity for the check writer to rectify the situation voluntarily without escalating to formal legal action. 2. Formal Notice of Dishonored Check: If the check writer fails to respond or resolve the issue after the informal notice, the recipient may proceed to issue a formal Notice of Dishonored Check. This document outlines the details of the bounced check, including the check amount, date, and the bank's reason for dishonor. It also specifies a deadline, usually within 30 days, by which the check writer must make full payment to avoid further legal consequences. 3. Potential Legal Action: If the check writer disregards the formal notice or fails to comply with the payment deadline, the recipient has the right to pursue legal action. This can involve filing a lawsuit in a civil court to recover the amount owed, plus any associated fees, penalties, or attorney costs. In such cases, additional legal documents may come into play, such as a Complaint or a Summons, which further formalize the legal process. It's crucial to note that laws and regulations regarding dishonored checks may vary from jurisdiction to jurisdiction. Therefore, it is advisable to consult with an attorney specializing in this area to ensure that you are following the correct legal procedures when dealing with a Springfield Missouri Notice of Dishonored Check — Civil. If you find yourself in a situation where you have received a bad or bounced check in Springfield, Missouri, it's important to act promptly. By understanding the process of the Notice of Dishonored Check — Civil and the available legal options, you can make informed decisions to protect your rights and seek the appropriate resolution.