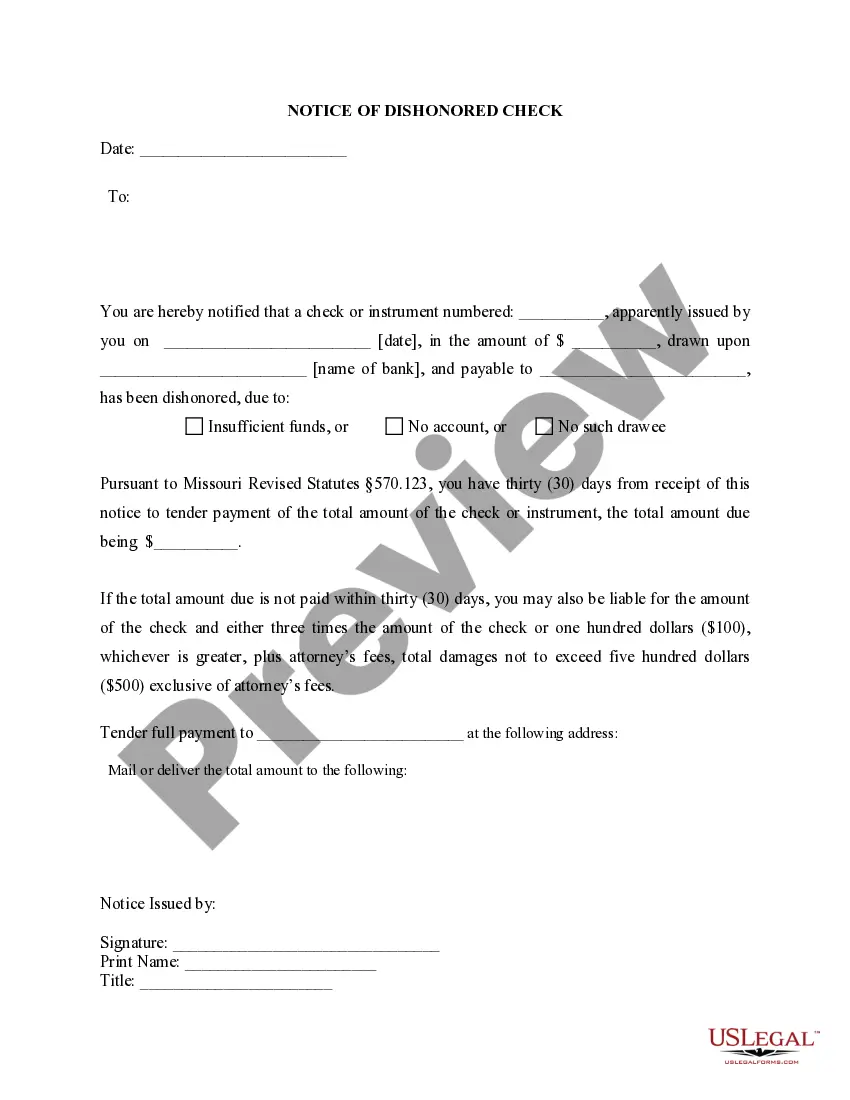

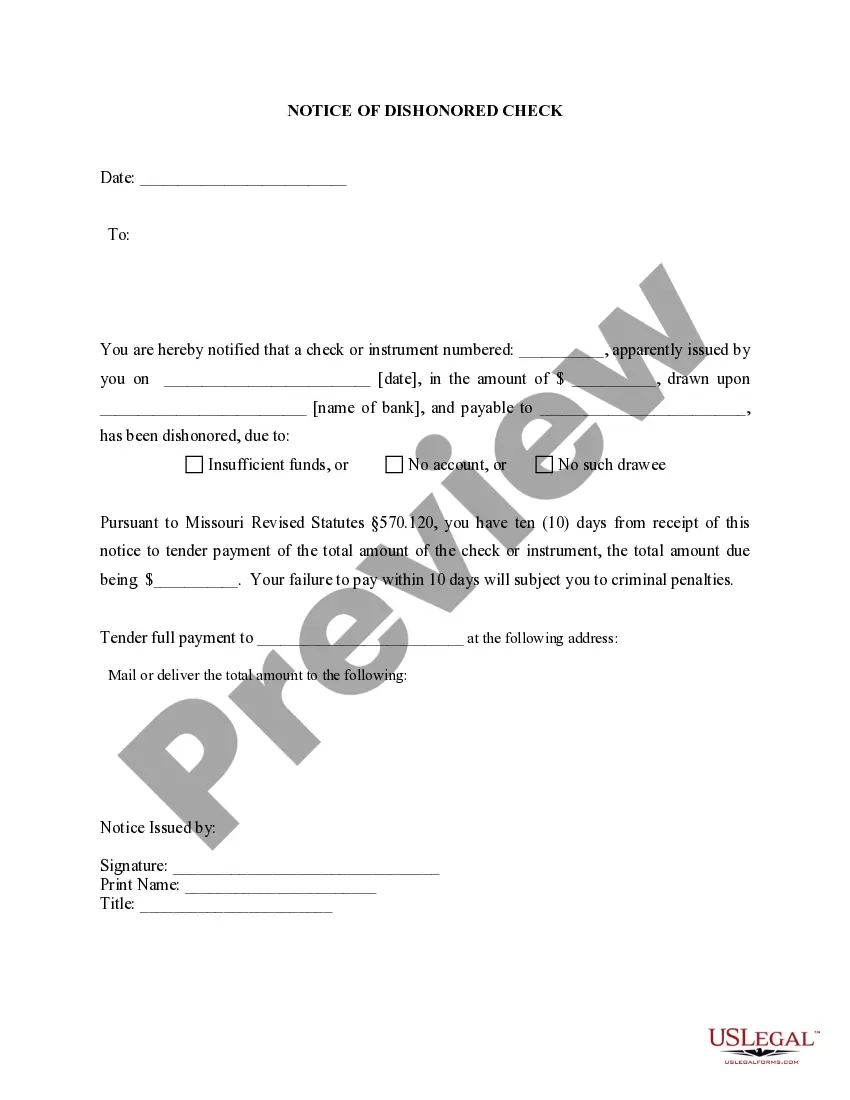

This is a Complaint - Warrant for Dishonored Check - Criminal. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the Springfield Missouri Notice of Dishonored Check — Criminal Introduction: In Springfield, Missouri, the Notice of Dishonored Check — Criminal is a legal document informing individuals about the consequences and penalties associated with writing bad or bounced checks. This detailed description aims to provide information about the types of bad checks, bouncing checks, and the potential recourse for violating related legal obligations. 1. What is a Bad Check? A bad check refers to a check that is not honored by the bank due to insufficient funds in the account, closed accounts, or unauthorized alterations. Writing a bad check, whether intentionally or mistakenly, is considered unlawful in Springfield, Missouri. 2. Understanding a Bounced Check: When a check is returned to the payee unpaid by the bank due to insufficient funds or other reasons, it is commonly referred to as a bounced check. A bounced check can result in various legal consequences if not promptly addressed. 3. Types of Springfield Missouri Notice of Dishonored Check — Criminal: a. Notice of Dishonored Check — Criminal: Insufficient Fund— - In cases where a check hasn't been honored due to a lack of available funds in the account, this notice serves as a warning about the potential criminal charges that may be filed. b. Notice of Dishonored Check — Criminal: CloseAccountun— - The notice notifies individuals about potential criminal charges resulting from writing a check from a closed bank account. c. Notice of Dishonored Check — Criminal: Unauthorized Alteration— - This type of notice specifically addresses situations where a check has been altered without proper authorization, leading to dishonor by the bank. 4. Consequences of Writing Bad or Bounced Checks: a. Criminal Charges: If a person is found guilty of intentionally writing a bad check or bouncing a check, they may face criminal charges. This could result in fines, probation, community service, or even imprisonment, depending on the severity of the offense. b. Payee's Recourse: When a check bounces, the payee has the right to seek repayment for the amount owed, along with any associated fees. The payee may pursue legal action against the issuer of the bad check to recover their losses. c. Civil Penalties: In addition to potential criminal charges, individuals who write bad checks may also be subject to civil penalties, wherein the payee can sue for damages, adding further financial repercussions. d. Negative Impact on Credit: Writing bad checks can negatively affect an individual's credit rating. Banks and other financial institutions may also report this to credit bureaus, potentially resulting in difficulties while seeking loans or credit in the future. Conclusion: It is crucial to understand the implications associated with writing bad or bounced checks in Springfield, Missouri. By adhering to financial responsibilities and ensuring sufficient funds are available before issuing checks, individuals can avoid the legal consequences, protect their financial reputation, and maintain good standing within their community.Title: Understanding the Springfield Missouri Notice of Dishonored Check — Criminal Introduction: In Springfield, Missouri, the Notice of Dishonored Check — Criminal is a legal document informing individuals about the consequences and penalties associated with writing bad or bounced checks. This detailed description aims to provide information about the types of bad checks, bouncing checks, and the potential recourse for violating related legal obligations. 1. What is a Bad Check? A bad check refers to a check that is not honored by the bank due to insufficient funds in the account, closed accounts, or unauthorized alterations. Writing a bad check, whether intentionally or mistakenly, is considered unlawful in Springfield, Missouri. 2. Understanding a Bounced Check: When a check is returned to the payee unpaid by the bank due to insufficient funds or other reasons, it is commonly referred to as a bounced check. A bounced check can result in various legal consequences if not promptly addressed. 3. Types of Springfield Missouri Notice of Dishonored Check — Criminal: a. Notice of Dishonored Check — Criminal: Insufficient Fund— - In cases where a check hasn't been honored due to a lack of available funds in the account, this notice serves as a warning about the potential criminal charges that may be filed. b. Notice of Dishonored Check — Criminal: CloseAccountun— - The notice notifies individuals about potential criminal charges resulting from writing a check from a closed bank account. c. Notice of Dishonored Check — Criminal: Unauthorized Alteration— - This type of notice specifically addresses situations where a check has been altered without proper authorization, leading to dishonor by the bank. 4. Consequences of Writing Bad or Bounced Checks: a. Criminal Charges: If a person is found guilty of intentionally writing a bad check or bouncing a check, they may face criminal charges. This could result in fines, probation, community service, or even imprisonment, depending on the severity of the offense. b. Payee's Recourse: When a check bounces, the payee has the right to seek repayment for the amount owed, along with any associated fees. The payee may pursue legal action against the issuer of the bad check to recover their losses. c. Civil Penalties: In addition to potential criminal charges, individuals who write bad checks may also be subject to civil penalties, wherein the payee can sue for damages, adding further financial repercussions. d. Negative Impact on Credit: Writing bad checks can negatively affect an individual's credit rating. Banks and other financial institutions may also report this to credit bureaus, potentially resulting in difficulties while seeking loans or credit in the future. Conclusion: It is crucial to understand the implications associated with writing bad or bounced checks in Springfield, Missouri. By adhering to financial responsibilities and ensuring sufficient funds are available before issuing checks, individuals can avoid the legal consequences, protect their financial reputation, and maintain good standing within their community.