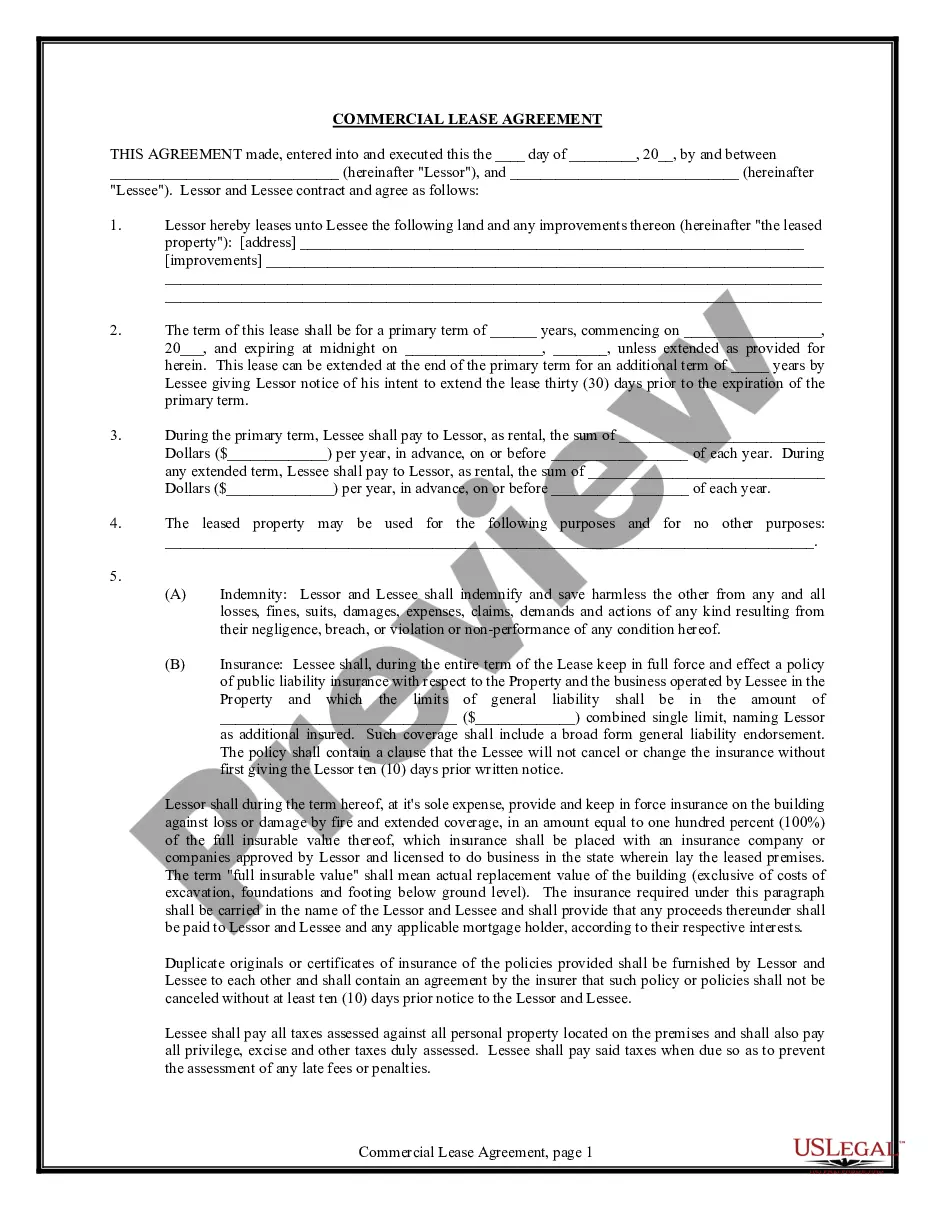

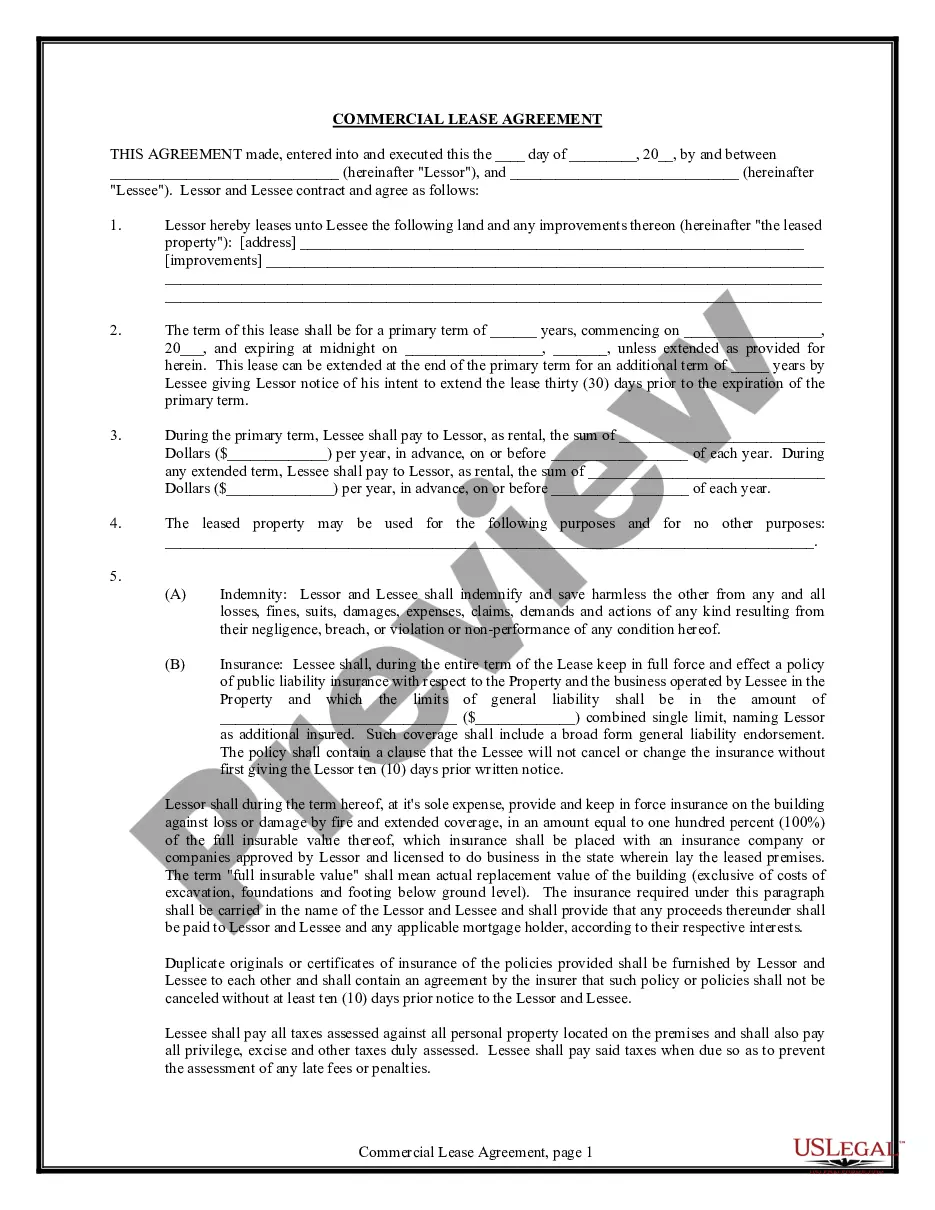

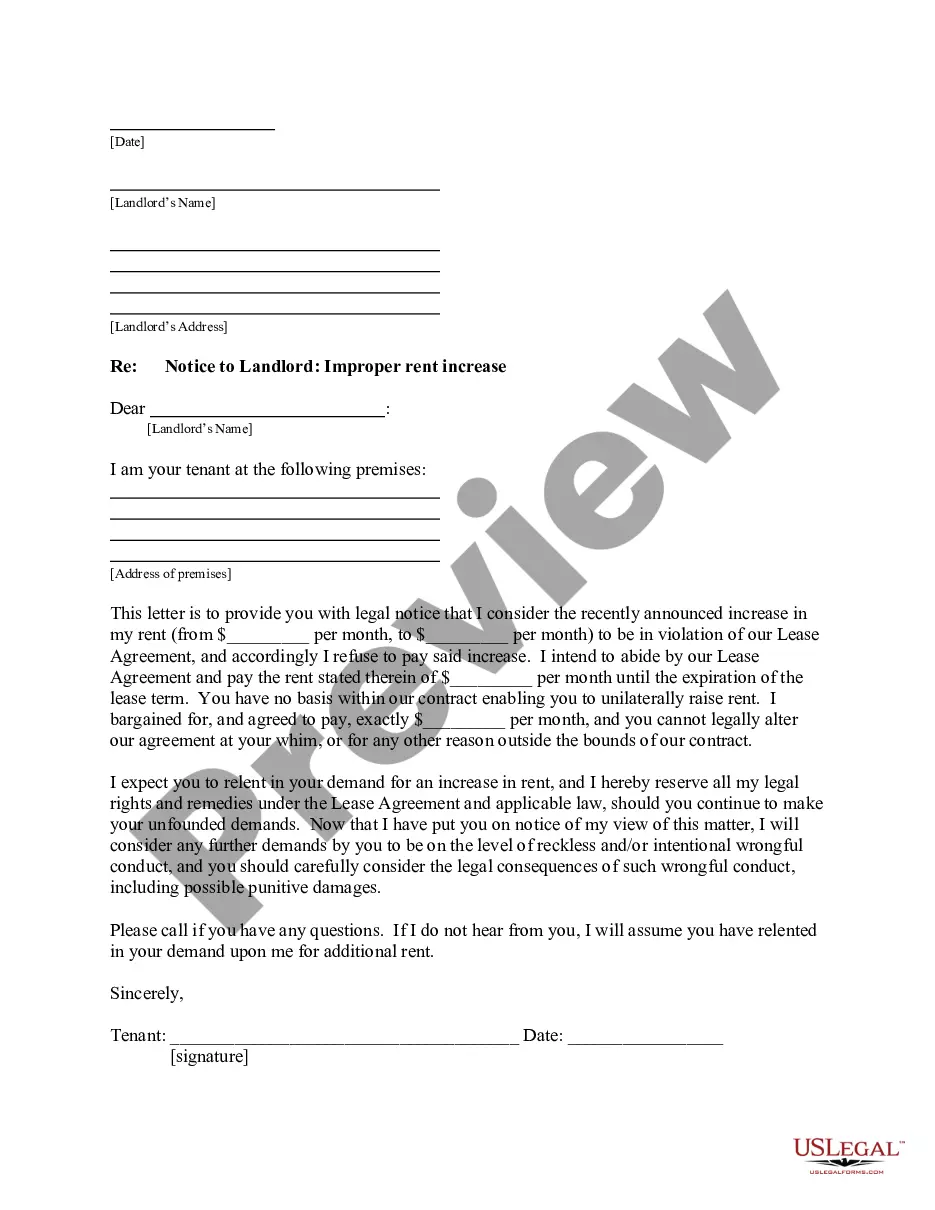

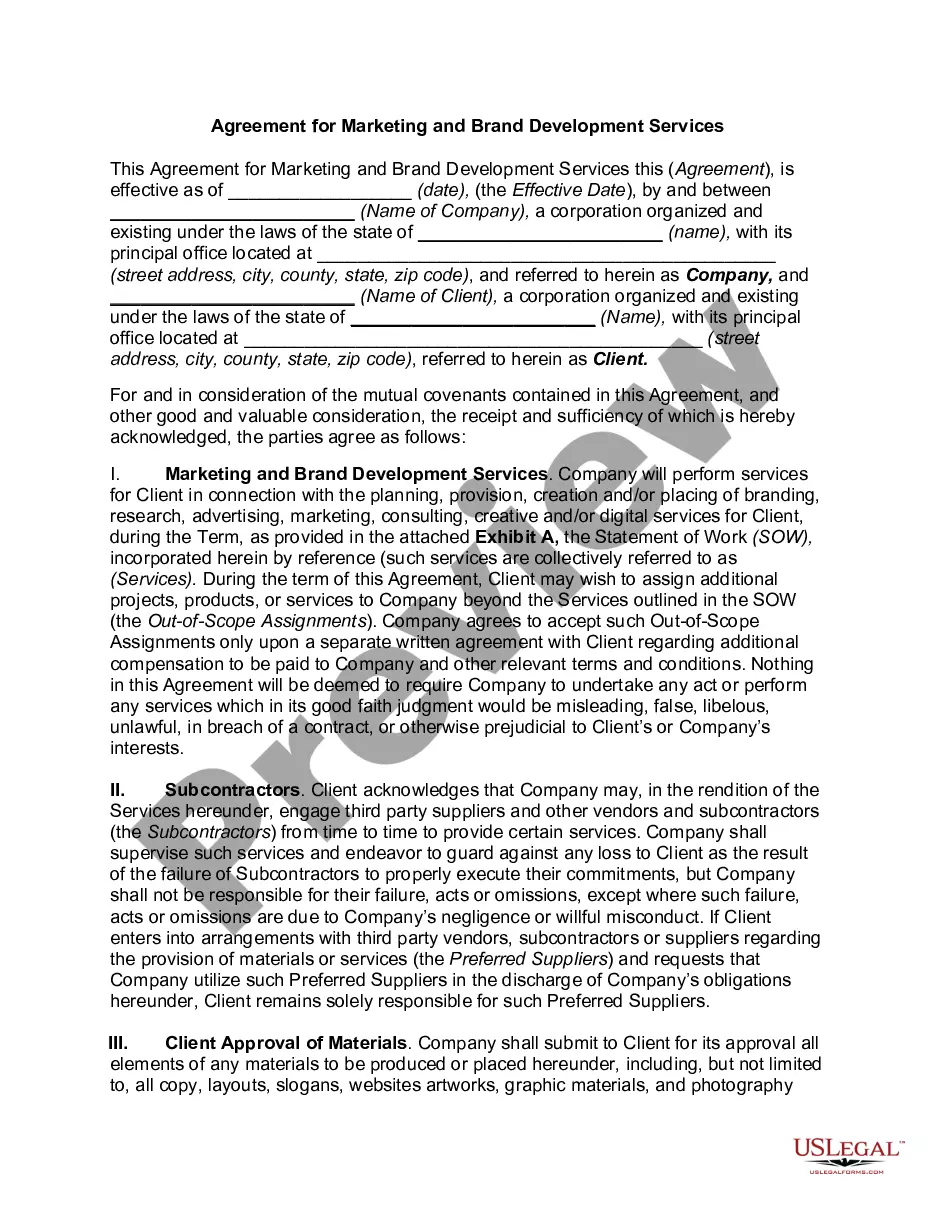

This is a commercial lease form for the State of Missouri. It is for leasing a building for any use, such as an office. This lease is very detailed and includes provisions addressing the areas of lease term, payment of rent, later charges, utilities, condition of premises, security deposits, default, termination, right of re-entry, holdover, and many other legal clauses. Make changes to suit your needs and agreement with your lessee.

Kansas City Missouri Commercial Building or Space Lease

Description

How to fill out Missouri Commercial Building Or Space Lease?

Are you searching for a reliable and affordable provider of legal forms to purchase the Kansas City Missouri Commercial Building or Space Lease? US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are tailored and crafted in alignment with the regulations of particular states and counties.

To obtain the document, you need to Log In to your account, find the needed template, and click the Download button next to it. Please remember that you can download your previously acquired document templates anytime in the My documents section.

Is this your first visit to our site? No problem. You can set up an account in just a few minutes, but beforehand, ensure you take the following steps.

Now you can create your account. Then choose the subscription plan and continue to payment. After the payment is completed, download the Kansas City Missouri Commercial Building or Space Lease in any available file format. You can revisit the website anytime to redownload the document at no additional cost.

Obtaining the most current legal forms has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending hours trying to understand legal documents online.

- Check if the Kansas City Missouri Commercial Building or Space Lease adheres to your state and local jurisdiction's regulations.

- Review the document's description (if available) to ascertain who and what the document is suitable for.

- Restart your search if the template does not fit your legal situation.

Form popularity

FAQ

In the state of Missouri, any lessor or renter who has paid tax on any previous purchase, lease, or rental of vehicle, will not be required to collect tax on any subsequent lease, rental, sub-lease or sub-rental. Sales of tangible media property are subject to sales tax in Missouri.

Rental income is taxed as ordinary income. This means that if the marginal tax bracket you're in is 22% and your rental income is $5,000, you'll end up paying $1,100. Here's the math we used to calculate that tax payment: $5,000 x . 22 = $1,100.

Copies of existing Occupant Load Certificates (OLC) can be obtained for a $33.00 fee. Please contact Permits Division, cdpermits@kcmo.org or (816) 513-1459, for guidance. Valid only for existing uses with no changes.

What to know about short term rentals in KCMO. In 2018, Kansas City Council passed an ordinance to regulate short term rentals, including Airbnb and Vrbo listings. The regulations include an approval and registration process that requires prospective hosts to update their neighbors about any new short term rental units

To apply for a Zoning Clearance for a business license can be made in two ways: Apply with KCMO BizCare. Apply on CompassKC for a ?Zoning Clearance for Business License?

Like hotel and B&B stays, short-term rentals in Missouri are subject to tax. Tax authorities require short-term vacation rental hosts to collect applicable short-term rental taxes from their guests and remit them to the proper authorities.

If your income is: Less than the basic rate threshold of £12,570 ? you'll pay 0% in tax on rental income. Above £12,570 and below the higher rate threshold of £50,270 - you'll pay 20% in tax on rental income. Above £50,270 and below the additional rate threshold of £150,000 ? you'll pay 40% in tax on rental income.

To calculate, first multiply the monthly rent amount by the number of months in the year to determine the income from rent; then, divide the income from rent by the appreciated home value. For example, if the monthly rent is $900, the total income from rent for the year would equal $10,800.

All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned.

The good news is, you can reduce what you owe in income taxes on rental income by claiming deductions for depreciation and rental expenses, such as maintenance, upkeep and repairs. When you sell a rental property, you may owe capital gains tax on the sale.