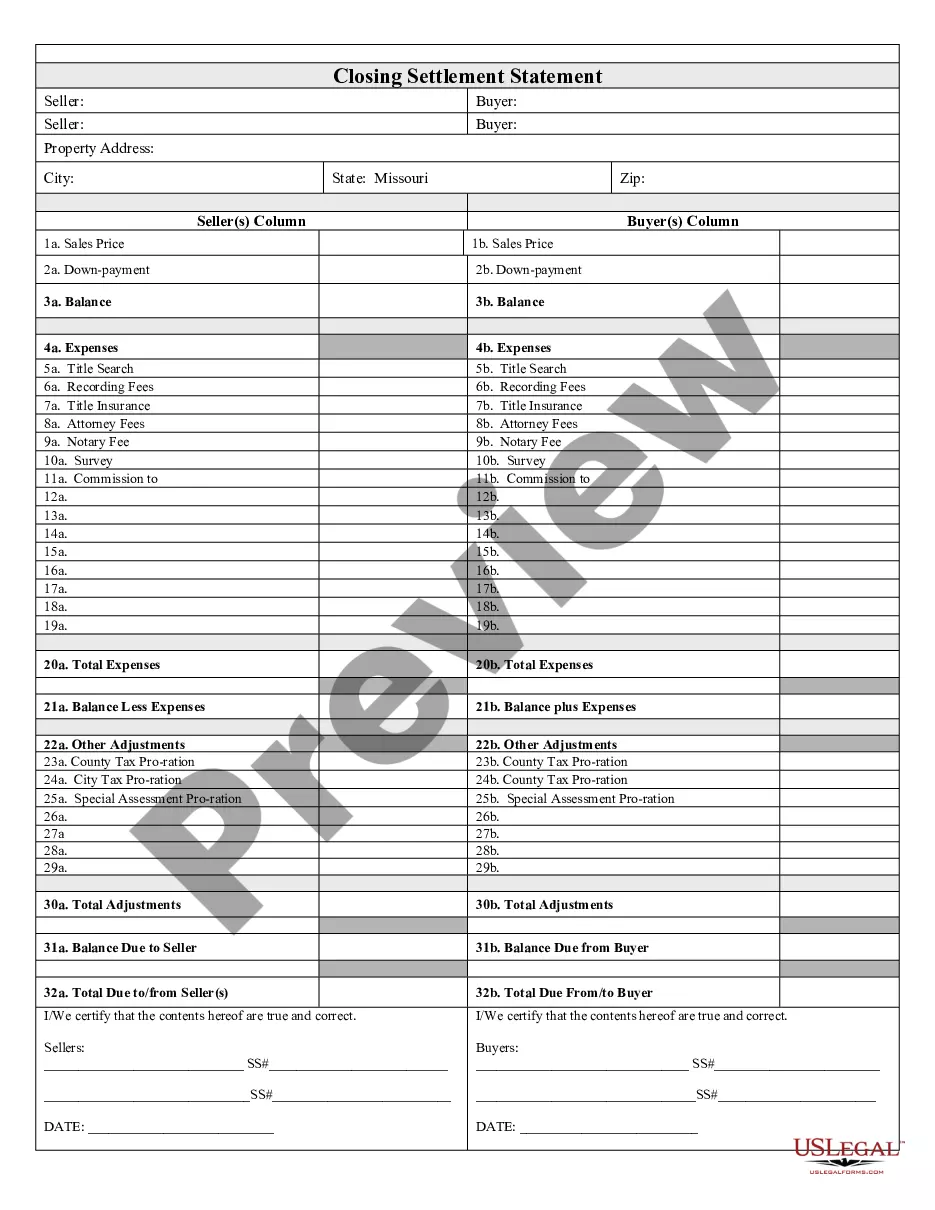

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Springfield Missouri Closing Statement

Description

How to fill out Missouri Closing Statement?

Take advantage of the US Legal Forms and gain instant access to any document you desire.

Our valuable platform featuring thousands of files enables you to locate and acquire nearly any document sample you require.

You can download, complete, and sign the Springfield Missouri Closing Statement in mere minutes instead of spending several hours online searching for an appropriate template.

Using our catalog is a fantastic method to enhance the security of your document submissions.

If you do not have an account yet, follow the instructions listed below.

Visit the page with the template you need. Verify that it is the template you were looking for: check its title and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search bar to locate the required one.

- Our expert lawyers frequently assess all records to guarantee that the forms are pertinent to a specific state and adhere to new laws and regulations.

- How can you obtain the Springfield Missouri Closing Statement.

- If you possess a profile, simply Log In to your account.

- The Download button will be active on all the documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

In Springfield, Missouri, quiet time typically starts at 10 PM on weekdays and 11 PM on weekends. This quiet time restricts noise and disturbances to ensure a peaceful environment for residents. Understanding local regulations regarding quiet hours is important for maintaining good relationships with neighbors. For those involved in real estate transactions, including understanding your Springfield Missouri closing statement, being aware of local ordinances can benefit you in your investment.

To file a complaint in Missouri, visit the appropriate state agency's website or contact them directly. Each agency has its own procedures for handling complaints. If your complaint relates to real estate transactions, reviewing your Springfield Missouri Closing Statement will help you navigate the specifics of your case more effectively.

Yes, you can get married at the Greene County courthouse in Springfield, MO. You will need to obtain a marriage license beforehand, which is a straightforward process. Additionally, if you are buying a house together and want to ensure smooth transactions, reviewing your Springfield Missouri Closing Statement is advisable.

If you need to report a nuisance property in Springfield, Missouri, you should contact the city's code enforcement division directly. They handle issues such as overgrown lawns, abandoned vehicles, and unsafe buildings. When involved in property matters, the Springfield Missouri Closing Statement can clarify the legal standing of the property in question.

Like any city, Springfield, MO, has neighborhoods that may face challenges. Areas generally seen as less desirable often include parts of the north and east sides. If you're negotiating a property transaction, the Springfield Missouri Closing Statement can provide essential information about zoning and area demographics.

The property tax rate in Springfield, Missouri, fluctuates based on the assessed value of your property and the location within the city. As of now, the rate is around 4.3% of the assessed value. If you're buying or selling property, understanding how the Springfield Missouri Closing Statement reflects these taxes is crucial for your financial planning.

To report a problem in Springfield, Missouri, you can reach out to the city's 311 service. This platform allows you to report issues ranging from potholes to illegal dumping. If your concern involves real estate transactions, understanding your Springfield Missouri Closing Statement can help clarify property-related issues.

To prepare a real estate closing statement in Springfield Missouri, start by collecting all necessary documents, including offers, contracts, and disclosures. You must itemize all costs, fees, and credits accurately to ensure clarity for both parties. Using our legal forms can streamline this process, making it easier to generate a thorough and accurate closing statement.

Typically, the final closing statement is prepared by the closing agent or title company managing the transaction in Springfield Missouri. This representative collects data from all parties and ensures that the document reflects the agreed-upon terms. You can rely on uslegalforms to provide templates and tools that simplify this preparation.

The steps of settlement in Springfield Missouri usually include preparing documentation, reviewing the settlement statement, obtaining financing, and finally, signing the necessary agreements. You will also need to verify that all fees and expenses are accounted for, ensuring that both parties understand their roles. Following these steps diligently promotes a successful closing process.