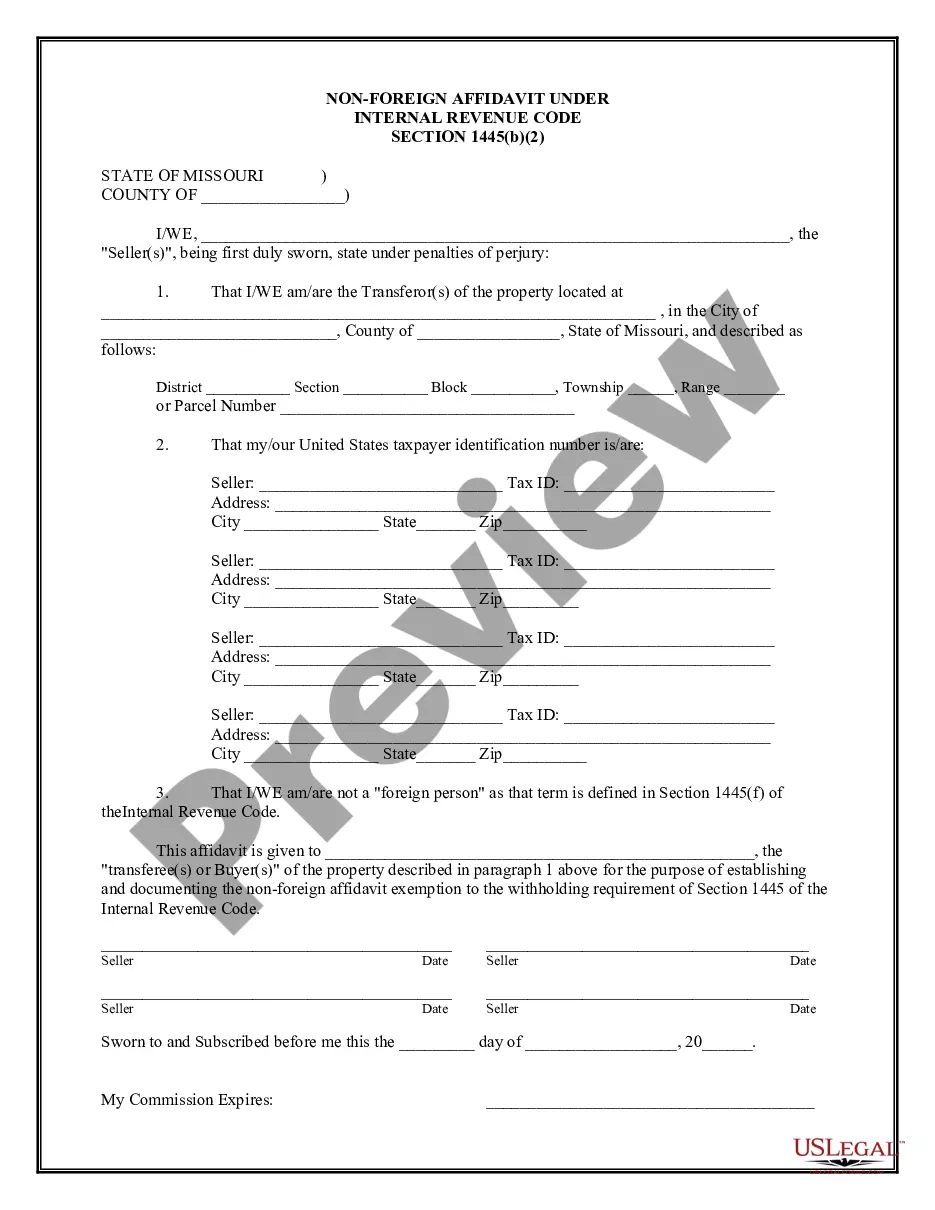

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Kansas City Missouri Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Missouri Non-Foreign Affidavit Under IRC 1445?

Locating authenticated templates tailored to your regional laws can be challenging unless you utilize the US Legal Forms repository.

It’s an online assortment of over 85,000 legal documents for personal and business requirements and various real-world scenarios.

All the files are accurately classified by usage area and jurisdiction, making the search for the Kansas City Missouri Non-Foreign Affidavit Under IRC 1445 as simple as pie.

Maintaining documents orderly and compliant with legal requirements holds substantial significance. Leverage the US Legal Forms library to always have crucial document templates for any needs right at your fingertips!

- Review the Preview mode and document description.

- Ensure you’ve selected the right one that aligns with your needs and fully complies with your local jurisdiction specifications.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription option you prefer.

Form popularity

FAQ

The transferor gives the transferee a certification stating, under penalties of perjury, that the transferor is not a foreign person. The certification should contain the transferor's name, U.S. taxpayer identification number, and home address (or office address, in the case of an entity).

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

CERTIFICATION OF FOREIGN STATUS UNDER FIRPTA The purpose of this Certification is to notify Buyer of Seller's/Sellers' status under FIRPTA (Section 1445 of the Internal Revenue Code) with regard to a prospective real estate transaction involving the Property identified below.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

There are two different types of FIRPTA Certifications: one for individuals (natural persons) and another for entities (e.g., corporation, partnership, limited liability company, etc.). The FIRPTA Certification must be signed by all transferors (sellers).

U.S. Tax Person A citizen or resident of the United States, a corporation or partnership (except to the extent provided in applicable Treasury Regulations) or other entity created or organized in, or under the laws of, the United States, any State thereof or the District of Columbia, including any entity treated as a

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.