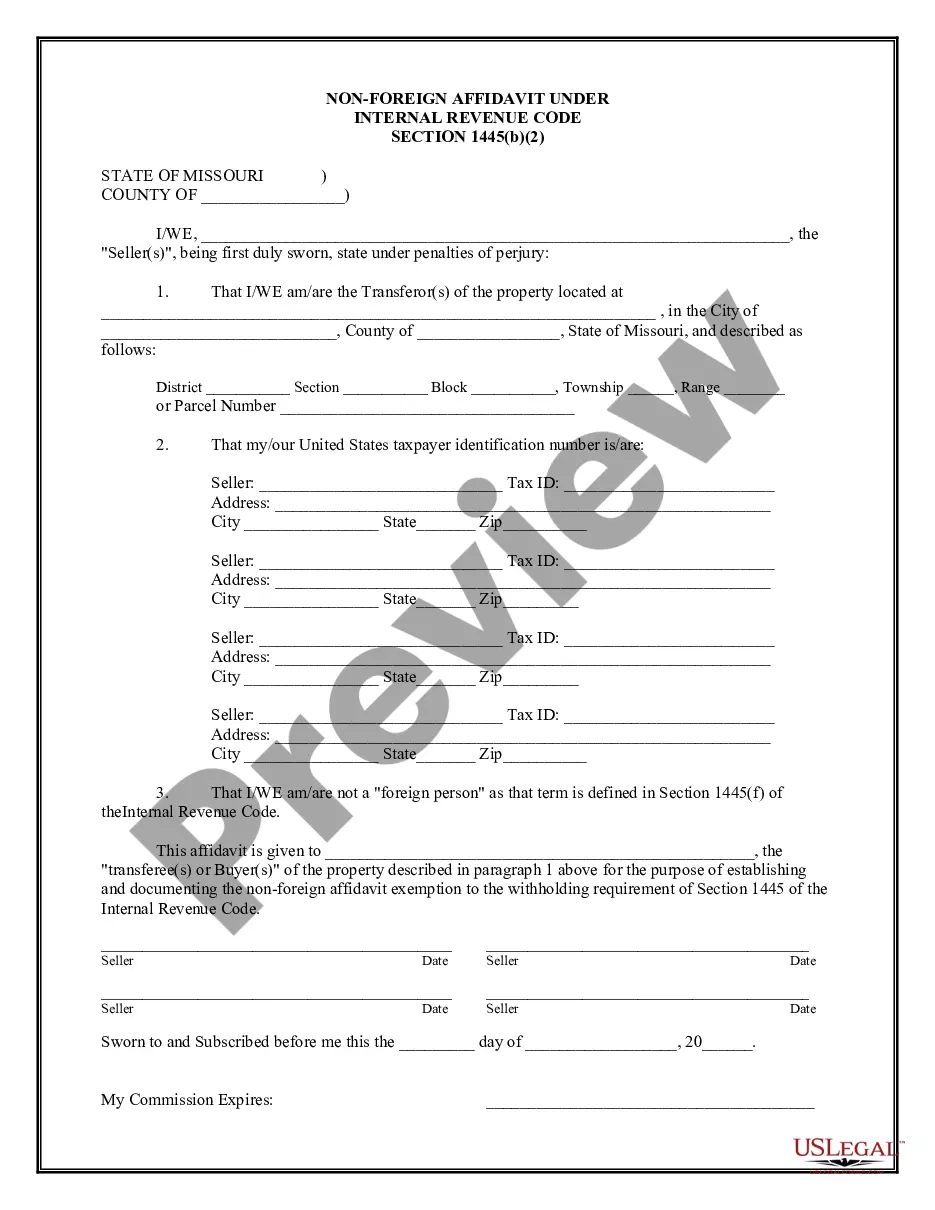

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is a legal document required for non-U.S. citizens or entities selling real estate located in the United States. This affidavit serves as proof that the transaction does not involve a foreign investment subject to withholding tax under the Internal Revenue Code (IRC) Section 1445. The purpose of the Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is to ensure compliance with U.S. tax laws and regulations, specifically regarding the sale of real property by non-U.S. sellers. The affidavit attests that the seller is not a foreign person, as defined by the IRC, and therefore exempt from the withholding requirements. It is essential for both buyers and sellers to understand the implications of this affidavit. For buyers, obtaining this document from the seller guarantees that the transaction will not be subject to the 10% withholding tax typically required when purchasing real estate from foreign sellers. On the other hand, sellers must complete the affidavit accurately and truthfully to avoid any potential legal consequences. The Springfield Missouri Non-Foreign Affidavit Under IRC 1445 should include the following information: 1. Seller's full legal name, address, and taxpayer identification number (TIN). 2. A statement affirming that the seller is not a foreign person, as defined by IRC Section 7701(b)(1)(A). 3. Declaration that the seller has a substantial presence in the United States or meets other criteria outlined in the Internal Revenue Code to qualify as a U.S. person. 4. Confirmation that the seller understands the consequences of filing a false or fraudulent affidavit and accepts full responsibility for any penalties or legal actions resulting from such acts. 5. Date of the transaction, description of the property being sold, and the purchase price. 6. Seller's signature and date of signing. It's important to note that the Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is specific to real estate transactions within the geographical jurisdiction of Springfield, Missouri. Different cities or states may have their own variations of non-foreign affidavits under IRC 1445. It is crucial to consult with a qualified real estate attorney or tax professional to ensure compliance with the specific requirements of the jurisdiction involved. Using relevant keywords related to this topic, we can mention terms like "Springfield Missouri," "Non-Foreign Affidavit," "IRC 1445," "real estate," "non-U.S. seller," "withholding tax," "Internal Revenue Code," "compliance," "U.S. tax laws," and "foreign person definition."Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is a legal document required for non-U.S. citizens or entities selling real estate located in the United States. This affidavit serves as proof that the transaction does not involve a foreign investment subject to withholding tax under the Internal Revenue Code (IRC) Section 1445. The purpose of the Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is to ensure compliance with U.S. tax laws and regulations, specifically regarding the sale of real property by non-U.S. sellers. The affidavit attests that the seller is not a foreign person, as defined by the IRC, and therefore exempt from the withholding requirements. It is essential for both buyers and sellers to understand the implications of this affidavit. For buyers, obtaining this document from the seller guarantees that the transaction will not be subject to the 10% withholding tax typically required when purchasing real estate from foreign sellers. On the other hand, sellers must complete the affidavit accurately and truthfully to avoid any potential legal consequences. The Springfield Missouri Non-Foreign Affidavit Under IRC 1445 should include the following information: 1. Seller's full legal name, address, and taxpayer identification number (TIN). 2. A statement affirming that the seller is not a foreign person, as defined by IRC Section 7701(b)(1)(A). 3. Declaration that the seller has a substantial presence in the United States or meets other criteria outlined in the Internal Revenue Code to qualify as a U.S. person. 4. Confirmation that the seller understands the consequences of filing a false or fraudulent affidavit and accepts full responsibility for any penalties or legal actions resulting from such acts. 5. Date of the transaction, description of the property being sold, and the purchase price. 6. Seller's signature and date of signing. It's important to note that the Springfield Missouri Non-Foreign Affidavit Under IRC 1445 is specific to real estate transactions within the geographical jurisdiction of Springfield, Missouri. Different cities or states may have their own variations of non-foreign affidavits under IRC 1445. It is crucial to consult with a qualified real estate attorney or tax professional to ensure compliance with the specific requirements of the jurisdiction involved. Using relevant keywords related to this topic, we can mention terms like "Springfield Missouri," "Non-Foreign Affidavit," "IRC 1445," "real estate," "non-U.S. seller," "withholding tax," "Internal Revenue Code," "compliance," "U.S. tax laws," and "foreign person definition."