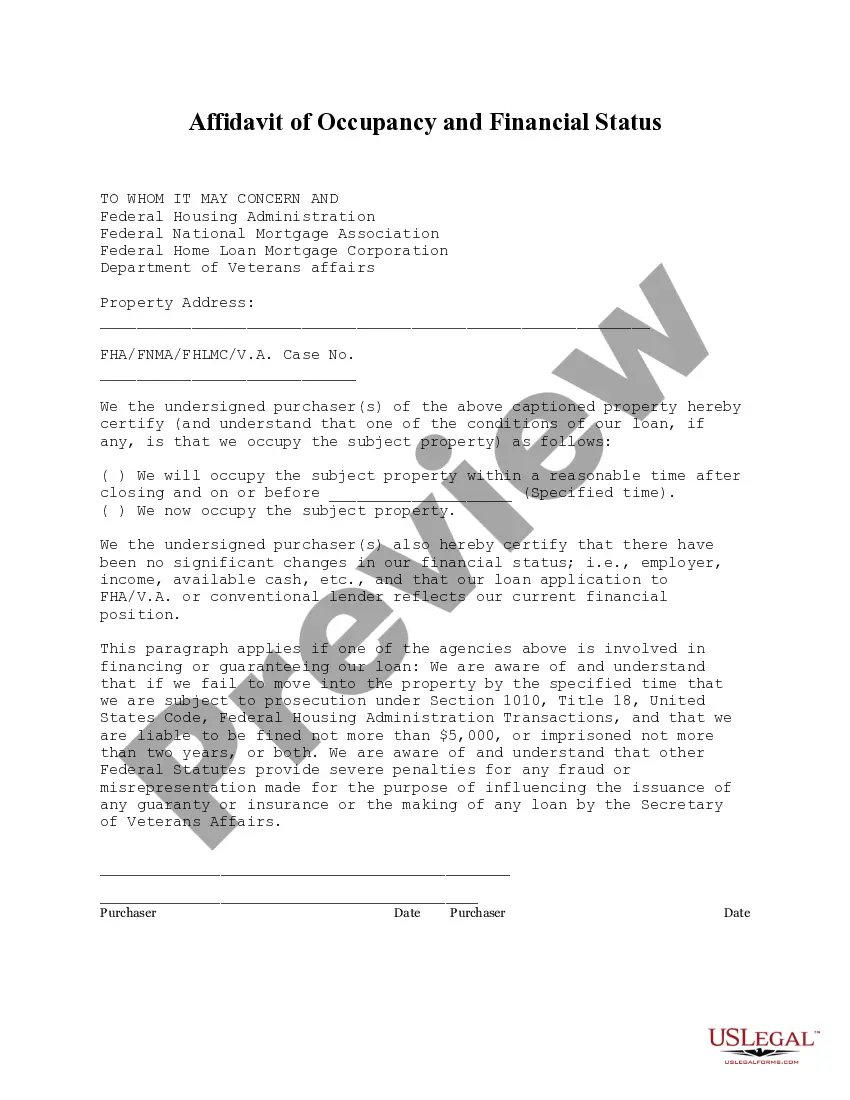

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

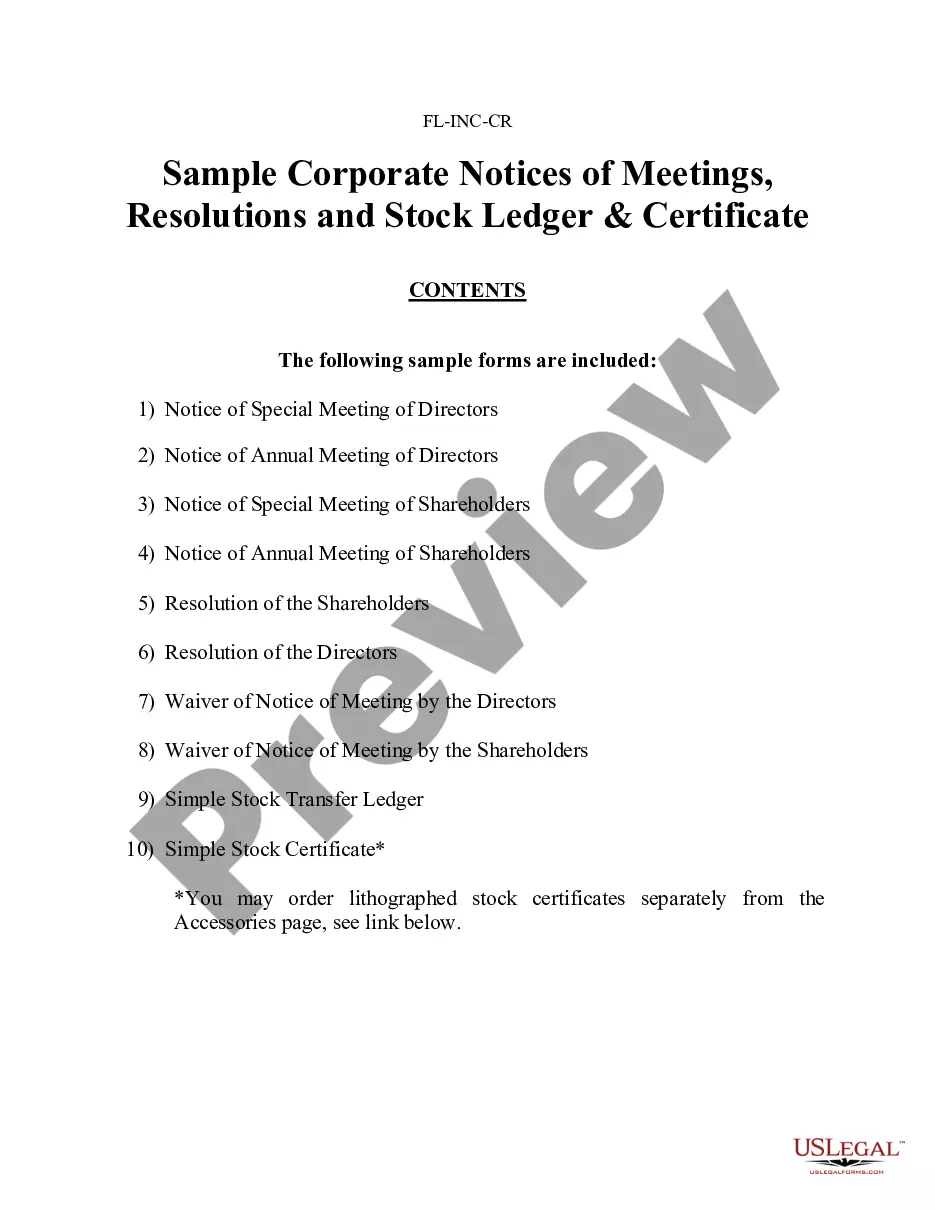

Kansas City Missouri Affidavit of Occupancy and Financial Status

Description

How to fill out Missouri Affidavit Of Occupancy And Financial Status?

Are you looking for a reliable and affordable supplier of legal forms to obtain the Kansas City Missouri Affidavit of Occupancy and Financial Status? US Legal Forms is your primary choice.

Whether you require a simple agreement to establish regulations for living together with your partner or a collection of documents to facilitate your separation or divorce through the legal system, we have everything you need. Our platform offers more than 85,000 current legal document templates for personal and commercial use. All templates that we provide are tailored specifically to comply with the laws of individual states and regions.

To download the document, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please be aware that you can retrieve your previously acquired form templates at any time from the My documents section.

Is this your first time visiting our site? No problem. You can establish an account in a matter of minutes, but first, ensure that you do the following.

Now you can create your account. Then select your subscription plan and continue to payment. Once the payment is finalized, download the Kansas City Missouri Affidavit of Occupancy and Financial Status in any format you choose. You can revisit the website whenever necessary and redownload the document at no additional cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms now, and say goodbye to wasting hours searching for legal paperwork online once and for all.

- Confirm that the Kansas City Missouri Affidavit of Occupancy and Financial Status aligns with your state and local regulations.

- Examine the form’s description (if provided) to understand its intended use and applicability.

- Re-initiate the search if the template does not meet your legal needs.

Form popularity

FAQ

Corporation Income Tax: Every corporation, as defined in Chapter 143, RSMo, is required to file a return of income in Missouri for each year it is required to file a federal income tax return and has gross income from sources within Missouri of $100 or more.

Beginning tax year 2022, all requests for refunds of the earnings tax must comply with Section 68-393 of the City's Code of Ordinances as amended on March 14, 2022. Get the protest form now. To check the status of a refund, use Quick Tax, email refunds@kcmo.org, or call 816-513-1120.

Copies of existing Occupant Load Certificates (OLC) can be obtained for a $33.00 fee. Please contact Permits Division, cdpermits@kcmo.org or (816) 513-1459, for guidance. Valid only for existing uses with no changes.

Who has to file and/or pay earnings tax? All Kansas City, Missouri residents are required to pay the earnings tax, even if they work outside of the city. Non-residents are required to pay the earnings tax on income earned within Kansas City, Missouri city limits.

Form RD-109 is a tax return used by a resident individual taxpayer or a non-resident working in Kansas City, Missouri to file and pay the earnings tax of one percent. Form RD-109 should not be filed if the earnings tax due is fully withheld by the taxpayer's employer.

To apply for a Zoning Clearance for a business license can be made in two ways: Apply with KCMO BizCare. Apply on CompassKC for a ?Zoning Clearance for Business License?

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

All Kansas City, Missouri, residents are required to pay the earnings tax, even if they work outside the city. Nonresidents are required to pay the earnings tax on income earned within Kansas City, Missouri, city limits. The tax also applies to the net profits of businesses.