The dissolution of a corporation package contains all forms to dissolve a corporation in Missouri, step by step instructions, addresses, transmittal letters, and other information.

- US Legal Forms

- Localized Forms

- Missouri

- Kansas City

-

Missouri Dissolution Package to Dissolve Corporation

Kansas City Missouri Dissolution Package to Dissolve Corporation

Description

Related forms

Viewed forms

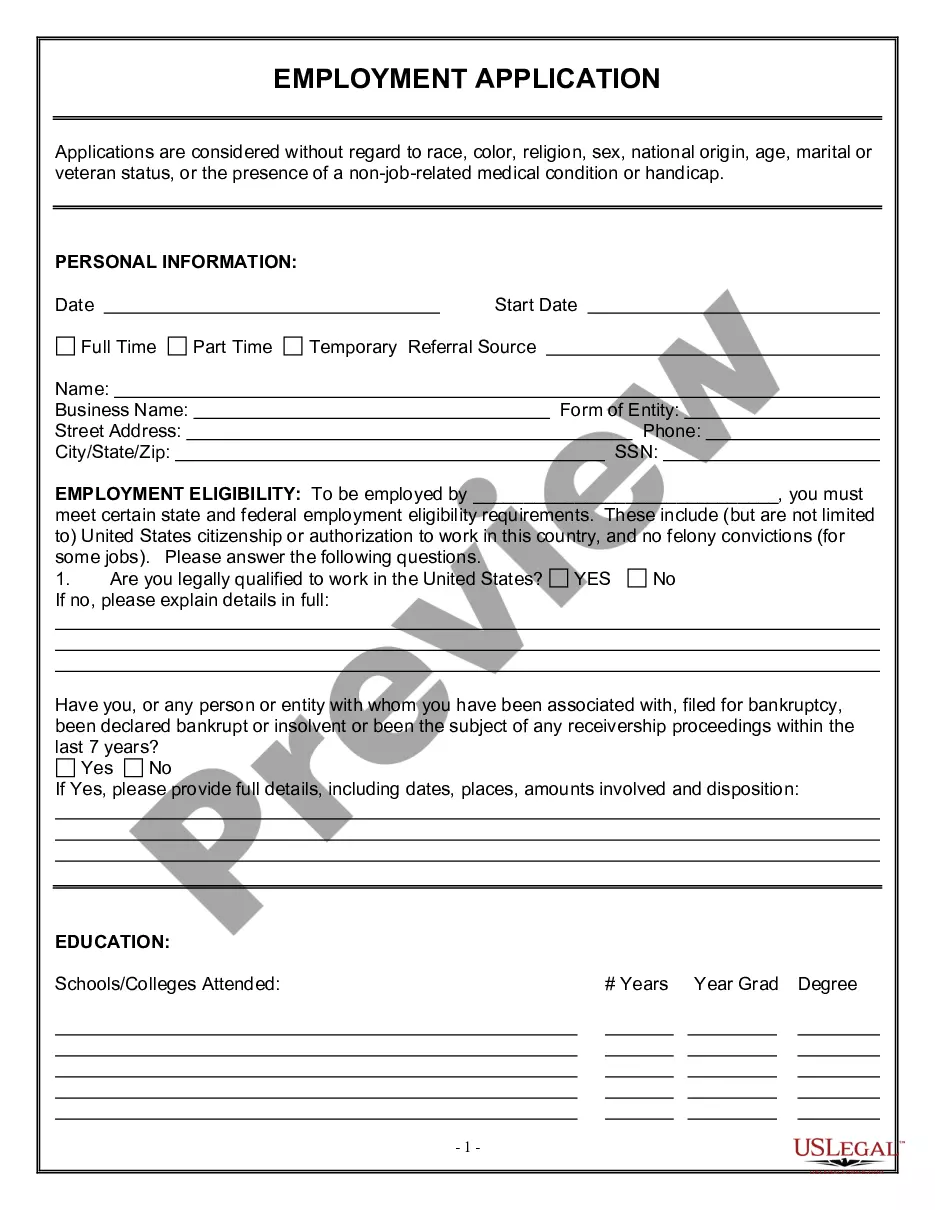

Employment Application for Assistant Professor

Notice to Vacate for Non Payment

Revocable Living Trust for Single Person

Sample Letter for Demand on Guarantor

EULA - End User License Agreement

Bill of Sale for Mobile Home

Telecommuting Agreement

Natural Hazard Disclosure Statement

How to fill out Kansas City Missouri Dissolution Package To Dissolve Corporation?

If you’ve already used our service before, log in to your account and download the Kansas City Missouri Dissolution Package to Dissolve Corporation on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Kansas City Missouri Dissolution Package to Dissolve Corporation. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!

Form Rating

Form popularity

FAQ

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

Dissolution of corporation refers to the closing of a corporate entity which can be a complex process. Ending a corporation becomes more complex with more owners and more assets.

Less... Hold a Board of Directors meeting and record a resolution to Dissolve the Missouri Corporation.Hold a Shareholder meeting to approve Dissolution of the Missouri Corporation.File a Articles of Dissolution with the MO Secretary of State.File all required Registration Reports with the Missouri Secretary of State.

Voluntary dissolution is generally a two-step process: Obtaining written consent from the Tax Department1 (which will check to see if the corporation owes back taxes and if it has filed all its returns)2; and. Filing paperwork with the New York Department of State, including a Certificate of Dissolution.

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

Modes of dissolution A corporation may be dissolved voluntarily or involuntarily. Voluntary dissolution could be done by (1) shortening the corporate term, (2) filing a request for dissolution (where no creditors are affected), and (3) filing a petition for dissolution (where creditors are affected).

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.

A corporation seeking voluntary dissolution shall submit a verified request signed by its duly authorized representatives containing the corporate name, SEC registration number, principal office, a statement requesting for the dissolution, and reason for the dissolution.

Dissolution of a Corporation is the termination of a corporation, either a) voluntarily by resolution, paying debts, distributing assets, and filing dissolution documents with the Secretary of State; or b) by state suspension for not paying corporate taxes or some other action of the government.

How to dissolve a business in 7 steps Step 1: Get approval of the owners of the corporation or LLC.Step 2: File the Certificate of Dissolution with the state.Step 3: File federal, state, and local tax forms.Step 4: Wind up affairs.Step 5: Notify creditors your business is closing.Step 6: Settle creditors' claims.

Kansas City Missouri Dissolution Package to Dissolve Corporation Related Searches

-

how to dissolve a missouri corporation

-

notice of winding up llc missouri

-

missouri secretary of state business search

-

mo secretary of state llc

-

missouri secretary of state certificate of good standing

-

notice of winding up missouri

-

missouri llc

-

missouri llc registered agent

-

how to dissolve a missouri corporation

-

articles of dissolution missouri

Interesting Questions

The Dissolution Package is a set of documents and forms that need to be filed with the Kansas City Missouri authorities to legally dissolve Corporation34694.

There could be various reasons for dissolving a corporation, such as the company no longer being active, bankruptcy, or ownership changes.

To dissolve a corporation in Kansas City Missouri, you need to complete and file various forms, including Articles of Dissolution, pay the applicable fees, and fulfill any other requirements set by the authorities.

You can find the Dissolution Package on the official website of Kansas City Missouri's Secretary of State or by visiting their office in person.

The exact documents required may vary, but typically you need to include the Articles of Dissolution, a Certificate of Good Standing, and any other relevant supporting documents.

The filing fees for the Dissolution Package may vary, but generally, there are fees associated with filing the Articles of Dissolution and obtaining a Certificate of Good Standing.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Missouri

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wyoming

MISSOURI

STATUTORY REFERENCE

MISSOURI REVISED STATUTES, §§ 351.462 through 351.504

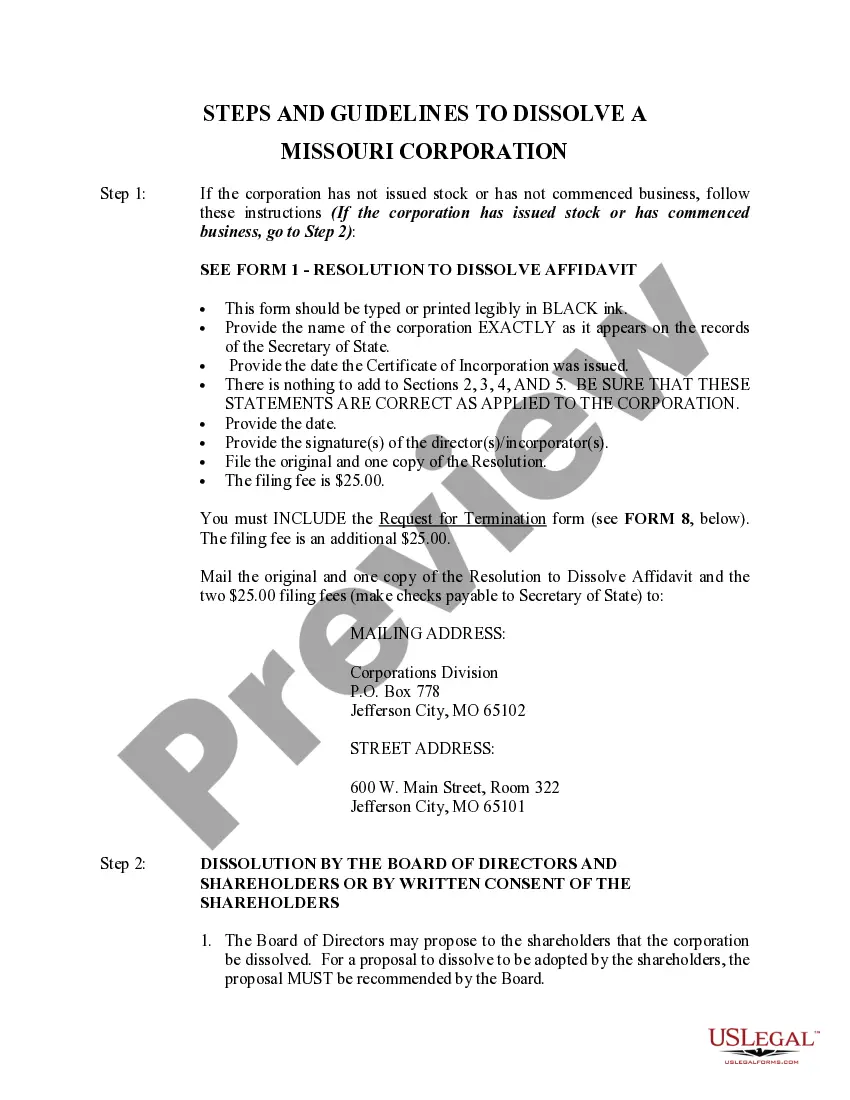

In Missouri, a corporation may be dissolved voluntarily, administratively, or judicially. THIS SUMMARY ADDRESSES ONLY VOLUNTARY DISSOLUTION.

A majority of the incorporators or initial directors of a corporation

that has not issued shares or has not commenced business may dissolve the

corporation by delivering to the secretary of state for filing articles

of dissolution that set forth:

(1) The name of the corporation;

(2) The date of its incorporation;

(3) Either that none of the corporation's shares have been issued,

or that the corporation has not commenced business;

(4) That no debt of the corporation remains unpaid;

(5) That the net assets of the corporation remaining after winding

up have been distributed to the shareholders, if shares were issued; and

(6) That a majority of the incorporators or initial directors authorized

the dissolution.

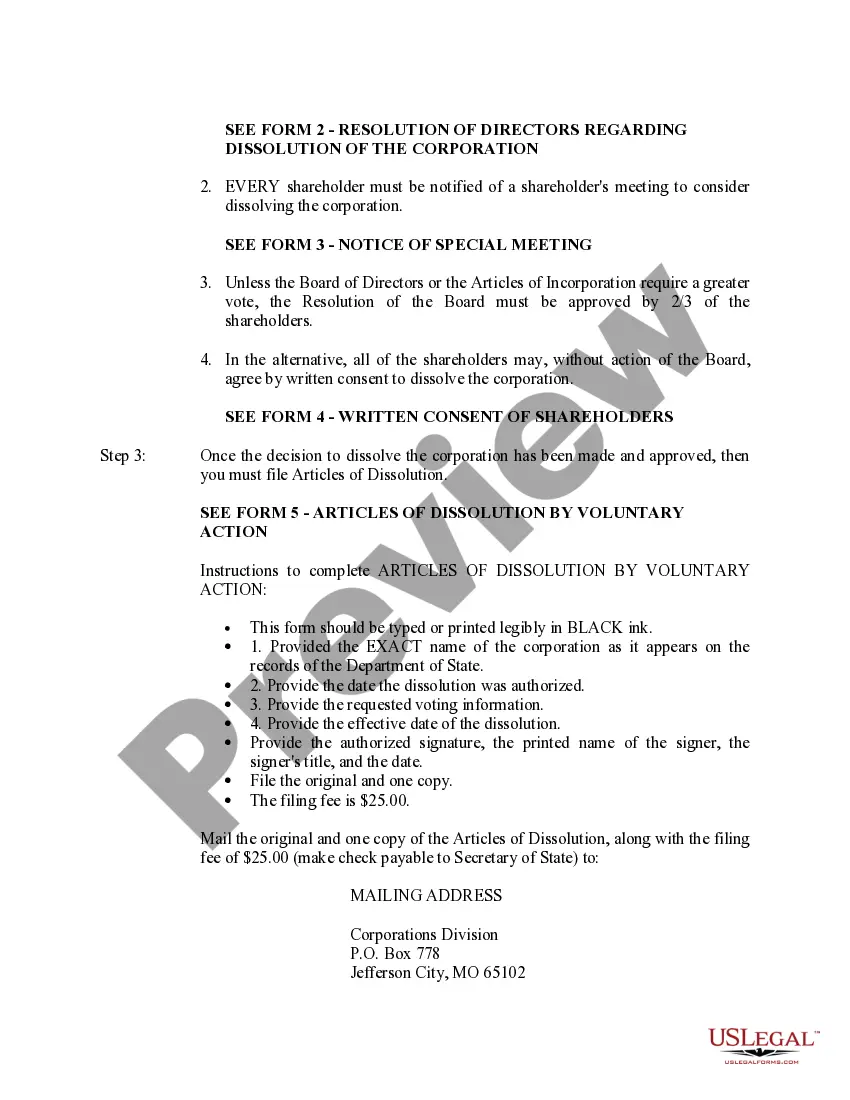

A corporation's board of directors may propose dissolution for submission

to the shareholders and may condition its submission of the proposal for

dissolution on any basis. For a proposal to dissolve to be adopted:

(1) The board of directors must recommend dissolution to the

shareholders unless the board of directors determines that because of conflict

of interest or other special circumstances it should make no recommendation

and communicates the basis for its determination to the shareholders; and

(2) The shareholders entitled to vote must approve the proposal to

dissolve as provided by law.

The corporation must notify each shareholder, whether or not entitled

to vote, of the proposed shareholders' meeting. The notice must state

that the purpose, or one of the purposes, of the meeting is to consider

dissolving the corporation.

Unless the articles of incorporation or the board of directors require a greater vote, including a vote by any class of stock or any series of any class, the proposal to dissolve to be adopted must be approved by at least two-thirds of the votes entitled to be cast on that proposal.

A corporation may be dissolved by the written consent of the holders of record of all of its outstanding shares entitled to vote on dissolution.

At any time after dissolution is authorized, the corporation may dissolve

by delivering to the secretary of state for filing articles of dissolution

setting forth:

(1) The name of the corporation;

(2) The date dissolution was authorized;

(3) If dissolution was approved by the shareholders:

(a) The number of votes entitled to be cast on the proposal

to dissolve; and

(b) Either the total number of votes cast for and against dissolution

or the total number of undisputed votes cast for dissolution and a statement

that the number cast for dissolution was sufficient for approval or a statement

that the dissolution was approved by the written consent of all shareholders;

(4) If voting by any class of stock or any series of any class of stock

was required, information by statute must be separately provided for each

class of stock or series of stock entitled to vote separately on the plan

to dissolve.

A corporation is dissolved upon the effective date of its articles

of dissolution.

A dissolved corporation continues its corporate existence but may not

carry on any business except that appropriate to wind up and liquidate

its business and affairs, including:

(1) Collecting its assets;

(2) Disposing of its properties that will not be distributed in kind

to its shareholders;

(3) Discharging or making provision for discharging its liabilities;

(4) Distributing its remaining property among its shareholders according

to their interests; and

(5) Doing every other act necessary to wind up and liquidate its business

and affairs.

Dissolution of a corporation does not:

(1) Transfer title to the corporation's property;

(2) Prevent transfer of its shares or securities, although the authorization

to dissolve may provide for closing the corporation's share transfer records;

(3) Subject its directors or officers to standards of conduct different

from those applicable to directors and officers of a corporation which

has not been dissolved (any officer or director who conducts business on

behalf of the corporation except as provided by statute shall be personally

liable for any obligation so incurred);

(4) Change quorum or voting requirements for its board of directors

or shareholders; change provisions for selection, resignation, or removal

of its directors or officers or both; or change provisions for amending

its bylaws;

(5) Prevent commencement of a proceeding by or against the corporation

in its corporate name;

(6) Abate or suspend a proceeding pending by or against the corporation

on the effective date of dissolution;

(7) Terminate the authority of the registered agent of the corporation;

or

(8) Make available for use by others its corporate name for a period

of one year from the effective date of its dissolution.

After dissolution is authorized, or the corporation has been dissolved

pursuant to law, a corporation shall dispose of the known claims against

it. The corporation must notify its known claimants in writing by

United States Postal Service of the dissolution at any time after dissolution

is authorized. The written notice must:

(1) Describe information that must be included in a claim;

(2) Provide a mailing address where a claim may be sent;

(3) State the deadline, which may not be fewer than one hundred eighty

days from the effective date of the written notice, by which the dissolved

corporation must receive the claim; and

(4) State that the claim will be barred if not received by the deadline.

Other rules of law, including rules on the permissibility of third-party

claims, to the contrary notwithstanding, a claim against a corporation

dissolved without fraudulent intent is barred:

(1) If a claimant who was given the requisite written does

not deliver the claim to the corporation by the deadline;

(2) If a claimant whose claim was rejected by the dissolved corporation

does not commence proceedings to enforce the claim within ninety days from

the effective date of the rejection notice.

A "claim" does not include a contingent liability or a claim based

on an event occurring after the effective date of dissolution.

"Fraudulent intent" is established if it is shown that the sole or primary purpose of the authorization for dissolution was to defraud shareholders, creditors or others.

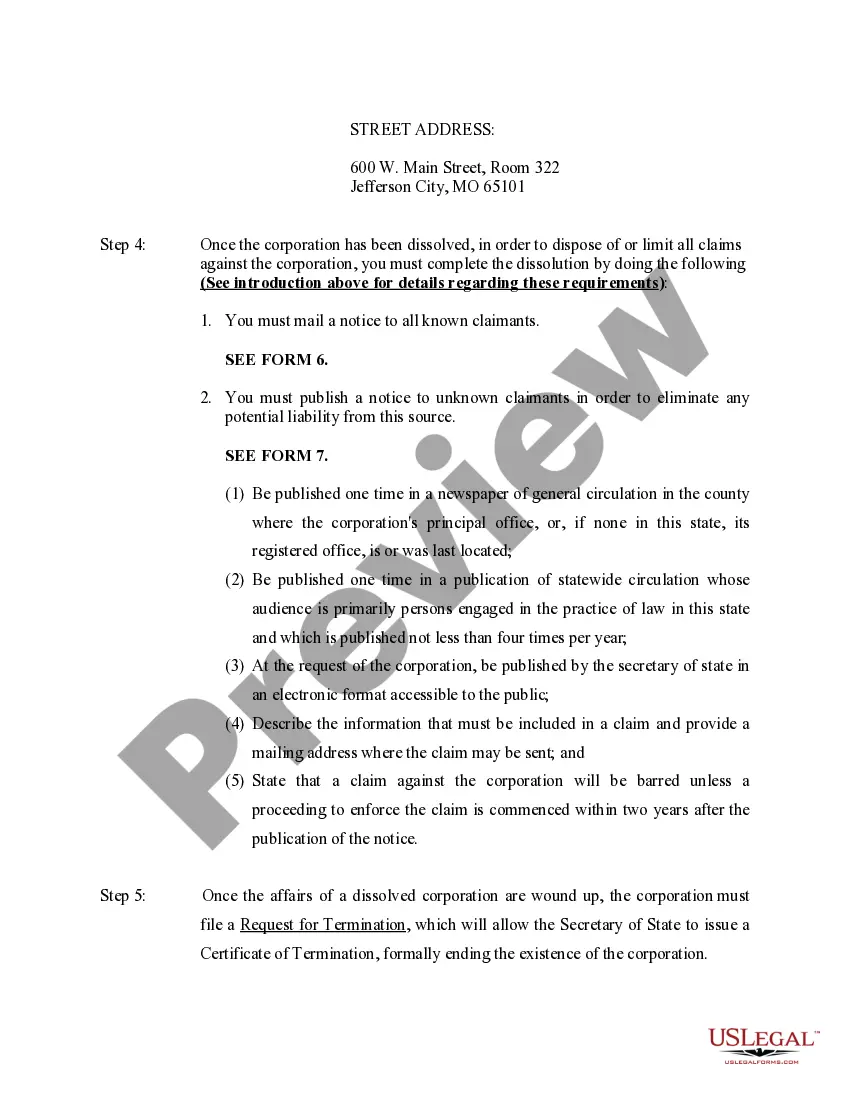

After dissolution is authorized, or the corporation has been dissolved

pursuant to law, a corporation may also publish notice of its dissolution

and request that persons with claims against the corporation present them

in accordance with the notice. The notice must:

(1) Be published one time in a newspaper of general circulation

in the county where the corporation's principal office, or, if none in

this state, its registered office, is or was last located;

(2) Be published one time in a publication of statewide circulation

whose audience is primarily persons engaged in the practice of law in this

state and which is published not less than four times per year;

(3) At the request of the corporation, be published by the secretary

of state in an electronic format accessible to the public;

(4) Describe the information that must be included in a claim and provide

a mailing address where the claim may be sent; and

(5) State that a claim against the corporation will be barred unless

a proceeding to enforce the claim is commenced within two years after the

publication of the notice.

Other rules of law, including rules on the permissibility of third-party

claims, to the contrary notwithstanding, if a corporation dissolved without

fraudulent intent publishes notices in accordance with the statutory provisions,

the claim of each of the following claimants is barred unless the claimant

commences a proceeding to enforce the claim against the dissolved corporation

within two years after the publication date of whichever of the notices

was published last:

(1) A claimant who did not receive written notice pursuant

to section 351.478;

(2) A claimant whose claim was timely sent to the dissolved corporation

but not acted on;

(3) A claimant whose claim is contingent or based on an event occurring

after the effective date of dissolution.

A claim may be enforced only:

(1) Against the dissolved corporation, to the extent of its

undistributed assets; or

(2) If the assets have been distributed in liquidation, against a shareholder

of the dissolved corporation to the extent of the shareholder's pro rata

share of the claim or the corporate assets distributed to the shareholder

in liquidation, whichever is less, but a shareholder's total liability

for all claims may not exceed the total amount of assets distributed to

the shareholder.

A claim against a corporation dissolved pursuant to statute for

which claim the corporation has a contract of insurance which will indemnify

the corporation for any adverse result from such claim:

(1) Is not subject to the provisions of §351.478 or §351.482,

and may not be barred by compliance with those sections;

(2) May be asserted at any time within the statutory period otherwise

provided by law for such claims;

(3) May be asserted against, and service of process had upon, the dissolved

or dissolving corporation for whom the court, at the request of the party

bringing the suit, shall appoint a defendant ad litem.

Assets of a dissolved corporation that should be transferred to

a creditor, claimant, or shareholder of the corporation who cannot be found

or who is not competent to receive them may be reduced to cash and deposited

with the state treasurer for safekeeping. When the creditor, claimant,

or shareholder furnishes satisfactory proof of entitlement to the amount

deposited, the state treasurer or other appropriate state official shall

pay him or his representative that amount

Note: All Information and Previews are subject to the Disclaimer located on the main forms page, and also linked at the bottom of all search results.

MISSOURI

STATUTORY REFERENCE

MISSOURI REVISED STATUTES, §§ 351.462 through 351.504

In Missouri, a corporation may be dissolved voluntarily, administratively, or judicially. THIS SUMMARY ADDRESSES ONLY VOLUNTARY DISSOLUTION.

A majority of the incorporators or initial directors of a corporation

that has not issued shares or has not commenced business may dissolve the

corporation by delivering to the secretary of state for filing articles

of dissolution that set forth:

(1) The name of the corporation;

(2) The date of its incorporation;

(3) Either that none of the corporation's shares have been issued,

or that the corporation has not commenced business;

(4) That no debt of the corporation remains unpaid;

(5) That the net assets of the corporation remaining after winding

up have been distributed to the shareholders, if shares were issued; and

(6) That a majority of the incorporators or initial directors authorized

the dissolution.

A corporation's board of directors may propose dissolution for submission

to the shareholders and may condition its submission of the proposal for

dissolution on any basis. For a proposal to dissolve to be adopted:

(1) The board of directors must recommend dissolution to the

shareholders unless the board of directors determines that because of conflict

of interest or other special circumstances it should make no recommendation

and communicates the basis for its determination to the shareholders; and

(2) The shareholders entitled to vote must approve the proposal to

dissolve as provided by law.

The corporation must notify each shareholder, whether or not entitled

to vote, of the proposed shareholders' meeting. The notice must state

that the purpose, or one of the purposes, of the meeting is to consider

dissolving the corporation.

Unless the articles of incorporation or the board of directors require a greater vote, including a vote by any class of stock or any series of any class, the proposal to dissolve to be adopted must be approved by at least two-thirds of the votes entitled to be cast on that proposal.

A corporation may be dissolved by the written consent of the holders of record of all of its outstanding shares entitled to vote on dissolution.

At any time after dissolution is authorized, the corporation may dissolve

by delivering to the secretary of state for filing articles of dissolution

setting forth:

(1) The name of the corporation;

(2) The date dissolution was authorized;

(3) If dissolution was approved by the shareholders:

(a) The number of votes entitled to be cast on the proposal

to dissolve; and

(b) Either the total number of votes cast for and against dissolution

or the total number of undisputed votes cast for dissolution and a statement

that the number cast for dissolution was sufficient for approval or a statement

that the dissolution was approved by the written consent of all shareholders;

(4) If voting by any class of stock or any series of any class of stock

was required, information by statute must be separately provided for each

class of stock or series of stock entitled to vote separately on the plan

to dissolve.

A corporation is dissolved upon the effective date of its articles

of dissolution.

A dissolved corporation continues its corporate existence but may not

carry on any business except that appropriate to wind up and liquidate

its business and affairs, including:

(1) Collecting its assets;

(2) Disposing of its properties that will not be distributed in kind

to its shareholders;

(3) Discharging or making provision for discharging its liabilities;

(4) Distributing its remaining property among its shareholders according

to their interests; and

(5) Doing every other act necessary to wind up and liquidate its business

and affairs.

Dissolution of a corporation does not:

(1) Transfer title to the corporation's property;

(2) Prevent transfer of its shares or securities, although the authorization

to dissolve may provide for closing the corporation's share transfer records;

(3) Subject its directors or officers to standards of conduct different

from those applicable to directors and officers of a corporation which

has not been dissolved (any officer or director who conducts business on

behalf of the corporation except as provided by statute shall be personally

liable for any obligation so incurred);

(4) Change quorum or voting requirements for its board of directors

or shareholders; change provisions for selection, resignation, or removal

of its directors or officers or both; or change provisions for amending

its bylaws;

(5) Prevent commencement of a proceeding by or against the corporation

in its corporate name;

(6) Abate or suspend a proceeding pending by or against the corporation

on the effective date of dissolution;

(7) Terminate the authority of the registered agent of the corporation;

or

(8) Make available for use by others its corporate name for a period

of one year from the effective date of its dissolution.

After dissolution is authorized, or the corporation has been dissolved

pursuant to law, a corporation shall dispose of the known claims against

it. The corporation must notify its known claimants in writing by

United States Postal Service of the dissolution at any time after dissolution

is authorized. The written notice must:

(1) Describe information that must be included in a claim;

(2) Provide a mailing address where a claim may be sent;

(3) State the deadline, which may not be fewer than one hundred eighty

days from the effective date of the written notice, by which the dissolved

corporation must receive the claim; and

(4) State that the claim will be barred if not received by the deadline.

Other rules of law, including rules on the permissibility of third-party

claims, to the contrary notwithstanding, a claim against a corporation

dissolved without fraudulent intent is barred:

(1) If a claimant who was given the requisite written does

not deliver the claim to the corporation by the deadline;

(2) If a claimant whose claim was rejected by the dissolved corporation

does not commence proceedings to enforce the claim within ninety days from

the effective date of the rejection notice.

A "claim" does not include a contingent liability or a claim based

on an event occurring after the effective date of dissolution.

"Fraudulent intent" is established if it is shown that the sole or primary purpose of the authorization for dissolution was to defraud shareholders, creditors or others.

After dissolution is authorized, or the corporation has been dissolved

pursuant to law, a corporation may also publish notice of its dissolution

and request that persons with claims against the corporation present them

in accordance with the notice. The notice must:

(1) Be published one time in a newspaper of general circulation

in the county where the corporation's principal office, or, if none in

this state, its registered office, is or was last located;

(2) Be published one time in a publication of statewide circulation

whose audience is primarily persons engaged in the practice of law in this

state and which is published not less than four times per year;

(3) At the request of the corporation, be published by the secretary

of state in an electronic format accessible to the public;

(4) Describe the information that must be included in a claim and provide

a mailing address where the claim may be sent; and

(5) State that a claim against the corporation will be barred unless

a proceeding to enforce the claim is commenced within two years after the

publication of the notice.

Other rules of law, including rules on the permissibility of third-party

claims, to the contrary notwithstanding, if a corporation dissolved without

fraudulent intent publishes notices in accordance with the statutory provisions,

the claim of each of the following claimants is barred unless the claimant

commences a proceeding to enforce the claim against the dissolved corporation

within two years after the publication date of whichever of the notices

was published last:

(1) A claimant who did not receive written notice pursuant

to section 351.478;

(2) A claimant whose claim was timely sent to the dissolved corporation

but not acted on;

(3) A claimant whose claim is contingent or based on an event occurring

after the effective date of dissolution.

A claim may be enforced only:

(1) Against the dissolved corporation, to the extent of its

undistributed assets; or

(2) If the assets have been distributed in liquidation, against a shareholder

of the dissolved corporation to the extent of the shareholder's pro rata

share of the claim or the corporate assets distributed to the shareholder

in liquidation, whichever is less, but a shareholder's total liability

for all claims may not exceed the total amount of assets distributed to

the shareholder.

A claim against a corporation dissolved pursuant to statute for

which claim the corporation has a contract of insurance which will indemnify

the corporation for any adverse result from such claim:

(1) Is not subject to the provisions of §351.478 or §351.482,

and may not be barred by compliance with those sections;

(2) May be asserted at any time within the statutory period otherwise

provided by law for such claims;

(3) May be asserted against, and service of process had upon, the dissolved

or dissolving corporation for whom the court, at the request of the party

bringing the suit, shall appoint a defendant ad litem.

Assets of a dissolved corporation that should be transferred to

a creditor, claimant, or shareholder of the corporation who cannot be found

or who is not competent to receive them may be reduced to cash and deposited

with the state treasurer for safekeeping. When the creditor, claimant,

or shareholder furnishes satisfactory proof of entitlement to the amount

deposited, the state treasurer or other appropriate state official shall

pay him or his representative that amount

Note: All Information and Previews are subject to the Disclaimer located on the main forms page, and also linked at the bottom of all search results.