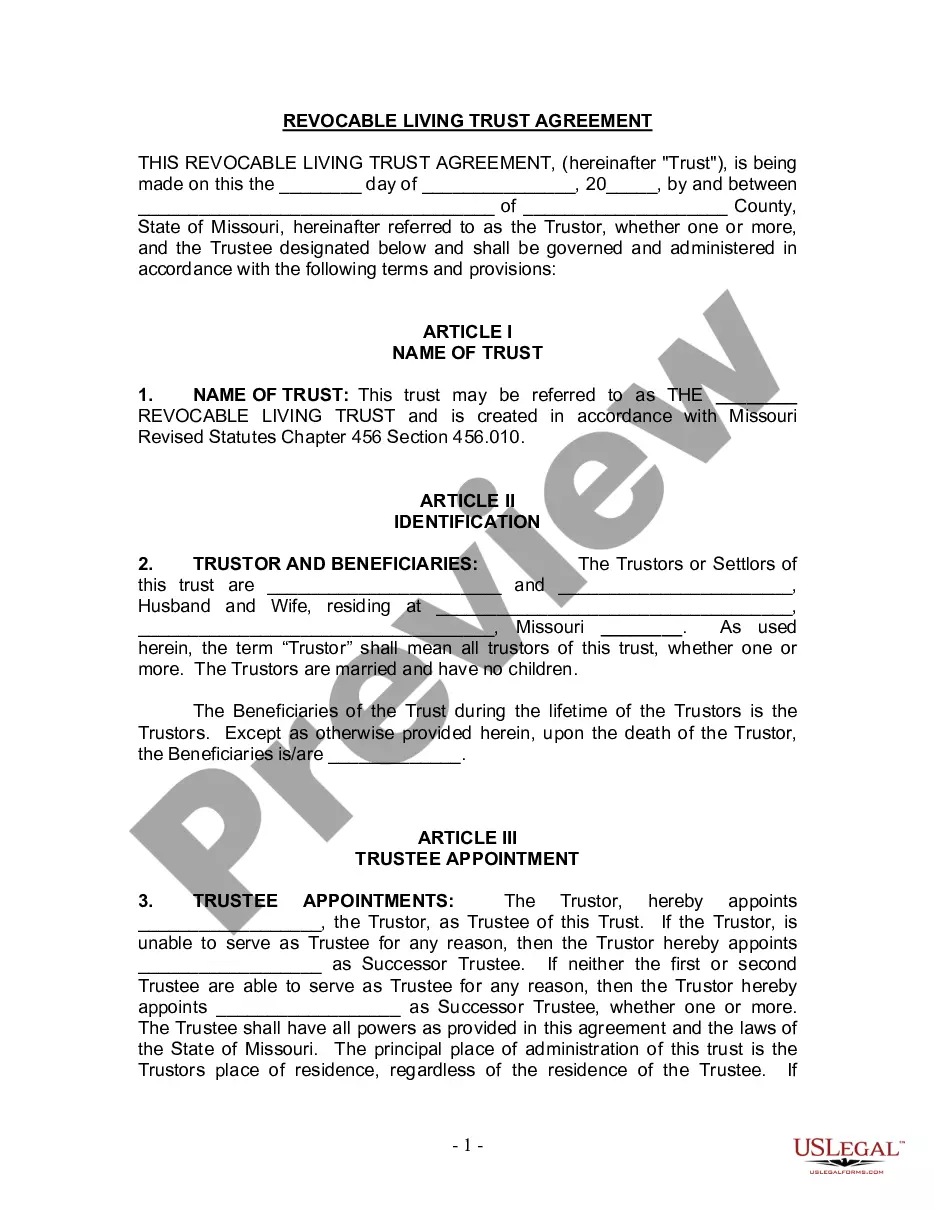

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Lee's Summit Missouri Living Trust for Husband and Wife with No Children is a legally established arrangement that allows a married couple to protect and manage their assets during their lifetime and efficiently transfer them to their chosen beneficiaries upon their passing. This specifically tailored trust structure helps individuals in Lee's Summit, Missouri, ensure their assets are distributed according to their specific wishes while minimizing the complexities and costs associated with probate. Benefits of a Living Trust for Husband and Wife with No Children in Lee's Summit, Missouri — Asset Protection: The main objective of a living trust is to safeguard assets from potential creditors and lawsuits. By transferring assets into the trust, a married couple can maintain control while keeping the assets shielded from potential risks. — Privacy and Avoidance of Probate: One significant advantage of a living trust is that it bypasses the time-consuming and public probate process. This means that the details of the trust, including asset distribution, remain private, and the transfer of assets to beneficiaries can occur seamlessly and more quickly. — Flexibility and Control: Lee's Summit Missouri Living Trust provides great flexibility, allowing couples to manage their assets during their lifetime and outline specific instructions for their distribution upon death. Individuals have the freedom to designate themselves as trustees and retain complete control over their assets until they are no longer able to do so. — Incapacity Planning: The trust also addresses the possibility of one or both spouses becoming incapacitated. In such cases, a successor trustee can be named to manage the assets and make crucial decisions on behalf of the incapacitated spouse, thereby avoiding the need for a court-appointed guardian. Different Types of Lee's Summit Missouri Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: This is the most common type of living trust, providing flexibility as it can be amended or revoked during the lifetime of the couple. It allows the couple to retain control over their assets and make changes as circumstances change. 2. Irrevocable Living Trust: Once established, this type of trust cannot typically be modified or revoked without the consent of both spouses and may provide certain tax benefits or asset protection advantages. 3. Joint Living Trust: In this type of trust, a single trust document is created for both spouses, streamlining the administration process and making it easier to manage and update. It allows assets to be shared and transferred seamlessly between spouses. 4. A-B Trust: Also known as a "credit shelter" or "by-pass" trust, this type of trust is commonly used to maximize estate tax exemptions. It creates separate shares for each spouse, ensuring that both individuals fully utilize their respective estate tax exemptions. Note: It is always essential to seek guidance from an experienced attorney or estate planner who is knowledgeable about Missouri state laws while considering establishing a Lee's Summit Missouri Living Trust for Husband and Wife with No Children.A Lee's Summit Missouri Living Trust for Husband and Wife with No Children is a legally established arrangement that allows a married couple to protect and manage their assets during their lifetime and efficiently transfer them to their chosen beneficiaries upon their passing. This specifically tailored trust structure helps individuals in Lee's Summit, Missouri, ensure their assets are distributed according to their specific wishes while minimizing the complexities and costs associated with probate. Benefits of a Living Trust for Husband and Wife with No Children in Lee's Summit, Missouri — Asset Protection: The main objective of a living trust is to safeguard assets from potential creditors and lawsuits. By transferring assets into the trust, a married couple can maintain control while keeping the assets shielded from potential risks. — Privacy and Avoidance of Probate: One significant advantage of a living trust is that it bypasses the time-consuming and public probate process. This means that the details of the trust, including asset distribution, remain private, and the transfer of assets to beneficiaries can occur seamlessly and more quickly. — Flexibility and Control: Lee's Summit Missouri Living Trust provides great flexibility, allowing couples to manage their assets during their lifetime and outline specific instructions for their distribution upon death. Individuals have the freedom to designate themselves as trustees and retain complete control over their assets until they are no longer able to do so. — Incapacity Planning: The trust also addresses the possibility of one or both spouses becoming incapacitated. In such cases, a successor trustee can be named to manage the assets and make crucial decisions on behalf of the incapacitated spouse, thereby avoiding the need for a court-appointed guardian. Different Types of Lee's Summit Missouri Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: This is the most common type of living trust, providing flexibility as it can be amended or revoked during the lifetime of the couple. It allows the couple to retain control over their assets and make changes as circumstances change. 2. Irrevocable Living Trust: Once established, this type of trust cannot typically be modified or revoked without the consent of both spouses and may provide certain tax benefits or asset protection advantages. 3. Joint Living Trust: In this type of trust, a single trust document is created for both spouses, streamlining the administration process and making it easier to manage and update. It allows assets to be shared and transferred seamlessly between spouses. 4. A-B Trust: Also known as a "credit shelter" or "by-pass" trust, this type of trust is commonly used to maximize estate tax exemptions. It creates separate shares for each spouse, ensuring that both individuals fully utilize their respective estate tax exemptions. Note: It is always essential to seek guidance from an experienced attorney or estate planner who is knowledgeable about Missouri state laws while considering establishing a Lee's Summit Missouri Living Trust for Husband and Wife with No Children.