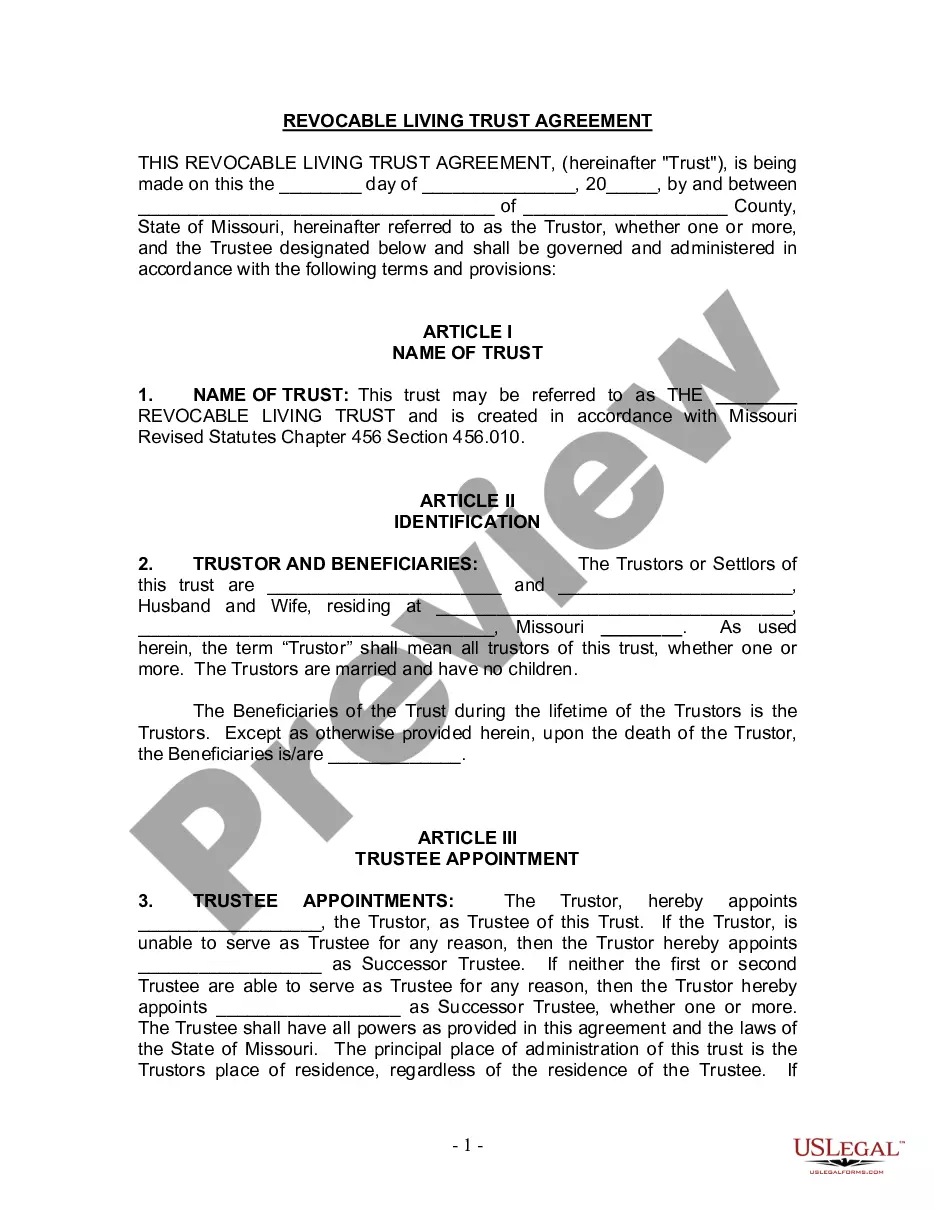

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Springfield, Missouri Living Trust for Husband and Wife with No Children: A Comprehensive Guide Introduction: A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their death. For couples residing in Springfield, Missouri, a living trust can be particularly advantageous, especially when there are no children involved. This article aims to provide a detailed description of what a Springfield Missouri Living Trust for Husband and Wife with No Children entails, highlighting its benefits and different types if applicable. 1. What is a Springfield Missouri Living Trust? A Springfield Missouri Living Trust for Husband and Wife with No Children is a legal agreement that enables a couple to place their assets, including property, investments, bank accounts, and personal belongings, into a trust. The trust is primarily designed to ease the transfer of assets to beneficiaries and avoid probate upon the couple's passing. As no children are involved, alternative provisions can be made for distribution, such as leaving assets to extended family members, friends, charitable organizations, or creating a testamentary trust. 2. Benefits of a Springfield Missouri Living Trust with No Children: a. Probate avoidance: The primary advantage of establishing a living trust is bypassing the probate process, which can be time-consuming, expensive, and open to public scrutiny. By transferring assets into a living trust, they can be distributed smoothly without court proceedings. b. Privacy: Unlike a will, which becomes part of the public record during probate, a living trust allows assets to be distributed privately, ensuring confidentiality for both spouse's personal and financial information. c. Incapacity planning: A living trust allows couples to plan for potential incapacity by designating successor trustees to manage the trust's assets if one or both individuals become mentally or physically incapable. d. Flexibility: Living trusts offer more flexibility in designing the distribution of assets. Couples can specify how and when beneficiaries receive their inheritance, including staggered distributions or contingent beneficiaries. e. Minimize estate taxes: In some cases, a living trust can help minimize estate taxes, although professional advice should be sought to ensure compliance with current tax laws. 3. Different Types of Springfield Missouri Living Trust for Husband and Wife with No Children: a. Joint Revocable Living Trust: This is the most common type of living trust for married couples. Both spouses serve as trustees and co-own the trust assets. They retain the authority to modify or revoke the trust during their lifetime, ensuring flexibility and control. b. Testamentary Trust: While not specific to couples with no children, a testamentary trust can be established within a living trust for cases where assets will be distributed to individuals or organizations after both spouses pass away. c. Charitable Remainder Trust: This type of trust allows couples to leave a part of their assets to charitable organizations while still providing income for themselves or another beneficiary during their lifetime. Conclusion: A Springfield Missouri Living Trust for Husband and Wife with No Children offers numerous benefits for couples seeking efficient estate planning and asset distribution. By avoiding probate, ensuring privacy, planning for incapacity, and providing flexibility, couples can maintain control over their assets and leave a lasting legacy. Consider consulting with an experienced estate planning attorney to determine the best living trust option tailored to your specific needs and goals.Springfield, Missouri Living Trust for Husband and Wife with No Children: A Comprehensive Guide Introduction: A living trust is a legal document that allows individuals to manage and distribute their assets during their lifetime and after their death. For couples residing in Springfield, Missouri, a living trust can be particularly advantageous, especially when there are no children involved. This article aims to provide a detailed description of what a Springfield Missouri Living Trust for Husband and Wife with No Children entails, highlighting its benefits and different types if applicable. 1. What is a Springfield Missouri Living Trust? A Springfield Missouri Living Trust for Husband and Wife with No Children is a legal agreement that enables a couple to place their assets, including property, investments, bank accounts, and personal belongings, into a trust. The trust is primarily designed to ease the transfer of assets to beneficiaries and avoid probate upon the couple's passing. As no children are involved, alternative provisions can be made for distribution, such as leaving assets to extended family members, friends, charitable organizations, or creating a testamentary trust. 2. Benefits of a Springfield Missouri Living Trust with No Children: a. Probate avoidance: The primary advantage of establishing a living trust is bypassing the probate process, which can be time-consuming, expensive, and open to public scrutiny. By transferring assets into a living trust, they can be distributed smoothly without court proceedings. b. Privacy: Unlike a will, which becomes part of the public record during probate, a living trust allows assets to be distributed privately, ensuring confidentiality for both spouse's personal and financial information. c. Incapacity planning: A living trust allows couples to plan for potential incapacity by designating successor trustees to manage the trust's assets if one or both individuals become mentally or physically incapable. d. Flexibility: Living trusts offer more flexibility in designing the distribution of assets. Couples can specify how and when beneficiaries receive their inheritance, including staggered distributions or contingent beneficiaries. e. Minimize estate taxes: In some cases, a living trust can help minimize estate taxes, although professional advice should be sought to ensure compliance with current tax laws. 3. Different Types of Springfield Missouri Living Trust for Husband and Wife with No Children: a. Joint Revocable Living Trust: This is the most common type of living trust for married couples. Both spouses serve as trustees and co-own the trust assets. They retain the authority to modify or revoke the trust during their lifetime, ensuring flexibility and control. b. Testamentary Trust: While not specific to couples with no children, a testamentary trust can be established within a living trust for cases where assets will be distributed to individuals or organizations after both spouses pass away. c. Charitable Remainder Trust: This type of trust allows couples to leave a part of their assets to charitable organizations while still providing income for themselves or another beneficiary during their lifetime. Conclusion: A Springfield Missouri Living Trust for Husband and Wife with No Children offers numerous benefits for couples seeking efficient estate planning and asset distribution. By avoiding probate, ensuring privacy, planning for incapacity, and providing flexibility, couples can maintain control over their assets and leave a lasting legacy. Consider consulting with an experienced estate planning attorney to determine the best living trust option tailored to your specific needs and goals.