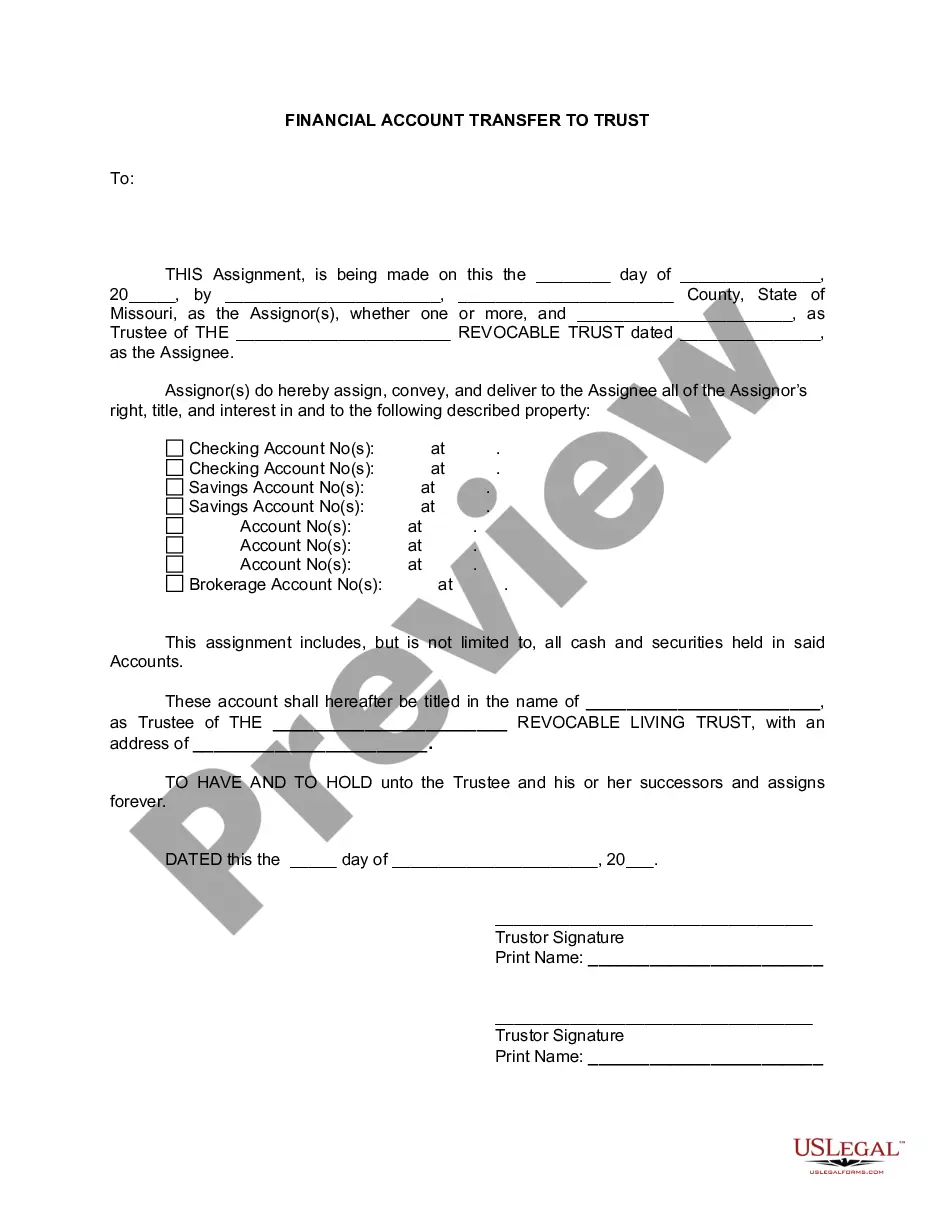

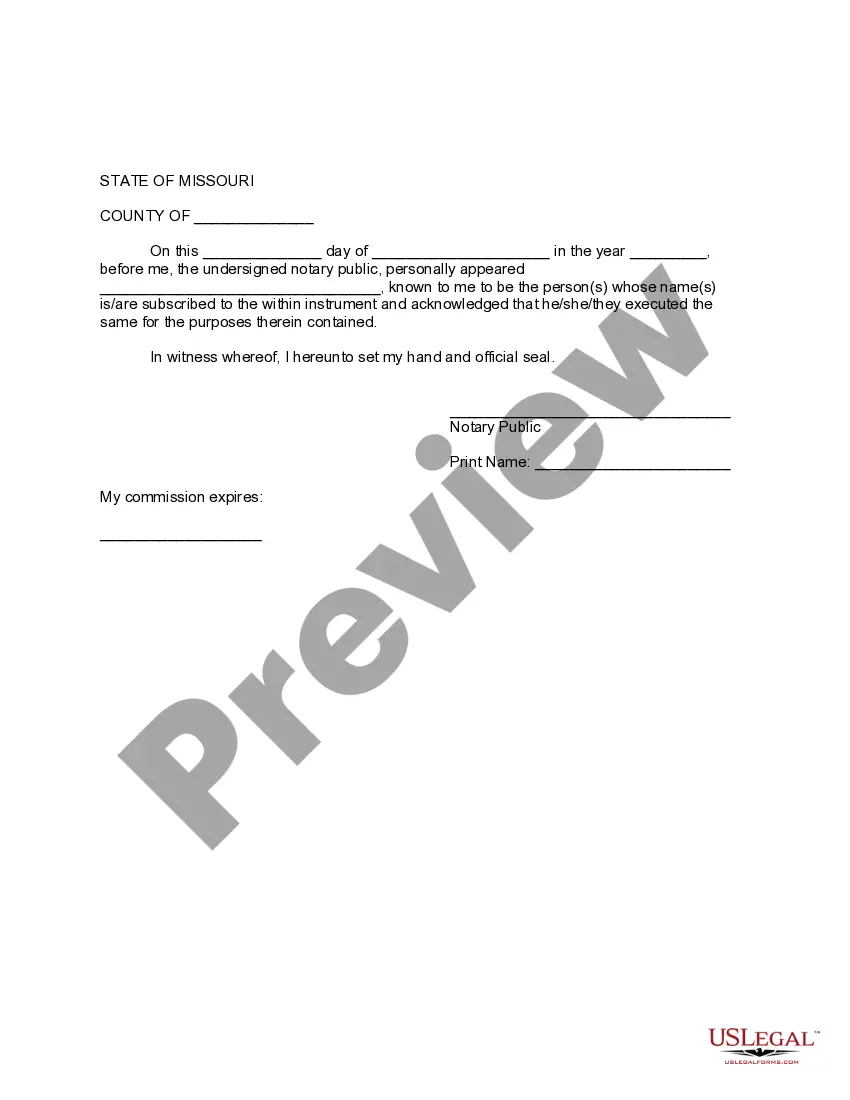

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Kansas City Missouri Financial Account Transfer to Living Trust A financial account transfer to a living trust in Kansas City, Missouri allows individuals to transfer ownership of their financial accounts into a trust that they have established during their lifetime. This process offers several benefits, including the ability to avoid probate, maintain privacy, and potentially reduce estate taxes. There are various types of financial account transfers to living trusts depending on the nature of the account. They include: 1. Bank Account Transfers: This involves transferring ownership of checking, savings, and money market accounts to a living trust. By doing so, the account funds will be managed by the trustee designated in the trust document. 2. Investment Account Transfers: Individuals can transfer ownership of stocks, bonds, mutual funds, certificates of deposit (CDs), and other investment accounts into a living trust. This allows for seamless management of investments and potentially ensures a smoother transition of assets to beneficiaries. 3. Retirement Account Transfers: It is possible to transfer ownership of retirement accounts such as 401(k)s, IRAs, and pensions into a living trust. However, special considerations should be made, and consulting with a financial advisor or attorney is highly recommended ensuring compliance with tax regulations and maximize beneficiary benefits. 4. Life Insurance Policies: By transferring life insurance policies into a living trust, policyholders can effectively manage these assets and dictate how the proceeds should be distributed to beneficiaries upon their passing. 5. Real Estate Transfers: In addition to financial accounts, individuals can also transfer ownership of their real estate assets, such as residential or commercial properties, into a living trust. This ensures that these properties are managed and distributed according to the trust's terms upon the owner's passing. It is crucial to consult with a qualified estate planning attorney or financial advisor in Kansas City, Missouri, to ensure that the financial account transfer to a living trust is conducted correctly and in compliance with state laws. They can provide guidance on the specific requirements and procedures involved in each type of account transfer, ensuring a smooth transition and effective management of assets.Kansas City Missouri Financial Account Transfer to Living Trust A financial account transfer to a living trust in Kansas City, Missouri allows individuals to transfer ownership of their financial accounts into a trust that they have established during their lifetime. This process offers several benefits, including the ability to avoid probate, maintain privacy, and potentially reduce estate taxes. There are various types of financial account transfers to living trusts depending on the nature of the account. They include: 1. Bank Account Transfers: This involves transferring ownership of checking, savings, and money market accounts to a living trust. By doing so, the account funds will be managed by the trustee designated in the trust document. 2. Investment Account Transfers: Individuals can transfer ownership of stocks, bonds, mutual funds, certificates of deposit (CDs), and other investment accounts into a living trust. This allows for seamless management of investments and potentially ensures a smoother transition of assets to beneficiaries. 3. Retirement Account Transfers: It is possible to transfer ownership of retirement accounts such as 401(k)s, IRAs, and pensions into a living trust. However, special considerations should be made, and consulting with a financial advisor or attorney is highly recommended ensuring compliance with tax regulations and maximize beneficiary benefits. 4. Life Insurance Policies: By transferring life insurance policies into a living trust, policyholders can effectively manage these assets and dictate how the proceeds should be distributed to beneficiaries upon their passing. 5. Real Estate Transfers: In addition to financial accounts, individuals can also transfer ownership of their real estate assets, such as residential or commercial properties, into a living trust. This ensures that these properties are managed and distributed according to the trust's terms upon the owner's passing. It is crucial to consult with a qualified estate planning attorney or financial advisor in Kansas City, Missouri, to ensure that the financial account transfer to a living trust is conducted correctly and in compliance with state laws. They can provide guidance on the specific requirements and procedures involved in each type of account transfer, ensuring a smooth transition and effective management of assets.