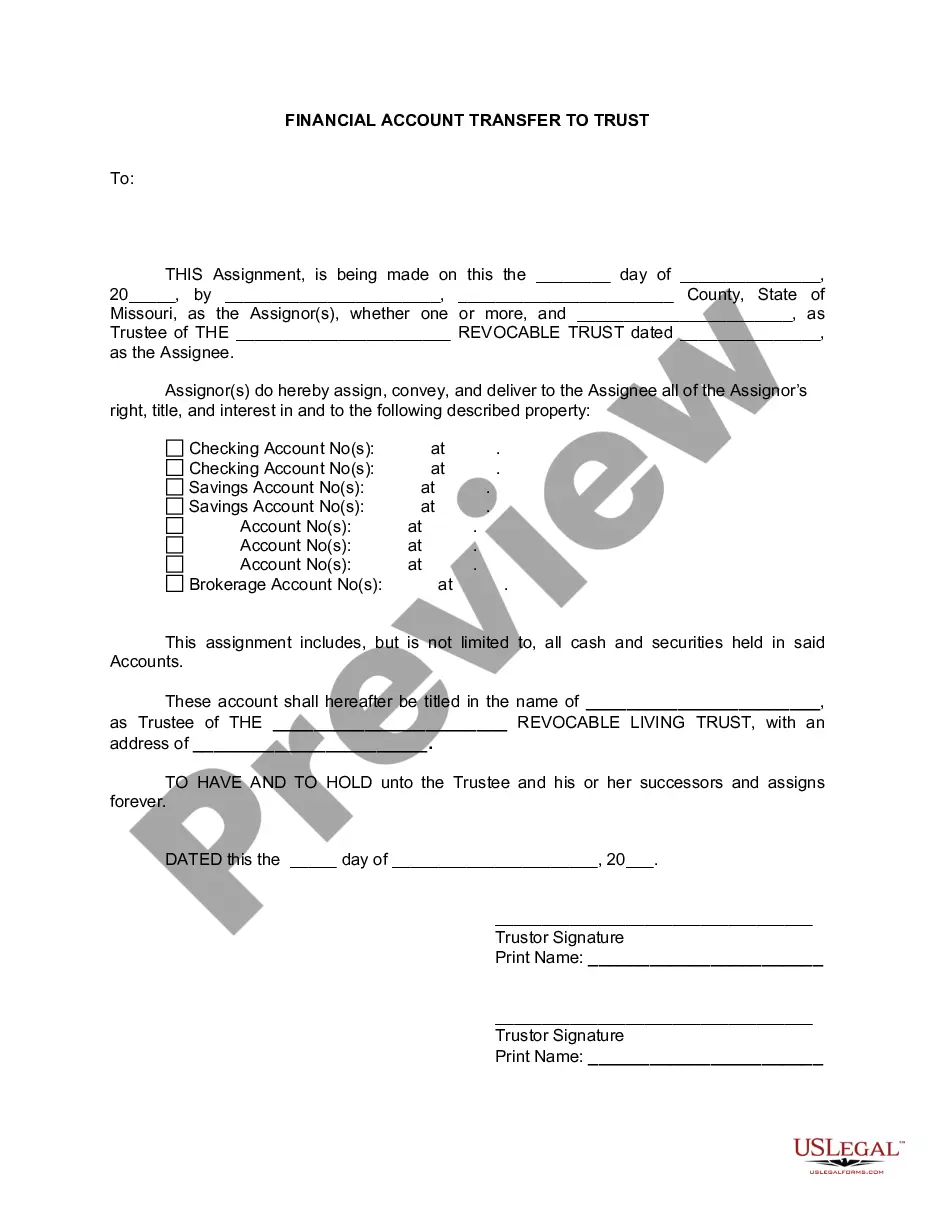

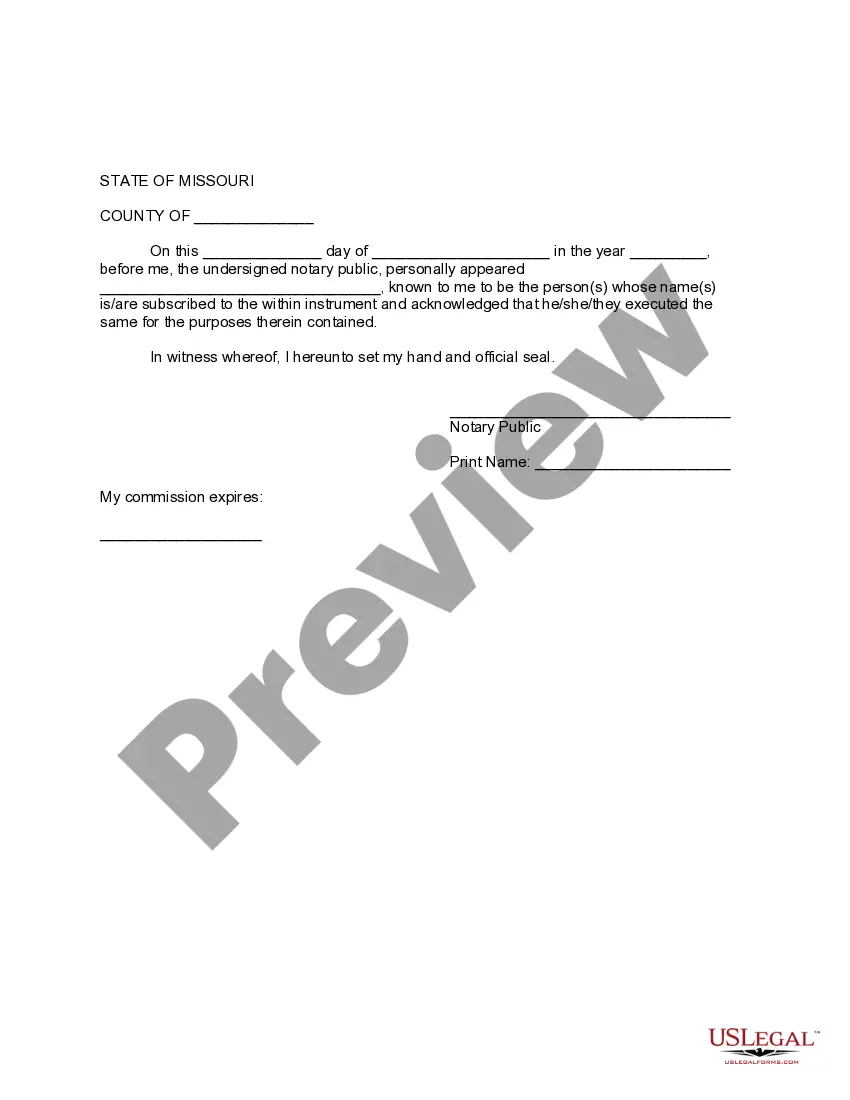

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Springfield Missouri Financial Account Transfer to Living Trust: In Springfield, Missouri, individuals often choose to transfer their financial accounts to a living trust to ensure the efficient management and distribution of their assets after their passing. A living trust is a legal entity that holds and manages a person's assets during their lifetime, and then transfers them to designated beneficiaries upon death, avoiding the need for probate court. There are different types of financial account transfers to living trusts in Springfield, Missouri, including: 1. Checking and Savings Accounts: By transferring these accounts to a living trust, the trustee appointed in the trust document gains the authority to manage and distribute funds, ensuring a seamless transition of assets. 2. Investment Accounts: Transferring investment accounts such as stocks, bonds, mutual funds, and brokerage accounts to a living trust provides comprehensive control and efficient distribution of these assets to beneficiaries. 3. Retirement Accounts: Springfield residents can also transfer their IRAs, 401(k)s, and other retirement accounts into a living trust. This can potentially offer tax advantages and ensure the continuation of tax-deferred growth for beneficiaries. 4. Real Estate: Individuals who own properties in Springfield can transfer ownership of their residential or commercial real estate to a living trust. This enables a smoother transition of ownership, avoiding complexities associated with probate. 5. Life Insurance Policies: It is also possible to transfer ownership of life insurance policies into a living trust. This allows the proceeds of the policy to be distributed according to the trust's provisions, providing financial security to loved ones. 6. Business Ownership Interests: For Springfield residents who own businesses, transferring ownership interests to a living trust ensures a well-defined plan for smooth business continuity and succession. It is crucial to consult an estate planning attorney or financial advisor in Springfield, Missouri, to understand the legal requirements and implications associated with each specific type of financial account transfer to a living trust. Professional guidance will help individuals establish a comprehensive estate plan that aligns with their specific goals and ensures the effective management and transfer of their assets in accordance with their wishes.Springfield Missouri Financial Account Transfer to Living Trust: In Springfield, Missouri, individuals often choose to transfer their financial accounts to a living trust to ensure the efficient management and distribution of their assets after their passing. A living trust is a legal entity that holds and manages a person's assets during their lifetime, and then transfers them to designated beneficiaries upon death, avoiding the need for probate court. There are different types of financial account transfers to living trusts in Springfield, Missouri, including: 1. Checking and Savings Accounts: By transferring these accounts to a living trust, the trustee appointed in the trust document gains the authority to manage and distribute funds, ensuring a seamless transition of assets. 2. Investment Accounts: Transferring investment accounts such as stocks, bonds, mutual funds, and brokerage accounts to a living trust provides comprehensive control and efficient distribution of these assets to beneficiaries. 3. Retirement Accounts: Springfield residents can also transfer their IRAs, 401(k)s, and other retirement accounts into a living trust. This can potentially offer tax advantages and ensure the continuation of tax-deferred growth for beneficiaries. 4. Real Estate: Individuals who own properties in Springfield can transfer ownership of their residential or commercial real estate to a living trust. This enables a smoother transition of ownership, avoiding complexities associated with probate. 5. Life Insurance Policies: It is also possible to transfer ownership of life insurance policies into a living trust. This allows the proceeds of the policy to be distributed according to the trust's provisions, providing financial security to loved ones. 6. Business Ownership Interests: For Springfield residents who own businesses, transferring ownership interests to a living trust ensures a well-defined plan for smooth business continuity and succession. It is crucial to consult an estate planning attorney or financial advisor in Springfield, Missouri, to understand the legal requirements and implications associated with each specific type of financial account transfer to a living trust. Professional guidance will help individuals establish a comprehensive estate plan that aligns with their specific goals and ensures the effective management and transfer of their assets in accordance with their wishes.