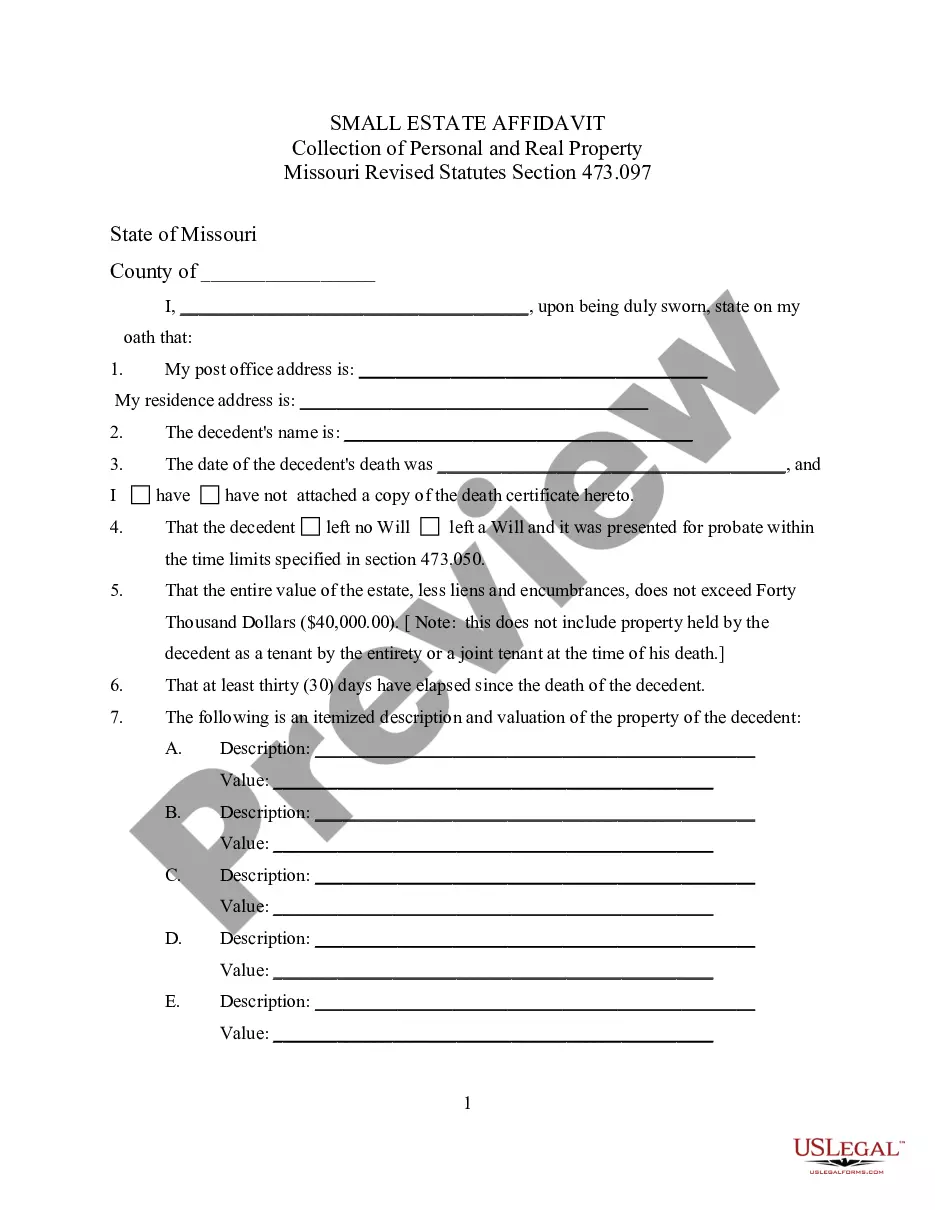

Small Estate Affidavit for Estates under 40,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Missouri Summary:

Under Missouri statute, where as estate is valued at less than $40,000, an interested party may, thirty (30) days after the death of the decedent, file an affidavit of administration of a small estate. Please see below statute for details. A copy of the affidavit and certificate shall be filed in the office of the clerk of the probate division and copies of the affidavit and certificate shall be furnished by the clerk. The affront shall collect the property of decedent described in the affidavit. The property of decedent shall be liquidated by the affiant to the extent necessary to pay debts of decedent, and the remainder shall be distributed to any beneficiaries of the estate.

Missouri Requirements:

Missouri requirements are set forth in the statutes below.

Chapter 473

Probate Code--Administration of Decedents' Estates

Section 473.097

Small estate--distribution of assets without letters, when-- affidavit--procedure--fee.

473.097.

1. Distributees of an estate which consists of personal property or real property or both personal and real property have a defeasible right to the personal property, and are entitled to the real property of such estate, as provided in this section, without awaiting the granting of letters testamentary or of administration, if all of the following conditions are met:

(1) The value of the entire estate, less liens, debt, and encumbrances, does not exceed forty thousand dollars;

(2) Thirty days have elapsed since the death of the decedent and no application for letters or for administration or for refusal of letters under section 473.090 is pending or has been granted, or if such refusal has been granted and subsequently revoked;

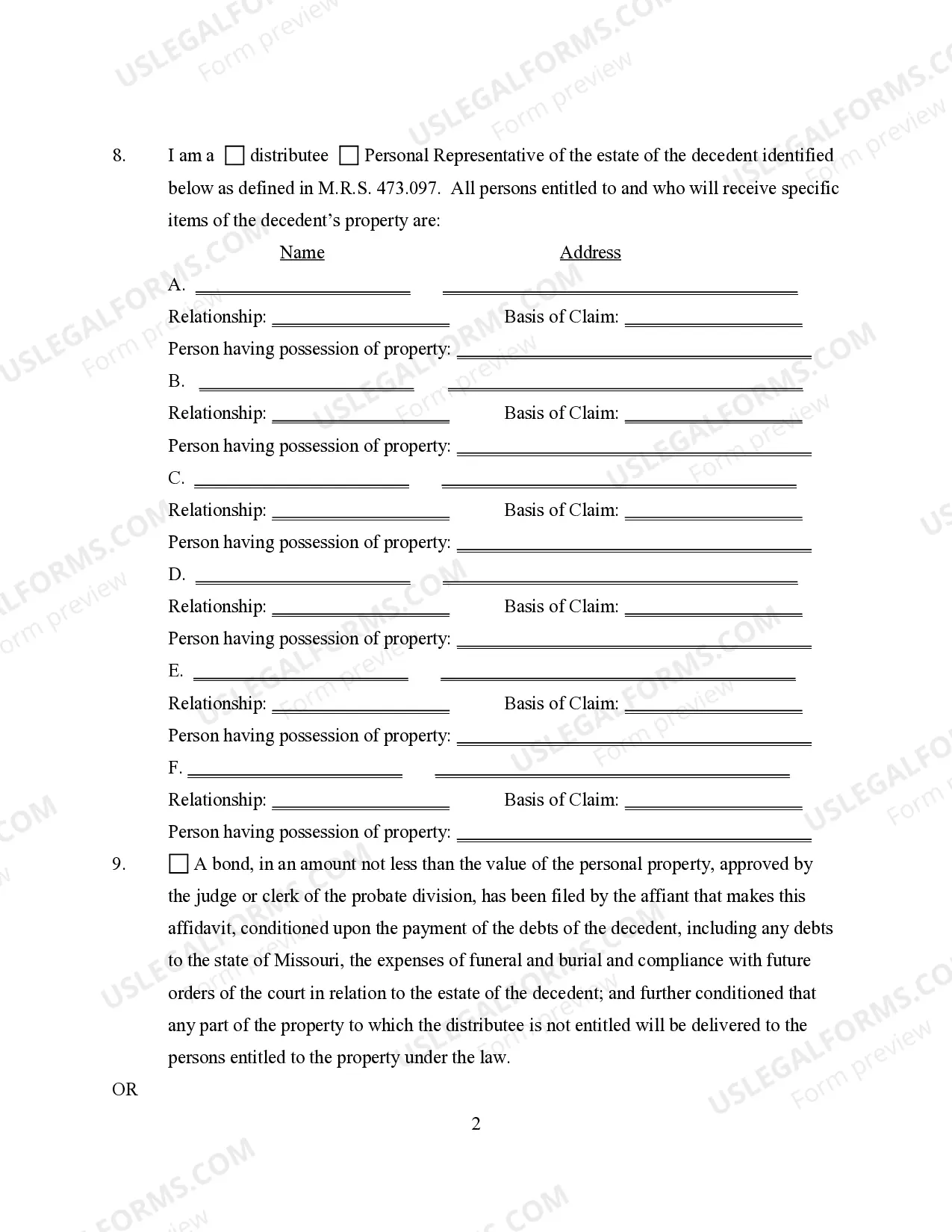

(3) A bond, in an amount not less than the value of the personal property, approved by the judge or clerk of the probate division is filed by the person making the required affidavit conditioned upon the payment of the debts of the decedent, including any debts to the state of Missouri, the expenses of funeral and burial and compliance with future orders of the court in relation to the estate of the decedent; and further conditioned that any part of the property to which the distributee is not entitled will be delivered to the persons entitled to the property under the law. Liability of the sureties on the bonds provided for in this section terminates unless proceedings against them are instituted within two years after the bond is filed; except that, the court may dispense with the filing of a bond if it finds that the same is not necessary;

(4) A fee, in the amount prescribed in subsection 1 of section 483.580, and when required, the publication cost of the notice to creditors are paid or the proof of payment for such publication is provided to the clerk of the probate division.

2. Notwithstanding the limitation periods set out in section 473.050, the affidavit required by this section may be made by the person designated as personal representative under the will of the decedent, if a will has been presented for probate within the limitation periods specified in section 473.050, otherwise by any distributee entitled to receive property of the decedent any time after thirty days after decedent's death, and shall set forth all of the following:

(1) That the decedent left no will or, if the decedent left a will, that the will was presented for probate within the limitation periods specified in section 473.050;

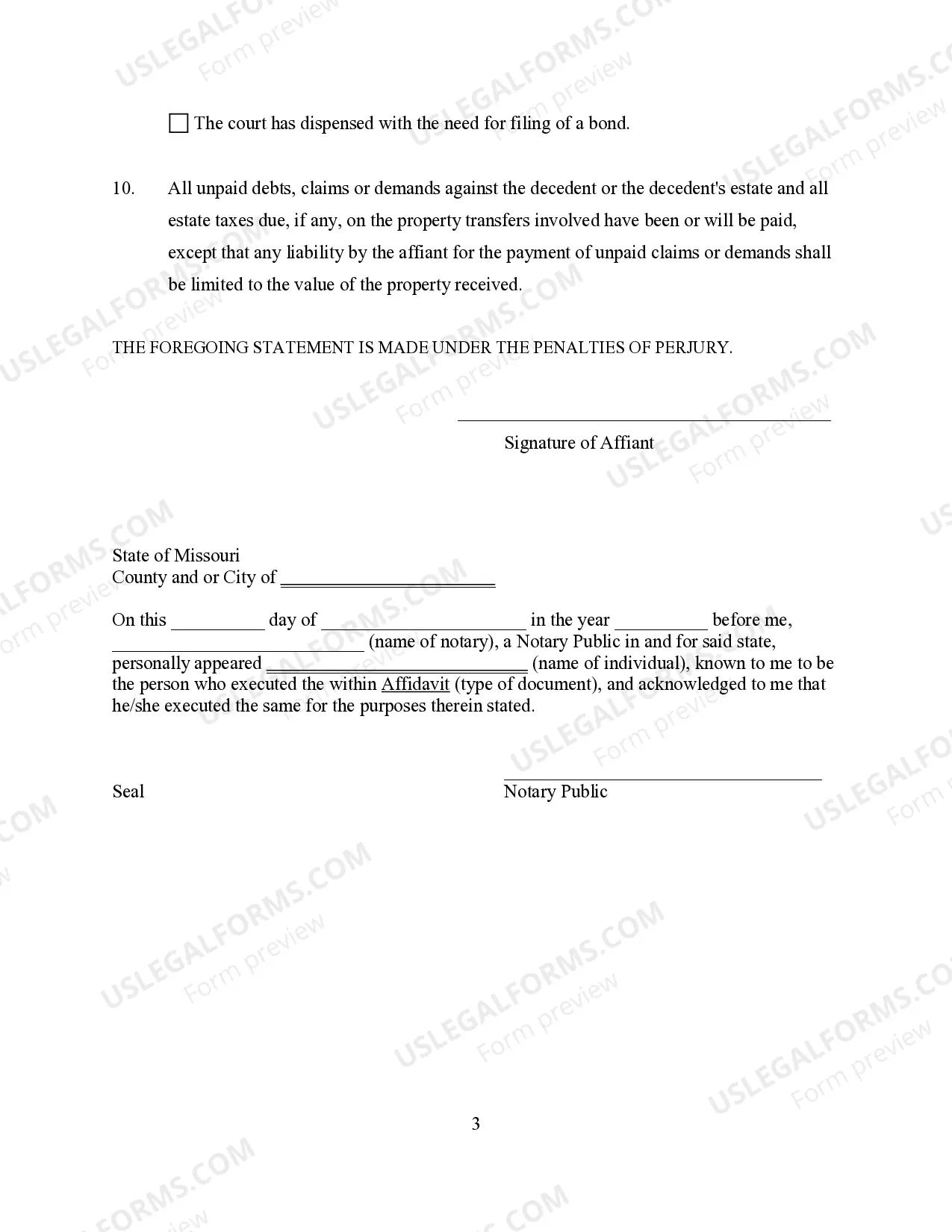

(2) That all unpaid debts, claims or demands against the decedent or the decedent's estate and all estate taxes due, if any, on the property transfers involved have been or will be paid, except that any liability by the affiant for the payment of unpaid claims or demands shall be limited to the value of the property received;

(3) An itemized description and valuation of property of the decedent. As used in this subdivision, the phrase "property of the decedent" shall not include property which was held by the decedent as a tenant by the entirety or a joint tenant at the time of the decedent's death;

(4) The names and addresses of persons having possession of the property;

(5) The names, addresses and relationship to the decedent of the persons entitled to and who will receive, the specific items of property remaining after payment of claims and debts of the decedent, included in the affidavit;

(6) The facts establishing the right to such specific items of property as prescribed by this section.

The certificate of the clerk shall be annexed to or endorsed on the affidavit and shall show the names and addresses of the persons entitled to the described property under the facts stated in the affidavit and shall recite that the will of decedent has been probated or that no will has been presented to the court and that all estate taxes on the property, if any are due, have been paid.

3. A copy of the affidavit and certificate shall be filed in the office of the clerk of the probate division and copies of the affidavit and certificate shall be furnished by the clerk.

4. The distributees mentioned in this section may establish their right to succeed to the real estate of the decedent by filing a copy of the foregoing affidavit and certificate of the clerk in the office of the recorder of deeds of each county where the real property is situated.

5. When the value of the property listed in the affidavit is more than fifteen thousand dollars, the clerk shall cause to be published in a newspaper of general circulation within the county which qualifies under chapter 493 a notice to creditors of the decedent to file their claims in the court or be forever barred. The notice shall be published once a week for two consecutive weeks. Proof of publication of notice pursuant to this section shall be filed not later than ten days after completion of the publication. The notice shall be in substantially the following form:

To all persons interested in the estate of ..............., Decedent:

On the ........... day of ........................, 20..., a small estate affidavit was <p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">filed by the distributees for the decedent under section 473.097, RSMo, with the probate division of the circuit court of ……………… County, Missouri.<br style="box-sizing: border-box;" />

All creditors of the decedent, who died on ……………, 20…, are notified that section 473.444 sets a limitation period that would bar claims one year after the death of the decedent. A creditor may request that this estate be opened for administration.<br style="box-sizing: border-box;" />

Receipt of this notice should not be construed by the recipient to indicate that the recipient may possibly have a beneficial interest in the estate. The nature and extent of any person’s interest, if any, may possibly be determined from the affidavit on this estate filed in the probate division of the circuit court of ………………… County, Missouri.<br style="box-sizing: border-box;" />

Date of first publication is ………….., 20…<br style="box-sizing: border-box;" />

………………………….. ………………<br style="box-sizing: border-box;" />

Clerk of the Probate Division<br style="box-sizing: border-box;" />

of the Circuit Court<br style="box-sizing: border-box;" />

……………… County, Missouri</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">6. Upon compliance with the procedure required by this section, the personal property and real estate involved shall not thereafter be taken in execution for any debts or claims against the decedent, but such compliance has the same effect in establishing the right of distributees to succeed to the property as if complete administration was had; but nothing in this section affects the right of secured creditors with respect to such property.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">7. The affiant shall collect the property of decedent described in the affidavit. The property of decedent shall be liquidated by the affiant to the extent necessary to pay debts of decedent. If the decedent’s property is not sufficient to pay such debts, abatement of the shares of the distributees shall occur in accordance with section 473.620. The affiant shall distribute the remaining property to such persons identified in the affidavit as required in subdivision (5) of subsection 2 of this section who are entitled to receive the specific items of personal property, as described in the affidavit, or to have any evidence of such property transferred to such persons. To the extent necessary to facilitate distribution, the affiant may liquidate all or part of decedent’s property.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">(L. 1955 p. 385 § 54, A.L. 1957 p. 829, A.L. 1967 p. 640, A.L. 1971 S.B. 19, A.L. 1973 S.B. 112, A.L. 1978 H.B. 1634, A.L. 1980 S.B. 637, A.L. 1981 S.B. 117, A.L. 1985 S.B. 35, et al., A.L. 1986 S.B. 787, A.L. 1993 S.B. 88, A.L. 1994 S.B. 701, A.L. 1996 S.B. 494, A.L. 2002 H.B. 1537)</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);"><span style="box-sizing: border-box; font-weight: 600;">Effect of acquittances by distributees of small estate.</span></p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">473.100.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">The person making payment, delivery, transfer or issuance of personal property or evidence thereof pursuant to the affidavit prescribed in section 473.097 is discharged and released to the same extent as if made to an executor or administrator of the decedent, and he is not required to see to the application thereof or to inquire into the truth of any statement in the affidavit if made by any other person. If any person to whom the affidavit is delivered refuses to pay, deliver, transfer, or issue any personal property or evidence thereof, it may be recovered or its payment, delivery, transfer, or issuance compelled in an action brought for that purpose by or on behalf of the persons entitled thereto under section 473.097, upon proof of the defeasible right declared by such section. Any person to whom payment, delivery, transfer or issuance is made is answerable and accountable therefor to any administrator or executor of the estate or to the surviving spouse or minor children of the decedent who proceed under section 473.090 or 473.093 or to any other person having a superior right. (L. 1955 p. 385 § 55)</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);"><span style="box-sizing: border-box; font-weight: 600;">Small estate appraised, when.</span></p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">473.107.</p>

<p style="box-sizing: border-box; margin: 0px 0px 15px; color: rgb(51, 51, 51); font-family: "Open Sans", sans-serif; font-size: 17px; background-color: rgb(255, 255, 255);">The probate division of the circuit court in its discretion may order the appraisal of the property before a certificate is made under section 473.097 or before an order refusing letters is made under section 473.090. The appraisal shall be made by one or more appraisers appointed by the court and the cost thereof shall be paid by the persons entitled to the property in accordance with the order of the court.<br style="box-sizing: border-box;" />

(L. 1955 p. 385 § 58, A.L. 1971 S.B. 163, A.L. 1978 H.B. 1634)<br style="box-sizing: border-box;" />

Effective 1-2-79</p>