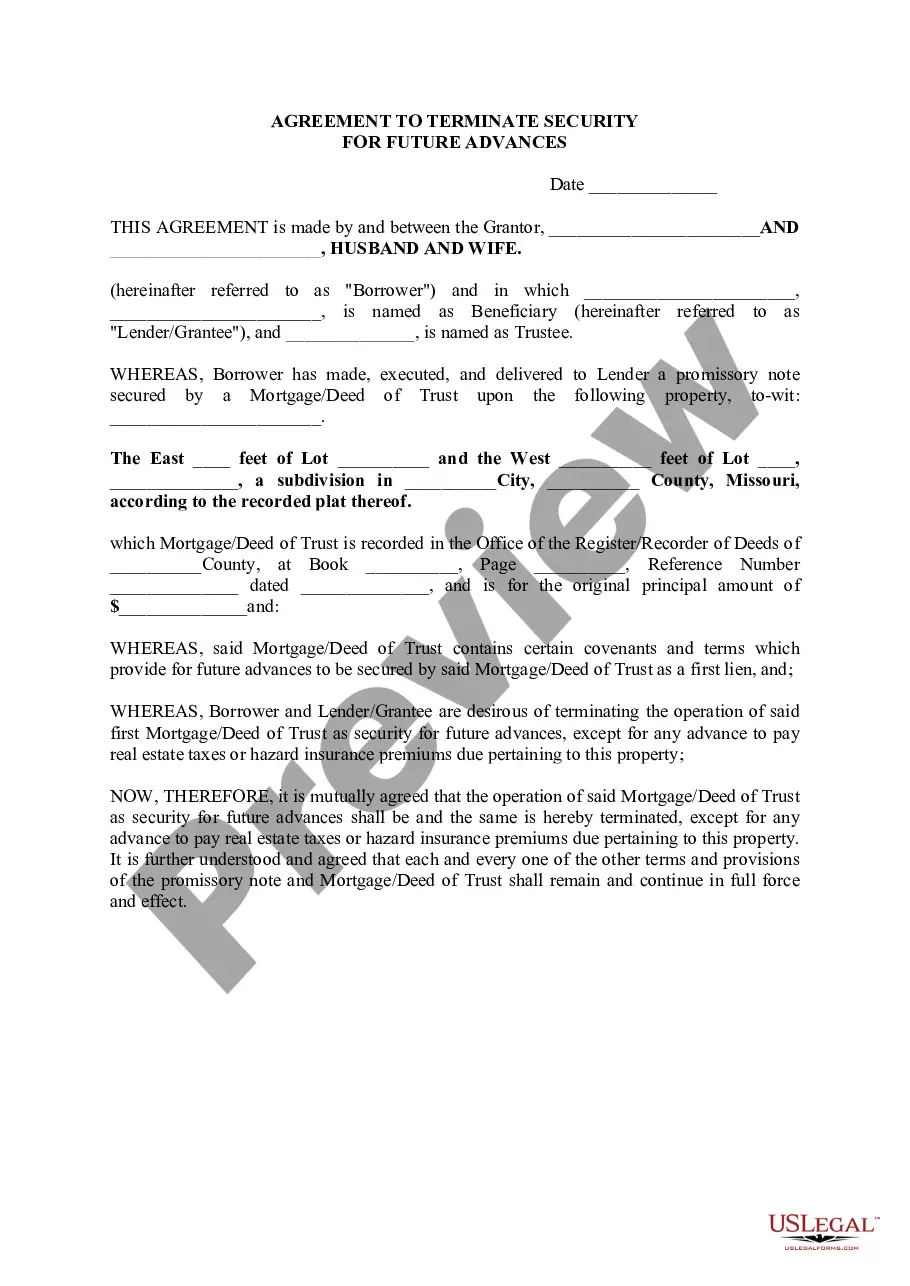

Springfield Missouri Agreement to Terminate Security For Future Advances is a legal document that outlines the terms and conditions for terminating a security agreement related to future advances in the city of Springfield, Missouri. This agreement is commonly used in situations where parties wish to terminate a security interest in collateral that was previously granted to secure future financing or other advances. The agreement typically begins with an introduction, stating the names of the parties involved, the date of the agreement, and a brief overview of the purpose. It may also reference any previous agreements or contracts that are being terminated or modified by this agreement. Key terms and clauses often included in a Springfield Missouri Agreement to Terminate Security For Future Advances include: 1. Collateral Description: This section describes the collateral or property that was originally pledged as security for future advances. It provides a detailed description of the collateral to ensure clarity and avoid any misunderstandings. 2. Termination of Security Interest: This clause states that the parties agree to terminate the previously established security interest in the collateral, thereby releasing the debtor from any obligations related to future advances secured by the collateral. 3. Representations and Warranties: Both parties typically provide representations and warranties in this agreement. The debtor may warrant that they have good title to the collateral and the right to terminate the security interest. The lender may warrant that they have no claims against the collateral other than the terminated security interest. 4. Release and Discharge: This section stipulates that the lender releases and discharges any and all claims, liens, or encumbrances they have on the collateral and confirms that they will take no further action to enforce their security interest. 5. Governing Law: The agreement may specify that it is governed by the laws of the state of Missouri, particularly those applicable in Springfield, Missouri. Different types of Springfield Missouri Agreement to Terminate Security For Future Advances may vary slightly in terminology or specific provisions based on the unique circumstances of each agreement. For instance, some agreements may include additional clauses related to the release of guarantees, mutual indemnification, or dispute resolution mechanisms. In conclusion, a Springfield Missouri Agreement to Terminate Security For Future Advances is a comprehensive legal document that enables parties to terminate a previous security agreement concerning future advances. By clearly defining the terms and conditions of termination, this agreement helps protect the rights and interests of both the debtor and the lender involved in the transaction.

Springfield Missouri Agreement to Terminate Security For Future Advances is a legal document that outlines the terms and conditions for terminating a security agreement related to future advances in the city of Springfield, Missouri. This agreement is commonly used in situations where parties wish to terminate a security interest in collateral that was previously granted to secure future financing or other advances. The agreement typically begins with an introduction, stating the names of the parties involved, the date of the agreement, and a brief overview of the purpose. It may also reference any previous agreements or contracts that are being terminated or modified by this agreement. Key terms and clauses often included in a Springfield Missouri Agreement to Terminate Security For Future Advances include: 1. Collateral Description: This section describes the collateral or property that was originally pledged as security for future advances. It provides a detailed description of the collateral to ensure clarity and avoid any misunderstandings. 2. Termination of Security Interest: This clause states that the parties agree to terminate the previously established security interest in the collateral, thereby releasing the debtor from any obligations related to future advances secured by the collateral. 3. Representations and Warranties: Both parties typically provide representations and warranties in this agreement. The debtor may warrant that they have good title to the collateral and the right to terminate the security interest. The lender may warrant that they have no claims against the collateral other than the terminated security interest. 4. Release and Discharge: This section stipulates that the lender releases and discharges any and all claims, liens, or encumbrances they have on the collateral and confirms that they will take no further action to enforce their security interest. 5. Governing Law: The agreement may specify that it is governed by the laws of the state of Missouri, particularly those applicable in Springfield, Missouri. Different types of Springfield Missouri Agreement to Terminate Security For Future Advances may vary slightly in terminology or specific provisions based on the unique circumstances of each agreement. For instance, some agreements may include additional clauses related to the release of guarantees, mutual indemnification, or dispute resolution mechanisms. In conclusion, a Springfield Missouri Agreement to Terminate Security For Future Advances is a comprehensive legal document that enables parties to terminate a previous security agreement concerning future advances. By clearly defining the terms and conditions of termination, this agreement helps protect the rights and interests of both the debtor and the lender involved in the transaction.