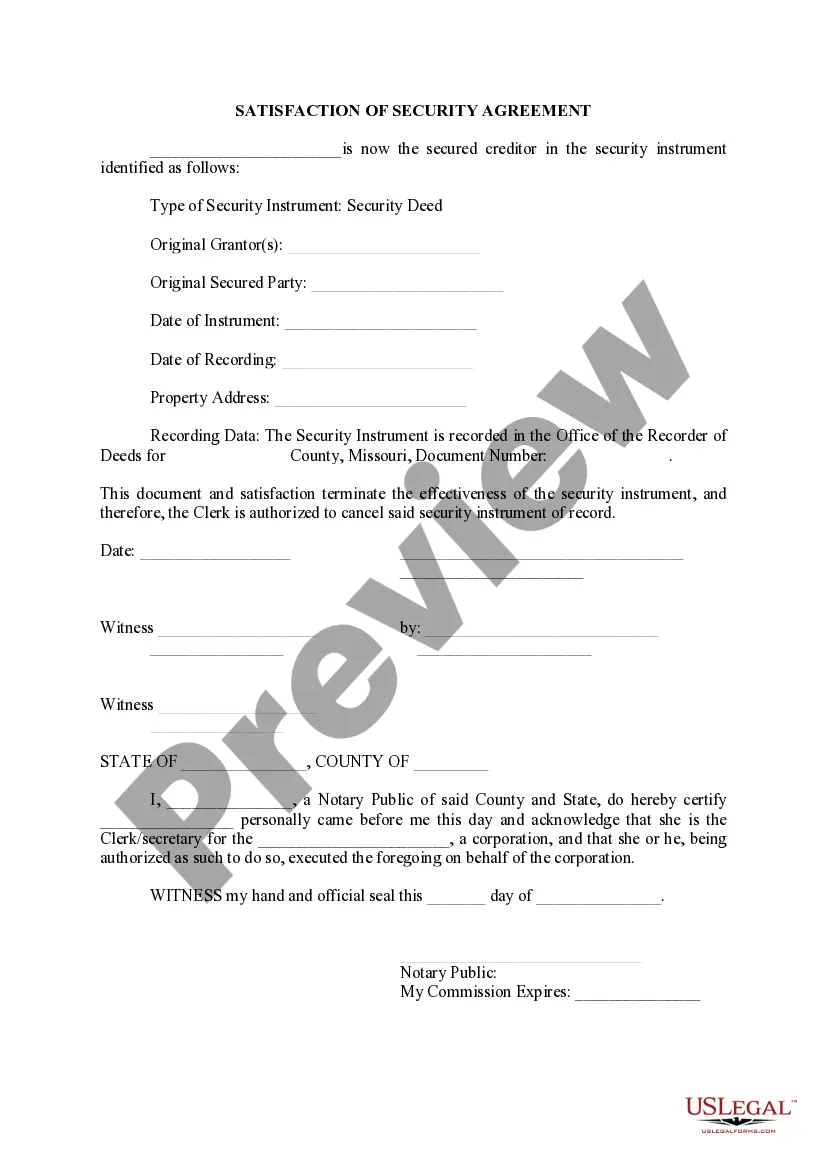

Springfield Missouri Satisfaction of Security Agreement is a legal document that signifies the completion of a loan or debt repayment and releases the debtor from their obligation to the lender. It serves as proof that the borrower has fulfilled all the terms and conditions mentioned in the original security agreement. The Springfield Missouri Satisfaction of Security Agreement is typically used in various financial transactions, such as secured loans, mortgages, or car loans, where the lender holds a security interest in the borrower's assets until the debt is fully repaid. Once the borrower satisfies their financial obligation and pays off the loan, a Satisfaction of Security Agreement is executed to release the lien or encumbrance on the collateral. This agreement helps in ensuring transparency and protection for all parties involved. It provides legal assurance to the borrower that their debt has been cleared and their assets are no longer pledged as collateral. Additionally, it safeguards the lender's interests by establishing that the debt has been fully settled and the security interest is no longer valid. In Springfield, Missouri, there are various types of Satisfaction of Security Agreements, depending on the nature of the loan or debt being satisfied. Some common types include: 1. Real estate satisfaction of security agreement: This type of agreement is used when a mortgage loan on a property in Springfield, Missouri, has been repaid in full. It releases the lender's security interest on the property, ensuring the borrower has clear ownership rights. 2. Vehicle satisfaction of security agreement: When a borrower fully pays off their car loan in Springfield, Missouri, a satisfaction of security agreement is executed. This document terminates the lender's security interest in the vehicle, allowing the borrower to obtain a clear title. 3. Business loan satisfaction of security agreement: In cases where a commercial loan has been satisfied, a satisfaction of security agreement is utilized. This type of agreement releases any collateral pledged by the borrower for the loan, providing assurance that the business assets are no longer encumbered. 4. Personal loan satisfaction of security agreement: When a borrower fully repays a personal loan, such as a student loan or a personal line of credit, a satisfaction of security agreement is employed. It cancels the lender's security interest on any pledged personal assets provided as collateral. In conclusion, the Springfield Missouri Satisfaction of Security Agreement is a crucial legal document that signifies the completion of a loan or debt repayment. It ensures that the borrower has satisfied all their obligations, releases the lender's security interest, and provides assurance to both parties that the debt has been fully cleared.

Springfield Missouri Satisfaction of Security Agreement

Description

How to fill out Springfield Missouri Satisfaction Of Security Agreement?

Are you looking for a trustworthy and inexpensive legal forms provider to get the Springfield Missouri Satisfaction of Security Agreement? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of separate state and county.

To download the document, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Springfield Missouri Satisfaction of Security Agreement conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Springfield Missouri Satisfaction of Security Agreement in any provided format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online for good.