Lee's Summit, Missouri Loan Modification Agreement is a legal document that allows borrowers to modify the terms of their existing mortgage agreement in order to make their loan more affordable. This agreement is specifically designed for residents of Lee's Summit, Missouri, who are struggling to meet their mortgage payments and are at risk of defaulting on their loan. A loan modification agreement can be a lifesaver for borrowers facing financial hardships, as it provides them with a chance to negotiate with their lender and make changes to their loan terms that align with their current financial situation. This agreement typically involves a reduction in the interest rate, extension of the loan term, or a combination of both, which ultimately lowers the monthly mortgage payments. There are various types of Lee's Summit, Missouri Loan Modification Agreements available to borrowers. One type is the interest rate modification, which involves reducing the interest rate charged on the loan. This can significantly lower the monthly payment amount and provide immediate relief to the borrower. Another type is a loan term extension, where the length of the loan is extended, resulting in smaller monthly payments spread out over a longer period. This option allows borrowers to restructure their debt and make it more manageable, especially if they are experiencing a temporary financial setback. Additionally, some borrowers may opt for a principal reduction modification, which involves reducing the total amount owed on the loan. This is less common but can be a viable option for borrowers who owe more than their property is worth or who are severely underwater on their mortgage. It is important to note that Lee's Summit, Missouri Loan Modification Agreements are subject to approval by the lender and are typically only offered to borrowers who can demonstrate a legitimate financial hardship. Borrowers will need to provide detailed financial information, such as income, expenses, and any supporting documents, to support their request for loan modification. In conclusion, Lee's Summit, Missouri Loan Modification Agreement provides struggling borrowers in Lee's Summit with an opportunity to modify the terms of their mortgage to make it more affordable. Interest rate modifications, loan term extensions, and principal reduction modifications are some common types of loan modifications available to borrowers. However, it is crucial for borrowers to meet the lender's eligibility criteria and provide appropriate documentation to support their request for loan modification.

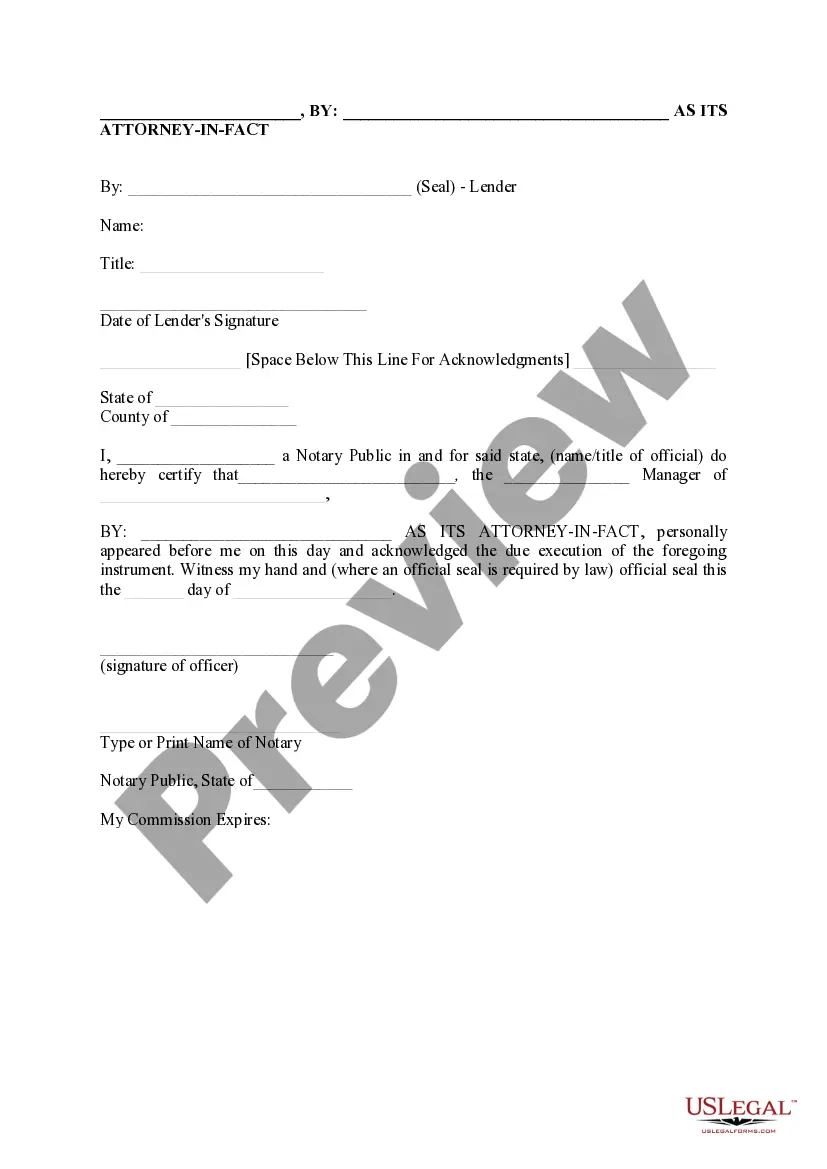

Lee's Summit Missouri Loan Modification Agreement

Description

How to fill out Lee's Summit Missouri Loan Modification Agreement?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Lee's Summit Missouri Loan Modification Agreement or any other document easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Lee's Summit Missouri Loan Modification Agreement complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Lee's Summit Missouri Loan Modification Agreement would work for you, you can pick the subscription option and make a payment.

- Then you can download the form in any suitable format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!