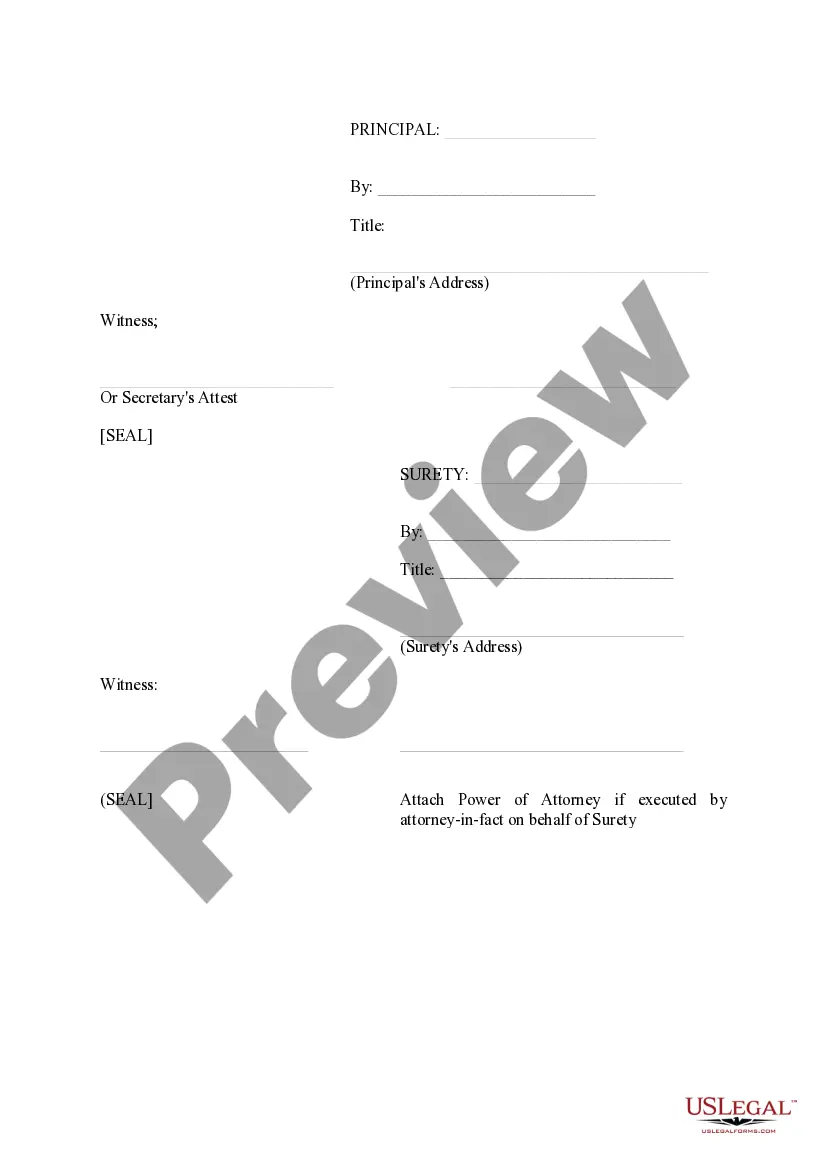

A Kansas City Missouri Performance Bond is a type of surety bond that guarantees the completion of a specific project or undertaking according to the terms agreed upon. It serves as a protection to the party who hired a contractor or company for a project, ensuring that the work will be executed as per the contractual requirements. Performance bonds are commonly used in the construction industry in Kansas City, Missouri. They are required by various entities such as government agencies, private project owners, or corporations for projects of significant size and value. The purpose of these bonds is to ensure that contractors fulfill their obligations, meet project deadlines, and deliver quality workmanship. There are different types of Kansas City Missouri Performance Bonds, including: 1. Bid Bond: This type of bond guarantees that a contractor will honor the terms of their bid and enter into a contract if awarded. It provides financial security to project owners during the bidding process. 2. Payment Bond: Payment bonds protect subcontractors, suppliers, and laborers by guaranteeing that they will receive payment for their services and materials supplied to a project. This bond is essential for maintaining a fair and ethical construction industry in Kansas City. 3. Maintenance Bond: A maintenance bond guarantees the quality of work performed by a contractor after project completion. It provides coverage for any defects or failures that may arise within a predetermined maintenance period. 4. Supply Bond: Supply bonds are used when a contractor is responsible for providing specific materials or equipment for a project. They ensure that the supplier will fulfill their obligations in terms of the quality and quantity of supplies. 5. Subdivision Bond: Subdivision bonds are required by municipalities when a land developer plans to divide a property into smaller lots for construction purposes. These bonds ensure that the developer will complete infrastructure improvements, such as roads, sidewalks, and utilities, within the specified time frame. Overall, Kansas City Missouri Performance Bonds are vital for project owners, subcontractors, and suppliers to mitigate financial risks associated with construction projects. They provide assurance that contractors will fulfill their obligations, resulting in successful project completion.

Kansas City Missouri Performance Bond

Description

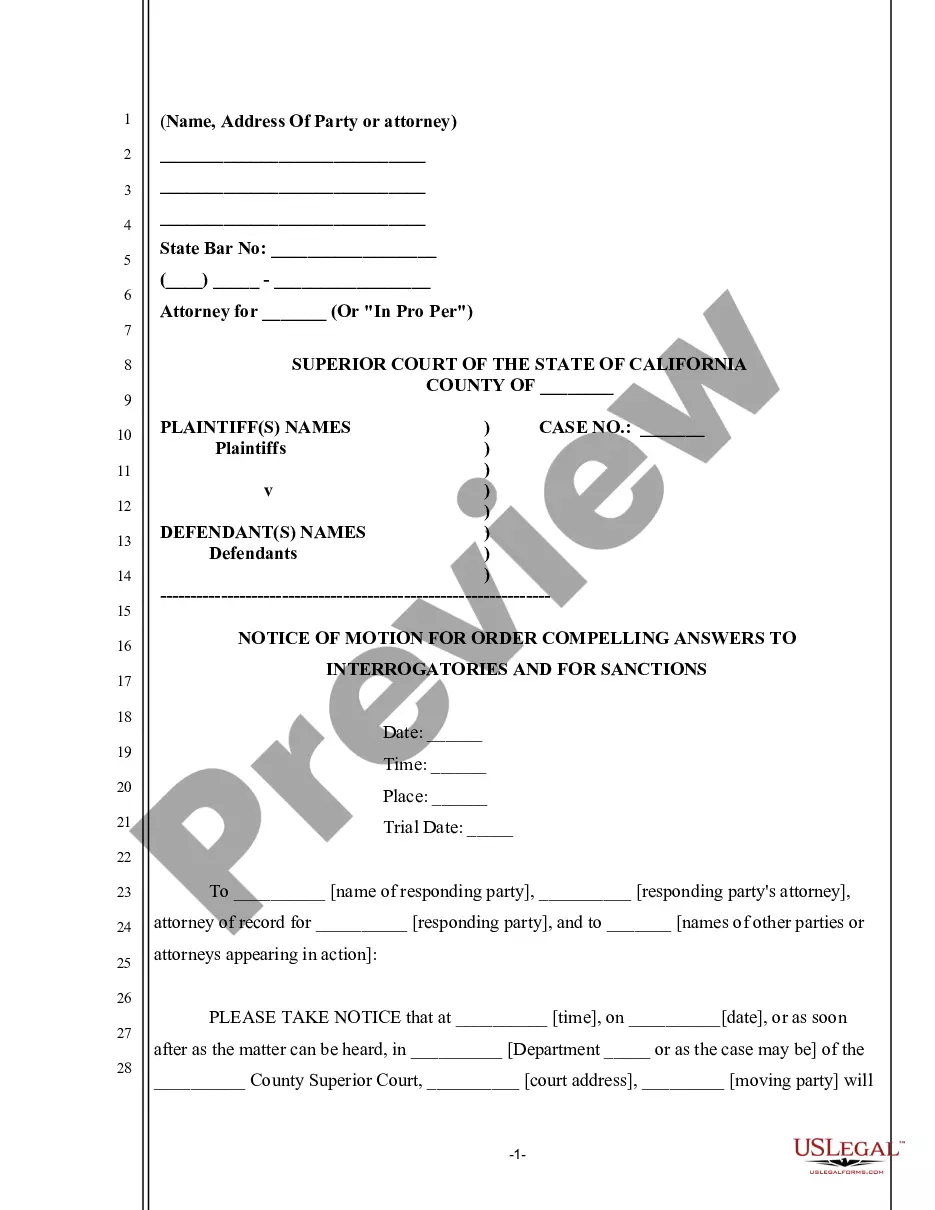

How to fill out Kansas City Missouri Performance Bond?

If you are searching for a pertinent form template, it’s unattainable to discover a superior platform than the US Legal Forms site – one of the most comprehensive libraries on the internet.

Here you can find a multitude of templates for both business and personal use categorized by types and states, or through key phrases.

With our top-quality search feature, locating the most current Kansas City Missouri Performance Bond is as simple as 1-2-3.

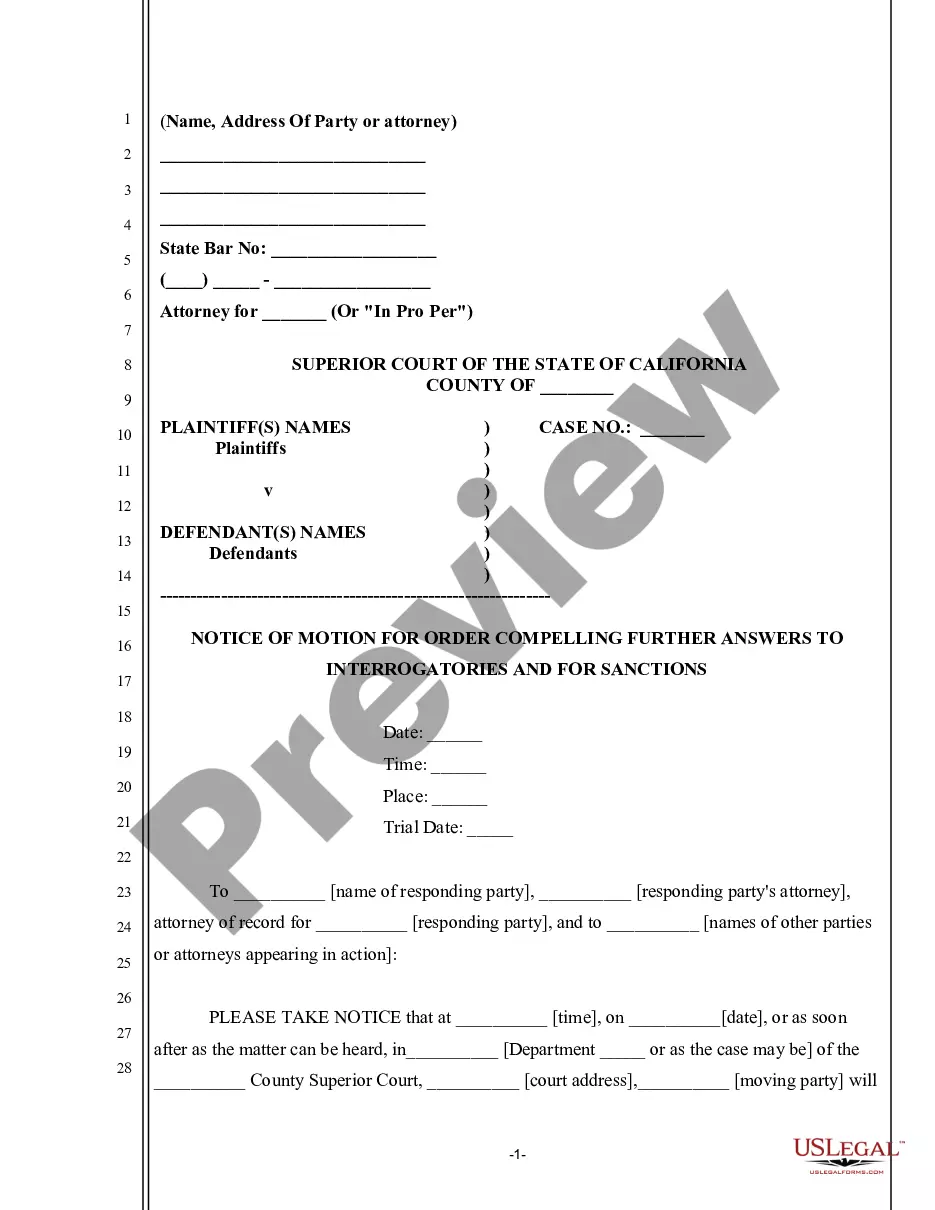

Execute the payment process. Use your credit card or PayPal account to complete the account registration.

Retrieve the template. Specify the file format and save it to your computer. Edit as needed. Fill in, review, print, and sign the acquired Kansas City Missouri Performance Bond.

- Moreover, the relevance of each document is confirmed by a group of specialized attorneys who routinely assess the templates on our platform and update them according to the latest state and county regulations.

- If you are already familiar with our platform and have a registered account, all you need to obtain the Kansas City Missouri Performance Bond is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have located the sample you desire. Review its description and utilize the Preview feature to examine its content. If it doesn’t fulfill your requirements, employ the Search bar at the top of the page to find the appropriate document.

- Confirm your choice. Click the Buy now button. Next, select your preferred subscription plan and enter your details to register an account.

Form popularity

FAQ

When the job is done, the service provider may collect the performance bond money. As the service provider, review the terms of the contract agreement.Obtain a signature of completion or receipt of goods and services from your client, the other party in the contract.

A payment bond and a performance bond work hand in hand. A payment bond guarantees a party pays all entities, such as subcontractors, suppliers, and laborers, involved in a particular project when the project is completed. A performance bond ensures the completion of a project.

The 100% payment and performance bond provides protection for a contractor in the event that they are unable to complete their contract. Contractors will be able to receive up to two times the value of their original pledge, which can help cover any additional costs incurred due to unforeseen circumstances.

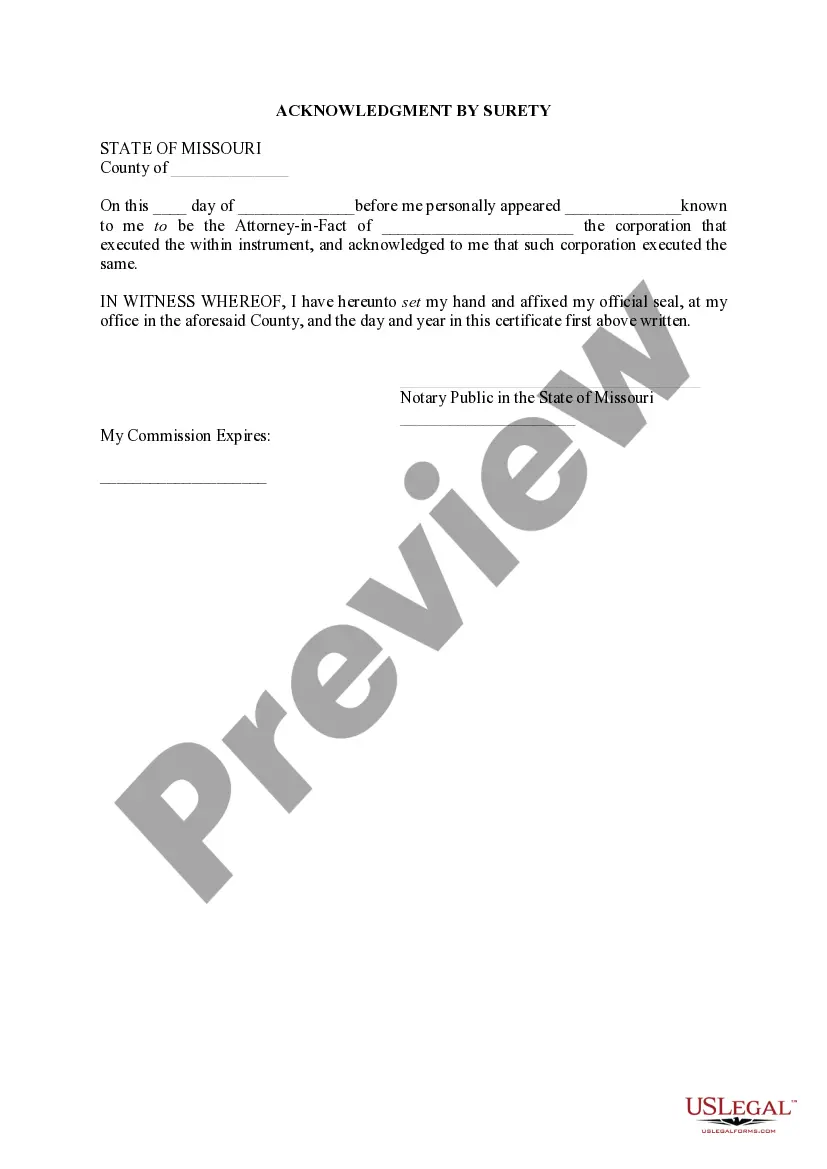

A formal claim under a performance bond can only be made if the contract is in default and the default has been declared. However, the owner does not need to wait for things to go south before calling the surety for assistance.

Payment and Performance Bond. Both bonds are often required of contractors by a hiring organization or individual as a means of ensuring that contractors and subcontractors involved in a given project provide quality workmanship, and are properly paid by the head contractor.

Benefits of Performance Bonds The most obvious benefit of a performance bond for the owner is the assurance of a project's completion. The surety protects the owner in the event the contractor defaults on the contract. Contractors are taken through a meticulous pre-qualification process.

Performance bond vs advance payment bond Whereas a performance bond provides the Employer with a cash sum in the event of failure of the Contractor to complete their work, an advance payment bond is used to provide security to the Employer where a large deposit is required.

A payment bond is a type of surety bond issued to contractors which guarantee that all entities involved with the project will be paid. A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment.

Performance bonds are essentially letters of guarantee issued by a bank on the request of the contractor, by which that bank undertakes to make a payment to the employer upon the employer's demand.

A performance bond is an agreement between the contractor and the owner of a project. The contractor agrees to provide a certain level of work in exchange for payment, while the owner agrees to pay if the work is not completed satisfactorily.