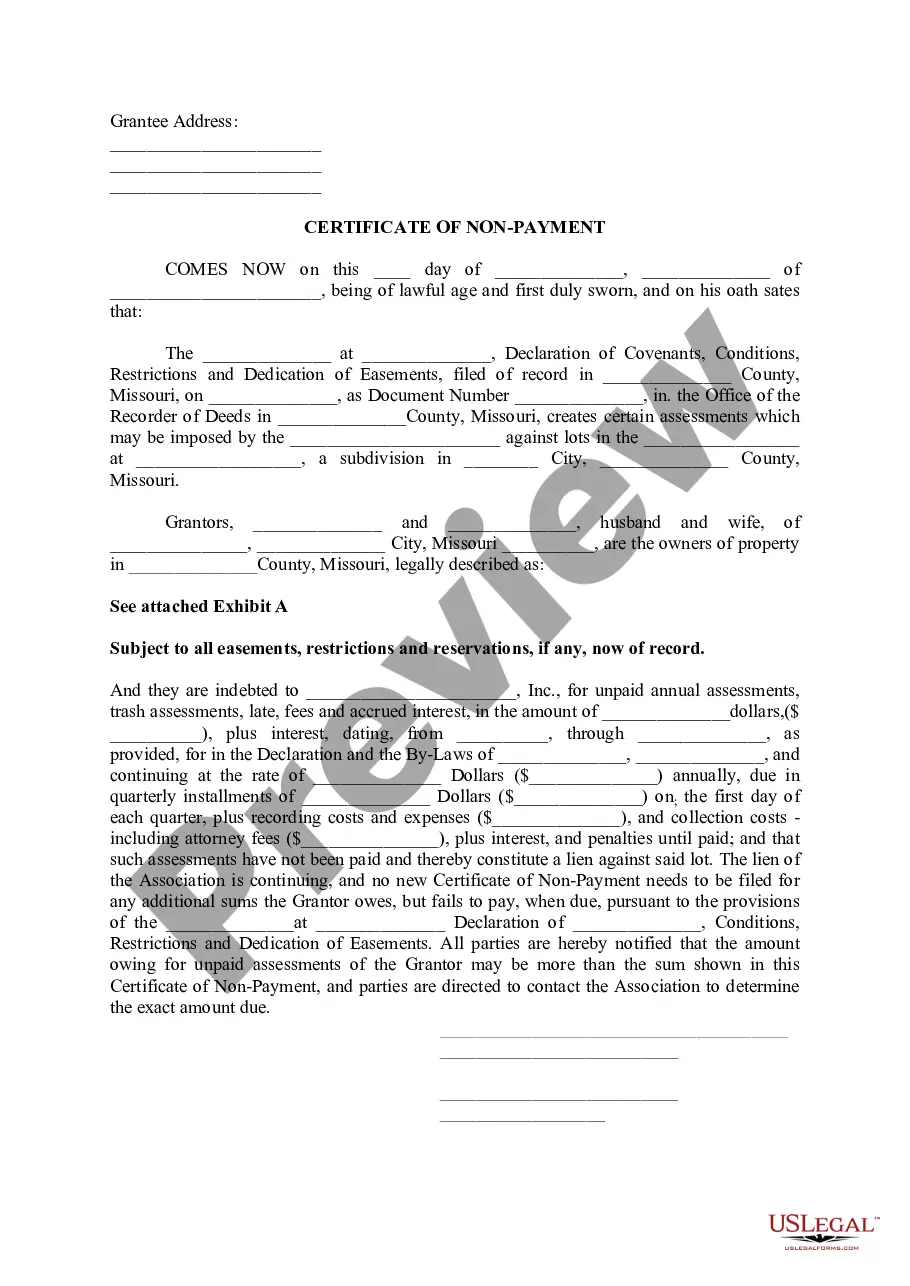

The Lee's Summit Missouri Certificate of Non-Payment is a crucial document issued by the city government to officially indicate that a particular individual, organization, or business has failed to fulfill their financial obligations. This certificate serves as a legal proof of non-payment and can have significant implications for the defaulter. Keywords: Lee's Summit, Missouri, Certificate of Non-Payment, document, city government, financial obligations, legal proof, implications, defaulter. In Lee's Summit, Missouri, there are two primary types of Certificate of Non-Payment issued: 1. Lee's Summit Missouri Certificate of Non-Payment for Taxes: This type of certificate is specifically related to the non-payment of taxes, such as property taxes, sales taxes, or any other outstanding tax liabilities owed to the city government. It is crucial for the city to issue this certificate to maintain tax revenue and ensure compliance from individuals and businesses. 2. Lee's Summit Missouri Certificate of Non-Payment for Municipal Services: This particular certificate is issued when an individual, business, or organization fails to pay for municipal services provided by the city. These municipal services may include water and sewage charges, garbage collection fees, licensing fees, and other municipal service charges. The city relies on these payments to maintain and enhance essential services within the community. When a Lee's Summit, Missouri Certificate of Non-Payment is issued, it has several notable implications. Firstly, it serves as an official notice to the defaulter, making them aware of their outstanding financial obligations and the consequences of non-compliance. Secondly, this certificate can adversely impact the individual or business's credit rating, making it difficult for them to secure loans or future financial agreements. Additionally, the Lee's Summit Missouri Certificate of Non-Payment may result in various enforcement actions by the city government. These actions may include imposing fines, penalties, initiating legal proceedings, or even placing a lien on the defaulter's property. Ultimately, the issuance of this certificate aims to safeguard the city's financial stability, ensure fairness among residents and businesses, and encourage timely payment of obligations. Overall, the Lee's Summit Missouri Certificate of Non-Payment is a critical documentation tool that enables the city government to address non-payment issues effectively. By issuing such certificates, the city can enforce financial compliance, protect its revenue, and maintain the overall financial health of the community.

Lee's Summit Missouri Certificate of Non-Payment

Description

How to fill out Lee's Summit Missouri Certificate Of Non-Payment?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no legal education to create such papers cfrom the ground up, mostly because of the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our service offers a huge catalog with over 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you want the Lee's Summit Missouri Certificate of Non-Payment or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Lee's Summit Missouri Certificate of Non-Payment in minutes employing our reliable service. If you are presently a subscriber, you can proceed to log in to your account to download the needed form.

However, in case you are new to our platform, make sure to follow these steps prior to obtaining the Lee's Summit Missouri Certificate of Non-Payment:

- Ensure the template you have found is suitable for your area considering that the regulations of one state or area do not work for another state or area.

- Review the form and read a quick outline (if available) of scenarios the paper can be used for.

- In case the one you chosen doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Lee's Summit Missouri Certificate of Non-Payment once the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. If you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

No Tax Obligations A taxpayer is presumed to owe taxes on property unless the taxpayer demonstrates qualification for a certificate of non-assessment. To obtain a certificate of non-assessment, contact the Jackson County Assessment Department or call 816-881-1330.

A Tax Waiver can normally only be obtained in person at the Assessor's Office. In light of the COVID-19 emergency, the Assessor's Office has implemented a procedure to request it online.

A business or organization that has received an exemption letter from the Department of Revenue should contact the Sales/Use Refund and Exemption Section at 573-751-2836 or salestaxexemptions@dor.mo.gov to request a Certificate of No Tax Due.

Online Copy of their driver's license. Copy of each car title (front and back), registration or renewal (front and back) and confirmation of their current address. Email the request for the waiver with the requested copies of the documents to assessor-personal-property@stlouis-mo.gov.

Under Missouri Law, the following property may be exempt: 1) Property owned by the State or other political subdivision such as city, county, public water district, etc. 2) Agricultural and Horticultural societies and non-profit cemeteries. 3) Property used exclusively for religious worship.

You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year(s): You moved to Missouri from out-of-state; or.... Call: 314-615-5500. Email: Collector@stlouiscountymo.gov. Visit: Make an appointment to visit us at 41 S. Central Avenue in Clayton, MO 63105.

65 years of age or older, or. a person 18-64 who receives SSI, SSD, or Veterans Disability, or. 60 and older and receiving Surviving Spouse benefits from SSA.

Mail to: Taxation Division. Phone: (573) 751-2836. Fax: (573) 522-1666. TTY: E-mail: salestaxexemptions@dor.mo.gov.

You may be entitled to a tax waiver if one of the following applies: A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)