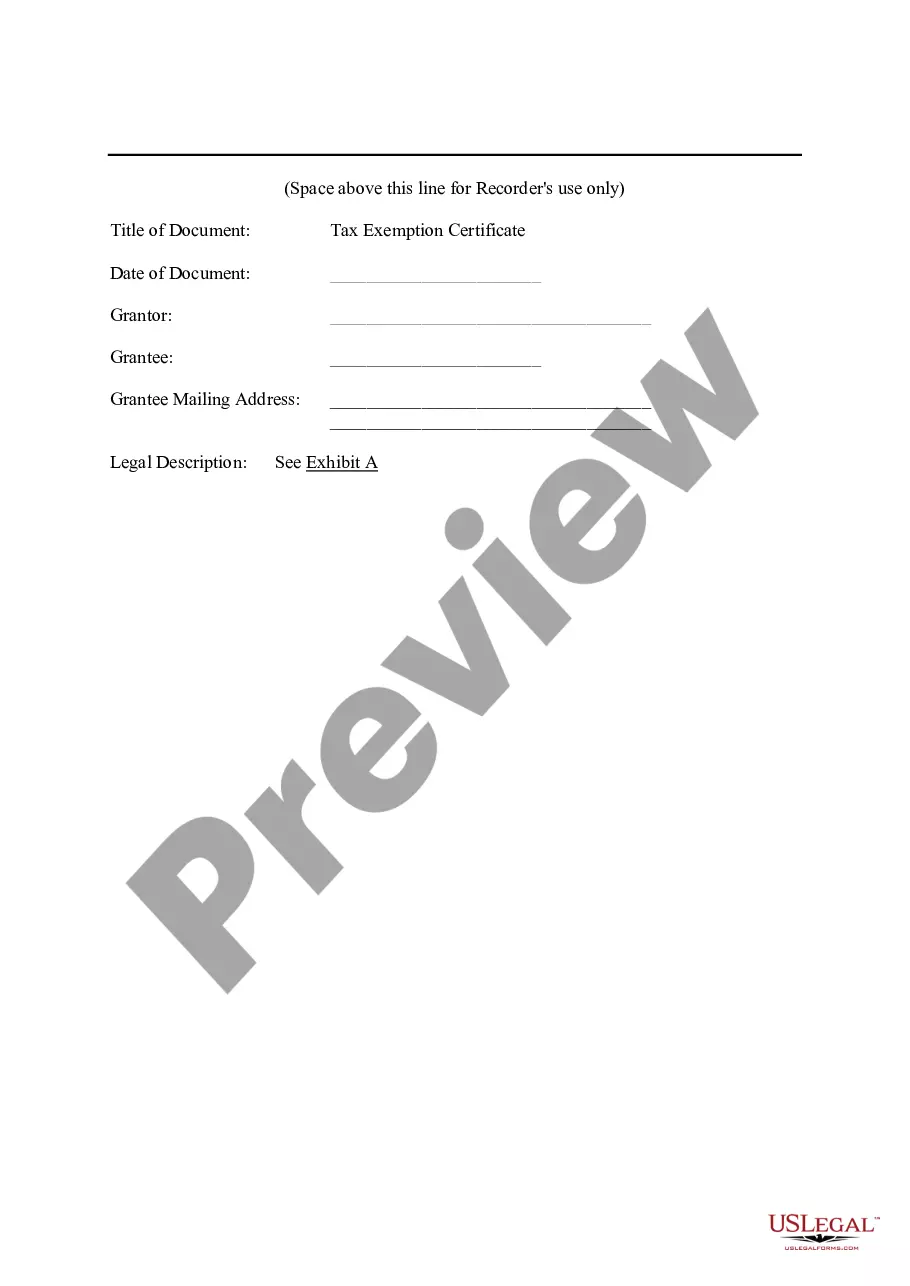

This ad valorem tax exemption certificate was issued to the

developer by the City as part of the contract to redevelop land

within the city.

Lee's Summit, Missouri Tax Exemption Certificate: A Detailed Description A tax exemption certificate in Lee's Summit, Missouri serves as an official document that enables eligible individuals and organizations to be exempt from paying certain taxes. This certificate is issued by the Missouri Department of Revenue and is based on specific criteria outlined by the state. Lee's Summit, located in Jackson County, Missouri, offers various tax exemptions to qualifying entities, including non-profit organizations, educational institutions, government agencies, and certain goods and services. This certificate plays a crucial role in facilitating economic development and incentivizing eligible parties to engage in activities that benefit the community. Types of Lee's Summit, Missouri Tax Exemption Certificates: 1. Non-Profit Organizations Exemption Certificate: Non-profit organizations operating in Lee's Summit can apply for this certificate to be exempt from paying sales and use taxes on goods and services directly related to their mission. Qualifying nonprofits typically include charitable, religious, and educational organizations recognized under section 501(c)(3) of the Internal Revenue Code. 2. Educational Institution Exemption Certificate: Educational institutions such as schools, colleges, and universities can obtain this certificate to be exempt from certain taxes in Lee's Summit. This exemption applies to sales and use taxes on educational materials, equipment, and other qualifying purchases made by these institutions. 3. Governmental Exemption Certificate: Government agencies at the local, state, and federal levels can obtain this certificate to be exempt from paying sales and use taxes on their purchases. This exemption aims to support the efficient operations of government bodies and the services they provide to the community. It is important to note that each type of tax exemption certificate may have specific requirements and limitations that applicants must fulfill. These requirements may include maintaining proper documentation, adhering to specific guidelines, or providing evidence of eligibility. To acquire a tax exemption certificate in Lee's Summit, interested parties must complete the application process outlined by the Missouri Department of Revenue. This typically involves submitting the necessary forms, supporting documents, and paying any applicable fees. In summary, Lee's Summit, Missouri Tax Exemption Certificates provide eligible individuals and organizations with the opportunity to avoid certain taxes, promoting community growth, and fostering economic development. By incentivizing non-profit organizations, educational institutions, and government agencies, Lee's Summit aims to create an environment that encourages beneficial activities while supporting essential public services.