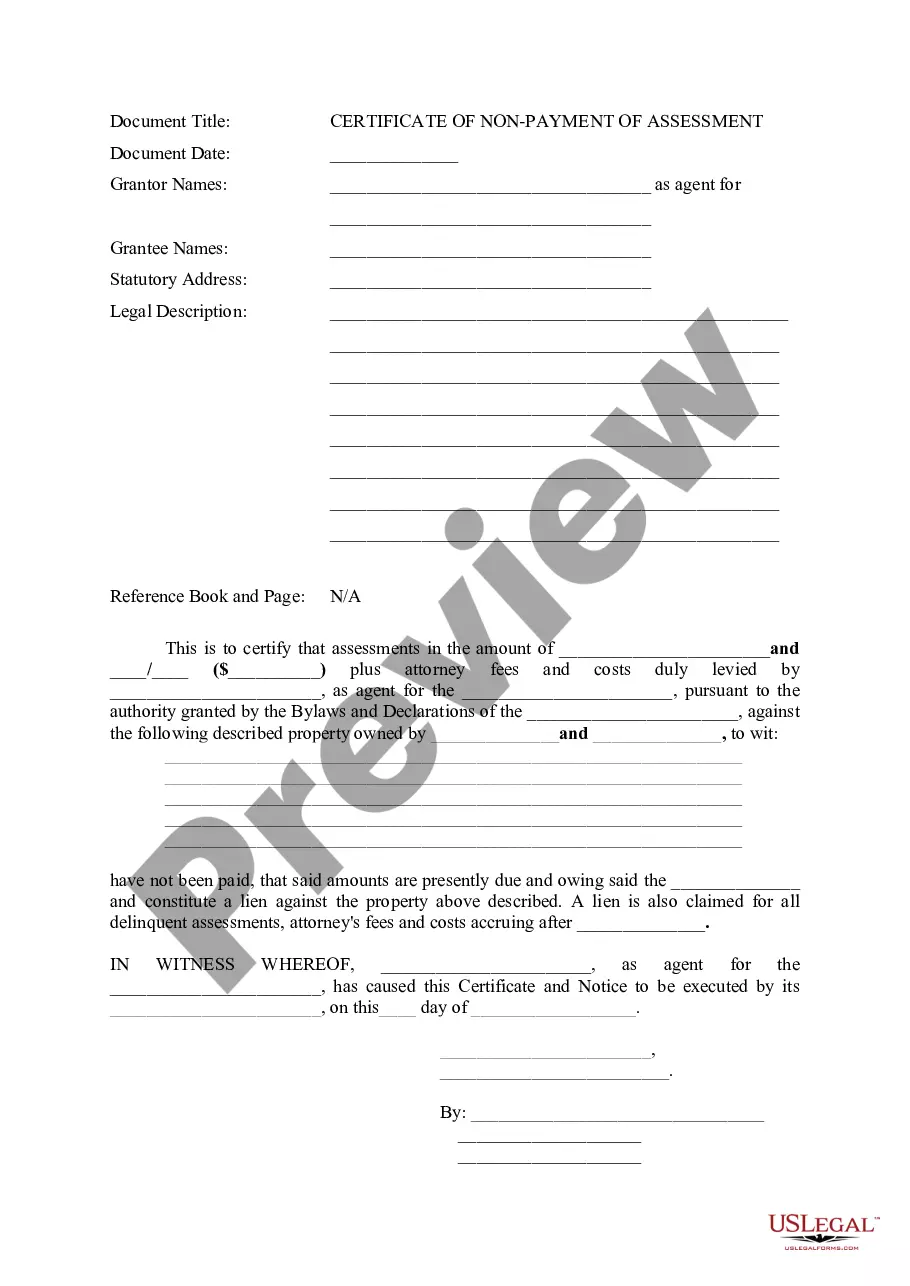

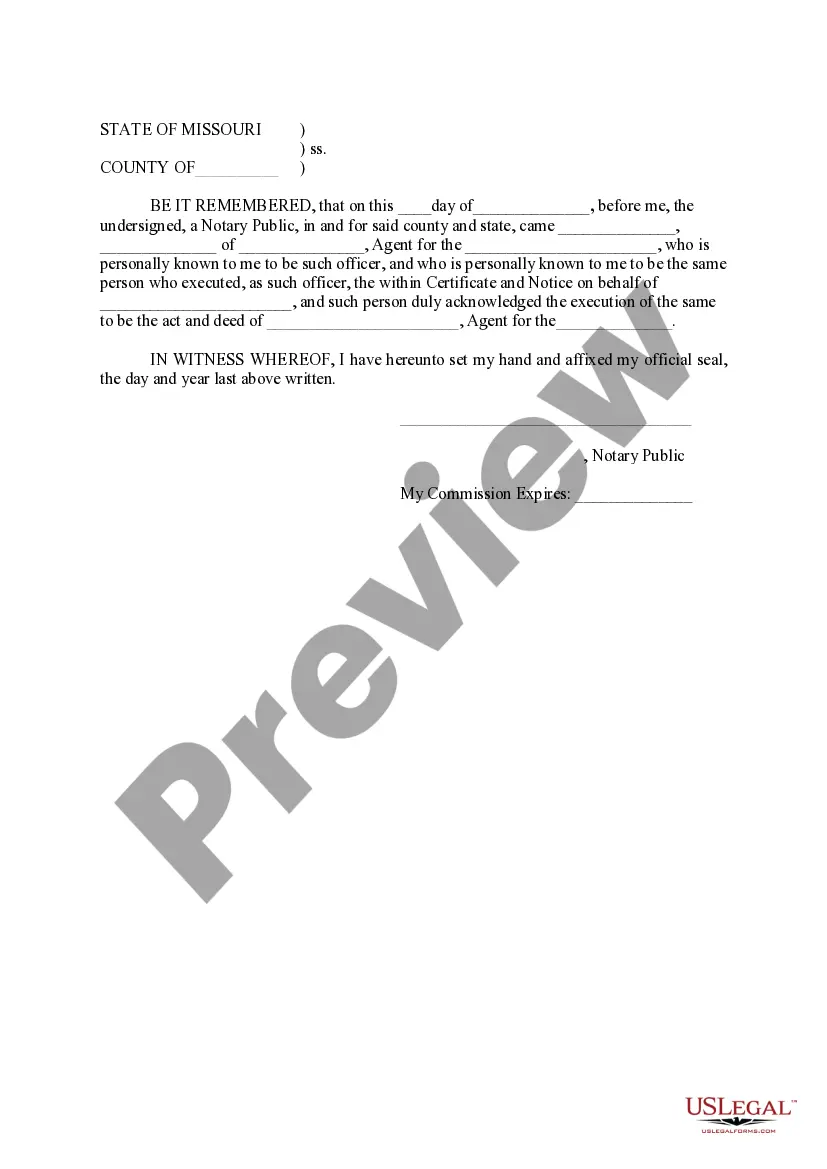

Title: Understanding Lee's Summit Missouri Certificate of Non-Payment of Assessment: Types and Detailed Description Keywords: Lee's Summit Missouri, Certificate of Non-Payment of Assessment, types, detailed description Introduction: The Lee's Summit Missouri Certificate of Non-Payment of Assessment is an official document issued by the city to notify property owners within a designated area who have failed to pay their assessments. This document serves as evidence of non-compliance with payment obligations related to a specific assessment, such as property improvements, maintenance, or local services. Here, we will provide a detailed description of the certificate's purpose, types, and implications. 1. General Purpose: The primary purpose of the Lee's Summit Missouri Certificate of Non-Payment of Assessment is to bring attention to property owners who have neglected their responsibility to fulfill the assessed fees within a specific timeframe. It serves as a legal notice and helps the city authorities track properties that have pending assessment payments. 2. Types of Certificates of Non-Payment of Assessment: a) Special Tax Bill Certificate: This type of certificate is issued when a property owner fails to pay their special tax assessment connected to various improvements or developments in Lee's Summit Missouri. The certificate will indicate the amount owed, penalties, interest, and any other relevant details. b) Municipal Assessment Certificate: This certificate is utilized when a property owner fails to pay their municipal assessment. Municipal assessments are typically levied to fund local infrastructure projects such as road maintenance, water facilities, or public safety improvements. c) Community Improvement District (CID) Assessment Certificate: This type of certificate is issued when a property owner fails to pay their assessments to a Community Improvement District. CID's are special taxing districts established for specific commercial areas to fund improvements and services within those areas. 3. Detailed Description: The Lee's Summit Missouri Certificate of Non-Payment of Assessment contains the following pertinent information: a) Property details: The certificate specifies the address and legal description of the property on which the assessment is imposed. b) Assessment reference: The document references the specific assessment type and details, such as the purpose or project for which the assessment was levied. c) Outstanding amount: The certificate provides a breakdown of the outstanding balance, including the principal amount, any interest accrued, penalties, applicable fees, and the total amount due at the time of issuance. d) Due date and delinquency: The document clearly states the due date of the assessment payment and highlights the property owner's failure to comply with the payment obligations within the designated timeframe. e) Consequences of non-payment: The certificate outlines the potential consequences of non-payment, such as the initiation of legal actions, tax liens, potential foreclosure proceedings, or any other enforcement mechanisms applicable under Lee's Summit Missouri law. f) Contact information: The certificate provides relevant contact details for property owners to address payment concerns or seek further information regarding the assessment and potential resolution options. Conclusion: The Lee's Summit Missouri Certificate of Non-Payment of Assessment plays a crucial role in safeguarding the equitable distribution of assessment burdens and ensuring property owners fulfill their financial obligations. Understanding the different types of certificates issued and the detailed description included within these documents is vital for property owners to address outstanding balances promptly and prevent possible legal consequences.

Lee's Summit Missouri Certificate of Non-Payment of Assessment

Category:

State:

Missouri

City:

Lee's Summit

Control #:

MO-LR081T

Format:

Word;

Rich Text

Instant download

Description

A common-law lien is the right of one person to retain in his possession property that belongs to another until a debt or claim secured by that property is satisfied. It pertains exclusively to personal property

Title: Understanding Lee's Summit Missouri Certificate of Non-Payment of Assessment: Types and Detailed Description Keywords: Lee's Summit Missouri, Certificate of Non-Payment of Assessment, types, detailed description Introduction: The Lee's Summit Missouri Certificate of Non-Payment of Assessment is an official document issued by the city to notify property owners within a designated area who have failed to pay their assessments. This document serves as evidence of non-compliance with payment obligations related to a specific assessment, such as property improvements, maintenance, or local services. Here, we will provide a detailed description of the certificate's purpose, types, and implications. 1. General Purpose: The primary purpose of the Lee's Summit Missouri Certificate of Non-Payment of Assessment is to bring attention to property owners who have neglected their responsibility to fulfill the assessed fees within a specific timeframe. It serves as a legal notice and helps the city authorities track properties that have pending assessment payments. 2. Types of Certificates of Non-Payment of Assessment: a) Special Tax Bill Certificate: This type of certificate is issued when a property owner fails to pay their special tax assessment connected to various improvements or developments in Lee's Summit Missouri. The certificate will indicate the amount owed, penalties, interest, and any other relevant details. b) Municipal Assessment Certificate: This certificate is utilized when a property owner fails to pay their municipal assessment. Municipal assessments are typically levied to fund local infrastructure projects such as road maintenance, water facilities, or public safety improvements. c) Community Improvement District (CID) Assessment Certificate: This type of certificate is issued when a property owner fails to pay their assessments to a Community Improvement District. CID's are special taxing districts established for specific commercial areas to fund improvements and services within those areas. 3. Detailed Description: The Lee's Summit Missouri Certificate of Non-Payment of Assessment contains the following pertinent information: a) Property details: The certificate specifies the address and legal description of the property on which the assessment is imposed. b) Assessment reference: The document references the specific assessment type and details, such as the purpose or project for which the assessment was levied. c) Outstanding amount: The certificate provides a breakdown of the outstanding balance, including the principal amount, any interest accrued, penalties, applicable fees, and the total amount due at the time of issuance. d) Due date and delinquency: The document clearly states the due date of the assessment payment and highlights the property owner's failure to comply with the payment obligations within the designated timeframe. e) Consequences of non-payment: The certificate outlines the potential consequences of non-payment, such as the initiation of legal actions, tax liens, potential foreclosure proceedings, or any other enforcement mechanisms applicable under Lee's Summit Missouri law. f) Contact information: The certificate provides relevant contact details for property owners to address payment concerns or seek further information regarding the assessment and potential resolution options. Conclusion: The Lee's Summit Missouri Certificate of Non-Payment of Assessment plays a crucial role in safeguarding the equitable distribution of assessment burdens and ensuring property owners fulfill their financial obligations. Understanding the different types of certificates issued and the detailed description included within these documents is vital for property owners to address outstanding balances promptly and prevent possible legal consequences.

Free preview

How to fill out Lee's Summit Missouri Certificate Of Non-Payment Of Assessment?

If you’ve already utilized our service before, log in to your account and download the Lee's Summit Missouri Certificate of Non-Payment of Assessment on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Lee's Summit Missouri Certificate of Non-Payment of Assessment. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!