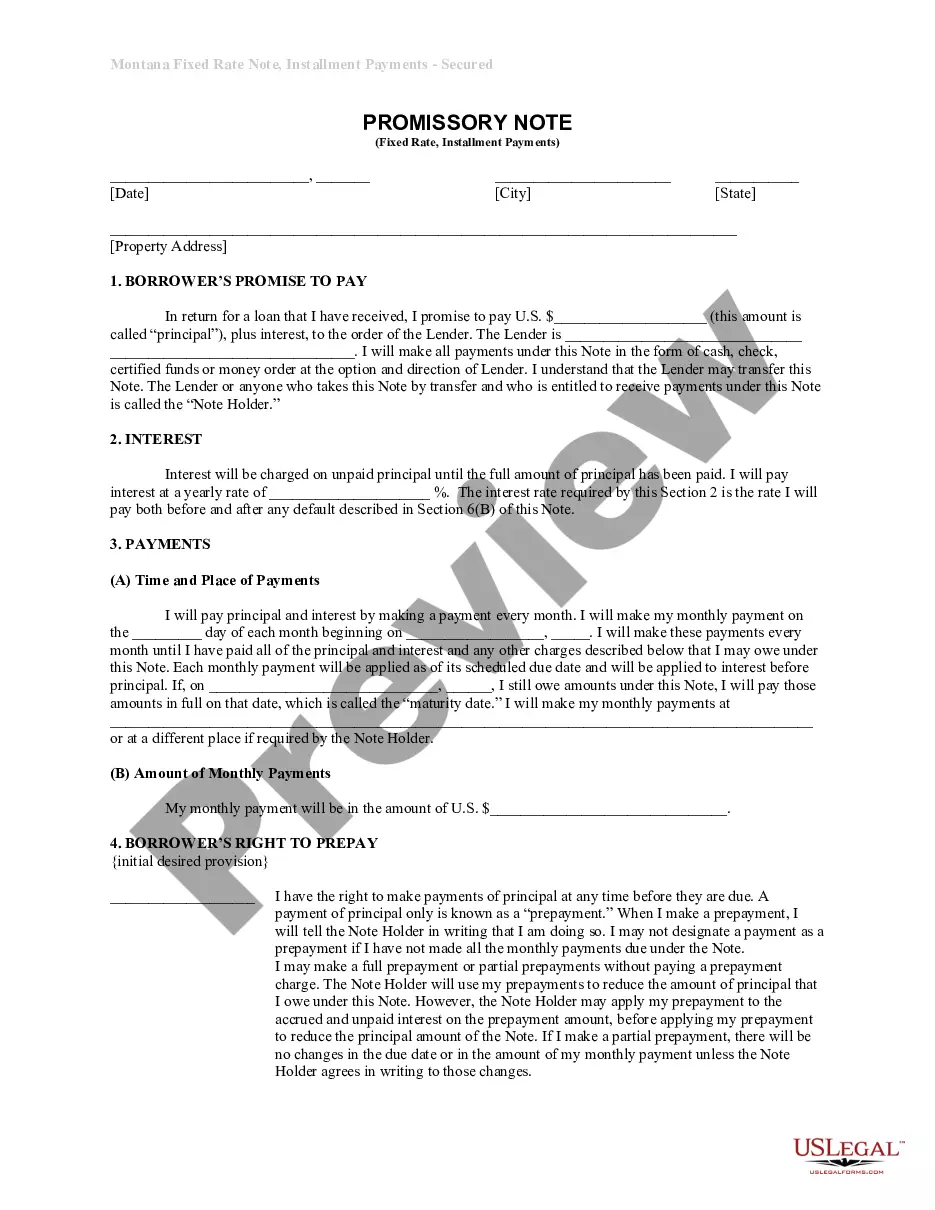

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

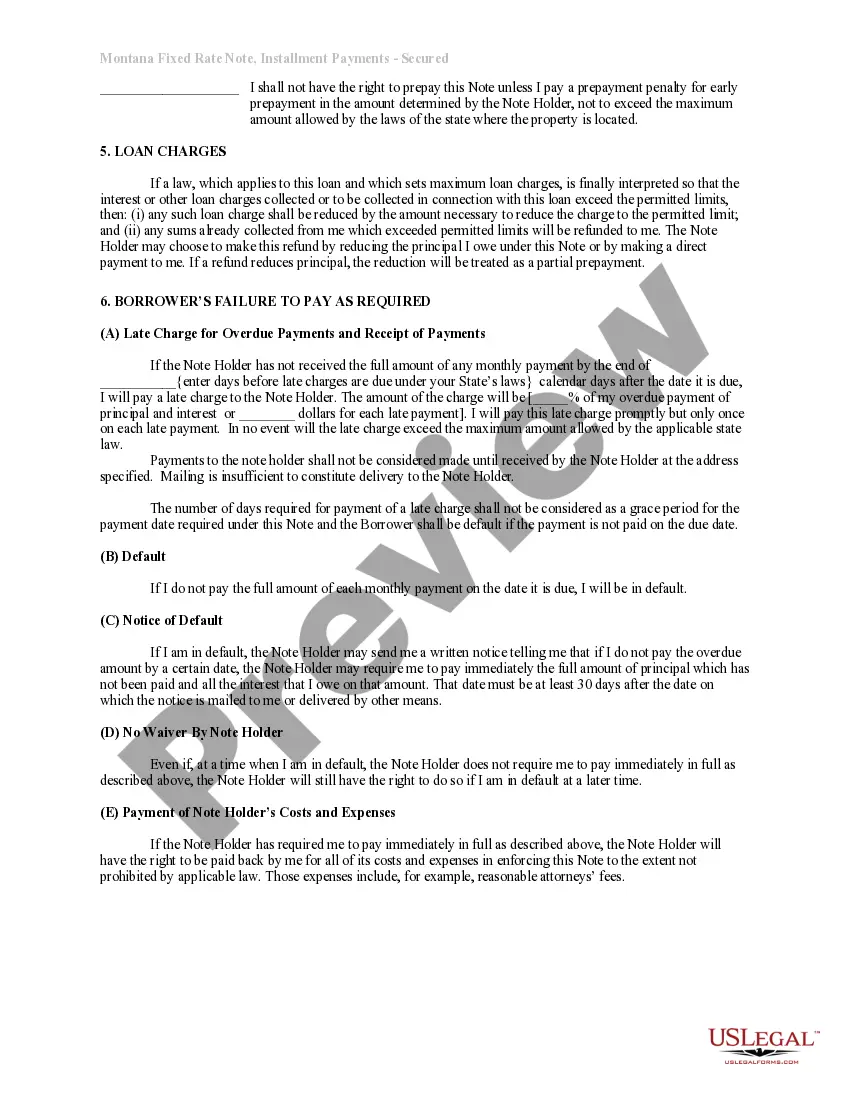

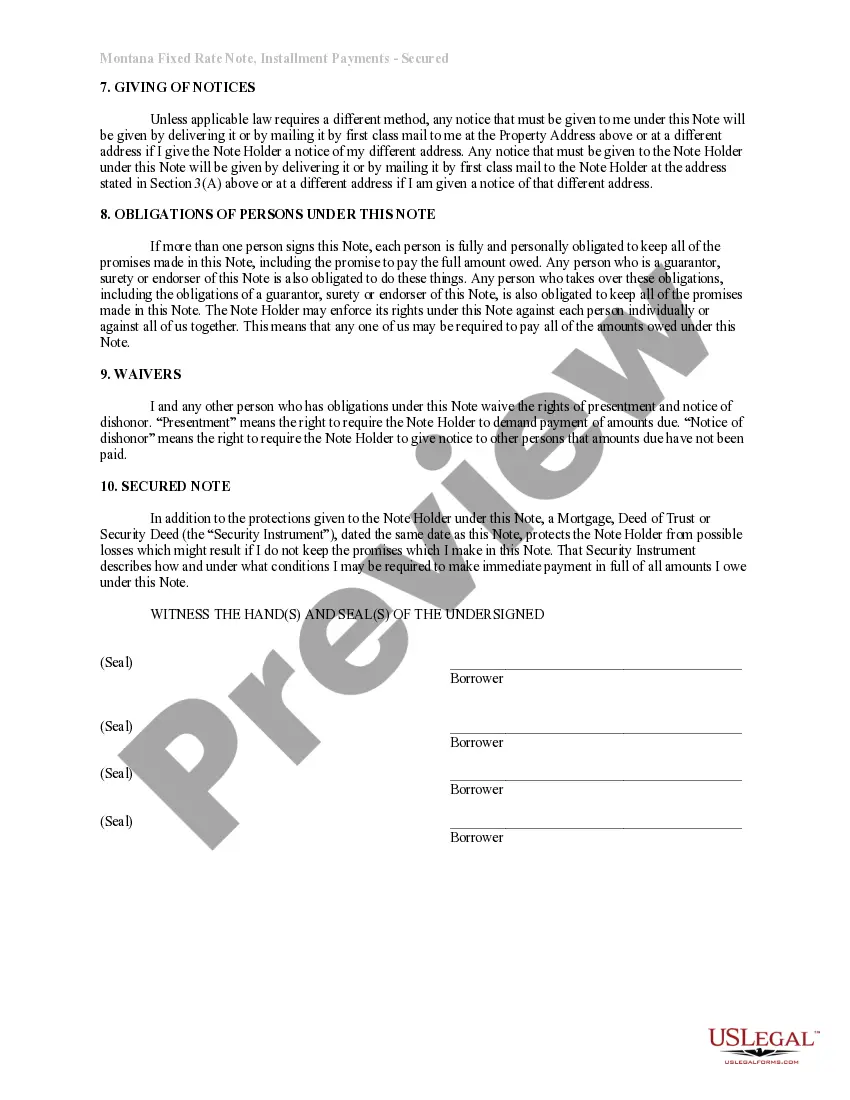

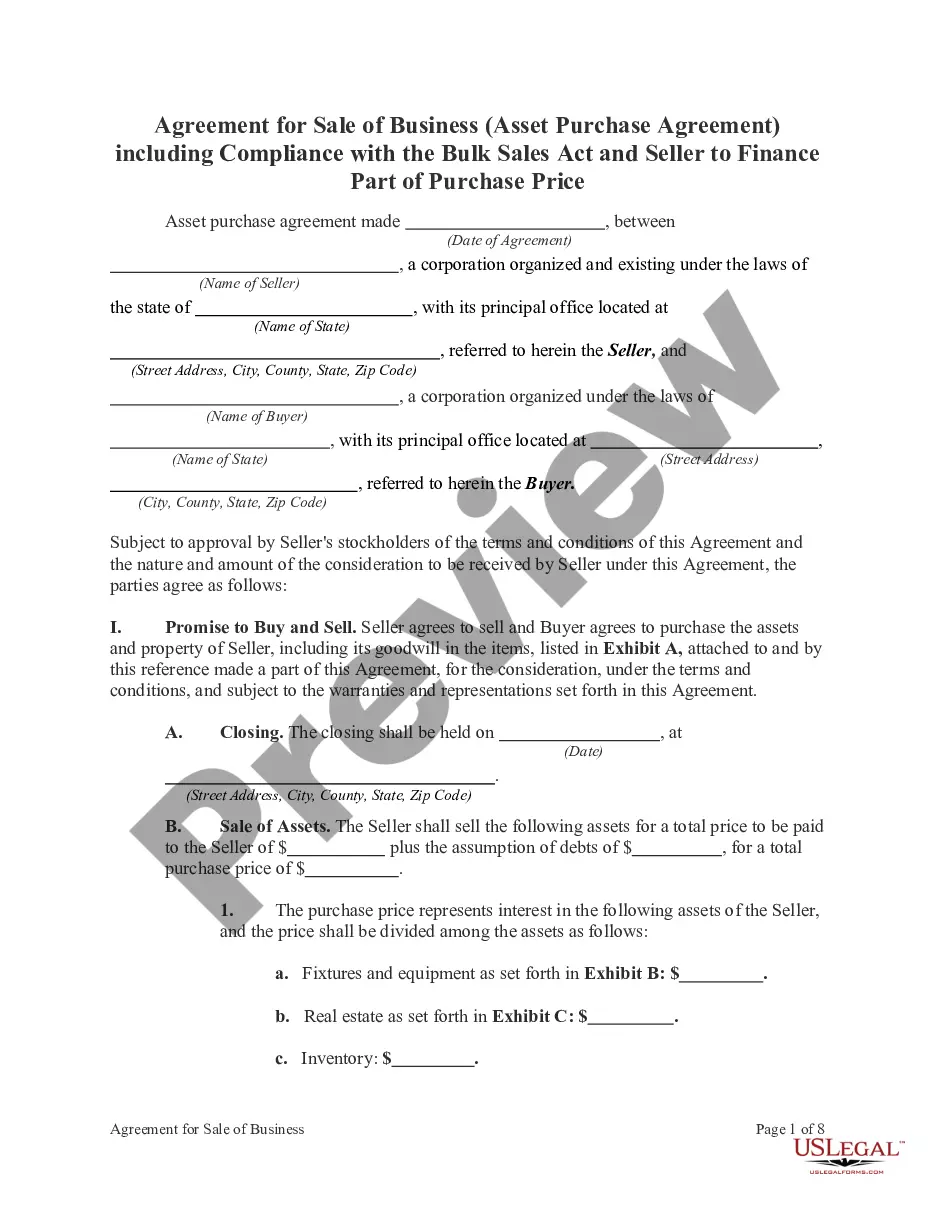

A Springfield Missouri Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan for purchasing residential real estate in Springfield, Missouri. This type of promissory note is commonly used in real estate transactions, providing financing options for both buyers and sellers. This promissory note is essentially a contract between the borrower (the buyer) and the lender (which could be a financial institution, private lender, or even the seller themselves). It serves as evidence of the agreed-upon loan amount, interest rate, payment schedule, and the collateral used to secure the loan, which in this case is residential real estate in Springfield, Missouri. The term "Installments Fixed Rate" indicates that the loan will be repaid in regular installments over a specific period of time, such as monthly or quarterly. This provides borrowers with a predictable repayment schedule and allows them to budget accordingly. The "fixed rate" aspect means that the interest rate remains constant throughout the duration of the loan, providing stability and certainty to both parties. By securing the promissory note with residential real estate in Springfield, Missouri, the lender has collateral that can be seized in the event of default. This collateral helps to mitigate the risk for the lender and provides assurance that they will be able to recoup their investment should the borrower fail to fulfill their repayment obligations. Different types of Springfield Missouri Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include variations in loan terms and conditions. For example, some promissory notes may have different fixed interest rates based on the borrower's creditworthiness or the loan-to-value ratio of the property. Others may have specific provisions outlining late payment penalties, prepayment options, or conditions for release of the collateral. In summary, a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document that formalizes a loan agreement for the purchase of residential property in Springfield, Missouri. It provides a structured payment plan for borrowers and ensures the lender has adequate security for the loan. The specific terms and conditions may vary depending on individual circumstances, but the fundamental purpose of the promissory note remains the same.A Springfield Missouri Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan for purchasing residential real estate in Springfield, Missouri. This type of promissory note is commonly used in real estate transactions, providing financing options for both buyers and sellers. This promissory note is essentially a contract between the borrower (the buyer) and the lender (which could be a financial institution, private lender, or even the seller themselves). It serves as evidence of the agreed-upon loan amount, interest rate, payment schedule, and the collateral used to secure the loan, which in this case is residential real estate in Springfield, Missouri. The term "Installments Fixed Rate" indicates that the loan will be repaid in regular installments over a specific period of time, such as monthly or quarterly. This provides borrowers with a predictable repayment schedule and allows them to budget accordingly. The "fixed rate" aspect means that the interest rate remains constant throughout the duration of the loan, providing stability and certainty to both parties. By securing the promissory note with residential real estate in Springfield, Missouri, the lender has collateral that can be seized in the event of default. This collateral helps to mitigate the risk for the lender and provides assurance that they will be able to recoup their investment should the borrower fail to fulfill their repayment obligations. Different types of Springfield Missouri Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include variations in loan terms and conditions. For example, some promissory notes may have different fixed interest rates based on the borrower's creditworthiness or the loan-to-value ratio of the property. Others may have specific provisions outlining late payment penalties, prepayment options, or conditions for release of the collateral. In summary, a Springfield Missouri Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document that formalizes a loan agreement for the purchase of residential property in Springfield, Missouri. It provides a structured payment plan for borrowers and ensures the lender has adequate security for the loan. The specific terms and conditions may vary depending on individual circumstances, but the fundamental purpose of the promissory note remains the same.