This package contains essential legal documents to assist individual or corporate buyers or sellers in the sale of a business. You may modify these forms to fit your particular circumstances. Some documents in this package are state-specific.

This package contains the following forms:

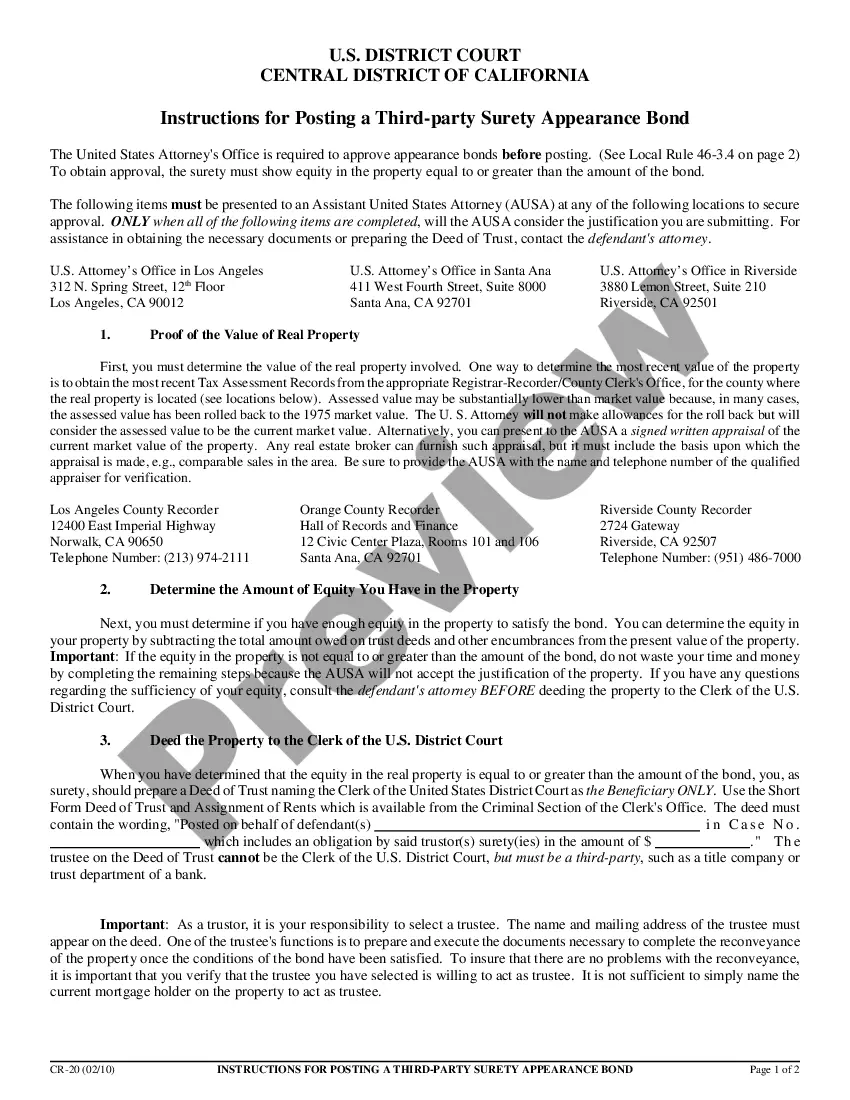

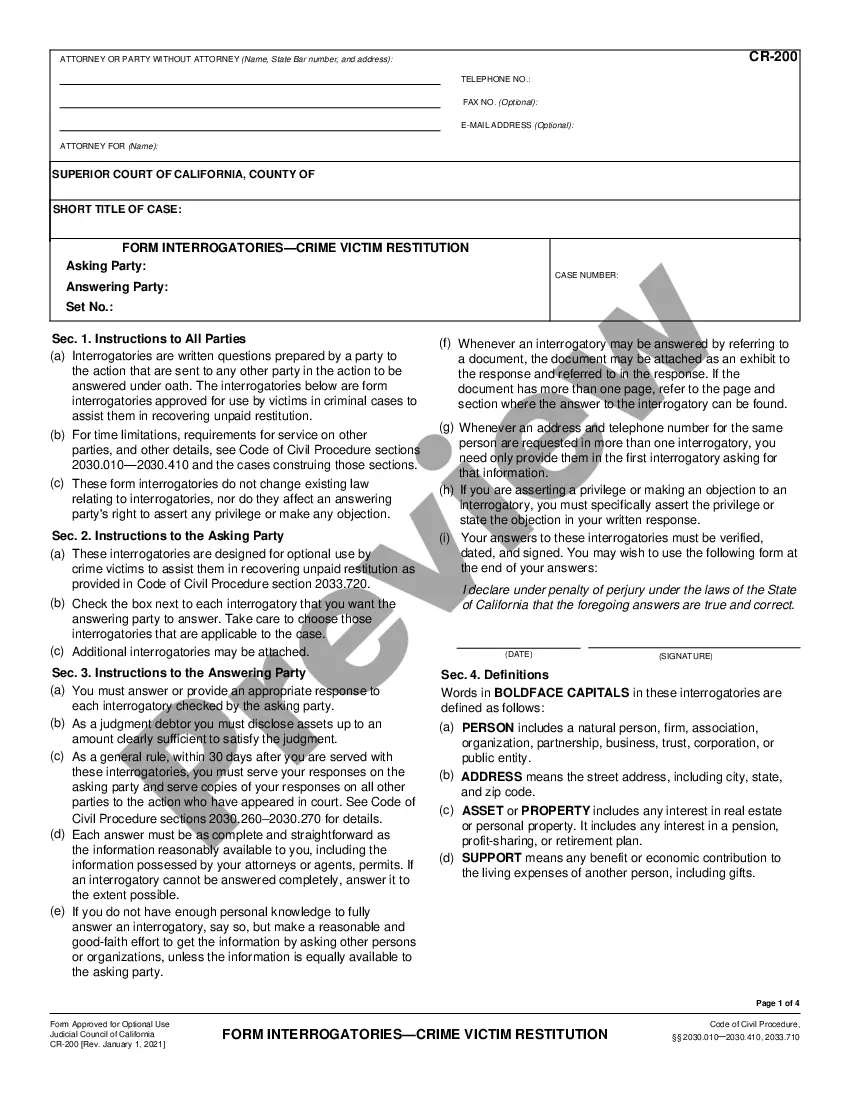

1) Agreement for Sale of Business- Sole Proprietorship

2) Asset Purchase Agreement

3) Bill of Sale for Personal Assets

4) Promissory Note

5) Landlord's Consent to Assignment of Lease

6) Retained Employees Agreement

7) Noncompetition Covenant by Seller

8) Profit and Loss Statement

9) Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Purchase this package and save up to 40% over purchasing the forms separately!

Kansas City Missouri Sale of a Business Package: A Comprehensive Solution for Your Business Transition Needs Are you looking to sell your business in Kansas City, Missouri? Look no further! The Kansas City Missouri Sale of a Business Package is a comprehensive solution designed to assist business owners in navigating the complexities of selling their business. The Sale of a Business Package is tailored to meet the unique needs of different types of businesses, ensuring a smooth and successful sale process. It includes a range of services and resources that are crucial for a successful business transition. Let's explore some key features and types of packages available: 1. Business Valuation Services: Accurately determining the value of your business is crucial for setting the right asking price. Our experienced team will conduct a thorough evaluation, considering various factors such as financial records, assets, liabilities, market conditions, and industry trends. 2. Listing and Marketing: A customized marketing plan is essential to attract prospective buyers. Our experts will create compelling listings to showcase the strengths and potential of your business. We utilize various channels, including online platforms, industry networks, and targeted advertising campaigns, to reach interested buyers. 3. Negotiation and Deal Structuring: Selling a business involves complex negotiations and deal structuring. Our team of skilled negotiators will work on your behalf, ensuring that your interests are protected at every step. We will assist in drafting purchase agreements, non-disclosure agreements, and other legal documents to facilitate a smooth transaction. 4. Due Diligence Support: Buyers conduct a thorough due diligence process to assess the risks and opportunities associated with the business. Our team will assist you in organizing and presenting necessary documentation, financial records, contracts, and other crucial information to expedite the due diligence process. 5. Legal and Financial Consultation: Selling a business requires a deep understanding of legal and financial matters. Our network of professionals, including attorneys, accountants, and tax experts, will provide invaluable guidance throughout the sale process, ensuring compliance with legal requirements and optimizing tax implications. 6. Transition Support: Once the sale is finalized, a smooth transition is crucial to maintain business continuity. We offer support to ensure a seamless transfer of ownership, including training assistance, employee communication strategies, and post-sale consultation. Different types of Kansas City Missouri Sale of a Business Packages are tailored to meet specific industry or business size requirements: 1. Small Business Package: Specifically designed for small businesses with fewer employees and a lower transaction value. 2. Mid-market Business Package: Targeted at medium-sized businesses with moderate transaction values and specialized marketing strategies to reach potential buyers. 3. Enterprise Level Package: Geared towards larger enterprises with complex financial structures, multiple locations, and higher transaction values. By leveraging the Kansas City Missouri Sale of a Business Package, business owners can confidently navigate the complexities of selling their business, ensuring a successful and rewarding transition. Trust our experienced team to guide you through every step of the process, from valuation to closing the deal. Contact us today to explore the package best suited for your business needs and start your journey toward a successful sale!