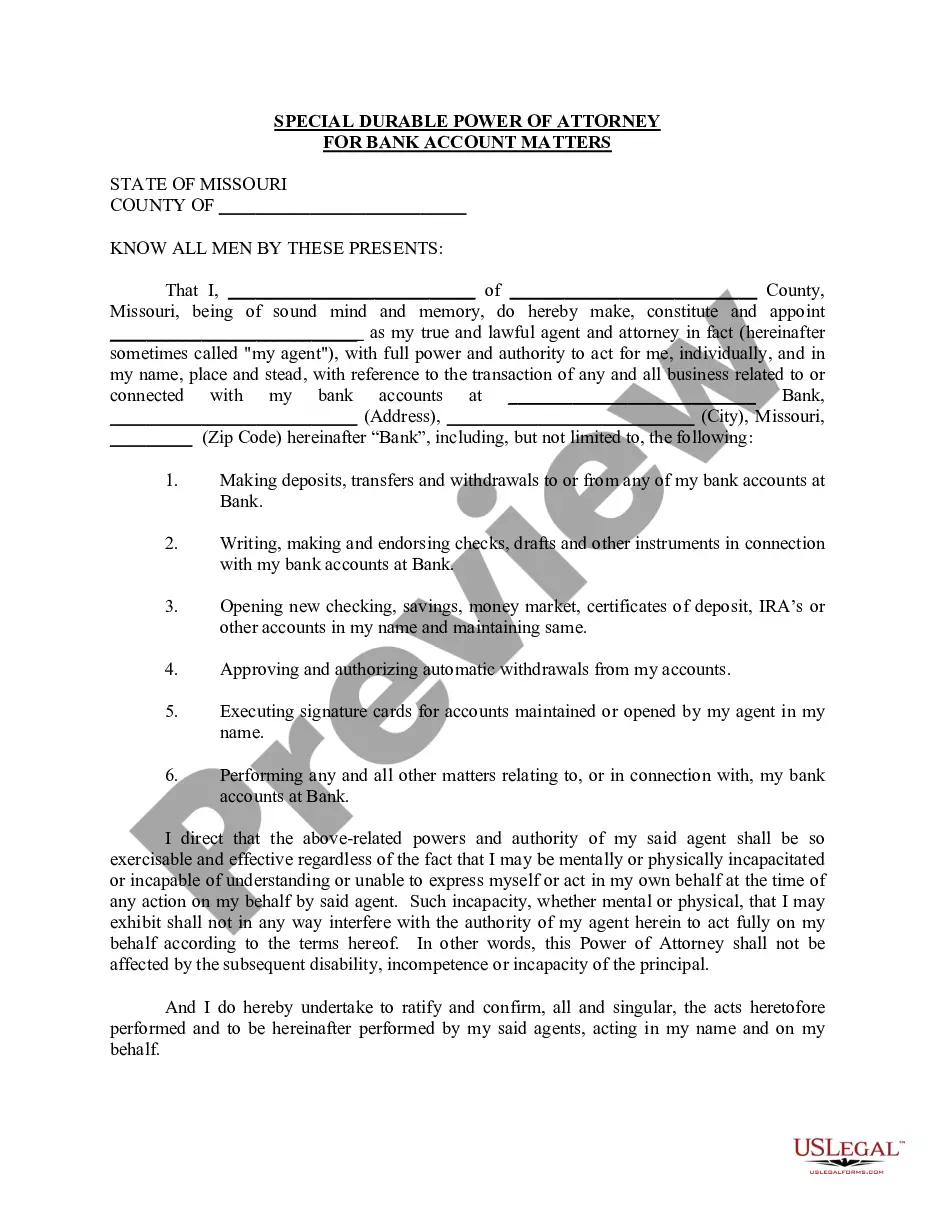

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual the authority to make financial decisions and act on behalf of another person specifically for bank account matters. This type of power of attorney ensures that someone trustworthy and reliable takes control of the principal's bank accounts and handles various financial transactions on their behalf, in the event they become unable to do so themselves due to incapacity or unavailability. By granting a Special Durable Power of Attorney for Bank Account Matters in Lee's Summit Missouri, individuals can select a trusted agent who can perform a variety of actions related to their bank accounts. Some key responsibilities and powers that can be granted to the agent include: 1. Withdrawals and Deposits: The agent is authorized to make withdrawals and deposits on behalf of the individual in their designated bank accounts. They can handle routine transactions, pay bills, and manage ongoing financial obligations. 2. Transfers and Investments: With the authority granted, the agent can make transfers between different bank accounts or investment accounts held by the principal. They can also handle investment decisions, including buying or selling stocks, bonds, or other financial instruments on the principal's behalf. 3. Access and Management: The agent has the power to access and manage all aspects of the principal's bank accounts, including viewing balances, transaction history, and statements. This allows them to monitor the financial state, detect any discrepancies, and take appropriate actions when necessary. 4. Financial Institution Interactions: The agent can communicate with financial institutions, including banks, credit unions, and investment firms, on behalf of the principal. This includes addressing any account-related issues, providing necessary documentation, and signing bank forms or agreements. 5. Estate Planning and Tax Matters: In certain cases, the agent may be authorized to handle estate planning matters, such as gifting assets or setting up trusts. They can also assist in organizing and preparing tax-related documents, ensuring compliance with the applicable laws and regulations. The Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters can be further classified into specific types based on the extent of powers granted and the duration. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney offers limited authority to the agent, narrowly defining the actions they can perform on behalf of the principal. It may cover specific bank accounts or transactions, ensuring control is granted only where necessary. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to a limited power of attorney, a general power of attorney grants the agent broad and comprehensive authority over all bank account matters of the principal. This type provides more flexibility but requires a high level of trust in the agent. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only when a specific event or condition occurs, as defined in the document. Typically, this condition is the incapacity or unavailability of the principal. Until then, the agent does not possess any authority. In conclusion, the Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that ensures financial affairs are managed effectively when individuals face incapacity or unavailability. By selecting a trustworthy agent and granting them the necessary powers, individuals can have peace of mind, knowing their bank accounts will be handled responsibly and in their best interests.Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual the authority to make financial decisions and act on behalf of another person specifically for bank account matters. This type of power of attorney ensures that someone trustworthy and reliable takes control of the principal's bank accounts and handles various financial transactions on their behalf, in the event they become unable to do so themselves due to incapacity or unavailability. By granting a Special Durable Power of Attorney for Bank Account Matters in Lee's Summit Missouri, individuals can select a trusted agent who can perform a variety of actions related to their bank accounts. Some key responsibilities and powers that can be granted to the agent include: 1. Withdrawals and Deposits: The agent is authorized to make withdrawals and deposits on behalf of the individual in their designated bank accounts. They can handle routine transactions, pay bills, and manage ongoing financial obligations. 2. Transfers and Investments: With the authority granted, the agent can make transfers between different bank accounts or investment accounts held by the principal. They can also handle investment decisions, including buying or selling stocks, bonds, or other financial instruments on the principal's behalf. 3. Access and Management: The agent has the power to access and manage all aspects of the principal's bank accounts, including viewing balances, transaction history, and statements. This allows them to monitor the financial state, detect any discrepancies, and take appropriate actions when necessary. 4. Financial Institution Interactions: The agent can communicate with financial institutions, including banks, credit unions, and investment firms, on behalf of the principal. This includes addressing any account-related issues, providing necessary documentation, and signing bank forms or agreements. 5. Estate Planning and Tax Matters: In certain cases, the agent may be authorized to handle estate planning matters, such as gifting assets or setting up trusts. They can also assist in organizing and preparing tax-related documents, ensuring compliance with the applicable laws and regulations. The Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters can be further classified into specific types based on the extent of powers granted and the duration. These may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney offers limited authority to the agent, narrowly defining the actions they can perform on behalf of the principal. It may cover specific bank accounts or transactions, ensuring control is granted only where necessary. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to a limited power of attorney, a general power of attorney grants the agent broad and comprehensive authority over all bank account matters of the principal. This type provides more flexibility but requires a high level of trust in the agent. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only when a specific event or condition occurs, as defined in the document. Typically, this condition is the incapacity or unavailability of the principal. Until then, the agent does not possess any authority. In conclusion, the Lee's Summit Missouri Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that ensures financial affairs are managed effectively when individuals face incapacity or unavailability. By selecting a trustworthy agent and granting them the necessary powers, individuals can have peace of mind, knowing their bank accounts will be handled responsibly and in their best interests.