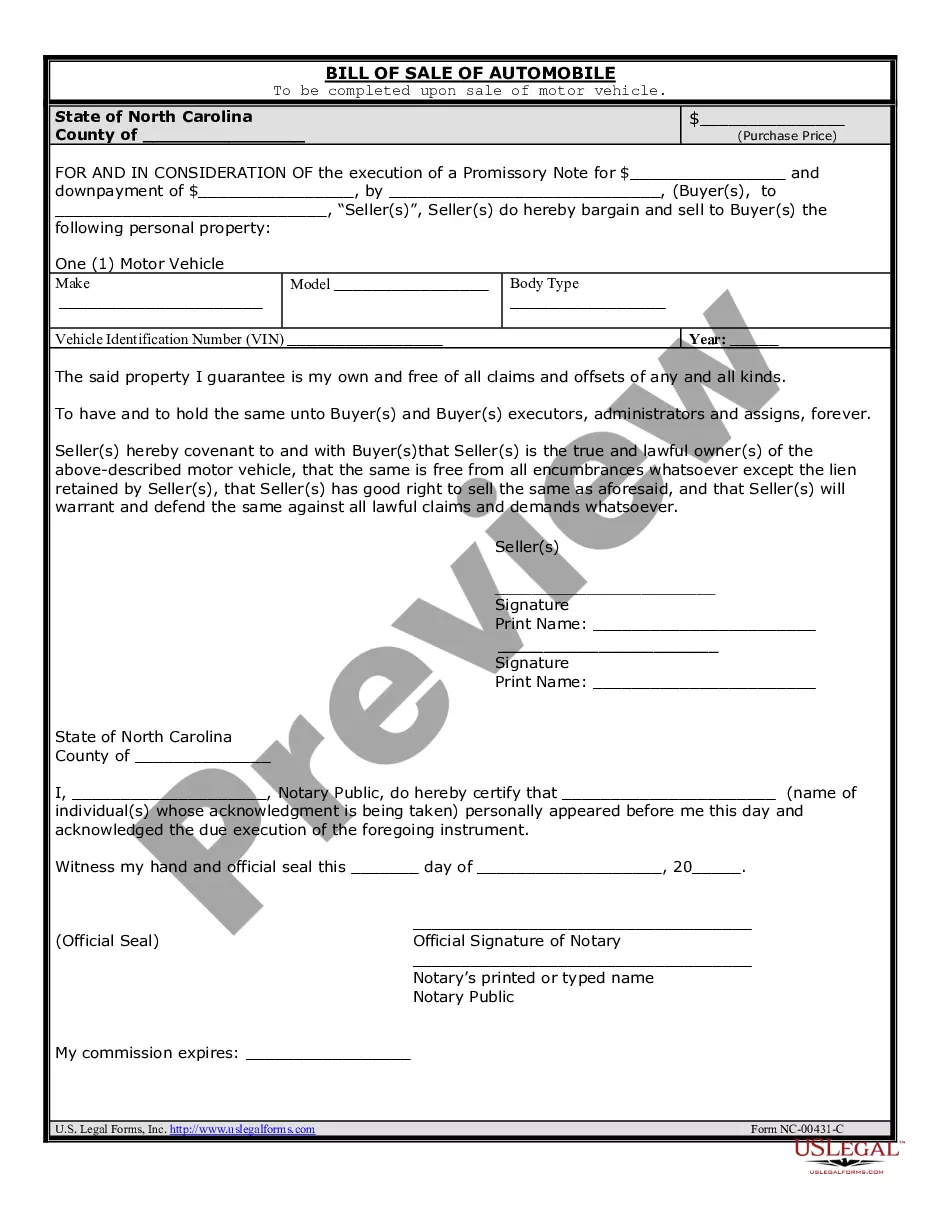

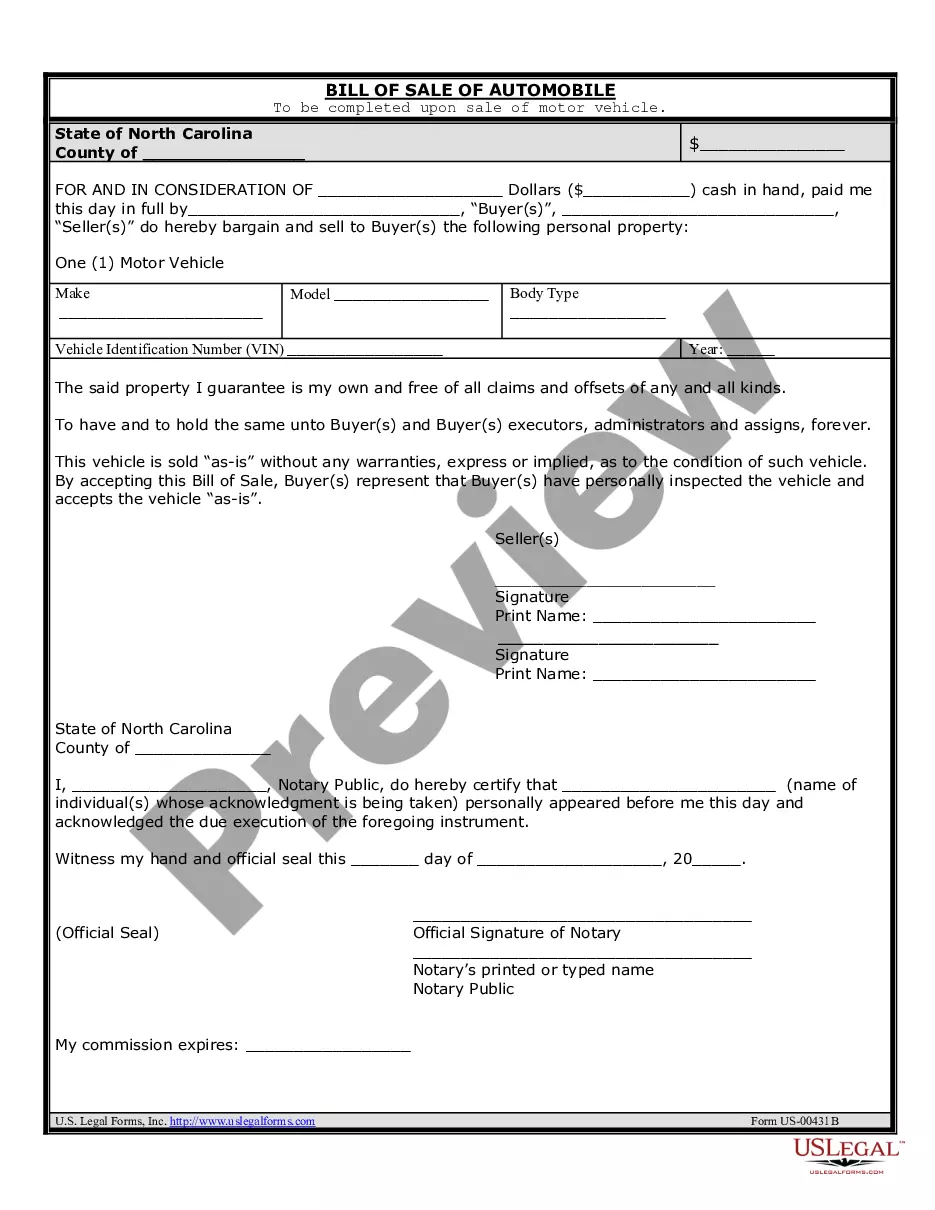

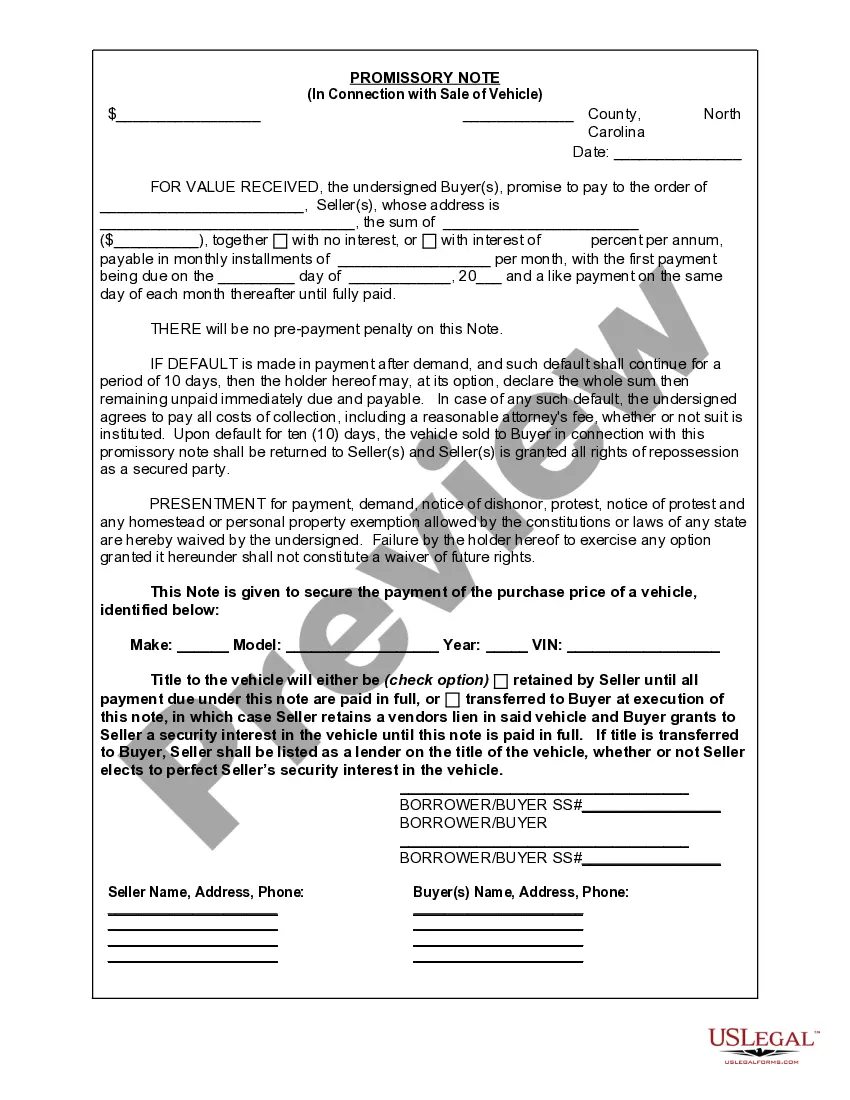

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties. In the context of the sale of a vehicle or automobile in Wilmington, North Carolina, a promissory note is commonly used to establish the repayment terms for the buyer's purchase. Wilmington North Carolina Promissory Note for Sale of Vehicle or Automobile: 1. Basic Promissory Note: This type of promissory note establishes the fundamental terms of the loan agreement, including the amount borrowed, interest rate, repayment schedule, and consequences of default. 2. Lump Sum Payment Promissory Note: In some cases, the buyer may agree to make a single lump sum payment for the vehicle or automobile. This promissory note will outline the repayment of the agreed-upon amount within a specified timeframe. 3. Installment Promissory Note: When the buyer cannot make a lump sum payment, an installment promissory note is commonly used. This note allows for the payment of the vehicle or automobile in multiple installments over a particular period, including the interest accrued. 4. Secured Promissory Note: If the buyer provides collateral, such as the vehicle itself, to secure the loan, a secured promissory note is necessary. This note includes relevant details about the collateral, ensuring the lender's security in case the borrower defaults. 5. Unsecured Promissory Note: In cases where the buyer does not provide any collateral, an unsecured promissory note is used. This note primarily relies on the borrower's promise to repay the loan according to the agreed-upon terms, without any specific collateral protection for the lender. 6. Balloon Promissory Note: A balloon promissory note involves the payment of relatively small, regular installments, with a larger final payment at the end of the loan term. This type of note is commonly used when the buyer expects to have additional funds available in the future to make the large final payment. When drafting a Wilmington North Carolina promissory note in connection with the sale of a vehicle or automobile, it is essential to include specific details unique to the transaction. These may include the vehicle's make, model, year, identification number, purchase price, and any warranties or guarantees provided by the seller. Remember, promissory notes are legally binding documents, so it is crucial to consult with a legal professional experienced in North Carolina law to ensure the note meets all legal requirements and protects the interests of both parties involved.

Wilmington North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Wilmington North Carolina Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you are searching for a relevant form, it’s impossible to choose a better place than the US Legal Forms site – probably the most extensive libraries on the internet. Here you can find a large number of templates for company and personal purposes by categories and regions, or key phrases. With the advanced search function, finding the latest Wilmington North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile is as easy as 1-2-3. Furthermore, the relevance of every file is confirmed by a group of professional lawyers that regularly check the templates on our website and revise them in accordance with the most recent state and county requirements.

If you already know about our system and have a registered account, all you need to receive the Wilmington North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile is to log in to your user profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the sample you need. Check its explanation and utilize the Preview function to explore its content. If it doesn’t meet your needs, use the Search field near the top of the screen to discover the proper file.

- Affirm your selection. Select the Buy now option. After that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the form. Select the file format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the acquired Wilmington North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile.

Each form you add to your user profile does not have an expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you want to get an additional duplicate for modifying or printing, you may return and export it again whenever you want.

Take advantage of the US Legal Forms professional catalogue to get access to the Wilmington North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile you were looking for and a large number of other professional and state-specific templates on one platform!