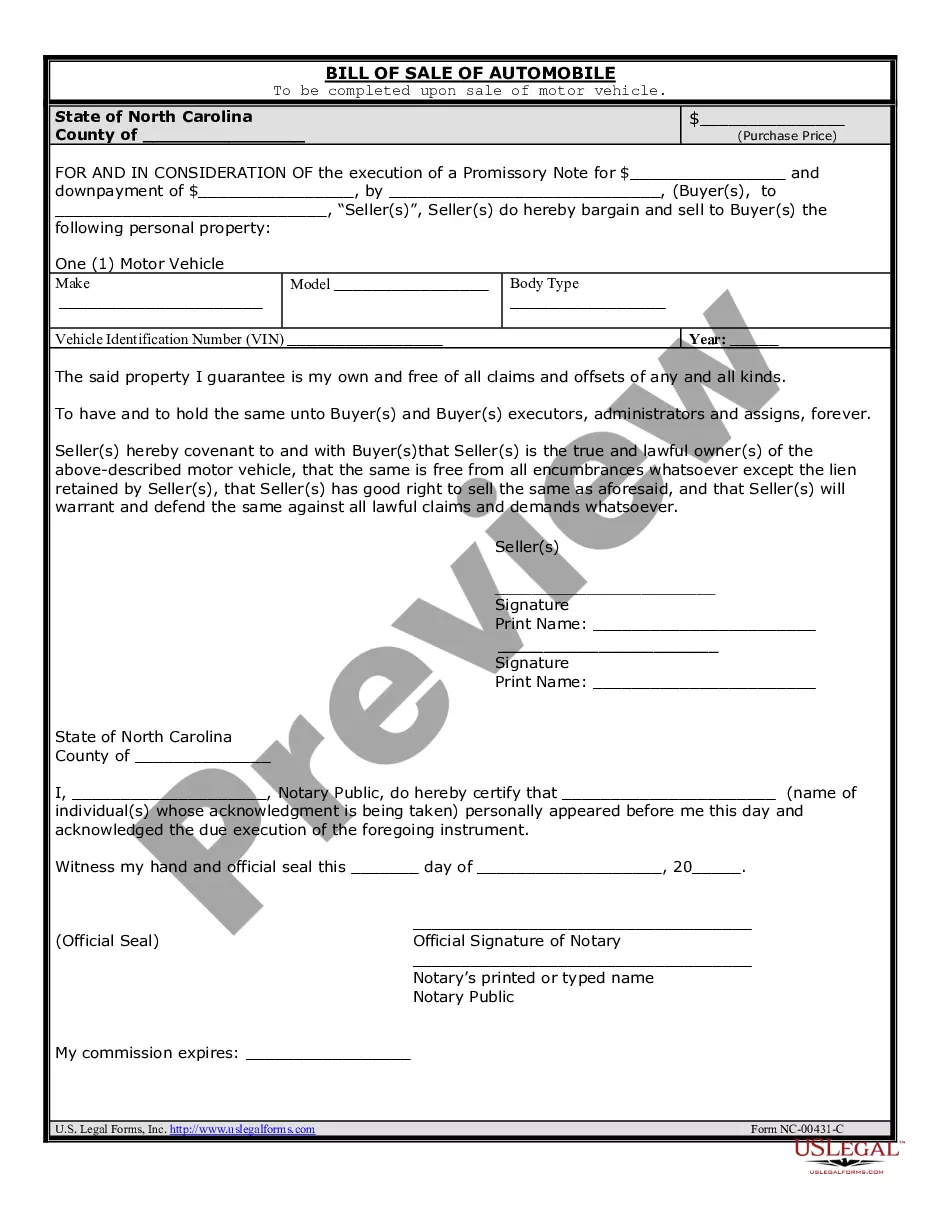

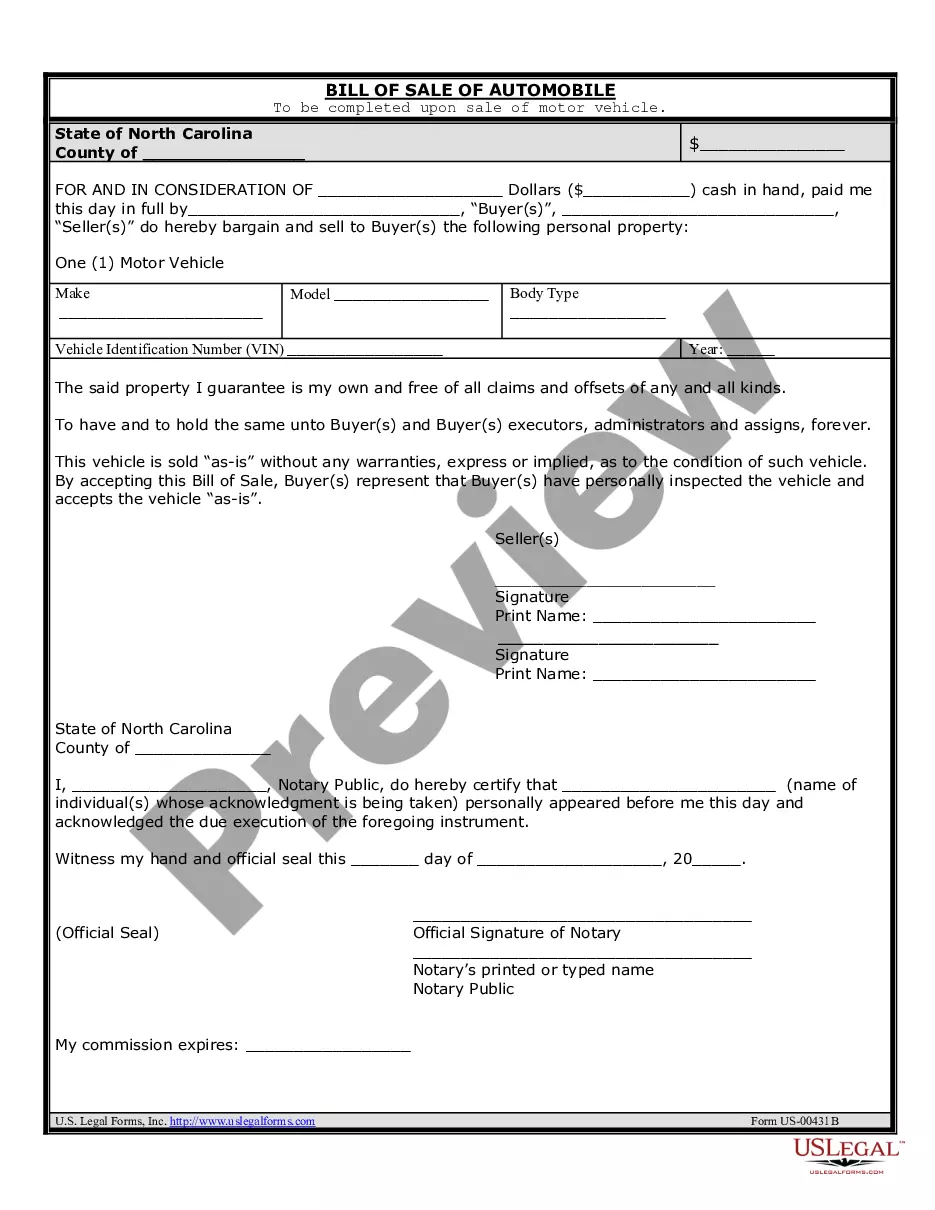

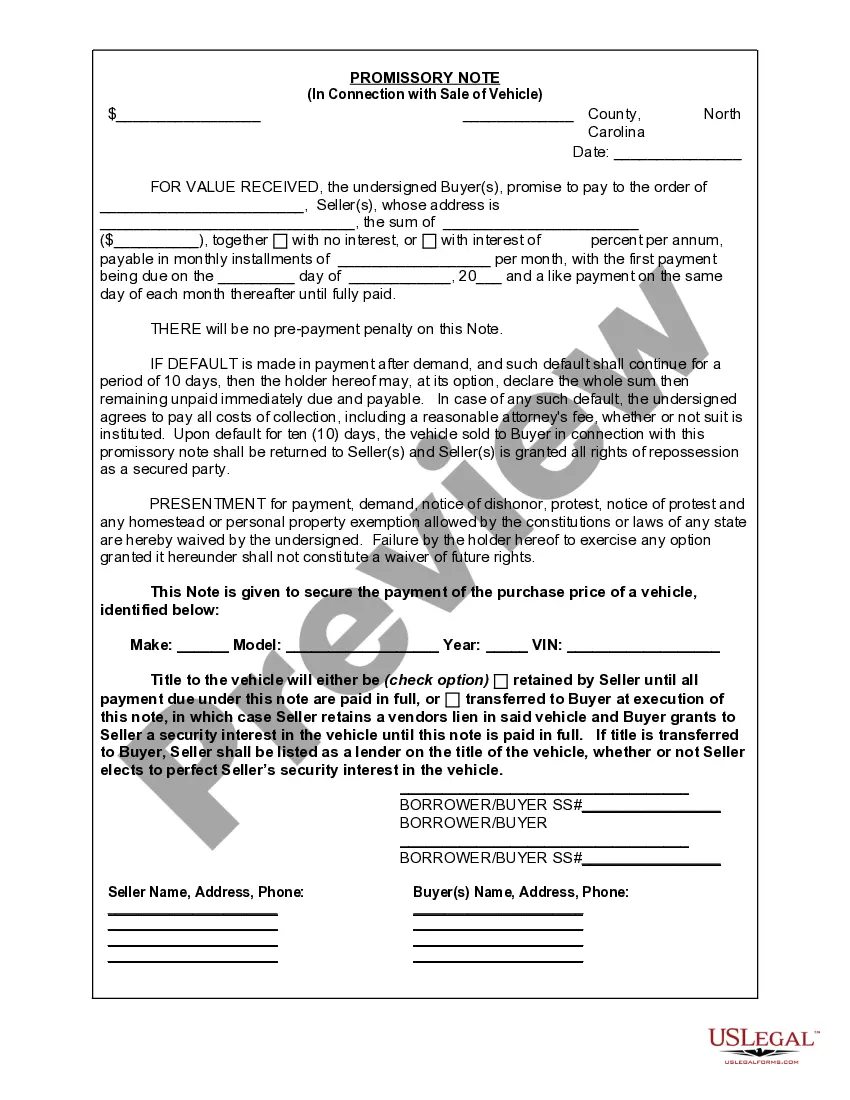

A Winston-Salemem North Carolina Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle. It serves as a written agreement to document the repayment terms and other obligations involved in the sale transaction. This document provides legal protection to both parties involved by clearly stating the terms of the loan and ensuring that both parties understand their responsibilities. The main purpose of a promissory note is to establish how and when the borrower will repay the loan amount to the lender. It specifies the principal amount borrowed, the interest rate (if applicable), the repayment schedule, and any additional fees or charges associated with the loan. The note also includes important details about the vehicle being sold, such as its make, model, year, and identification number (VIN). In Winston-Salemem North Carolina, there are different types of Promissory Notes in Connection with the Sale of a Vehicle or Automobile, each designed to meet specific requirements or circumstances. These variants may include: 1. Simple Promissory Note: This type of promissory note outlines the basic terms of the loan, such as the principal amount borrowed, the interest rate (if applicable), and the repayment schedule. It is suitable for straightforward loan transactions without any complex conditions. 2. Secured Promissory Note: A secured promissory note is used when the lender requires collateral to secure the loan. In the case of a vehicle sale, the vehicle itself may serve as collateral. The note outlines the consequences of defaulting on the loan and the procedure for repossession in case the borrower fails to make timely payments. 3. Conditional Promissory Note: This type of promissory note includes certain conditions that must be met before the loan becomes due or certain obligations the borrower must fulfil during the loan term. For example, the borrower might agree to perform specific repairs or maintenance on the sold vehicle within a specified time frame. 4. Installment Promissory Note: An installment promissory note is used when the loan repayment is structured through a series of regular payments rather than a lump sum. This type of note outlines the specific schedule of installments, including dates, amounts, and any associated interest or fees. It is crucial to consult with legal professionals familiar with the laws and regulations of North Carolina when creating a Promissory Note in Connection with the Sale of a Vehicle or Automobile in Winston-Salemem. This ensures that the note complies with state-specific requirements and protects the rights and interests of both the buyer and the seller.

Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Winston–Salem North Carolina Promissory Note In Connection With Sale Of Vehicle Or Automobile?

If you have previously employed our service, sign in to your account and download the Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile onto your device by clicking the Download button. Ensure that your subscription is active. If it is not, renew it as per your payment schedule.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have lifetime access to all the documents you have purchased: you can find them in your profile within the My documents menu whenever you wish to utilize them again. Make use of the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you’ve found a suitable document. Browse through the description and utilize the Preview feature, if accessible, to verify if it satisfies your requirements. If it’s not fitting, use the Search tab above to locate the correct one.

- Obtain the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Input your credit card information or select the PayPal option to finalize the transaction.

- Receive your Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile. Choose the file format for your document and save it on your device.

- Finalize your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Filling out a North Carolina title requires careful attention to detail. Start by entering the name of the seller and the buyer in the designated fields. Ensure you specify the vehicle identification number (VIN), make, model, and year of the automobile. Finally, remember to sign and date the title; this step is crucial when you create a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, as it formalizes the transaction and protects both parties.

The borrower is primarily liable on a promissory note, making them responsible for repaying the debt as agreed. In Winston–Salem North Carolina, this means that if the borrower fails to make payments, the lender can pursue repayment through legal channels. It's important to ensure that you fully understand your obligations under the note, especially in the context of buying or selling a vehicle or automobile. Using resources from providers like uslegalforms can help clarify these responsibilities and ensure compliance.

A valid promissory note must contain several important elements to be enforceable. It should clearly identify the parties, state the amount to be repaid, specify a payment schedule, and include a signature from the borrower. In Winston–Salem North Carolina, it is crucial that the document is unambiguous to avoid any future disputes, especially when connected to the sale of a vehicle or automobile. You can rely on platforms like uslegalforms to help you create a legally sound note that meets all requirements.

When selling a car privately in North Carolina, you need the title, a bill of sale, and any release of liability documentation. If financing the sale, preparing a promissory note is also crucial. Utilizing a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile can help ensure the transaction proceeds smoothly and all parties are protected.

Typically, the person providing the credit, often the seller in a vehicle sale, sends the promissory note. However, the process can vary based on the agreement made between the parties involved. If you're using resources like US Legal Forms, you can easily draft and prepare a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile and ensure it’s correctly delivered.

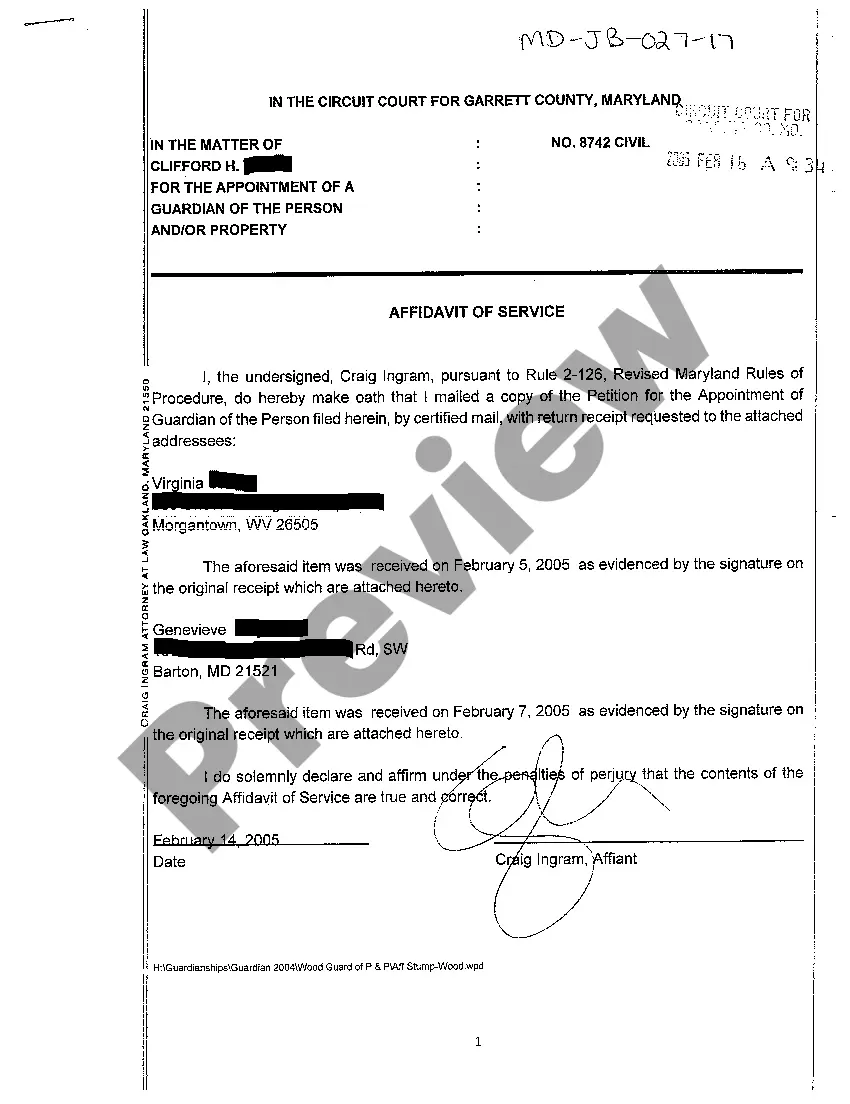

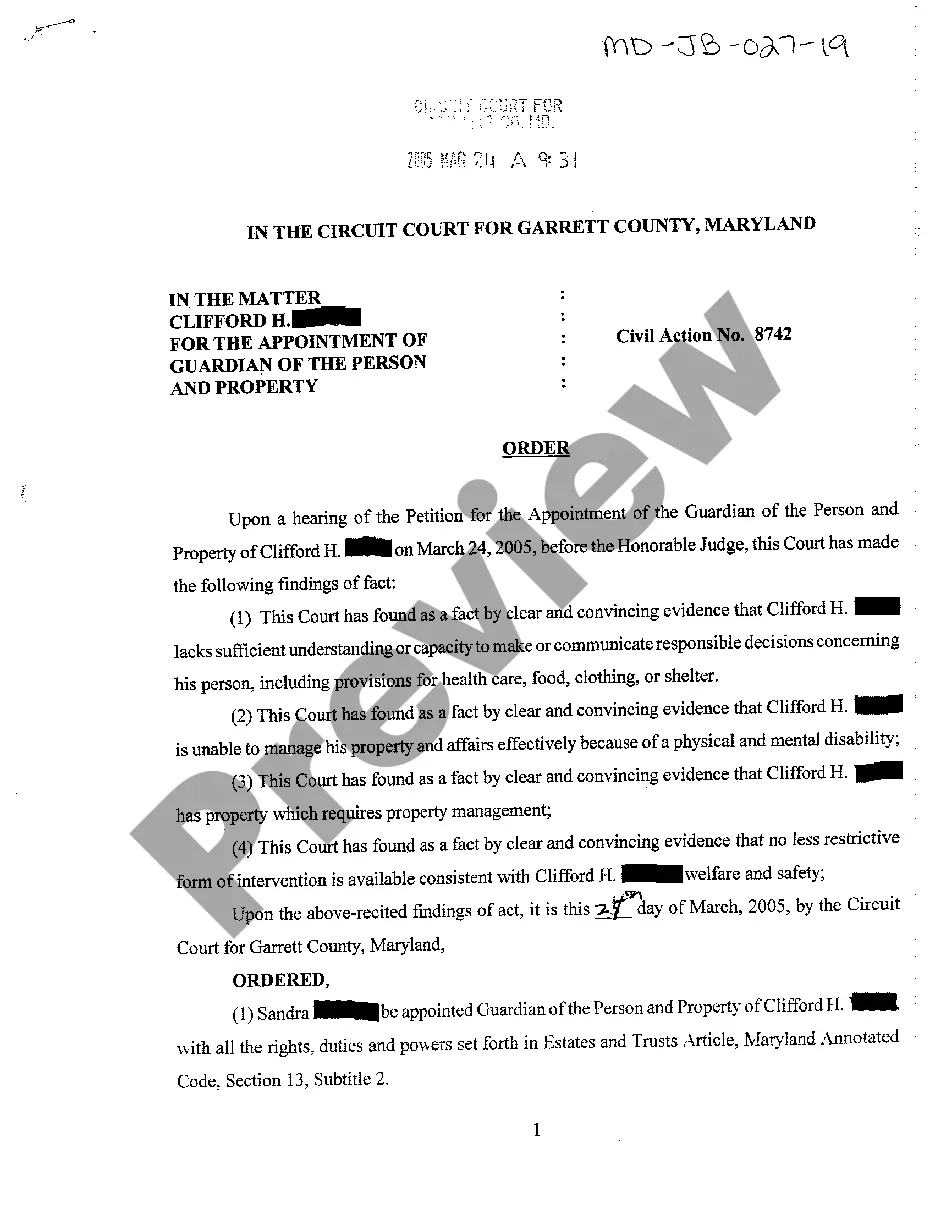

In North Carolina, various documents may require notarization, including wills, real estate deeds, and certain financial instruments. Although a promissory note is not mandated to be notarized, it can often be beneficial. When dealing with a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, having notarization can reduce confusion and bolster trust.

While a promissory note does not necessarily need to be notarized in North Carolina to be valid, notarization can add assurance for both parties involved. It helps to confirm the identities of those signing and the agreement’s authenticity. If you are preparing a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, consider notarizing it to strengthen its validity.

You can obtain your promissory note by contacting the lender or the person who issued the note. If you used a platform like US Legal Forms, you can log in and access your stored documents easily. For a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, ensure you keep a copy safe for your records.

In North Carolina, a promissory note is generally valid for three years, which is the statute of limitations for written contracts. This timeframe starts from the date of the last action, such as a payment made on the note. For a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, it's important to keep track of this time to protect your interests.

In North Carolina, a contract does not always have to be notarized, but some specific types of agreements may require it for added verification. Notarization provides an extra layer of protection in ensuring the parties involved adhere to the terms. It's wise to consider notarization, especially for a Winston–Salem North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, to avoid potential disputes.