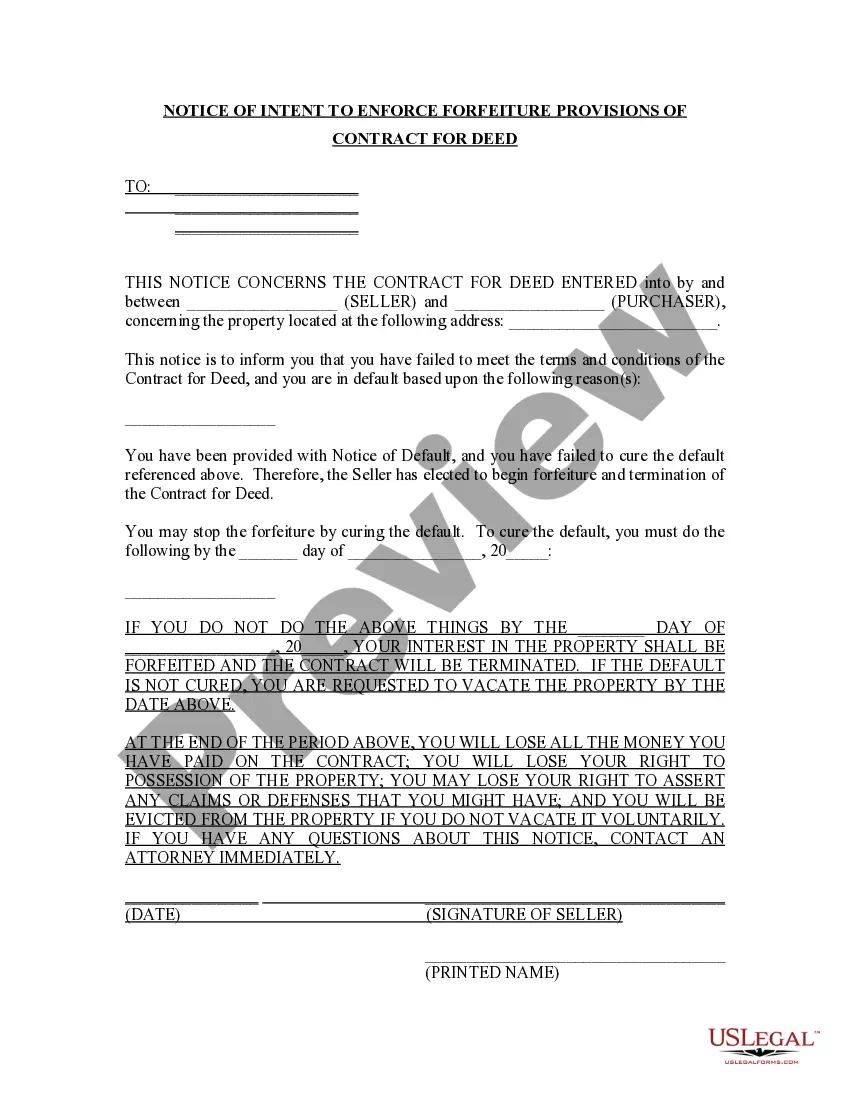

Raleigh North Carolina Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed

Description

How to fill out North Carolina Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed?

Regardless of social or occupational standing, completing legal documents is a regrettable requirement in today’s work environment.

Too frequently, it’s almost unfeasible for someone without legal training to generate this type of documentation from the ground up, primarily because of the intricate terminology and legal nuances they encompass.

This is where US Legal Forms proves to be advantageous.

Ensure that the form you have located is appropriate for your region because the regulations of one state or locality may not apply to another.

Check the form and review a brief summary (if available) regarding the situations for which the document can be utilized.

- Our platform provides an extensive assortment with over 85,000 ready-to-use state-specific forms suitable for almost any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisers aiming to enhance efficiency by using our DIY paperwork.

- Whether you require the Raleigh North Carolina Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed or any other relevant form for your state or locality, US Legal Forms has everything available.

- Here’s how to quickly obtain the Raleigh North Carolina Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed using our reliable platform.

- If you are already a registered user, feel free to Log In to your account to download the needed form.

- However, if you are unfamiliar with our service, please follow these instructions prior to acquiring the Raleigh North Carolina Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed.

Form popularity

FAQ

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

Can I prepare my own deed and have it recorded? A. North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advice of legal counsel.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

Deeds of trust and mortgages are a means of securing the payment of a debt or performance of an obligation. The debt may be established by promissory note, bond or other instrument. In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

The basic requirements of a valid deed are (1) written instrument, (2) competent grantor, (3) identity of the grantee, (4) words of conveyance, (5) adequate description of the land, (6) consideration, (7) signature of grantor, (8) witnesses, and (9) delivery of the completed deed to the grantee.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.