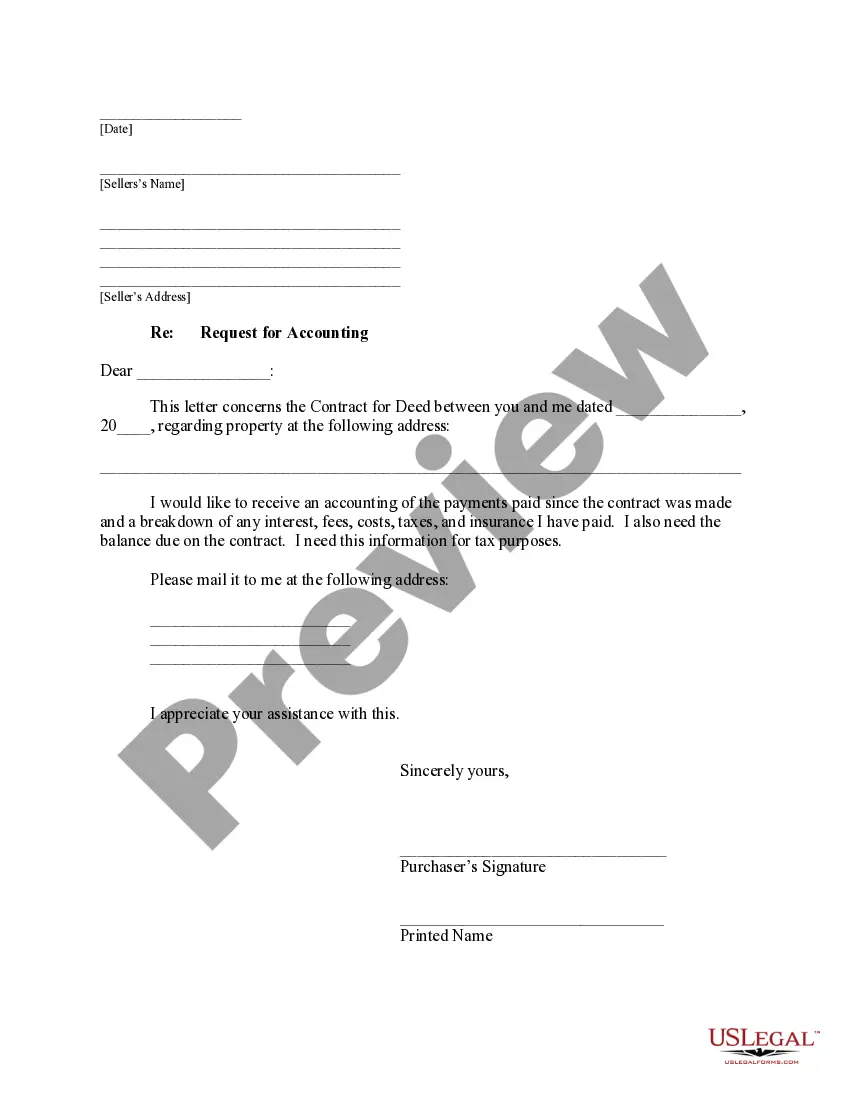

Wilmington North Carolina Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out North Carolina Buyer's Request For Accounting From Seller Under Contract For Deed?

Do you require a trustworthy and affordable legal documents provider to obtain the Wilmington North Carolina Buyer's Request for Accounting from Seller under Contract for Deed? US Legal Forms is your premier choice.

Whether you need a simple contract to establish guidelines for living with your partner or a collection of papers to facilitate your separation or divorce through the legal system, we have you covered. Our platform provides over 85,000 current legal document templates for individual and business use.

All templates that we offer are tailored and designed according to the regulations of specific states and regions.

To access the document, you must Log In to your account, find the required form, and click the Download button next to it. Please note that you can retrieve your previously purchased form templates at any time from the My documents section.

Now you can create your account. Then select the subscription plan and move on to payment.

Once the payment is completed, download the Wilmington North Carolina Buyer's Request for Accounting from Seller under Contract for Deed in any available file format. You can return to the website whenever needed and download the document again at no additional charge. Finding current legal documents has never been more straightforward. Try US Legal Forms now and say goodbye to wasting hours searching for legal papers online.

- Are you unfamiliar with our site? No problem.

- You can establish an account in a few minutes, but before doing that, please ensure the following.

- Verify that the Wilmington North Carolina Buyer's Request for Accounting from Seller under Contract for Deed complies with the legislation of your state and locality.

- Review the form’s specifics (if provided) to understand whom and what the document serves.

- Restart the search if the form doesn’t suit your legal needs.

Form popularity

FAQ

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A land contract lets the seller enjoy a steady cash flow without the hassles of managing it as rental property, and also offers an asset or equity interest in exchange for other property.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

What is one advantage of a contract for deed? Gives the seller certain tax benefits.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.