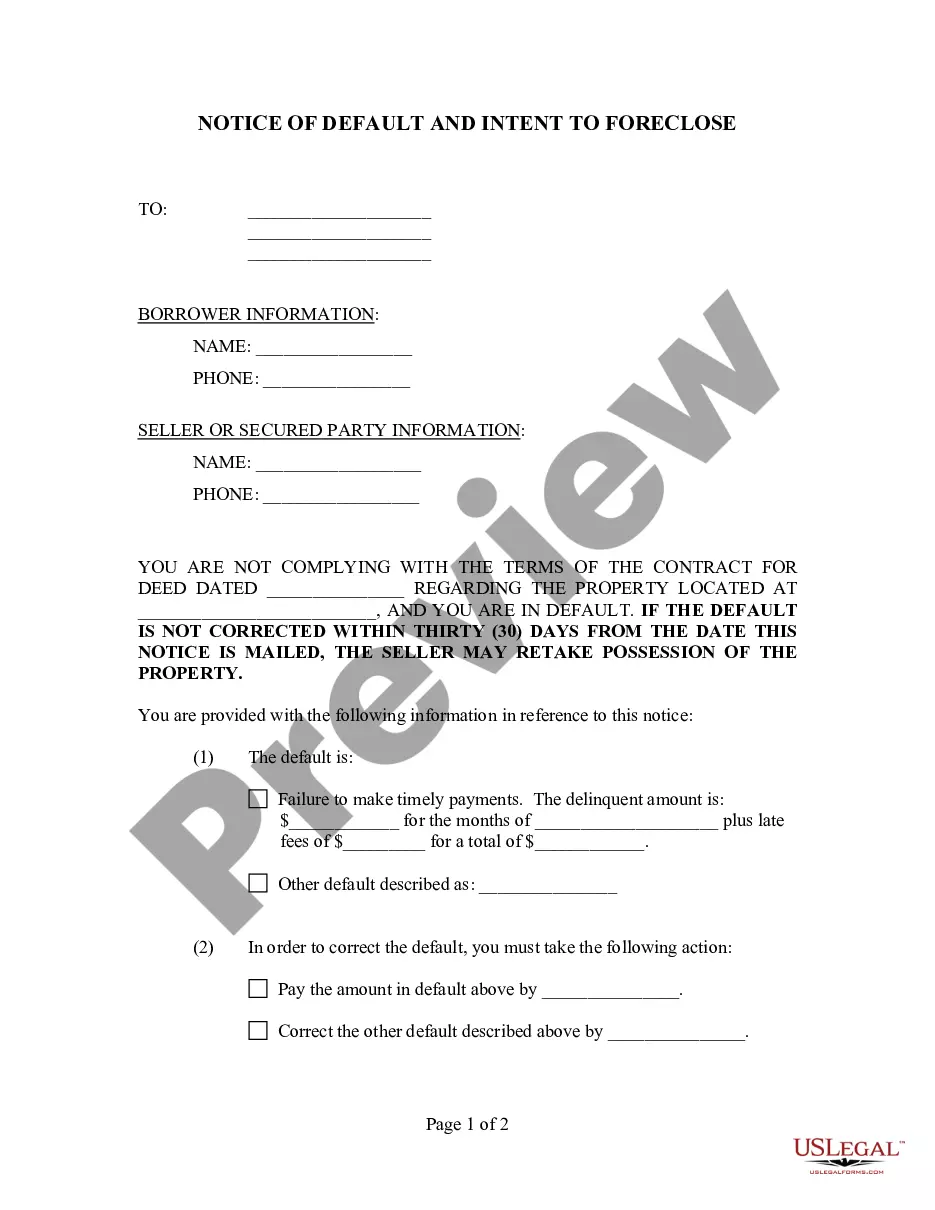

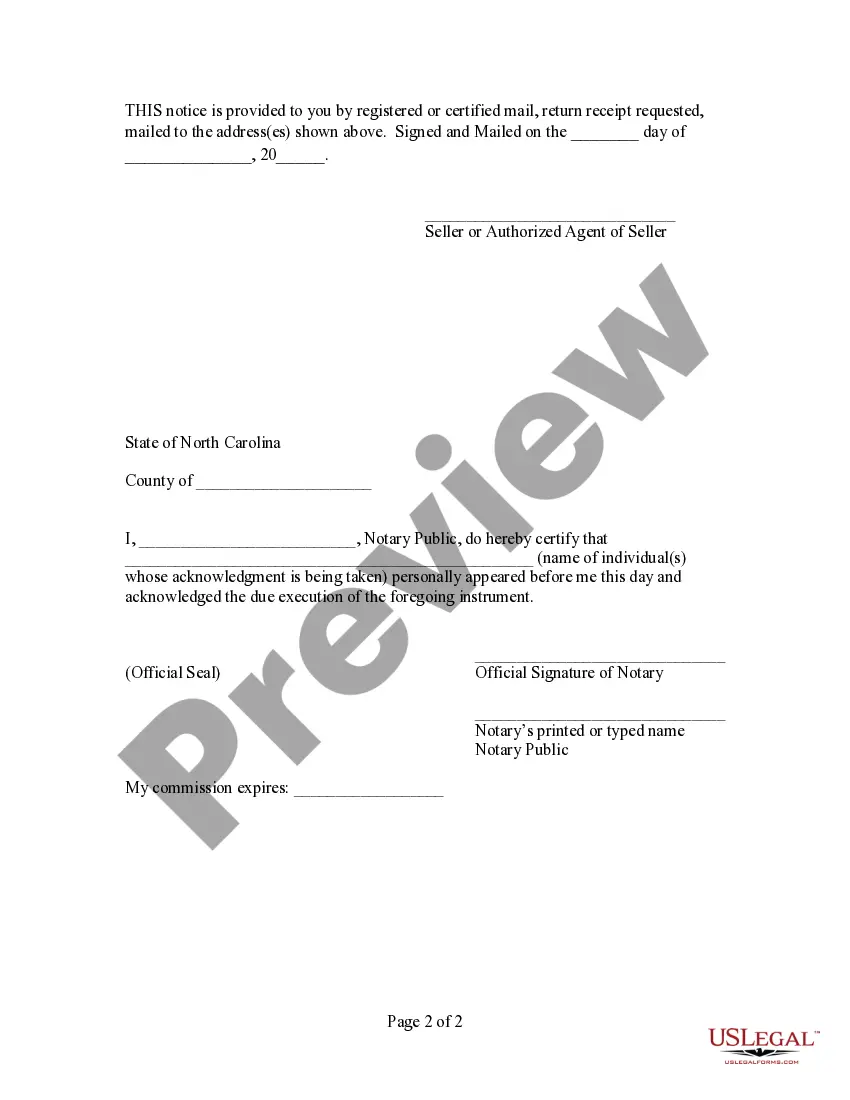

Cary, North Carolina General Notice of Default for Contract for Deed serves as a legal document that notifies all parties involved about a default on a specific contract for deed in the town of Cary, North Carolina. This notice is a necessary step in the process of handling default situations in real estate transactions, ensuring transparency and adhering to legal procedures. When a buyer fails to meet the agreed-upon terms and conditions stated in the Contract for Deed, the seller can issue a General Notice of Default. This document clearly states the defaulting party's name, address, and detailed description of the default, including the specific terms violated and the actions required to cure the default. The notice will typically outline the legal consequences of default, such as foreclosure, the steps to rectify the default, and the timeframe given for the defaulting party to address the issue. It is essential for all parties to thoroughly review the terms of the General Notice of Default, understand their rights and responsibilities, and seek legal advice when necessary. In Cary, North Carolina, there might be different types of General Notices of Default for Contract for Deed, including: 1. Partial Payment Default: This occurs when the buyer fails to make full or partial payments on time as stipulated in the contract. The notice will specify the amount overdue and provide a deadline for payment. 2. Non-Payment Default: When the buyer completely fails to make any payments, this default may be issued. The notice will state the payment amount due, the due date, and the consequences if the payment is not made within the given timeframe. 3. Breach of Covenants Default: If the buyer breaches specific covenants mentioned in the contract, such as property maintenance or insurance obligations, a General Notice of Default will be issued. It will detail the specific breach and actions to remedy the default. 4. Failure to Meet Other Obligations Default: This type of default may occur if the buyer fails to fulfill other obligations outlined in the contract, such as obtaining necessary permits or approvals. The notice will highlight the non-compliance and the necessary steps to resolve the default. When issuing a Cary, North Carolina General Notice of Default for Contract for Deed, it is crucial to ensure accuracy, compliance with local laws, and delivery to all relevant parties involved. Seeking legal guidance or consulting local real estate professionals can assist in navigating the process effectively.

Cary North Carolina General Notice of Default for Contract for Deed

Description

How to fill out Cary North Carolina General Notice Of Default For Contract For Deed?

No matter what social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law background to create this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Cary North Carolina General Notice of Default for Contract for Deed or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cary North Carolina General Notice of Default for Contract for Deed in minutes using our trustworthy platform. If you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are unfamiliar with our library, make sure to follow these steps before obtaining the Cary North Carolina General Notice of Default for Contract for Deed:

- Ensure the form you have found is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the document and go through a quick outline (if provided) of scenarios the paper can be used for.

- If the one you picked doesn’t suit your needs, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Cary North Carolina General Notice of Default for Contract for Deed once the payment is through.

You’re good to go! Now you can proceed to print the document or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.