A Fayetteville North Carolina General Notice of Default for Contract for Deed is a legal document that serves as a notice to inform parties involved in a contract for deed agreement about a default by the buyer. This notice outlines the specific details of the default, including the nature of the non-compliance and the necessary actions required to rectify the situation. Keywords: Fayetteville North Carolina, General Notice of Default, Contract for Deed, legal document, default, parties involved, buyer, non-compliance, rectify Different types of Fayetteville North Carolina General Notice of Default for Contract for Deed may include: 1. Notice of Payment Default: This type of notice is issued when the buyer fails to make timely payments as required by the contract for deed agreement. It outlines the number of missed payments, the amount due, and a deadline by which the buyer must make the payment to avoid further actions. 2. Notice of Non-Compliance: This notice is used when the buyer violates other terms and conditions specified in the contract for deed agreement, such as property maintenance obligations or insurance requirements. It details the specific areas of non-compliance and provides a timeframe for the buyer to remedy the situation. 3. Notice of Property Encumbrance: This type of notice is issued when the buyer places an encumbrance on the property without consent from the seller. An encumbrance refers to any claim, lien, or restriction that affects the property's title or use. The notice outlines the encumbrance and demands its removal within a specified time frame. 4. Notice of Breach of Contract: This notice is given when the buyer fails to fulfill any substantial obligations under the contract for deed agreement. This can include failure to maintain insurance, pay property taxes, or keep the property in good condition. The notice specifies the breach, the corrective action required, and the consequences if the breach is not resolved within a given period. 5. Notice of Intent to Foreclose: In cases where the buyer's default is severe and cannot be resolved, the seller may issue a notice of intent to foreclose. This notice serves as a warning to the buyer that legal action will be pursued, and the property may be repossessed if the default is not remedied promptly. It is essential to consult an attorney or legal expert to ensure compliance with all relevant laws and regulations while drafting and serving a Fayetteville North Carolina General Notice of Default for Contract for Deed.

Fayetteville North Carolina General Notice of Default for Contract for Deed

State:

North Carolina

City:

Fayetteville

Control #:

NC-00470-16

Format:

Word;

Rich Text

Instant download

Description

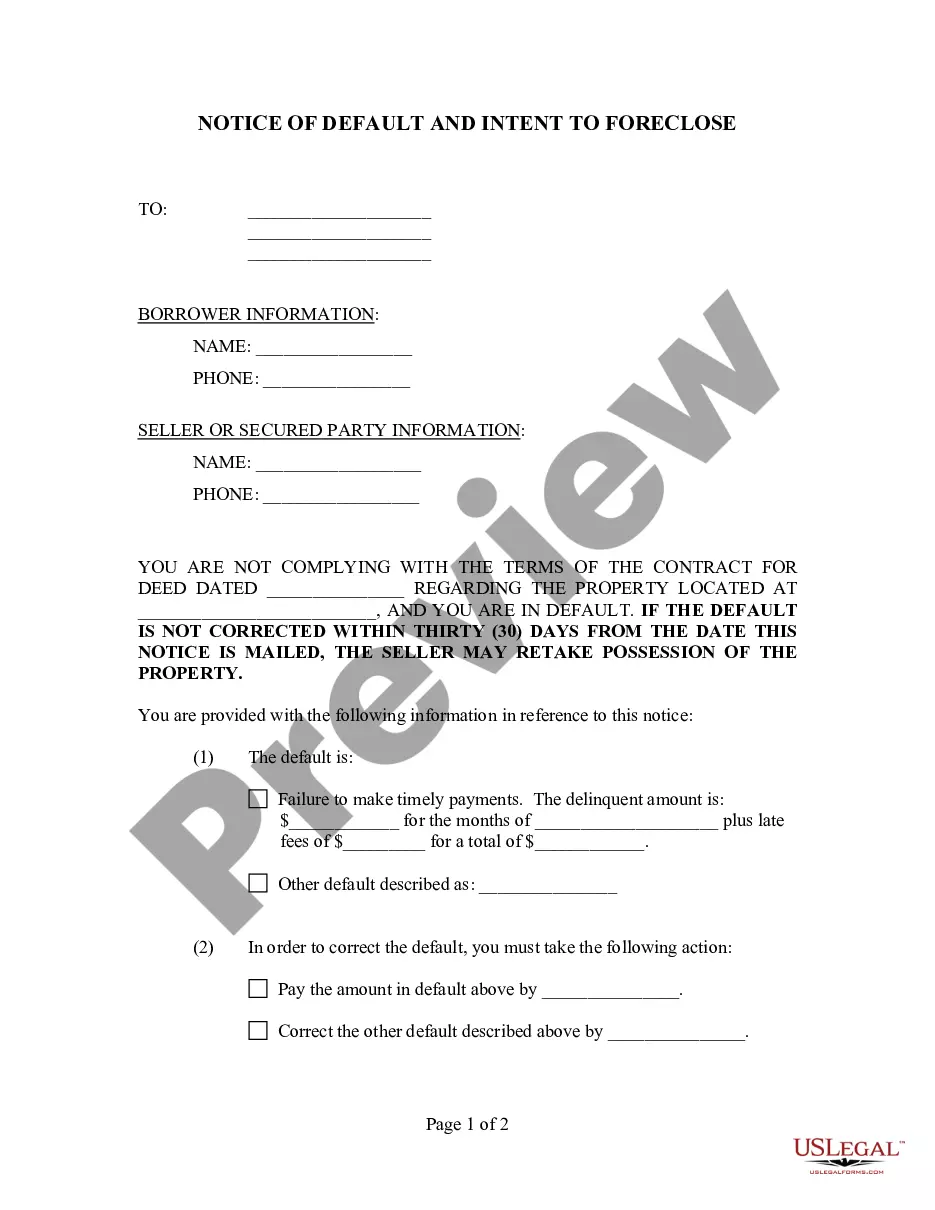

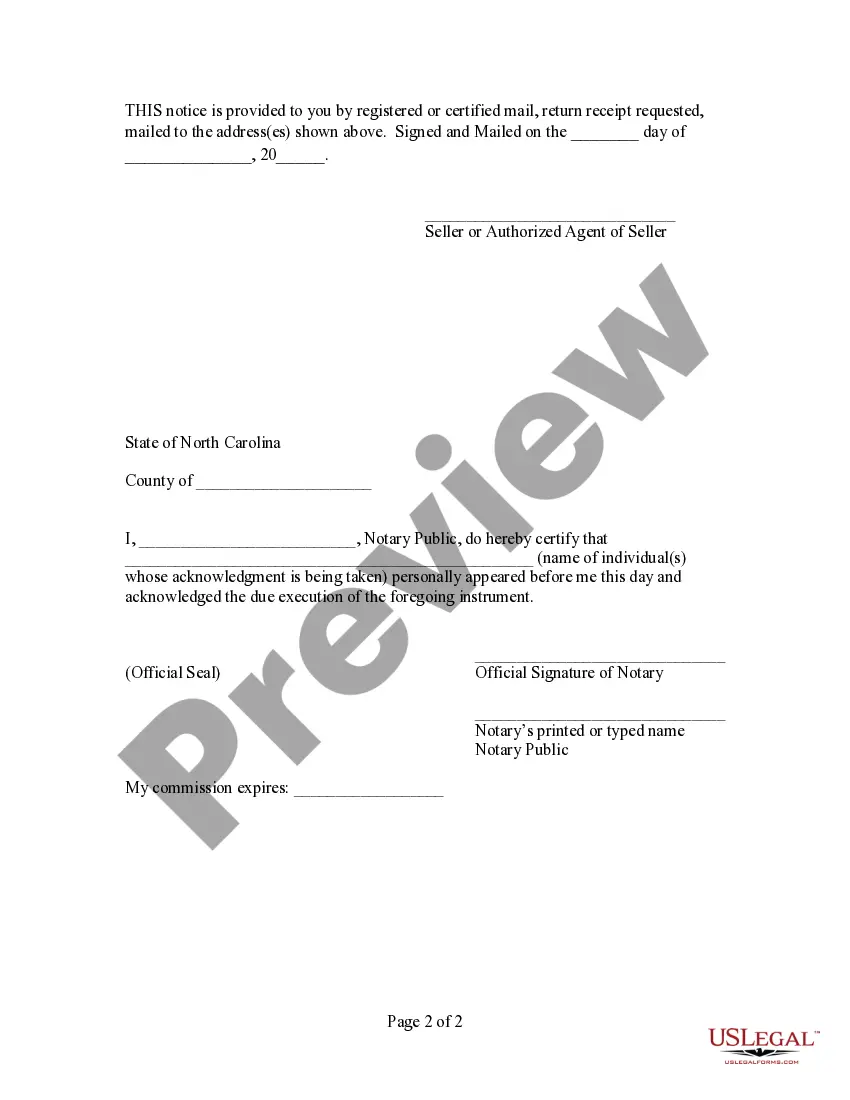

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for deed is in default, the performance required to cure the default, and the Seller's planned remedy in case the Purchaser does not cure.

A Fayetteville North Carolina General Notice of Default for Contract for Deed is a legal document that serves as a notice to inform parties involved in a contract for deed agreement about a default by the buyer. This notice outlines the specific details of the default, including the nature of the non-compliance and the necessary actions required to rectify the situation. Keywords: Fayetteville North Carolina, General Notice of Default, Contract for Deed, legal document, default, parties involved, buyer, non-compliance, rectify Different types of Fayetteville North Carolina General Notice of Default for Contract for Deed may include: 1. Notice of Payment Default: This type of notice is issued when the buyer fails to make timely payments as required by the contract for deed agreement. It outlines the number of missed payments, the amount due, and a deadline by which the buyer must make the payment to avoid further actions. 2. Notice of Non-Compliance: This notice is used when the buyer violates other terms and conditions specified in the contract for deed agreement, such as property maintenance obligations or insurance requirements. It details the specific areas of non-compliance and provides a timeframe for the buyer to remedy the situation. 3. Notice of Property Encumbrance: This type of notice is issued when the buyer places an encumbrance on the property without consent from the seller. An encumbrance refers to any claim, lien, or restriction that affects the property's title or use. The notice outlines the encumbrance and demands its removal within a specified time frame. 4. Notice of Breach of Contract: This notice is given when the buyer fails to fulfill any substantial obligations under the contract for deed agreement. This can include failure to maintain insurance, pay property taxes, or keep the property in good condition. The notice specifies the breach, the corrective action required, and the consequences if the breach is not resolved within a given period. 5. Notice of Intent to Foreclose: In cases where the buyer's default is severe and cannot be resolved, the seller may issue a notice of intent to foreclose. This notice serves as a warning to the buyer that legal action will be pursued, and the property may be repossessed if the default is not remedied promptly. It is essential to consult an attorney or legal expert to ensure compliance with all relevant laws and regulations while drafting and serving a Fayetteville North Carolina General Notice of Default for Contract for Deed.

Free preview

How to fill out Fayetteville North Carolina General Notice Of Default For Contract For Deed?

If you’ve already utilized our service before, log in to your account and download the Fayetteville North Carolina General Notice of Default for Contract for Deed on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Fayetteville North Carolina General Notice of Default for Contract for Deed. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!