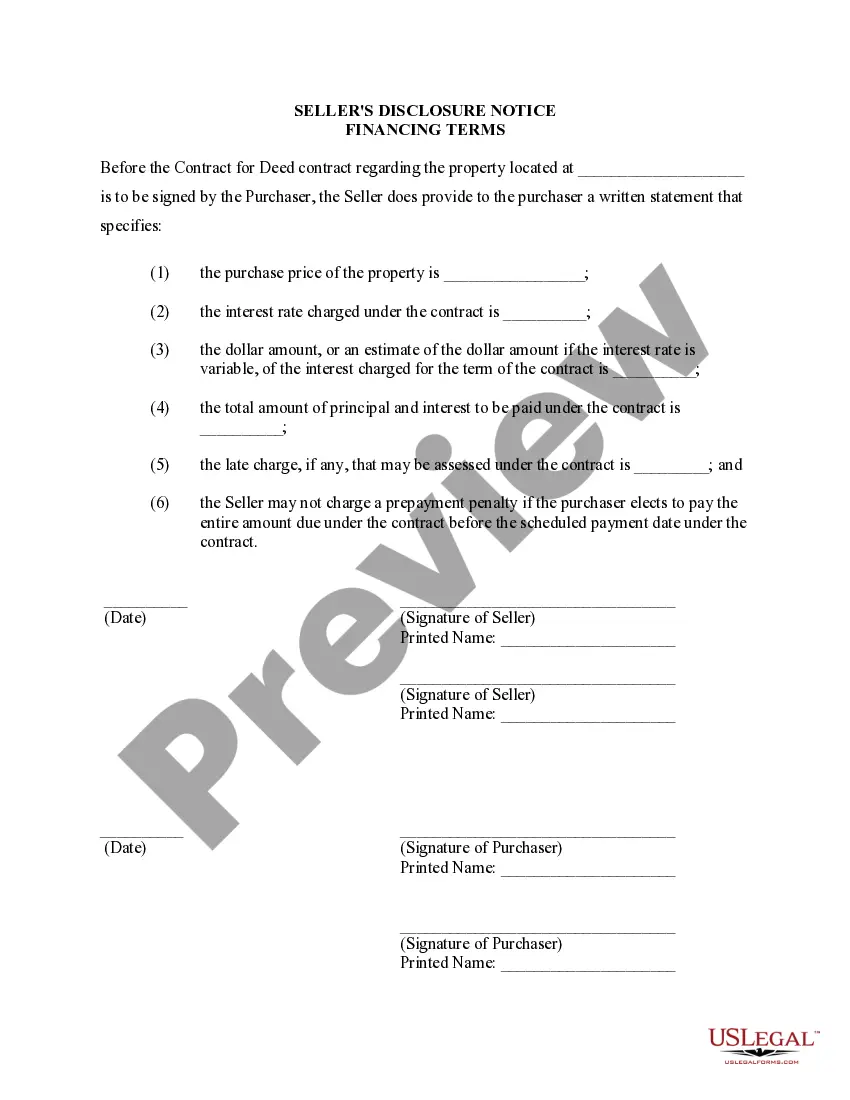

Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a legally binding document that outlines the specific terms and conditions related to the financing of a residential property purchase. This disclosure is crucial for potential buyers to fully understand the financial aspects of the agreement before entering into a contract. There are several types of financing terms and conditions that may be included in a Cary North Carolina Seller's Disclosure, depending on the specifics of the agreement. Some common terms and conditions that may be disclosed include: 1. Purchase Price: This section of the disclosure will outline the agreed-upon purchase price of the residential property. It is essential for the buyer to be aware of the exact amount they will be required to pay. 2. Down Payment: The disclosure will specify the amount of money the buyer must pay as a down payment. This upfront payment is typically a percentage of the purchase price and is paid at the time of contract execution. 3. Interest Rate: The interest rate is an important element of the financing terms. The disclosure will state the specific interest rate that will be applied to the remaining balance of the purchase price. This is crucial for buyers to understand the long-term financial implications of the agreement. 4. Payment Schedule: The disclosure will detail the payment schedule, including the due date and frequency of payments. It will specify whether the payments are monthly, quarterly, or annually. 5. Length of Contract: The disclosure will state the duration of the contract or land contract, including the start and end date. This information is vital for both the buyer and seller to be aware of the agreed-upon time frame for completing the payment and transferring ownership. 6. Late Payment Penalties: It is common for a Seller's Disclosure to include information regarding late payment penalties. This section outlines the consequences of late or missed payments, such as additional fees or interest charges. 7. Property Insurance and Taxes: The disclosure may include information regarding property insurance and taxes. It will specify whether the buyer or seller is responsible for these expenses during the contract period. 8. Default and Remedies: This section will outline the potential consequences in the event of default by either party. It may include details about foreclosure, repossession, or other remedies available to the seller. It is important for both buyers and sellers to carefully review and understand the contents of a Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. Furthermore, it is recommended to seek legal advice from a real estate attorney to ensure that both parties fully comprehend their rights and obligations under the contract.

Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Cary North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone without any law education to draft such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract quickly employing our trusted platform. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are new to our platform, make sure to follow these steps prior to obtaining the Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract:

- Be sure the form you have chosen is specific to your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a quick outline (if available) of scenarios the document can be used for.

- In case the form you selected doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and choose the subscription plan you prefer the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Cary North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract once the payment is through.

You’re all set! Now you can go on and print the document or fill it out online. In case you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.