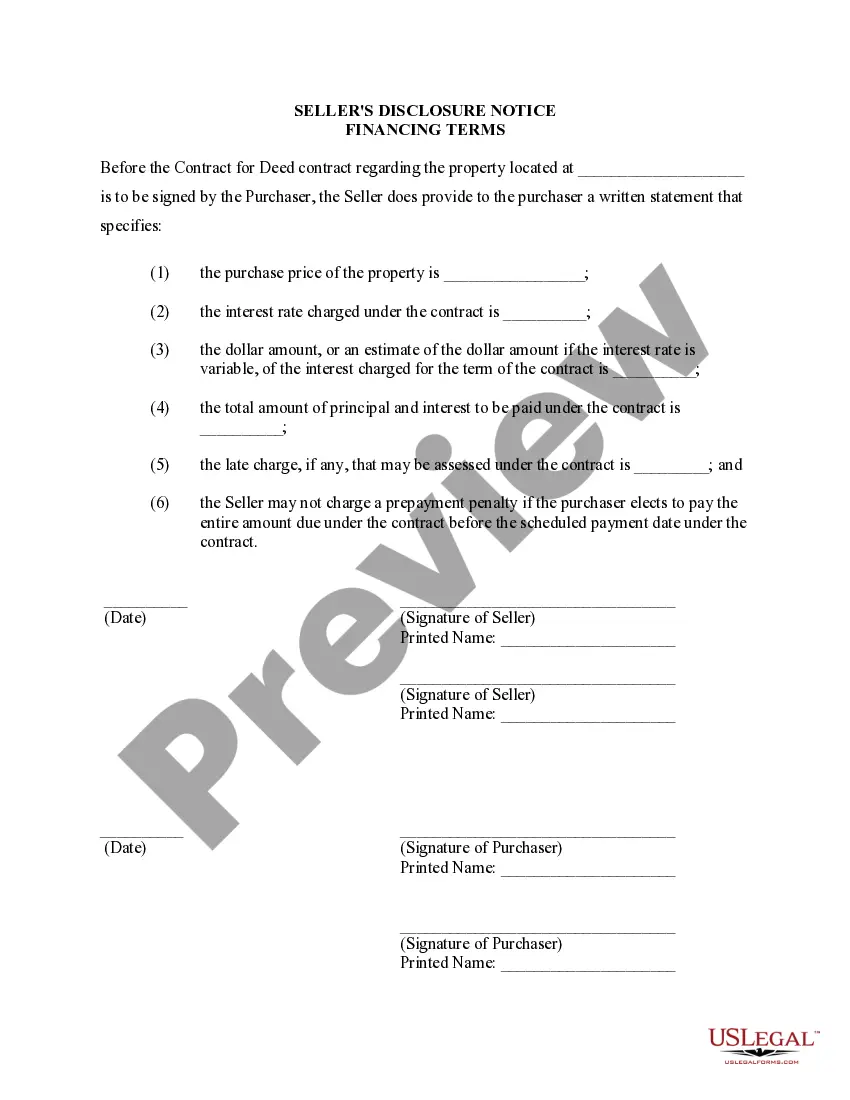

The Charlotte North Carolina Seller's Disclosure of Financing Terms for Residential Property is a document that outlines the specific terms and conditions of financing for a residential property being sold under a Contract or Agreement for Deed, also known as a Land Contract. This disclosure is required by law in Charlotte, North Carolina to provide transparency and protect both the seller and the buyer in the transaction. The Seller's Disclosure of Financing Terms for Residential Property contains essential information regarding the financing arrangements for the property, ensuring that both parties are aware of the details and implications of the agreement. The disclosure typically includes the following key elements: 1. Purchase Price: The disclosure will state the agreed-upon purchase price for the property. This price is essential for both the seller and the buyer to know and understand the financial obligations involved. 2. Down Payment: It specifies the amount of the down payment required by the seller as part of the financing terms. The buyer needs to be aware of the upfront cash amount they need to pay to secure the property. 3. Interest Rate: This element details the interest rate that will be charged on the outstanding balance of the seller-financed loan. The disclosure should explicitly state whether the interest rate is fixed or adjustable, providing clarification to the buyer on the financing costs involved. 4. Payment Terms: The disclosure explains the payment terms for the seller-financed loan, including the frequency of payments (monthly, quarterly, etc.), the due date of each payment, and where the payments should be made. 5. Balloon Payment: In some cases, a seller-financed loan may include a balloon payment, which is a lump-sum payment due at the end of a specified term. The disclosure should clearly state whether a balloon payment is involved, along with the specific amount and due date. 6. Late Payment Penalties: The disclosure will outline any penalties or fees that may be imposed if the buyer fails to make timely payments. These penalties could include late payment fees or additional interest charges, and it is crucial for the buyer to be aware of their financial responsibilities. It is important to note that there may be different variations or additional disclosures related to Seller's Financing Terms for Residential Property in connection with Contract or Agreement for Deed in Charlotte, North Carolina. However, the above-mentioned elements encompass the key elements that are typically addressed in this type of disclosure. When entering into a Contract or Agreement for Deed involving seller financing, it is imperative for both the seller and the buyer to carefully review and understand the Seller's Disclosure of Financing Terms. It is recommended to seek legal advice or clarification if any questions or concerns arise before signing the agreement.

Charlotte North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Charlotte North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you have previously utilized our service, Log In to your account and obtain the Charlotte North Carolina Seller's Disclosure of Financing Terms for Residential Property regarding Contract or Agreement for Deed also known as Land Contract on your device by clicking the Download button. Verify that your subscription is active. If not, renew it as per your payment schedule.

If this is your initial experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly discover and preserve any template for your personal or business needs!

- Confirm you have found an appropriate document. Review the description and use the Preview feature, if available, to ensure it satisfies your requirements. If it’s not suitable, use the Search option above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and proceed with payment. Use your credit card information or the PayPal option to finalize the purchase.

- Retrieve your Charlotte North Carolina Seller's Disclosure of Financing Terms for Residential Property in relation to Contract or Agreement for Deed also referred to as Land Contract. Choose the file format for your document and save it to your device.

- Finalize your document. Print it out or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

North Carolina law mandates that sellers identify any known defects in their property before a purchase contract is signed. The purpose of this is to make sure that buyers are not surprised with a problem when they move into the home: a busted air-conditioner, a termite infestation, a flooded basement, and so forth.

Dornfest says 37 states now have full disclosure; six states (Arkansas, Delaware, North Carolina, Oklahoma, Rhode Island and Tennessee) have transfer tax; and he classifies seven states as nondisclosure: Alaska, Idaho, Louisiana, Mississippi, Missouri, Texas and Utah.

In order to have a valid contract in North Carolina, there must be an offer, an acceptance, along with consideration. The parties must also have the capacity to enter into the contract.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

North Carolina law mandates that sellers identify any known defects in their property before a purchase contract is signed. The purpose of this is to make sure that buyers are not surprised with a problem when they move into the home: a busted air-conditioner, a termite infestation, a flooded basement, and so forth.

Material Fact: Any fact that could affect a reasonable person's decision to buy, sell, or lease is considered a material fact and must be disclosed by a broker to the parties in the transaction and any interested third parties regardless of the broker's agency role within the transaction.

To be validly registered pursuant to G.S. 47-20, a deed of trust or mortgage of real property must be registered in the county where the land lies, or if the land is located in more than one county, then the deed of trust or mortgage must be registered in each county where any portion of the land lies in order to be

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

What must you declare when selling a property? Major problems found in previous surveys (e.g. subsidence, problems with the roof etc.) Crime rates in the area (e.g. neighbourhood burglaries, murders etc.) Location of the house (e.g. is it near a flight path or near a motorway?)

North Carolina General Statutes Chapter 47H governs a ?Contract for Deed?, or installment sale agreements. Chapters 47G and 47H were enacted into law in 2010 with the goal of protecting purchasers who enter into non-traditional real estate purchase contracts.