The Raleigh North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific terms and conditions related to the financing aspect of a property sale. This disclosure acts as a safeguard for both the seller and the buyer, ensuring transparency and clarity throughout the transaction process. There are several types of Seller's Disclosure of Financing Terms in Raleigh, North Carolina, which can be tailored to fit the specific requirements of the parties involved. Here are some key types: 1. Initial Disclosure: This type of disclosure is provided by the seller to the prospective buyer at the beginning of the transaction process. It informs the buyer about the various financing options available, including the terms, interest rates, down payment requirements, and any additional fees or charges that may apply. 2. Amended Disclosure: In some cases, there may be changes or modifications to the financing terms agreed upon initially. An amended disclosure is used to update the buyer about these changes, ensuring that both parties are aware of any alterations made to the original financing terms. 3. Final Disclosure: This disclosure is provided to the buyer at the end of the transaction, just before the contract or agreement for deed is finalized. It serves as a comprehensive summary of the financing terms and conditions, including any amendments made throughout the process. The final disclosure aims to provide a clear understanding to the buyer of their financing obligations and the overall financial implications of the property purchase. Key Terms and Requirements: 1. Interest Rate: The disclosure should clearly state the interest rate that applies to the financing provided by the seller. This includes any variations, such as fixed or adjustable rates. 2. Loan Duration: The disclosure should specify the length of the loan term, indicating whether it is a short-term or long-term financing arrangement. 3. Down Payment: The seller's disclosure must outline the required down payment or upfront payment, which is usually a percentage of the property's purchase price. 4. Payment Schedule: The disclosure should include details about the payment schedule, including the frequency of payments (monthly, bi-monthly, etc.), the due dates, and any late payment penalties or grace periods. 5. Additional Fees: Any additional fees or charges related to the financing should be disclosed, such as origination fees, closing costs, or prepayment penalties. 6. Default and Remedies: The disclosure should outline the consequences of defaulting on the financing terms, including potential remedies available to the seller, such as repossession of the property or legal actions. It is important for both buyers and sellers involved in a Contract or Agreement for Deed to thoroughly read and understand the Seller's Disclosure of Financing Terms. Consulting with a real estate attorney or a qualified real estate agent can also provide valuable guidance in navigating this important document.

Raleigh North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

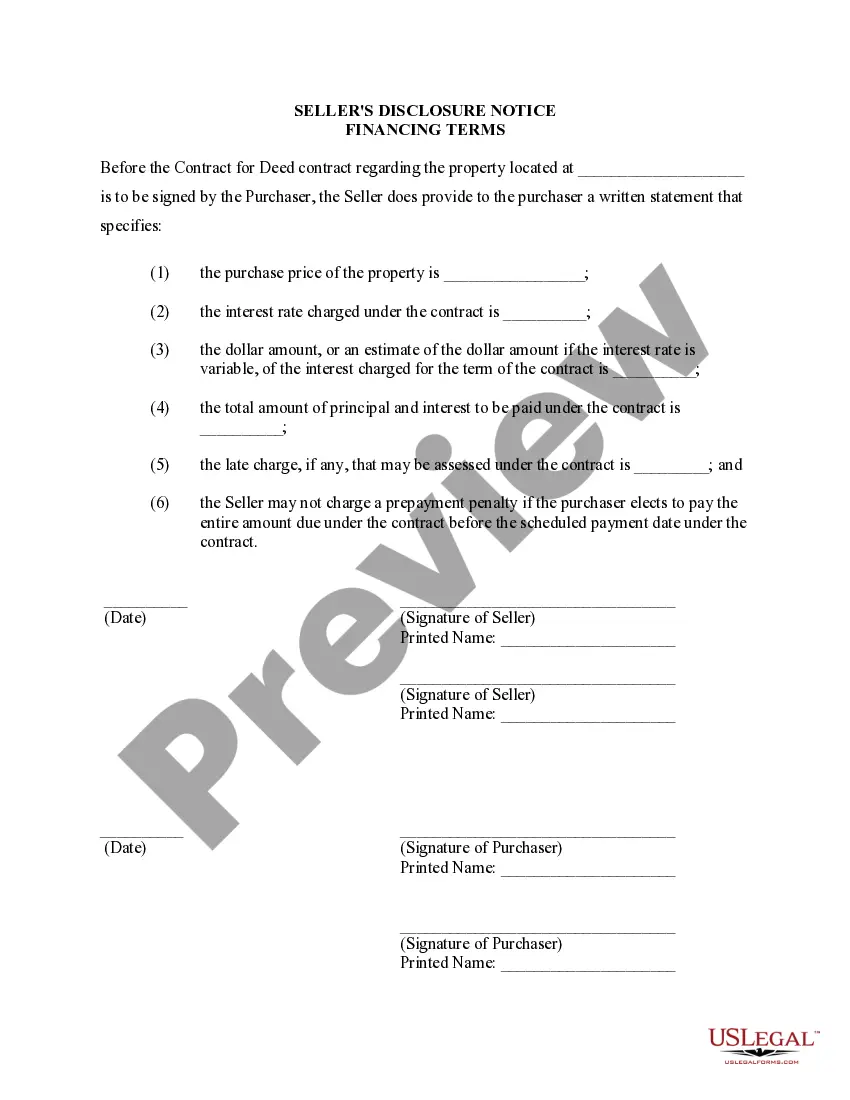

How to fill out Raleigh North Carolina Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you’ve already used our service before, log in to your account and save the Raleigh North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Raleigh North Carolina Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!