The Charlotte, North Carolina Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document prepared by a seller who has entered into a contract for deed agreement with a buyer in the state of North Carolina. This statement serves as an annual report accounting for the various financial transactions and obligations between the seller and the buyer over the course of the year. The accounting statement includes detailed information regarding all financial aspects of the contract for deed, such as the principal amount, interest payments, late fees, and any other charges applicable to the agreement. It provides a breakdown of the payments made by the buyer, including the total amount paid towards the principal, interest, and any other fees, as well as the remaining balance owed. The statement also includes information on any taxes and insurance premiums associated with the property, which may be collected by the seller and held in escrow for the buyer. It outlines the amounts collected for these purposes and any disbursements made towards property taxes or insurance coverage. Additionally, the Charlotte, North Carolina Contract for Deed Seller's Annual Accounting Statement may include details about any assessments or improvements made to the property during the year, along with associated costs and fees. This allows both the seller and the buyer to have a clear understanding of the financial status of the property and any developments that may impact the overall value. It is important to note that there may be different types of Charlotte, North Carolina Contract for Deed Seller's Annual Accounting Statements based on specific contractual agreements. Some variations may include specific clauses or provisions unique to individual contracts, such as rent credit agreements, balloon payment schedules, or early termination options. These different types of statements would cater to the specific terms and conditions of the respective contracts. In summary, the Charlotte, North Carolina Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document that provides a detailed overview of all financial transactions and obligations between a seller and a buyer in a contract for deed agreement. It ensures transparency and accountability, allowing both parties to have a clear understanding of the financial status of the property and any associated costs or fees.

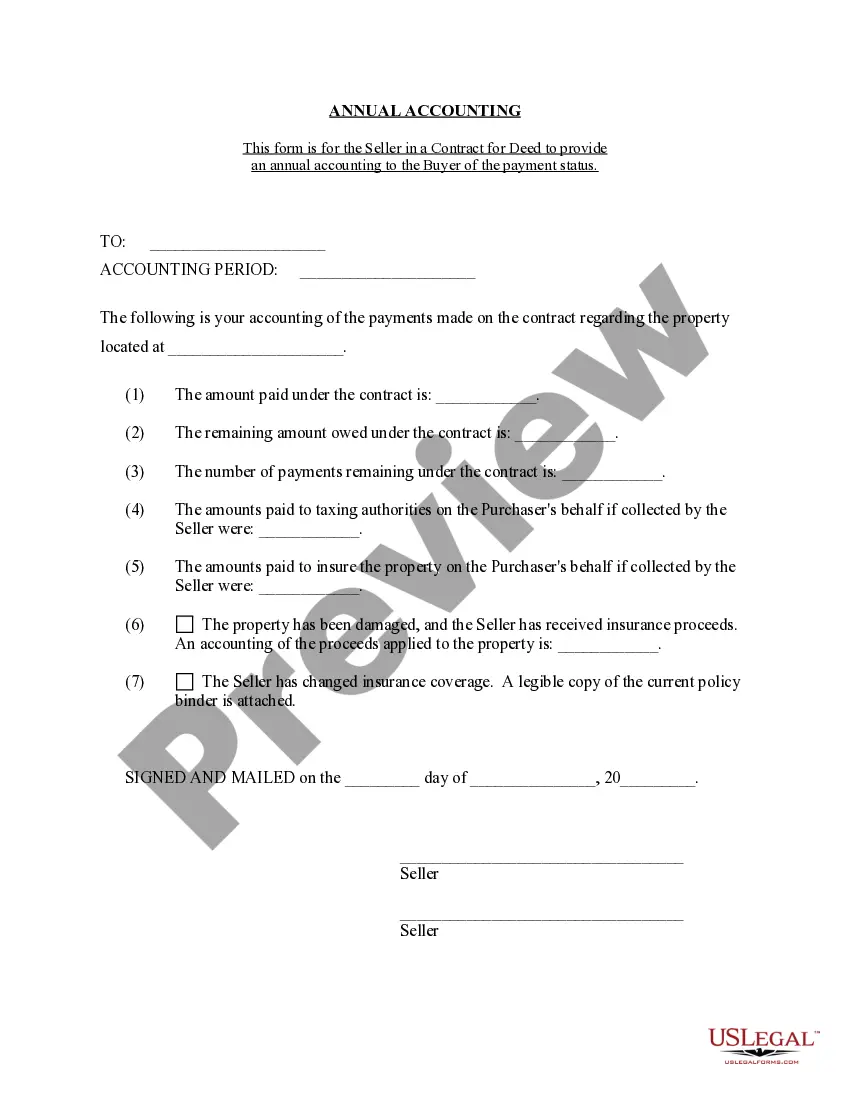

Charlotte North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Charlotte North Carolina Contract For Deed Seller's Annual Accounting Statement?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Charlotte North Carolina Contract for Deed Seller's Annual Accounting Statement gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Charlotte North Carolina Contract for Deed Seller's Annual Accounting Statement takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Charlotte North Carolina Contract for Deed Seller's Annual Accounting Statement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!