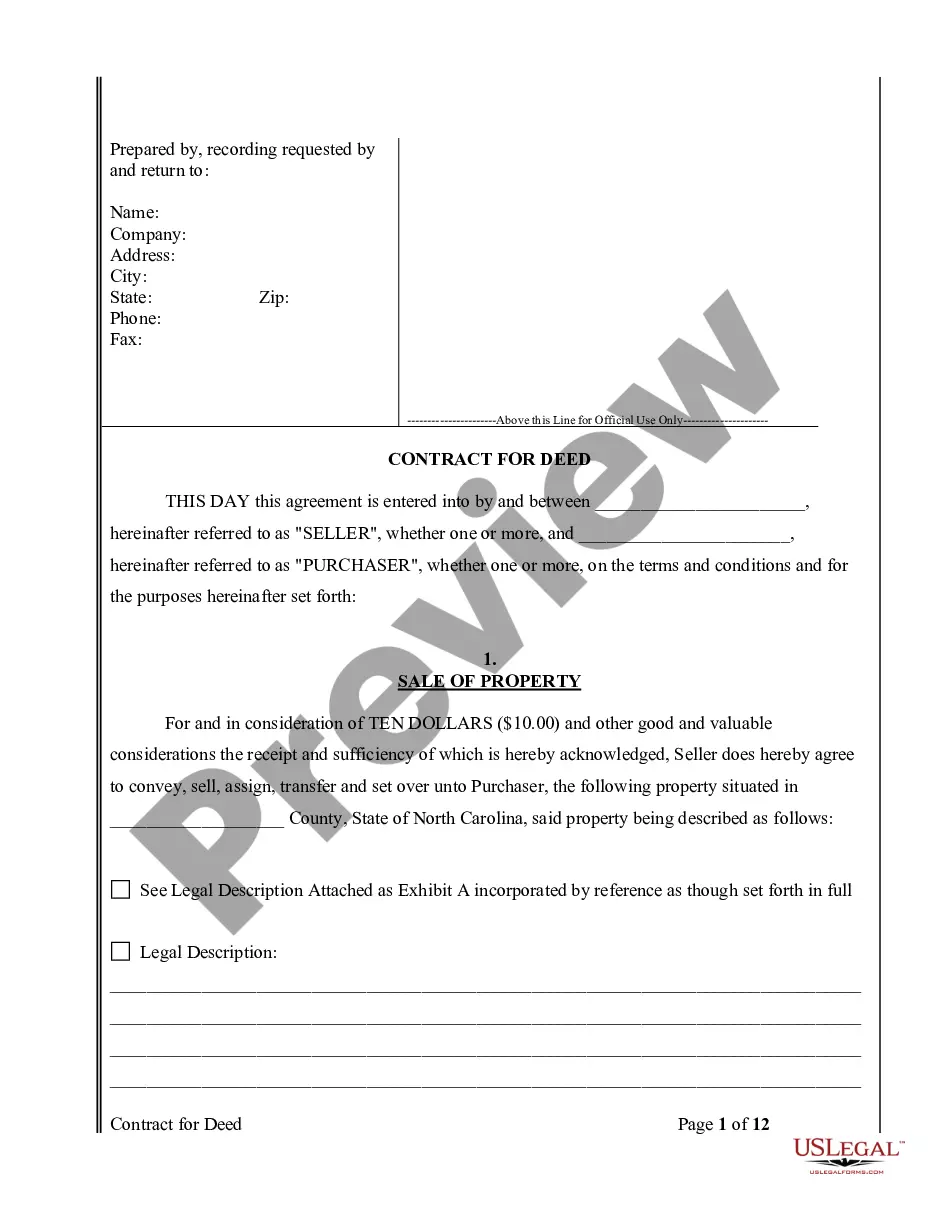

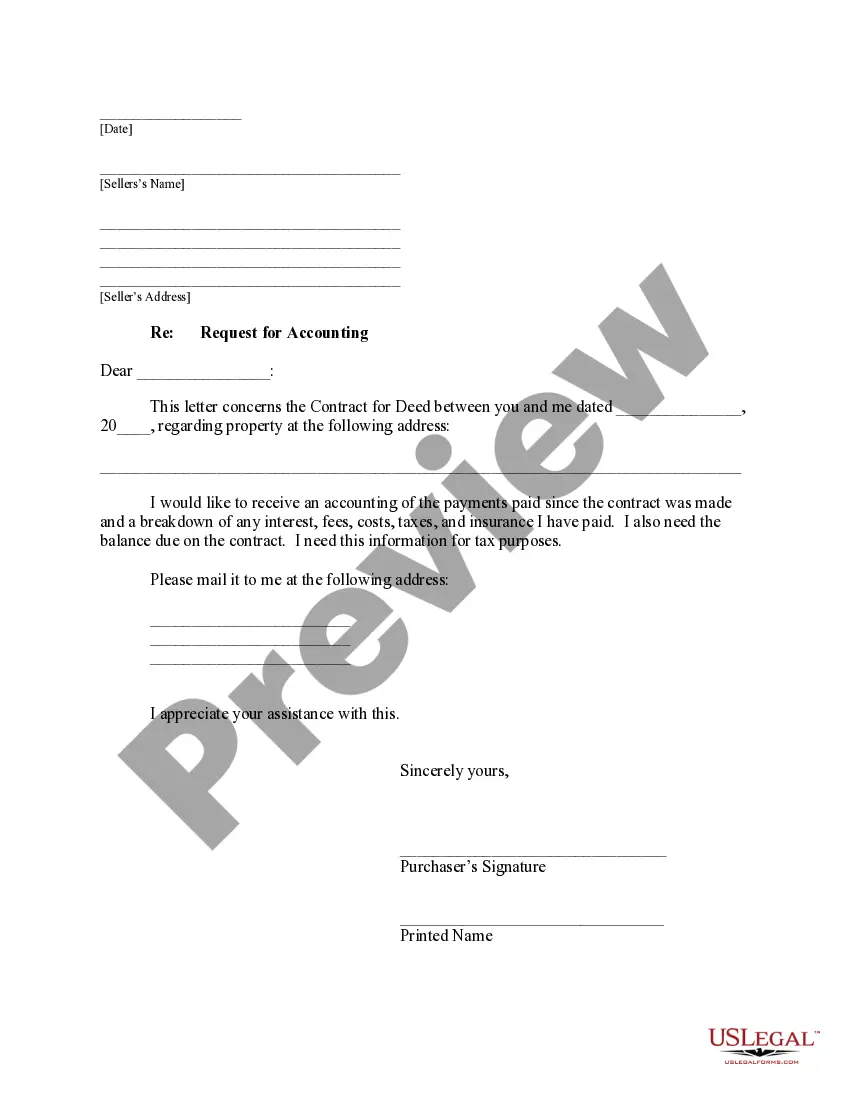

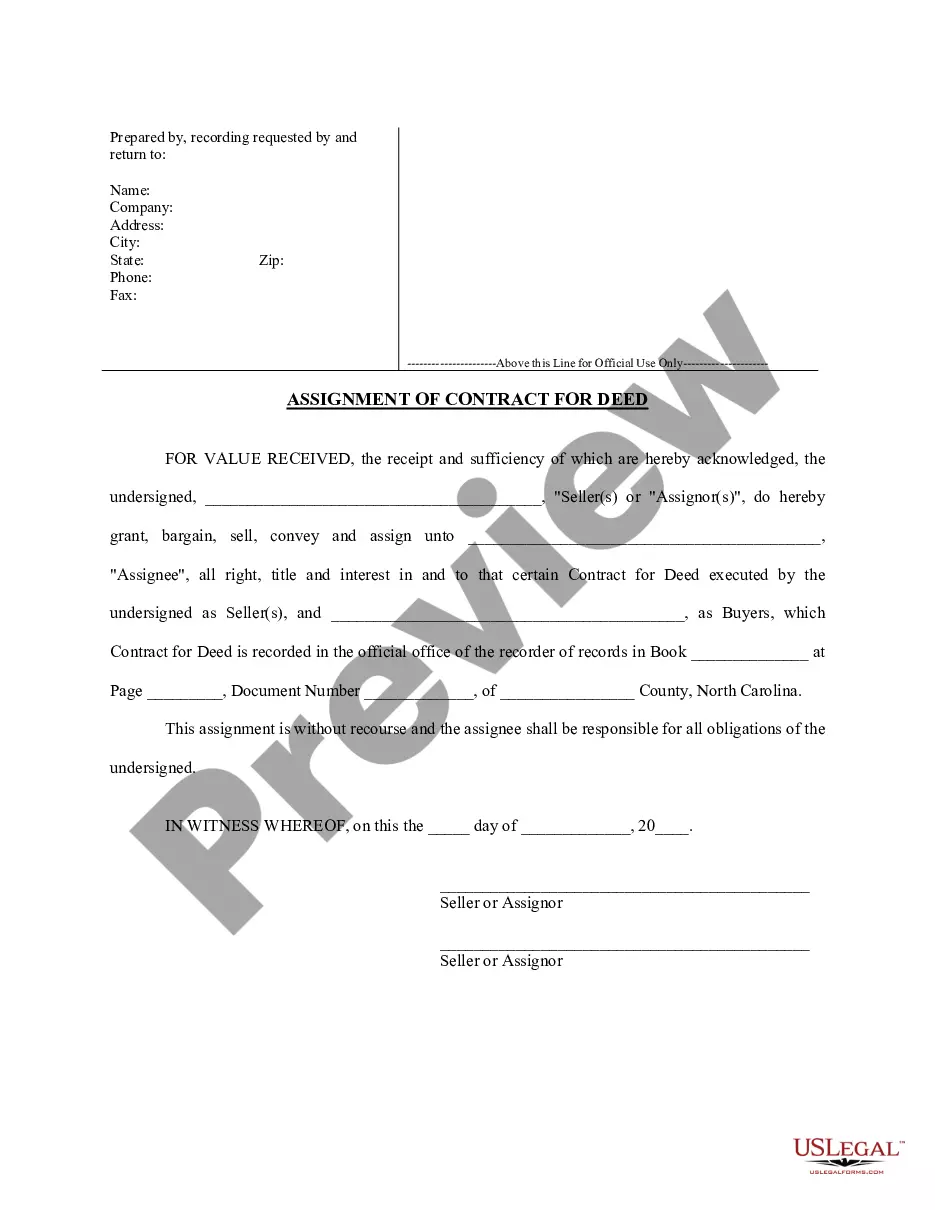

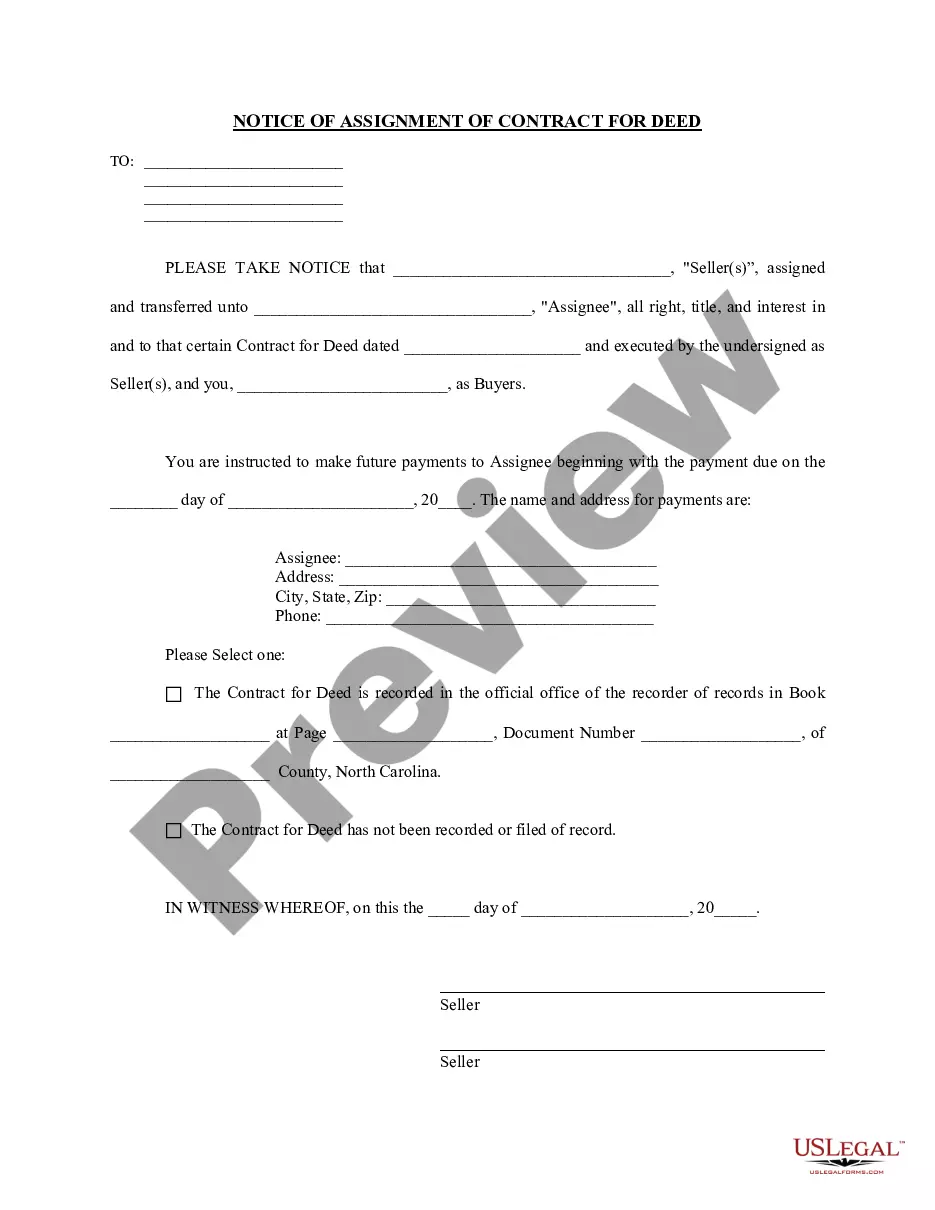

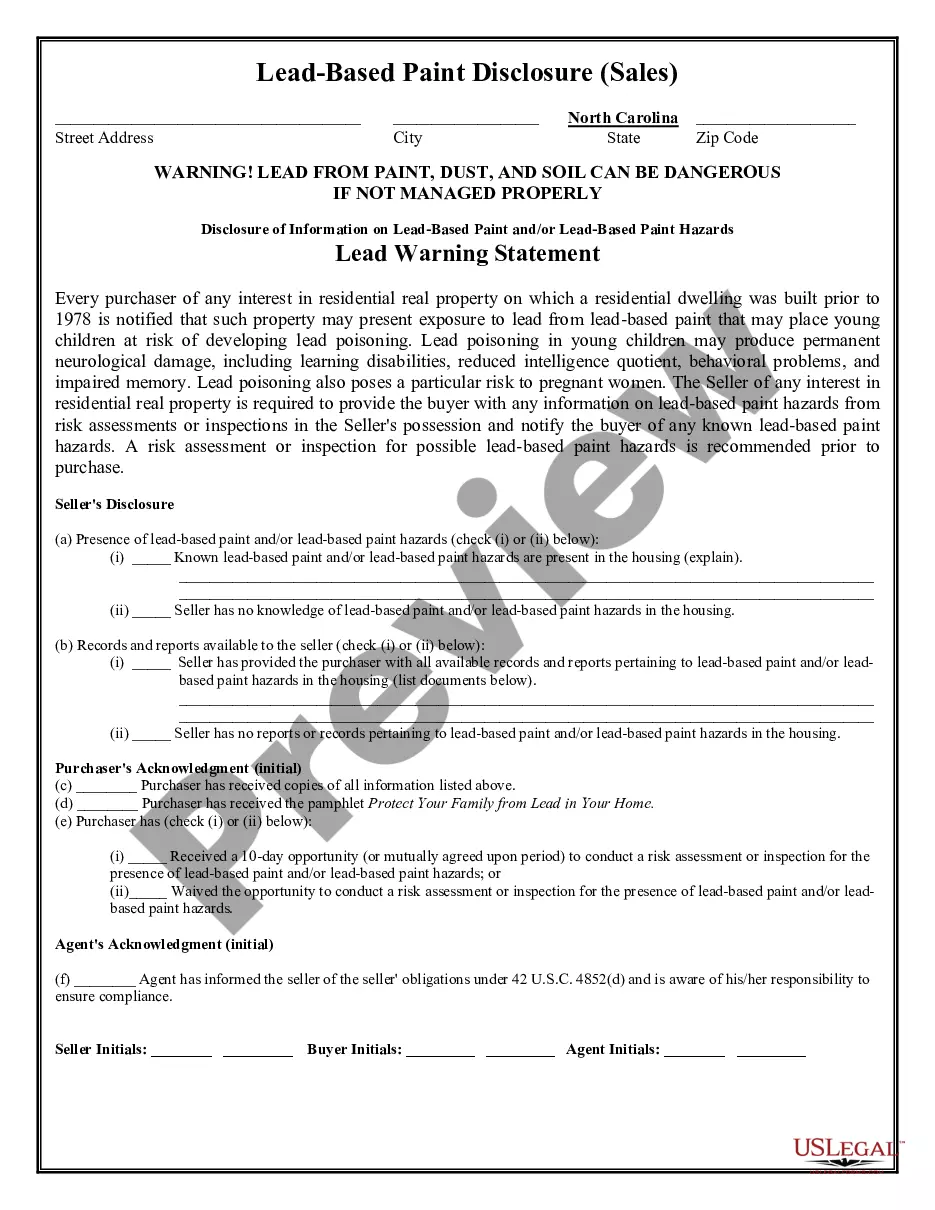

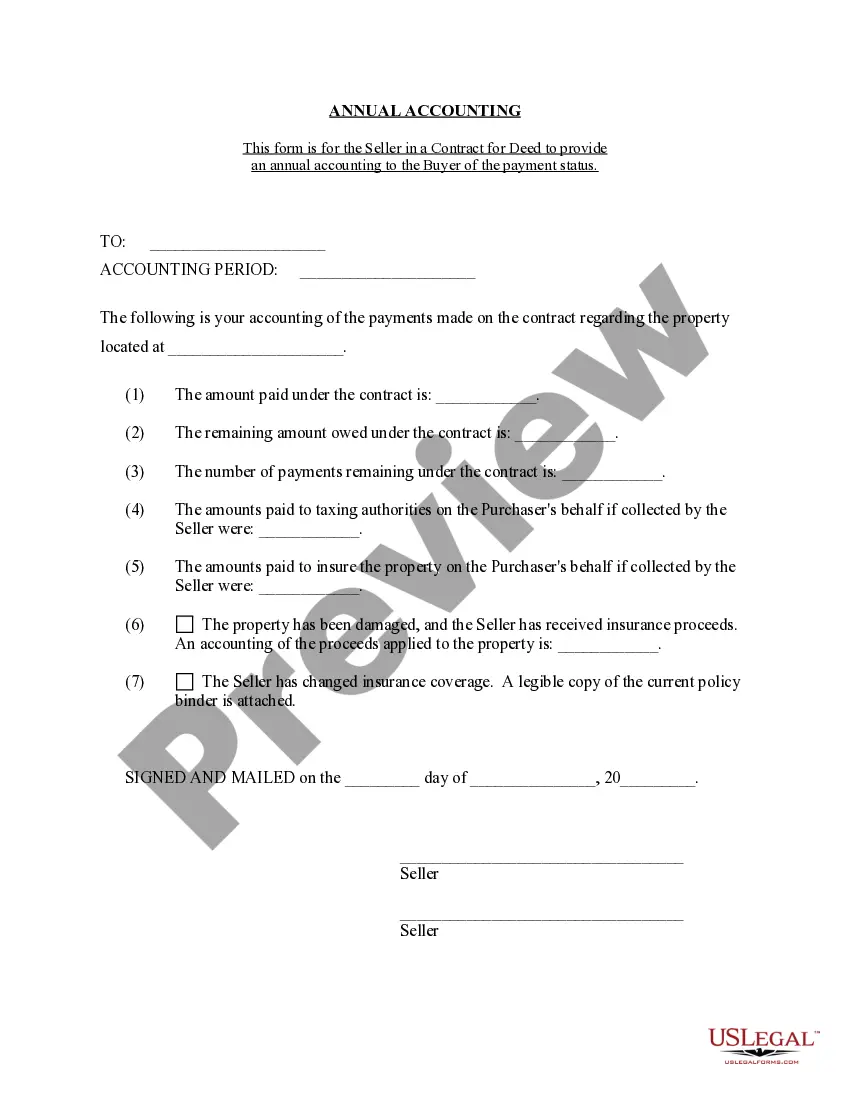

The High Point North Carolina Contract for Deed Seller's Annual Accounting Statement is a crucial document that serves as a comprehensive financial summary for sellers engaged in a contract for deed transaction. This statement provides an in-depth assessment of the financial transactions, income, expenses, and other relevant financial aspects of the contract for deed agreement. The Contract for Deed Seller's Annual Accounting Statement outlines the financial details of the seller's involvement in a contract for deed arrangement, specifically in High Point, North Carolina. It includes a record of all payments received, deductions made, and expenses incurred during the specified accounting period. The statement provides essential information for the buyer and seller to track and verify payments, ensuring transparency and accountability throughout the contract for deed process. It allows both parties to have a clear understanding of the financial standing, ensuring all obligations are met and any necessary adjustments can be made. Keywords: High Point, North Carolina, contract for deed, seller, annual accounting statement, financial summary, transactions, income, expenses, financial aspects, contract for deed agreement, payments, deductions, transparency, accountability, obligations, adjustments. Different types of High Point North Carolina Contract for Deed Seller's Annual Accounting Statements may include: 1. Basic Annual Accounting Statement: This type of statement provides a concise overview of the financial transactions, income, and expenses associated with the contract for deed agreement. 2. Detailed Financial Statement: This type of statement provides an in-depth breakdown of the financial transactions, income sources, expenses, and deductions involved in the contract for deed arrangement. 3. Tax-Related Annual Accounting Statement: This statement focuses on the tax implications and obligations of the seller in the contract for deed agreement, such as reporting income, deductible expenses, and compliance with tax laws in High Point, North Carolina. 4. Profit and Loss Statement: This type of statement analyzes the financial performance of the seller, highlighting the profits and losses incurred during the accounting period. It helps both parties evaluate the financial viability of the contract for deed agreement. 5. Expense Statement: This statement provides a detailed breakdown of the various expenses incurred by the seller during the specified accounting period, including maintenance costs, property taxes, insurance premiums, and any other relevant expenses. Note: The specific types of High Point North Carolina Contract for Deed Seller's Annual Accounting Statements may vary based on the preferences and requirements of the buyer and seller involved in the contract for deed arrangement.

High Point North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out High Point North Carolina Contract For Deed Seller's Annual Accounting Statement?

Do you need a trustworthy and inexpensive legal forms provider to get the High Point North Carolina Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to option.

No matter if you need a simple agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of particular state and county.

To download the form, you need to log in account, locate the required form, and click the Download button next to it. Please remember that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the High Point North Carolina Contract for Deed Seller's Annual Accounting Statement conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your specific scenario.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is done, download the High Point North Carolina Contract for Deed Seller's Annual Accounting Statement in any available file format. You can get back to the website at any time and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online for good.