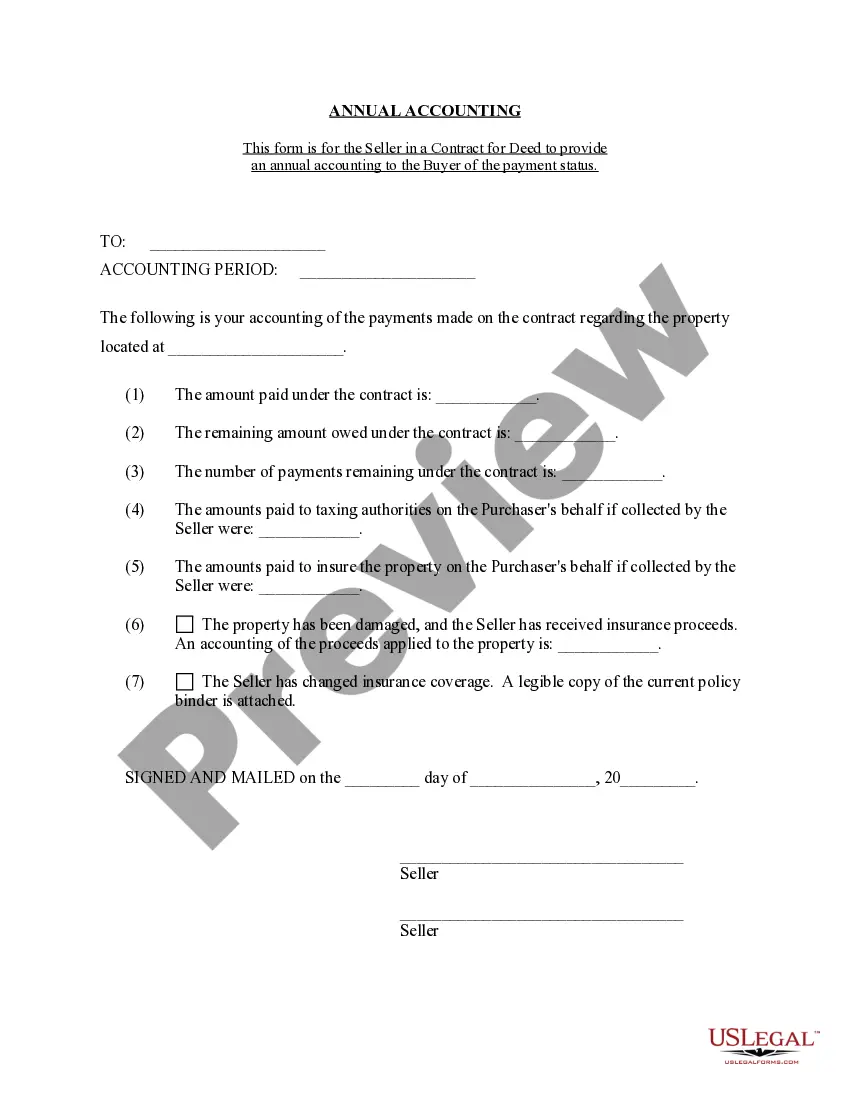

The Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement is a vital document that provides a comprehensive overview of financial transactions and obligations between the seller and the buyer in a contract for deed arrangement in Mecklenburg County, North Carolina. This statement serves as a transparent record of all financial transactions and helps maintain a clear understanding of the financial health of the contract for deed agreement. The seller's annual accounting statement is typically composed of several key components, including: 1. Gross Receipts: This section provides a detailed breakdown of all payments received by the seller throughout the year, including monthly payments made by the buyer, any down payments, and any other additional payments agreed upon in the contract for deed. 2. Deductions: In this section, the statement outlines all the allowable deductions that the seller may deduct from the gross receipts. These deductions commonly include property taxes, insurance premiums, maintenance costs, and any other authorized expenses relevant to the contract for deed property. 3. Net Receipts: The net receipts are calculated by subtracting the total deductions from the gross receipts. This figure represents the actual amount of income received by the seller during the accounting period. 4. Payment Allocation: This section breaks down how the net receipts are allocated among various expenses and obligations. It outlines how much of the funds were allocated towards property taxes, insurance premiums, maintenance costs, and principal payments. 5. Interest Calculation: For certain types of contract for deed arrangements, which may include a provision for interest on the outstanding balance, this section calculates the interest accrued during the accounting period. It provides a clear breakdown of how much interest has been earned and how it impacts the overall financial picture. Different types of Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement may exist based on specific nuances within the contract for deed agreement. For instance, there may be different versions for residential and commercial properties or one's tailored to unique circumstances such as agreements with balloon payments or specific clauses regarding default. In summary, the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement is a crucial document that details the financial aspects of a contract for deed arrangement. It ensures transparency and accountability between the seller and buyer, and can have various versions depending on the specific terms and conditions outlined in the contract for deed agreement.

Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Mecklenburg North Carolina Contract For Deed Seller's Annual Accounting Statement?

Take advantage of the US Legal Forms and obtain immediate access to any form template you need. Our helpful platform with a huge number of templates allows you to find and get almost any document sample you require. It is possible to export, fill, and certify the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement in a few minutes instead of surfing the Net for several hours attempting to find the right template.

Utilizing our library is a superb strategy to increase the safety of your record submissions. Our experienced lawyers on a regular basis check all the documents to make sure that the forms are relevant for a particular state and compliant with new laws and polices.

How do you get the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement? If you already have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. In addition, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Find the form you require. Make sure that it is the template you were seeking: check its name and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Indicate the format to obtain the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement and edit and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy template libraries on the web. Our company is always ready to help you in virtually any legal case, even if it is just downloading the Mecklenburg North Carolina Contract for Deed Seller's Annual Accounting Statement.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!