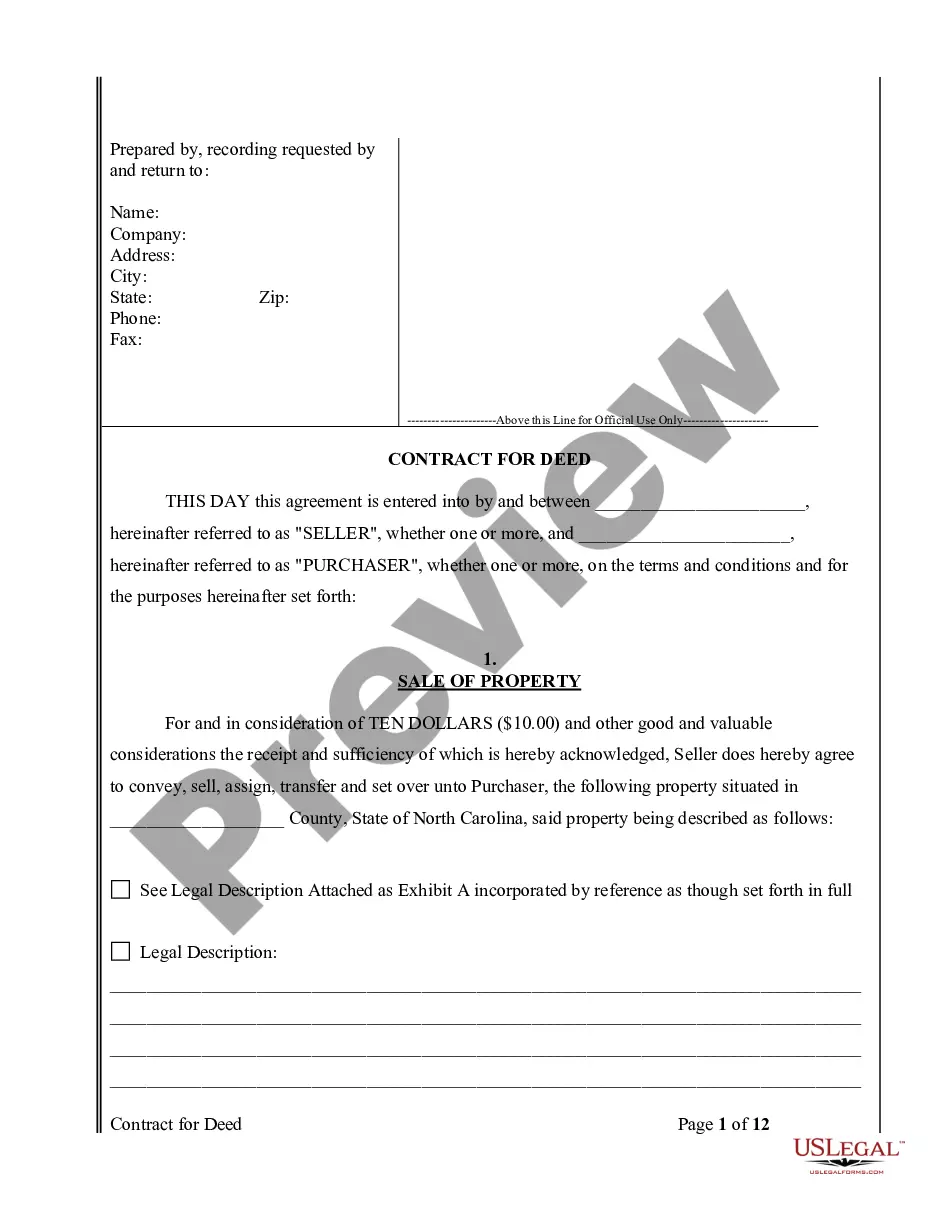

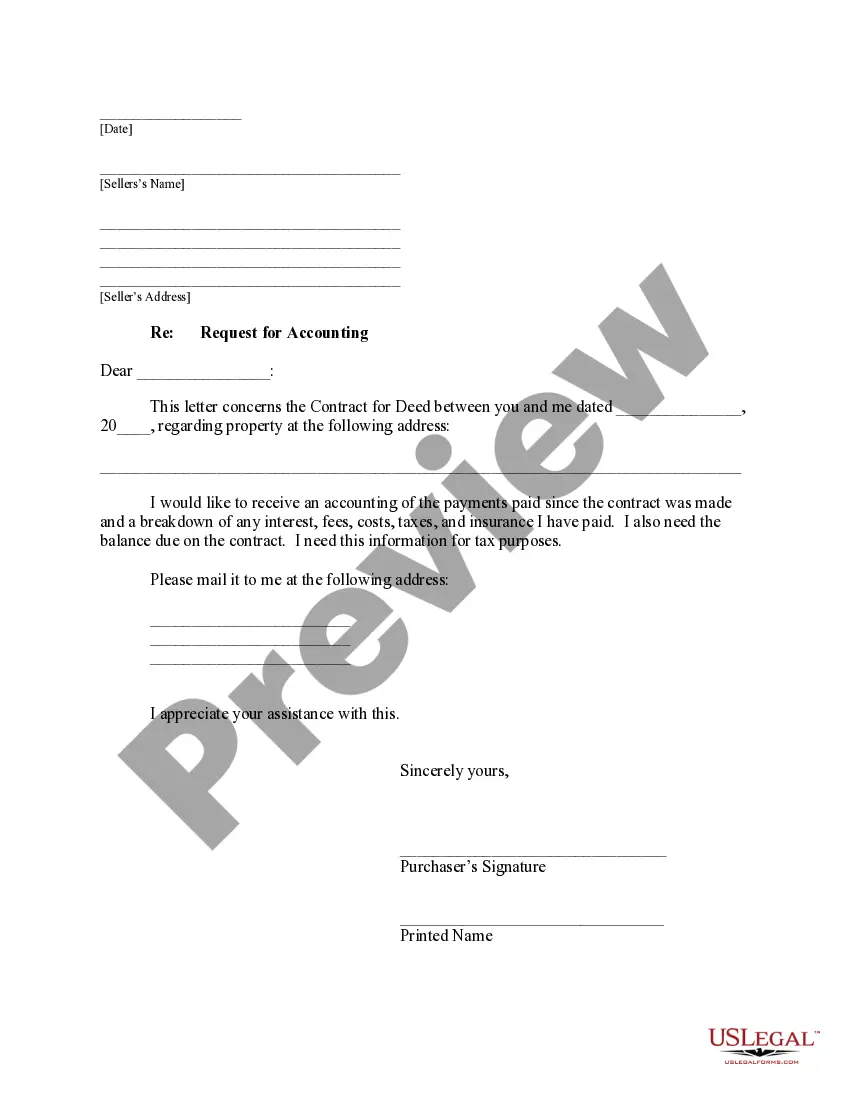

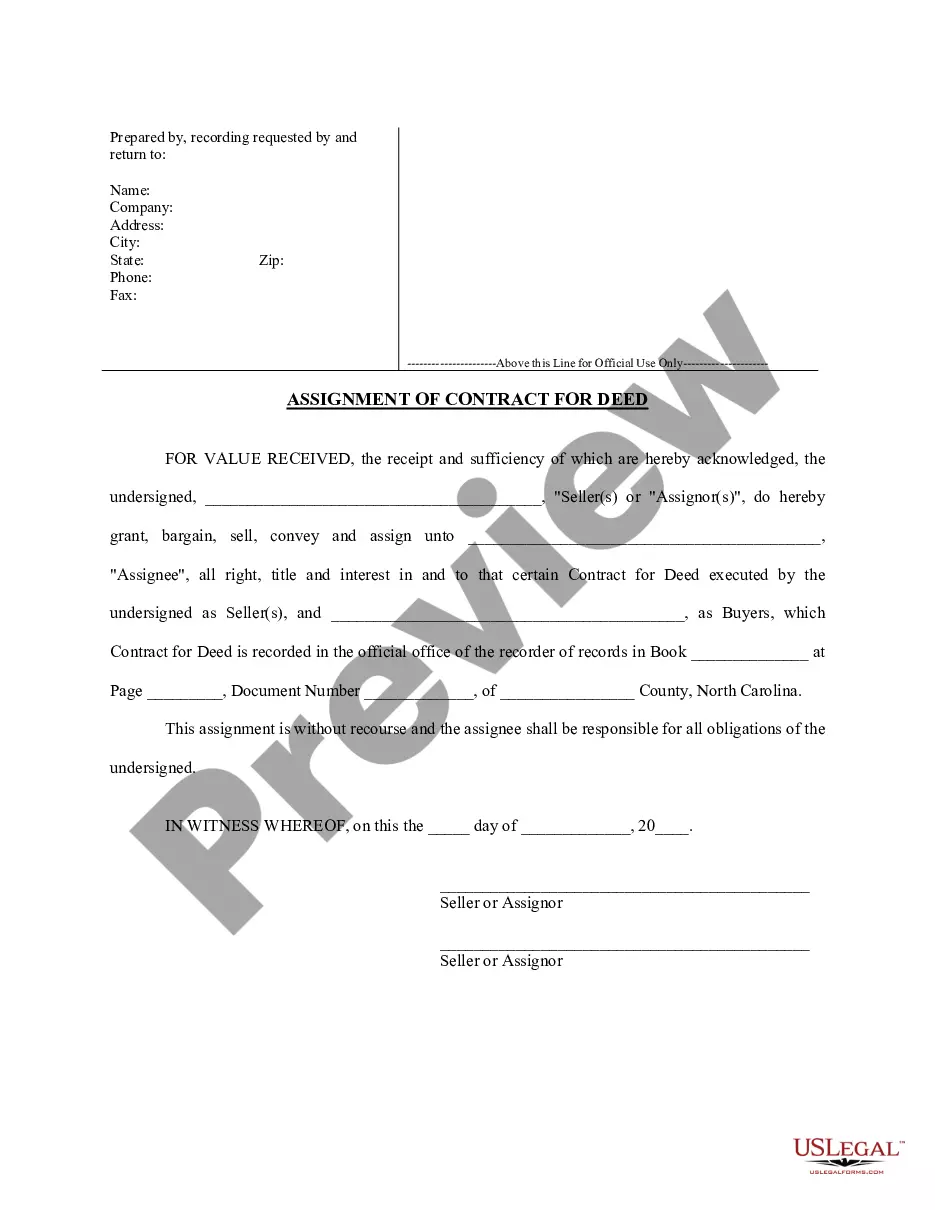

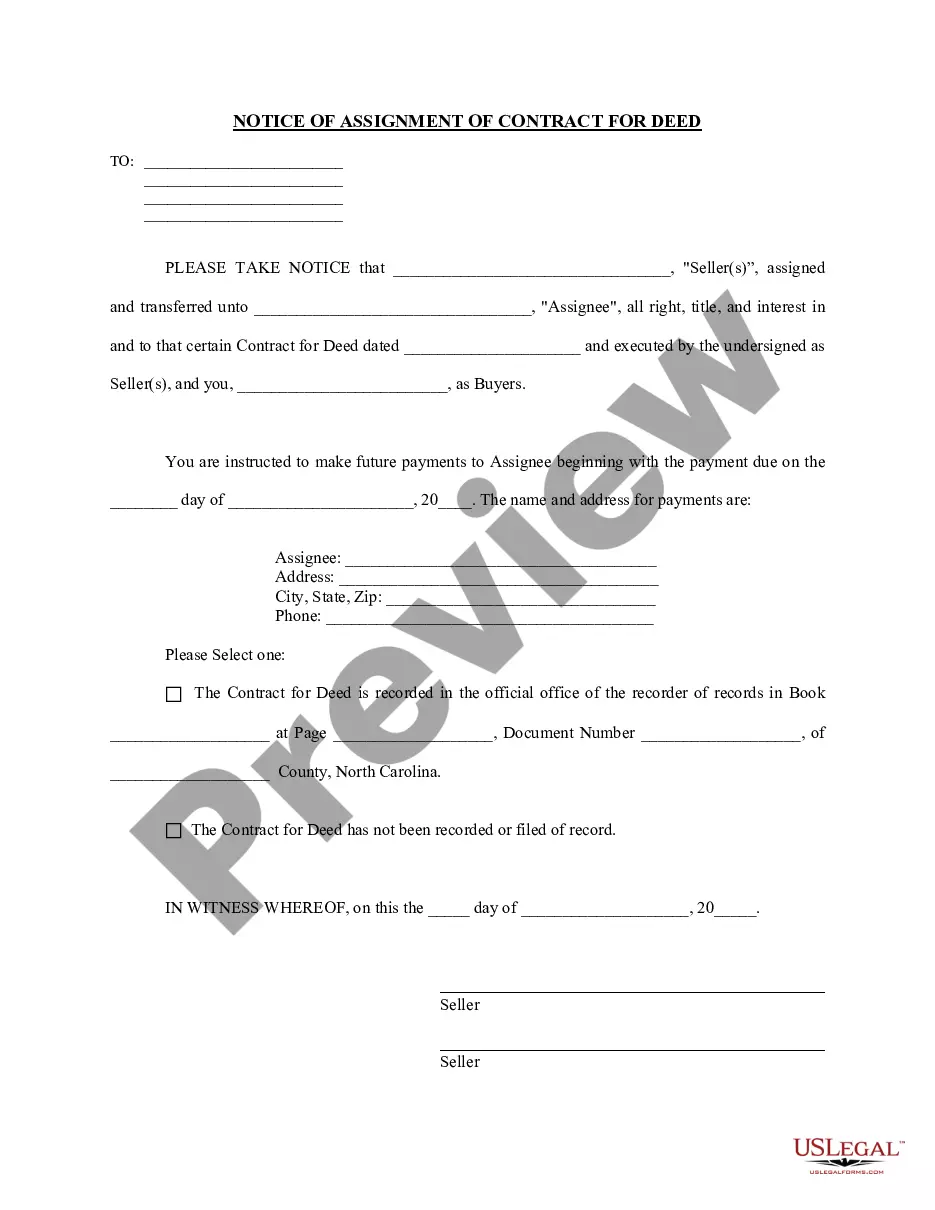

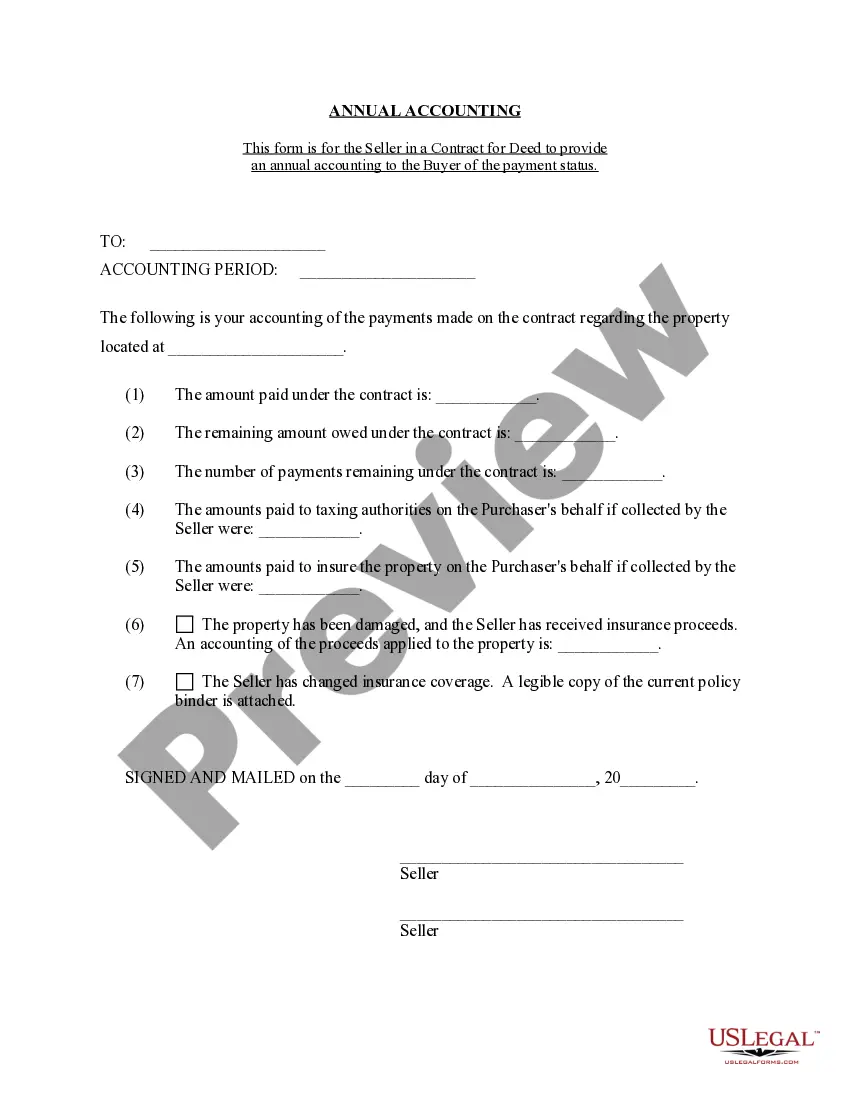

The Wake North Carolina Contract for Deed Seller's Annual Accounting Statement is a legal document designed to provide a comprehensive overview of the financial transactions and obligations related to a contract for deed agreement in Wake County, North Carolina. It serves as an important tool for both the seller and buyer to track and reconcile the financial aspects of the contract. Keywords: Wake North Carolina, contract for deed, seller's annual accounting statement, financial transactions, obligations, agreement, seller, buyer, track, reconcile. There may be different types of Wake North Carolina Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions stated in the contract. Some common variations include: 1. Simple Annual Accounting Statement: This type of statement provides a basic overview of the financial dealings between the seller and buyer, including the total payments made, the remaining balance, and any outstanding charges or credits. 2. Detailed Financial Statement: This statement is more comprehensive and includes a breakdown of the payments made for principal, interest, escrow, taxes, insurance, and any additional fees specified in the contract. 3. Payment Schedule Analysis: This type of statement focuses on analyzing the payment schedule outlined in the contract, highlighting the amortization breakdown, interest paid over time, and the remaining balance after each payment. 4. Escrow Account Statement: If an escrow account is established as part of the contract, the seller's annual accounting statement will include a detailed report of the funds deposited, disbursed, and any changes in the escrow balance. 5. Tax and Insurance Accounting Statement: In contracts where the seller is responsible for paying property taxes and insurance premiums, this statement provides an overview of the paid amounts, any adjustments, and the remaining balance. 6. Credit and Charge Statement: This statement is provided when there are outstanding charges or credits to be accounted for, such as repairs or improvements made by the seller or buyer, which may affect the final balance owed. By utilizing Wake North Carolina Contract for Deed Seller's Annual Accounting Statements, both parties can ensure transparency, accuracy, and compliance with the terms of the contract. It serves as a tool for maintaining financial records and resolving any discrepancies that may arise between the seller and buyer.

Wake North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Wake North Carolina Contract For Deed Seller's Annual Accounting Statement?

Benefit from the US Legal Forms and get instant access to any form template you want. Our useful website with thousands of templates simplifies the way to find and get almost any document sample you will need. You can download, complete, and certify the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement in just a couple of minutes instead of surfing the Net for many hours searching for a proper template.

Utilizing our collection is an excellent strategy to increase the safety of your record filing. Our experienced legal professionals on a regular basis review all the records to ensure that the templates are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Open the page with the form you require. Make sure that it is the template you were looking for: examine its headline and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the document. Choose the format to get the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement and change and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable document libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Wake North Carolina Contract for Deed Seller's Annual Accounting Statement.

Feel free to take full advantage of our service and make your document experience as convenient as possible!