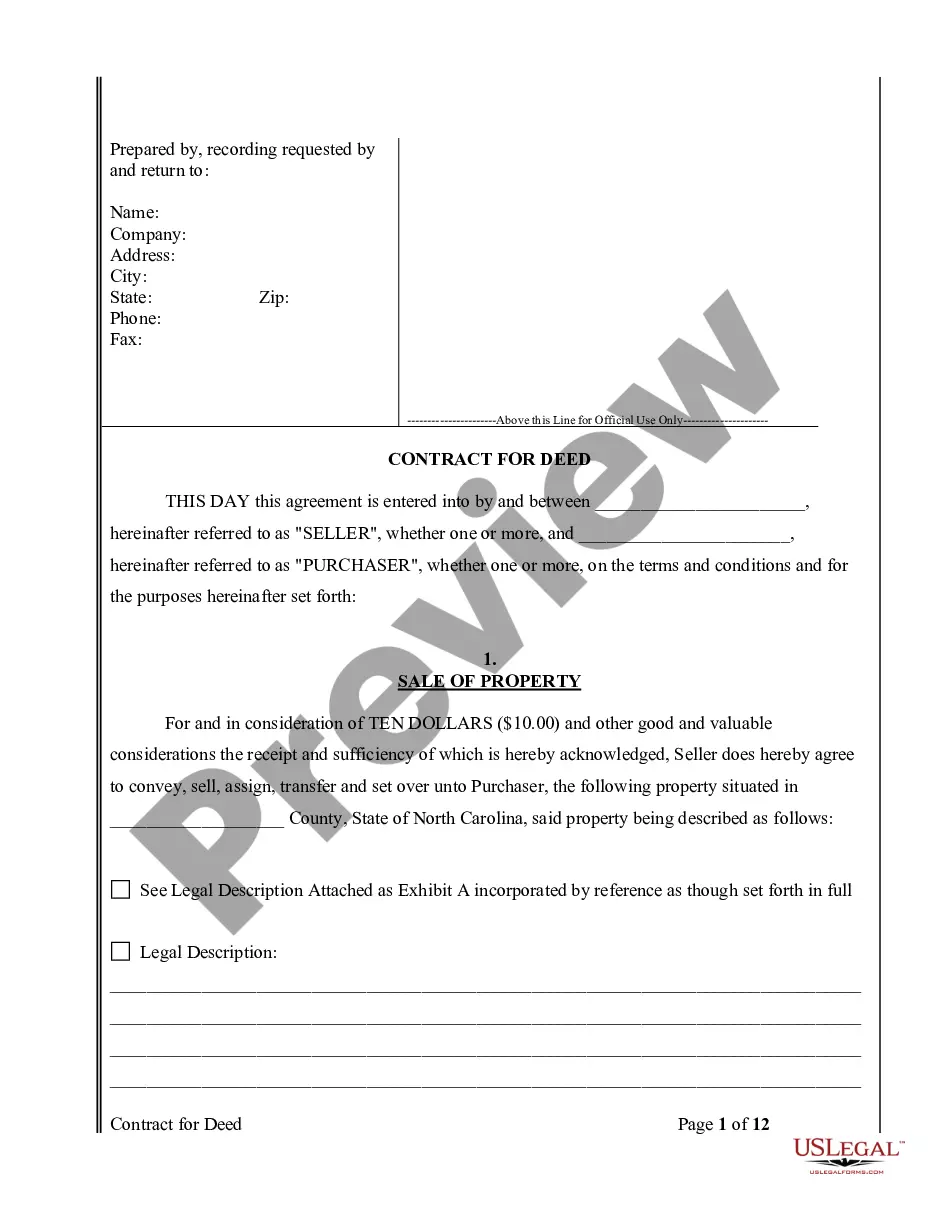

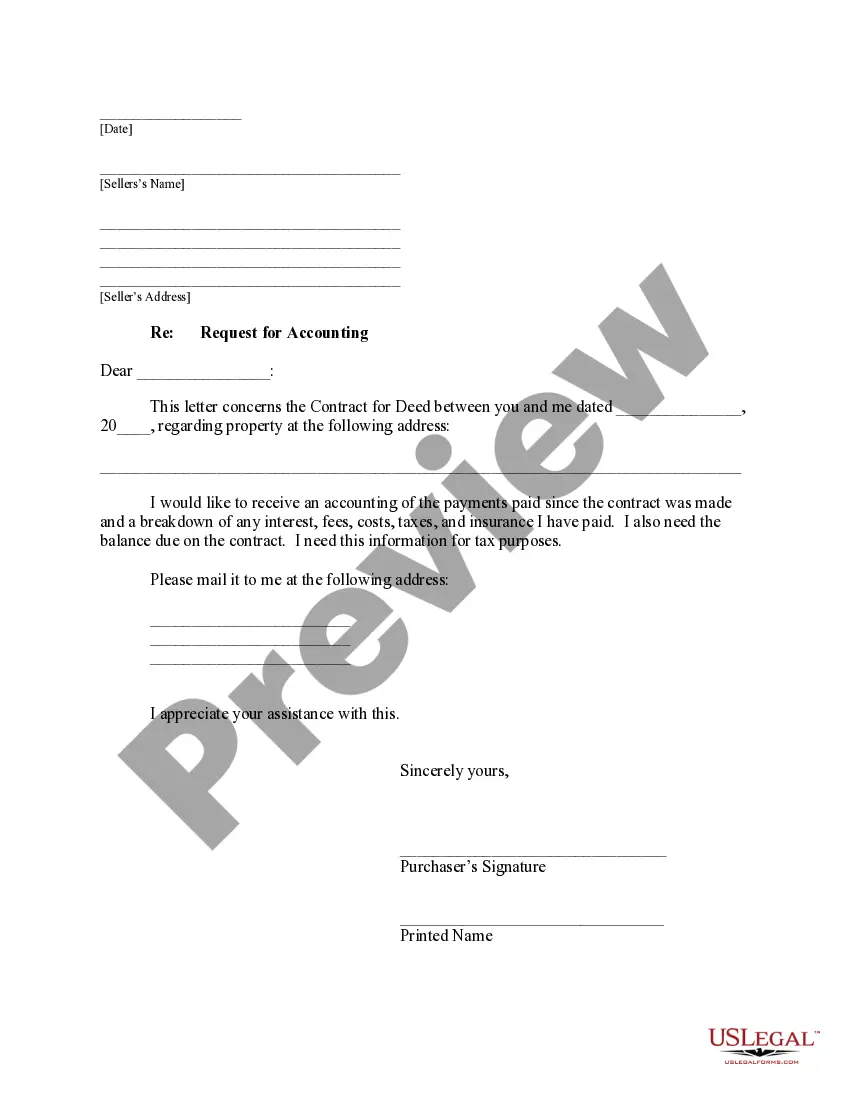

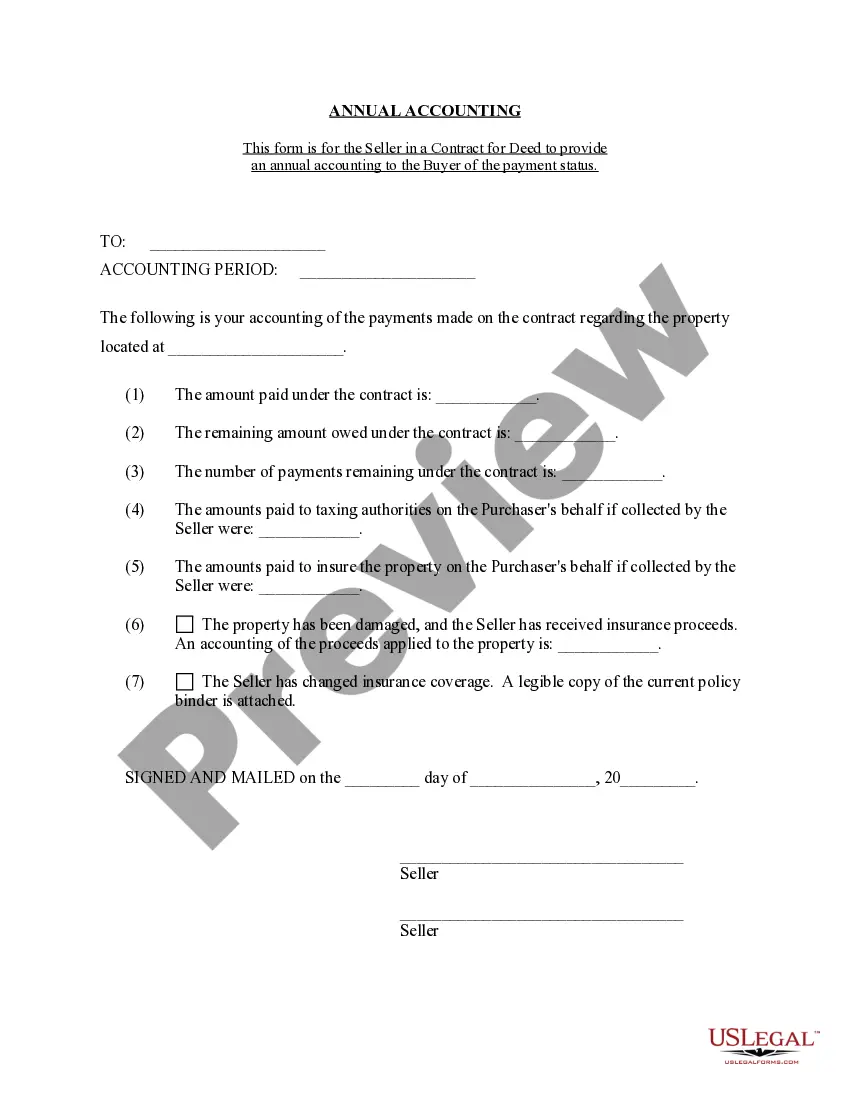

Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Winston–Salem North Carolina Contract For Deed Seller's Annual Accounting Statement?

We consistently aim to reduce or avert legal damage when managing intricate legal or financial matters.

In order to achieve this, we seek attorney options that are typically quite costly.

Nonetheless, not all legal challenges are as intricately complicated. Many of them can be handled independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you misplace the form, you can always re-download it in the My documents tab. The process is equally simple if you are new to the website! You can set up your account in a matter of minutes. Ensure that the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement complies with the laws and regulations of your state and locality. Furthermore, it’s crucial to review the form’s outline (if available), and if you encounter any variations from what you were initially seeking, look for an alternative template. Once you’ve confirmed that the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement is appropriate for your situation, you can select the subscription option and proceed to payment. Then you can download the form in any format provided. For over 24 years in the industry, we’ve assisted millions of individuals by offering ready-to-customize and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our platform empowers you to manage your affairs autonomously without resorting to a lawyer.

- We provide access to legal document templates that aren’t universally available.

- Our templates are designed for specific states and regions, which significantly simplifies the searching process.

- Benefit from US Legal Forms whenever you need to acquire and download the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement or any other document quickly and securely.

Form popularity

FAQ

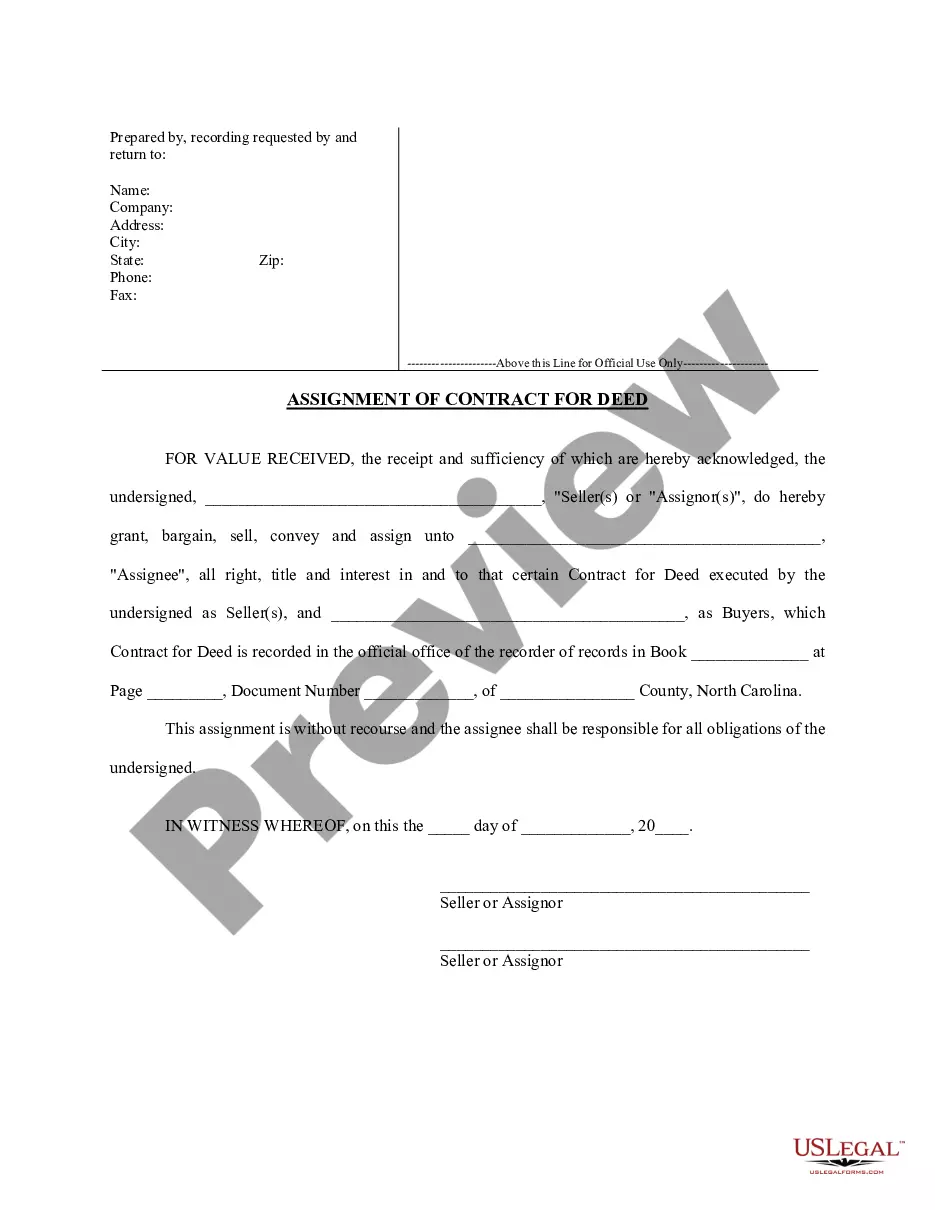

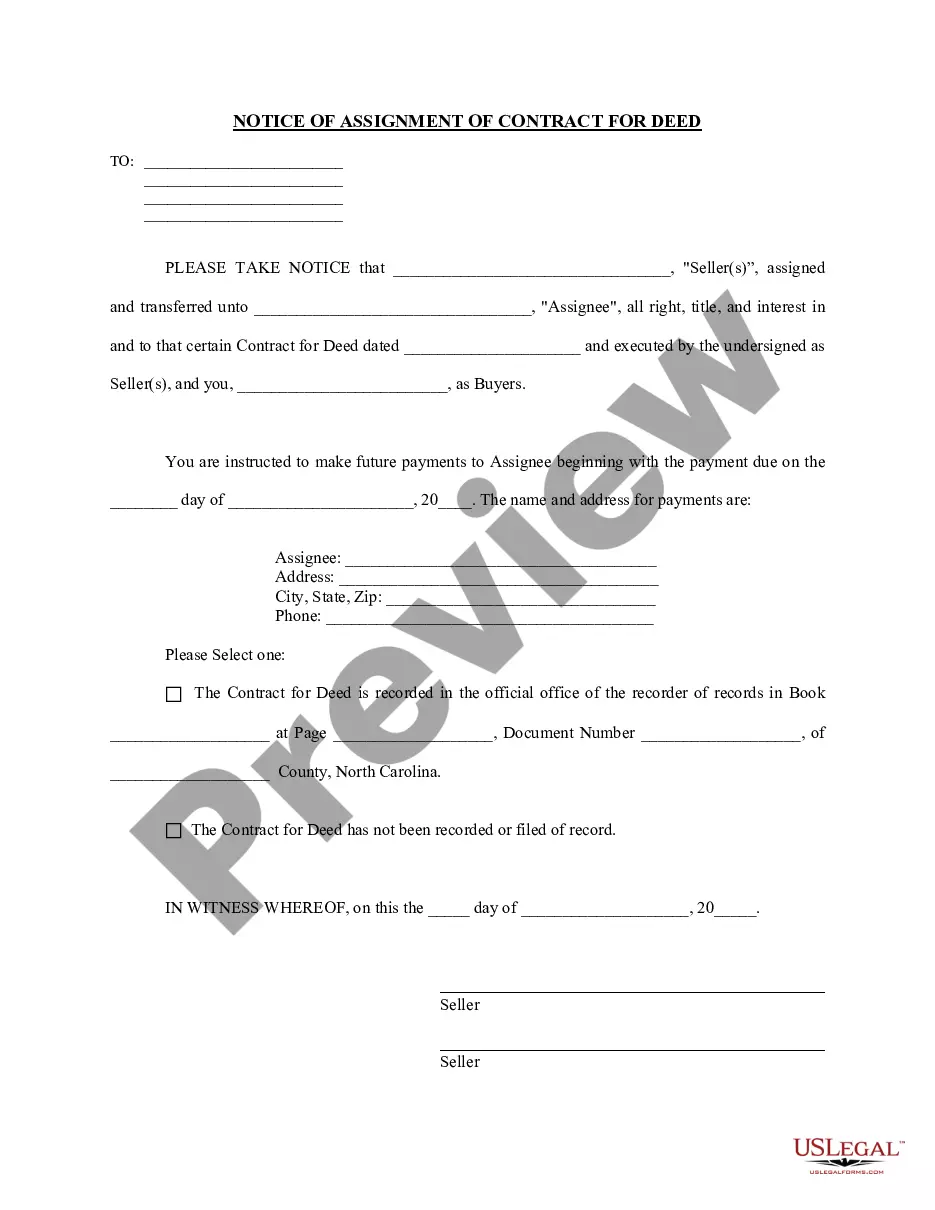

The rules governing land contracts can vary by state but generally include clear terms regarding payments, interest rates, and the responsibilities of both the buyer and seller. In Winston–Salem, it's essential to document each aspect of the transaction for clarity. Additionally, providing a Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement is fundamental for accountability. Always review local laws to ensure compliance and protection.

Several factors can void a land contract, including violations of the agreements made by either party. If the buyer fails to make payments on time, or if the property is misrepresented, the seller can take legal action. Additionally, a failure to follow state regulations regarding the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement may render the contract void. It's important to adhere to all terms to maintain its validity.

A land contract, while offering flexibility, can have significant downsides. Buyers may face a lack of legal protections compared to traditional mortgages. Furthermore, the seller retains the title until full payment, meaning you risk losing your investment if you default. For those dealing with a Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement, understanding these risks is crucial.

You can file a warranty deed yourself in North Carolina by visiting the appropriate county register of deeds office. Ensure that you have completed the deed correctly before filing. While this process is straightforward, using uslegalforms can streamline your preparation and filing, especially when dealing with complex matters like the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

Filling out an NC general warranty deed requires you to gather necessary information such as the grantor and grantee's names, the property legal description, and any terms of the transfer. Each section must be filled out completely for the deed to be recognized legally. After signing the deed in front of a notary, you can effectively utilize it in relation to the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

Filling out a North Carolina General warranty deed involves several key steps. First, include the grantor's and grantee's names, making sure they are spelled correctly. Next, provide a detailed legal description of the property, and ensure that the deed is signed in front of a registered notary. After completing this, you will have a valid document that can be used for the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

A deed may be deemed invalid in North Carolina if it does not meet the legal requirements set forth by state law. Common reasons for invalidation include failure to properly execute the deed, missing essential information, or if the deed violates public policy. To avoid invalid deeds, consider utilizing resources like USLegalForms for your Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

A deed can be considered void in North Carolina if it lacks essential elements, such as signatures or proper notarization. Additionally, deeds executed under duress, fraud, or by individuals lacking the capacity to contract can also be voided. Understanding these aspects is crucial, especially in the context of a Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

A contract may be signed as a deed to provide greater assurance regarding the obligations of the involved parties. By executing a contract as a deed, the parties agree to be bound by its terms without the need for consideration, enhancing its enforceability. This approach is particularly useful in situations involving a Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.

In North Carolina, a home seller may back out of a contract under certain circumstances, such as a breach of contract by the buyer or failure to meet contingencies. However, this action can lead to legal repercussions, including potential lawsuits for specific performance. It is wise to consult legal resources, like USLegalForms, when managing a Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement.