- US Legal Forms

- Localized Forms

- North Carolina

- Winston–Salem

-

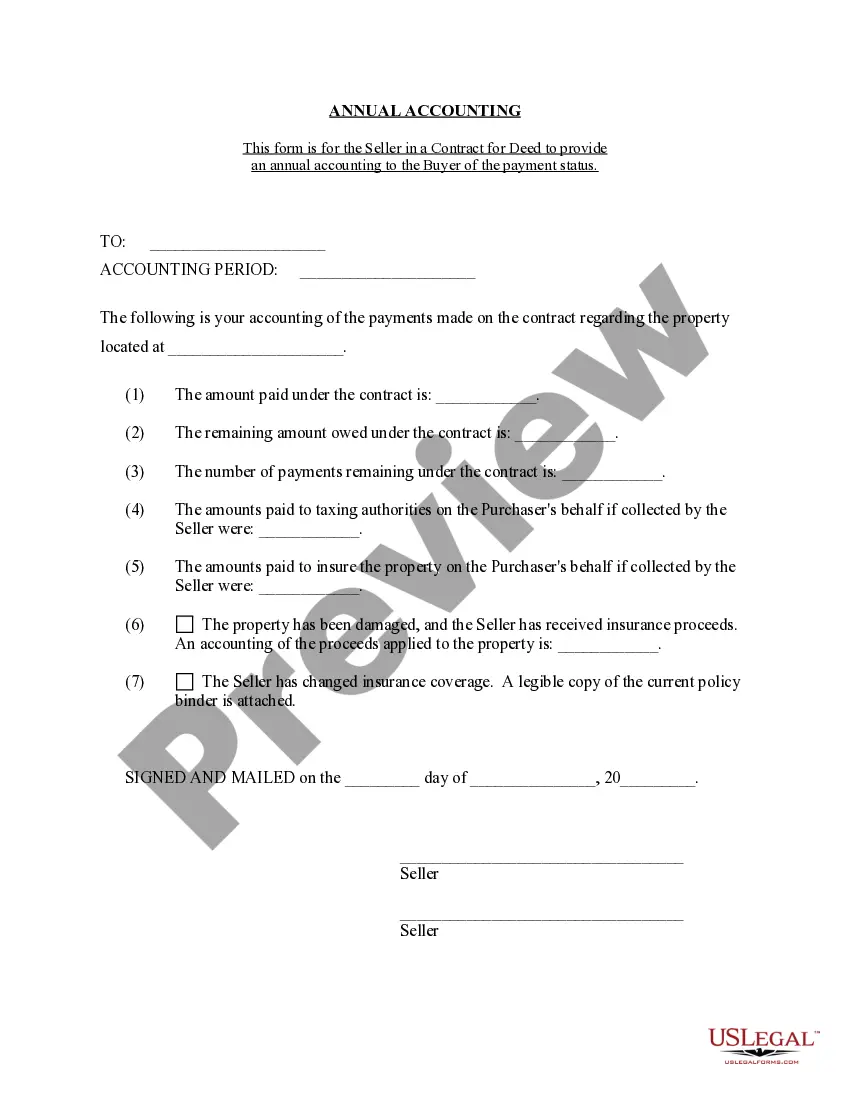

North Carolina Contract for Deed Seller's Annual Accounting Statement

Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement

Description

Related Forms

Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Buyer's Request for Accounting from Seller under Contract for Deed

Assignment of Contract for Deed by Seller

Notice of Assignment of Contract for Deed

Residential Real Estate Sales Disclosure Statement

Lead Based Paint Disclosure for Sales Transaction

View Montgomery

View Montgomery

View Montgomery

View Montgomery

View Montgomery

Related legal definitions

Viewed forms

Agreement Adding Silent Partner to Existing Partnership

Exclusive Agency or Agent Agreement - Real Estate - Realtor Contract

License Agreement -- Sublicense of Trademark and Domain Names

Sample Corporate Records for a California Professional Corporation

Residential Room Lease Agreement

How to fill out Winston–Salem North Carolina Contract For Deed Seller's Annual Accounting Statement?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

Form Rating

Form popularity

FAQ

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

A contract for deed is a unique financing tool available for a buyer, typically used when purchasing property. The buyer makes monthly payments on the property and receives the title only after the full purchase price is paid. The seller retains the title of the property until then.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

A contract for deed is a unique financing tool available for a buyer, typically used when purchasing property. The buyer makes monthly payments on the property and receives the title only after the full purchase price is paid. The seller retains the title of the property until then.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

A contract for deed is a unique financing tool available for a buyer, typically used when purchasing property. The buyer makes monthly payments on the property and receives the title only after the full purchase price is paid. The seller retains the title of the property until then.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

An installment land contract (also known as a land contract, land sales contract, or contract for deed) is a written agreement whereby real property is sold on the installment payment method with the seller retaining legal title to the property until all of the purchase price is paid or until some other agreed point in

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

A contract for deed is a unique financing tool available for a buyer, typically used when purchasing property. The buyer makes monthly payments on the property and receives the title only after the full purchase price is paid. The seller retains the title of the property until then.

NCGS Chapter 47H: Contracts for Deed Installment land sales contracts or contracts for deed are now governed by State law as of October 1, 2010 if the subject property will be used as the principal dwelling of the purchaser.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

Contract for deed is a contract for the sale of land which provides that the buyer will acquire possession of the land immediately and pay the purchase price in installments over a period of time, but the seller will retain legal title until all payments are made.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Winston–Salem North Carolina Contract for Deed Seller's Annual Accounting Statement Related Searches

-

contract for deed between family members

-

free contract for deed pdf

-

what happens if a seller fails to record the contract for deed

-

contract for deed income tax implications

-

contract for deed who pays property tax

-

illinois installment sales contract act

-

termination of contract for deed

-

minnesota contract for deed statute

-

secretary of state nc

-

nc sos business search

Interesting Questions

The Contract for Deed Seller's Annual Accounting Statement83884 is a financial document that provides a detailed summary of the income, expenses, and profit/loss of the seller who entered into a contract for deed agreement in Winston-Salem.

Any seller who has engaged in a contract for deed arrangement in Winston-Salem should prepare the annual accounting statement.

The Annual Accounting Statement helps sellers track their financial performance, assess the profitability of their contracts for deed, and fulfill legal obligations related to providing financial transparency to the involved parties.

The statement should be prepared annually, within a reasonable time after the end of each fiscal year.

The statement should include a comprehensive breakdown of all income received, expenses incurred, interest collected, principal payments received, and any other relevant financial transactions related to the contract for deed.

The statement should be submitted to the buyer(s) involved in the contract for deed arrangement, as well as any other parties mentioned in the contract who have a legitimate interest in financial updates.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

North Carolina

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming