Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed

Description

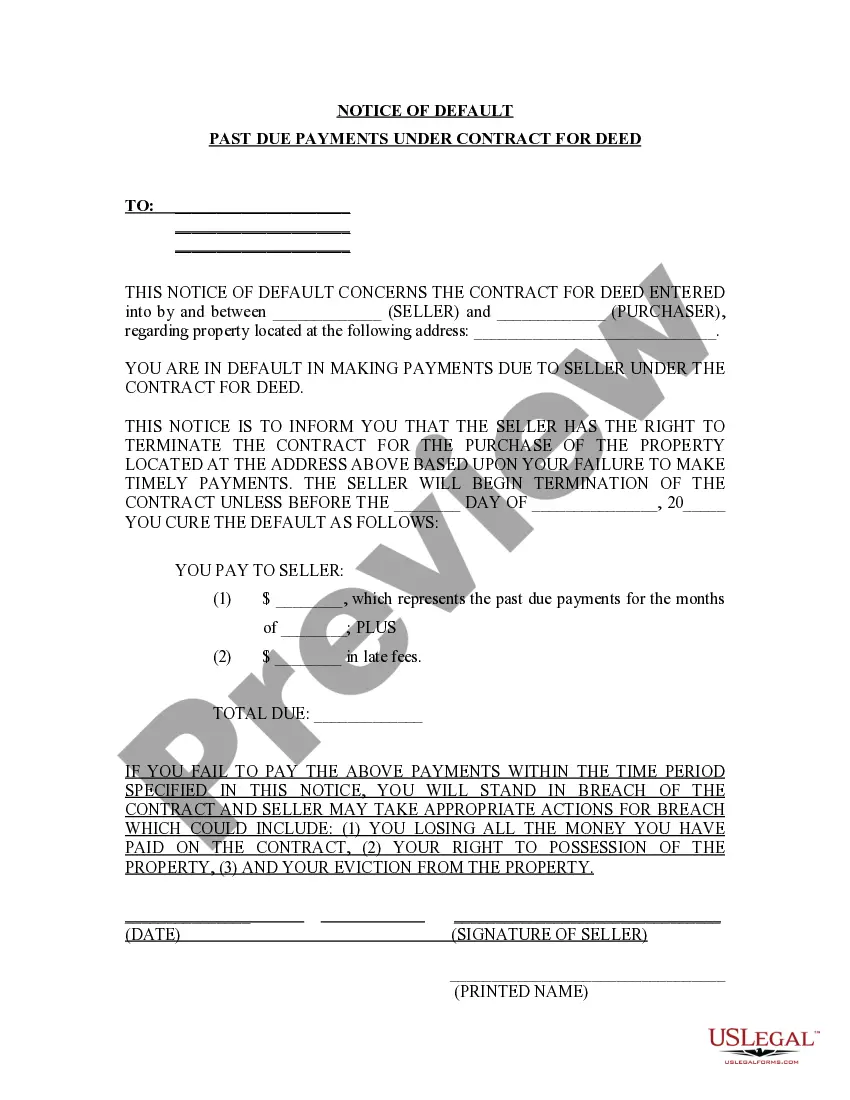

How to fill out North Carolina Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We consistently seek to minimize or evade legal repercussions when navigating intricate legal or financial situations.

To achieve this, we seek legal assistance that is often prohibitively costly.

However, not every legal challenge is as merely convoluted.

Many can be handled by ourselves.

Utilize US Legal Forms whenever you require to obtain and download the Fayetteville North Carolina Notice of Default for Past Due Payments in relation to Contract for Deed or any other document swiftly and securely.

- US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our repository allows you to manage your issues independently without the necessity of legal representation.

- We grant access to legal document templates that aren't universally accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

A request for notice of default is a formal appeal to be updated about any default notifications on a mortgage or deed. If you are dealing with Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, this request ensures you stay informed about your contract status. This knowledge allows you to take timely action to address any issues before they escalate.

Filing a notice of default involves submitting specific documentation to your lender or court system to formally declare your default status. In cases related to Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, you should ensure that you include all relevant payment details and accurately follow local regulations. Consider seeking assistance through legal platforms like uslegalforms to complete this process efficiently.

A default letter serves as a written warning from a lender indicating that you have not fulfilled your payment obligations. In the scope of Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, this letter typically outlines the missed payments and possible next steps. Addressing the concerns in this letter quickly can often prevent more severe consequences.

A notice of intention to default is a written document indicating an impending formal notice of default. In Fayetteville, North Carolina, this notice gives a final warning about overdue payments before legal action commences under the Notice of Default for Past Due Payments in connection with Contract for Deed. It is vital to respond proactively to avoid escalation.

A default judgment in North Carolina occurs when a lender obtains a court ruling after you fail to respond to a lawsuit regarding your property. For those dealing with Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, this judgment can result in the loss of your property without your defense being heard. It is essential to address all notices to avoid reaching this outcome.

A land contract in North Carolina is a legal agreement in which the buyer purchases property directly from the seller, bypassing traditional mortgage processes. Under this arrangement, the seller retains the title until the buyer fulfills payment obligations. If you find yourself dealing with a Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, understanding the intricacies of land contracts can be vital. Uslegalforms provides customizable templates to help you create or review these agreements.

Yes, real estate contracts in North Carolina are typically assignable unless stated otherwise within the contract. This means that one party can transfer their rights and obligations to another party. If you are navigating through a Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, knowing about assignability can be beneficial. Platforms like uslegalforms can offer templates and resources to help you manage contracts effectively.

In North Carolina, for a contract to be legal, it must include several key elements: mutual consent, lawful subject matter, and an exchange of value. Additionally, both parties must have the legal capacity to enter into the agreement. When dealing with matters such as the Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, these elements are essential to your contract's validity. Use uslegalforms to ensure your contracts meet all legal requirements.

Yes, land contracts are legal in North Carolina. However, it is important to comply with state regulations to ensure enforceability. If you are facing Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, understanding the legal landscape is crucial. Consulting a legal expert or a resource like uslegalforms can help clarify any uncertainties.

The foreclosure timeline in North Carolina can vary, but generally, it takes about 90 to 120 days from the notice of default to the foreclosure sale. This timeframe allows for notice to be given to the homeowner and the opportunity to remediate the default. Understanding this timeline is crucial, especially if you are facing a Fayetteville North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed.