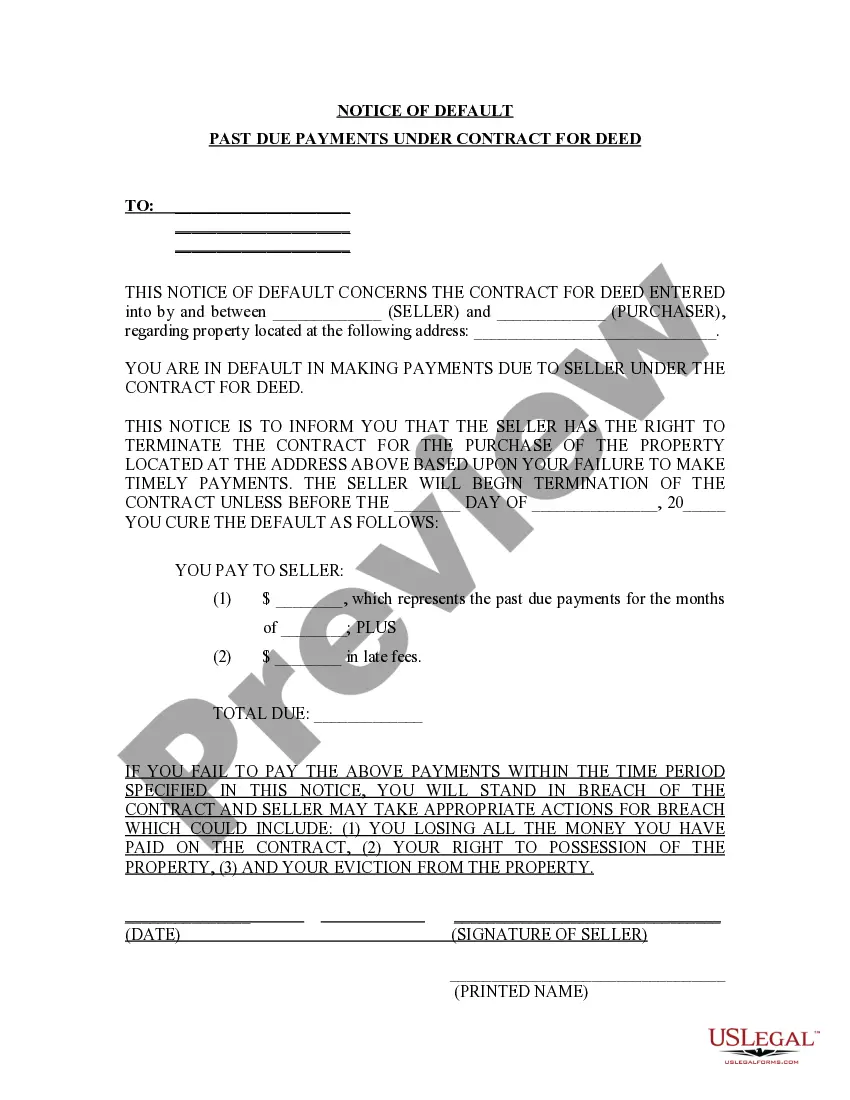

Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Winston–Salem North Carolina Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you have previously utilized our service, sign in to your account and retrieve the Winston–Salem North Carolina Notice of Default for Overdue Payments related to Contract for Deed onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business needs!

- Verify that you have found a suitable document. Review the description and use the Preview feature, if available, to ensure it aligns with your requirements. If it does not meet your needs, use the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal method to finalize the transaction.

- Obtain your Winston–Salem North Carolina Notice of Default for Overdue Payments related to Contract for Deed. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or leverage professional online editors to complete and electronically sign it.

Form popularity

FAQ

Foreclosure laws in North Carolina involve a non-judicial process, making it essential to understand your rights. When a lender files a foreclosure notice, the process can move quickly, often starting within a couple of months of default. Receiving a Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed can be daunting, but knowing the legal parameters can help you navigate these tough situations more effectively.

In North Carolina, a lender may initiate foreclosure after you miss just one payment, but they usually wait 90 days or more before taking action. This grace period allows homeowners to address payment issues before facing a potential foreclosure. If you receive a Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, it’s crucial to act quickly to avoid further complications.

In North Carolina, the redemption period for foreclosure is typically ten days after the confirmation of the sale. This period allows homeowners to reclaim their property by paying the full amount owed. It's important to remain vigilant and monitor any notices, such as the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, to ensure you don't miss this crucial timeframe.

In North Carolina, a borrower typically needs to be at least 90 days behind on payments before foreclosure proceedings can start. This period gives homeowners a chance to catch up on their payments. If you receive a Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, it’s essential to take action swiftly. Early intervention can help you avoid the stress of foreclosure.

In North Carolina, the statute of limitations for a deed of trust is typically 10 years. This means that you have a decade to enforce the terms of the contract. If a borrower fails to make payments, the lender may seek to initiate a Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed within this timeframe. It's crucial to stay informed about these timelines to protect your rights.

One downside of a land contract is the risk of defaulting on payments, which could lead to losing the property without regaining any equity built. Additionally, the seller retains the title until the contract is fulfilled, leaving the buyer with limited rights until payment completion. Being aware of issues like the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed helps buyers make informed decisions. US Legal Forms offers resources to help navigate these risks.

Yes, land contracts are legal in North Carolina, and many individuals use them as an alternative to traditional property sales. These contracts offer flexible terms that can benefit both buyers and sellers. However, it’s essential to navigate the complexities, particularly regarding the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed. Consulting resources like US Legal Forms can help streamline understanding and compliance.

Several factors can void a land contract, including misrepresentation, failure to follow the agreed terms, or significant changes in property condition. It’s important to recognize that any violation of the contract can trigger the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed. Ensuring compliance with all terms is vital for both parties to uphold the contract’s validity.

A land contract in North Carolina is an agreement where the buyer makes payments directly to the seller for a property, while the seller retains the title until full payment is completed. This type of arrangement can be a beneficial alternative for buyers who may have trouble qualifying for a traditional mortgage. However, buyers must be aware of the implications of the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed. Understanding these elements ensures a smoother transaction.

In Winston–Salem, North Carolina, a land contract regulates the agreement between the buyer and seller. This contract typically includes payment schedules, property descriptions, and other essential terms. It's crucial for both parties to understand their rights and responsibilities tightly tied to the Winston–Salem North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed. Failure to comply with the terms might lead to potential disputes.