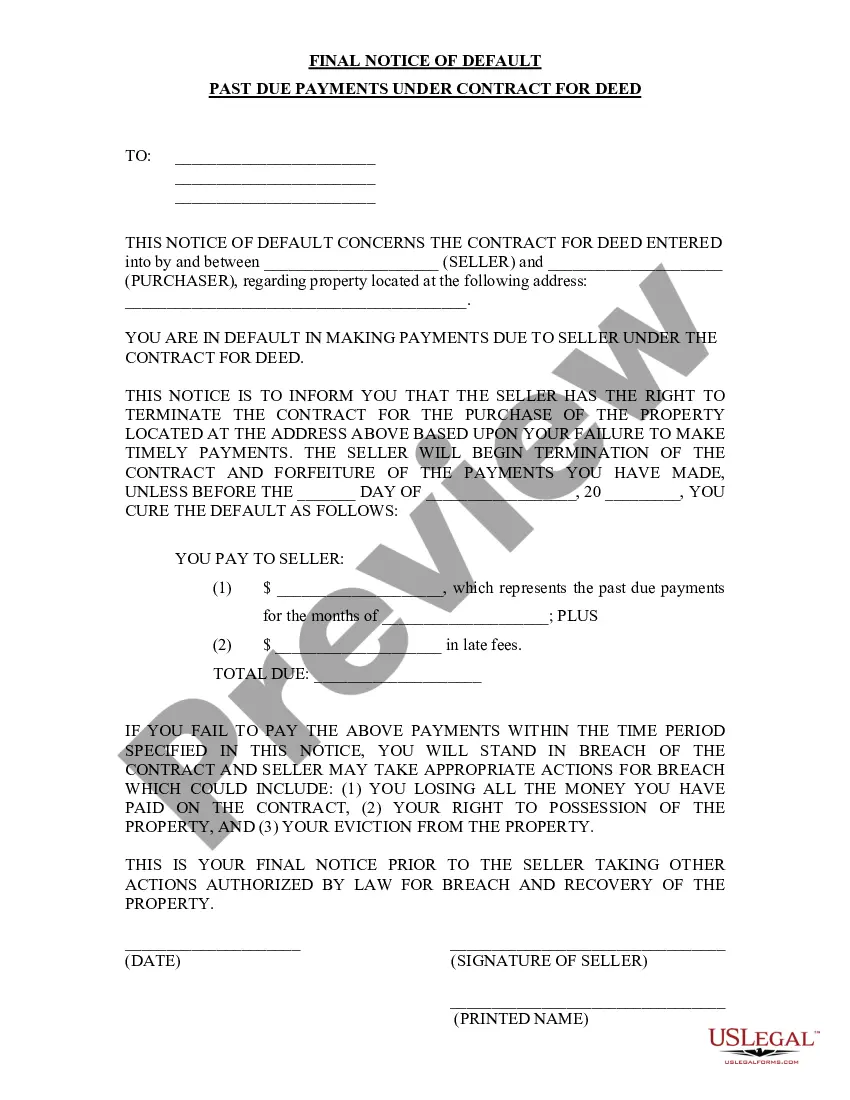

Title: Understanding Cary North Carolina Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Cary, North Carolina, individuals who enter into a Contract for Deed to purchase a property must adhere to specific payments and timelines stipulated in the agreement. However, in certain cases, when a buyer falls behind on their payments, the seller has the right to send a Final Notice of Default. This notice serves as a warning indicating that the buyer's failure to bring their payments up to date may result in serious consequences, including potential foreclosure. This article aims to provide a comprehensive understanding of the Final Notice of Default for Past Due Payments in connection with the Contract for Deed in Cary, North Carolina. 1. What is a Final Notice of Default? A Final Notice of Default is a formal document issued by the seller to the buyer who has fallen behind on payments in a Contract for Deed agreement. It acts as a final warning, notifying the buyer that they have a specific period to rectify the outstanding payments and bring their account up to date. Failure to do so may result in severe consequences, such as foreclosure. 2. Situations prompting a Final Notice of Default: a. Late or missed payments: When a buyer fails to make payments on time, consistently or according to the agreed-upon terms of the Contract for Deed, the seller may send a Final Notice of Default. b. Non-payment of property taxes: If the buyer neglects to pay property taxes associated with the purchased property, the seller may issue a Final Notice of Default to address this issue. c. Breach of additional obligations: In some Contract for Deed agreements, buyers may have additional obligations, such as maintaining homeowner's insurance, repairing damages, or up keeping the property. Failure to comply with these obligations may also lead to a Final Notice of Default. 3. Contents of a Cary North Carolina Final Notice of Default: a. Identification: The notice will typically contain the buyer's and seller's legal names, contact information, and any relevant identification numbers (if applicable). b. Property information: The notice will specify the property address associated with the Contract for Deed. c. Outstanding payment details: The notice will clearly state the exact amount owed, the due date, and any penalties or late fees incurred as a result of non-payment. d. Cure period: The notice will indicate a specific period, usually 30 days, during which the buyer must remedy the default by making the necessary payments or rectifying the issue. e. Consequences of non-compliance: The notice will underscore the potential consequences of failing to remedy the default, such as foreclosure proceedings and legal actions that may be taken by the seller. 4. Different types of Cary North Carolina Final Notice of Default: Though the Final Notice of Default generally serves the same purpose for all types of non-payment or non-compliance with the Contract for Deed, it may vary in specific language or format based on the circumstances of the default. Examples of potential types include Late Payment Notice, Property Tax Default Notice, or Breach of Obligations Notice. Conclusion: A Final Notice of Default is a significant document that aims to alert buyers who have fallen behind on payments or obligations in their Contract for Deed in Cary, North Carolina. It serves as the last opportunity for the buyer to rectify the default and avoid potential foreclosure. Understanding the contents, consequences, and different types of Final Notices is crucial for both buyers and sellers involved in Contract for Deed agreements in Cary, North Carolina.

Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Cary North Carolina Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Take advantage of the US Legal Forms and obtain immediate access to any form template you need. Our beneficial website with thousands of document templates allows you to find and get virtually any document sample you want. You are able to export, complete, and certify the Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed in a matter of minutes instead of browsing the web for hours attempting to find the right template.

Using our library is a wonderful strategy to improve the safety of your record submissions. Our experienced lawyers on a regular basis review all the records to ensure that the forms are relevant for a particular state and compliant with new acts and polices.

How can you get the Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed? If you already have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. Furthermore, you can get all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the instructions below:

- Open the page with the template you need. Make certain that it is the template you were hoping to find: examine its title and description, and make use of the Preview feature when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Choose the format to get the Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed and change and complete, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy form libraries on the web. We are always ready to help you in virtually any legal process, even if it is just downloading the Cary North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed.

Feel free to take advantage of our platform and make your document experience as straightforward as possible!