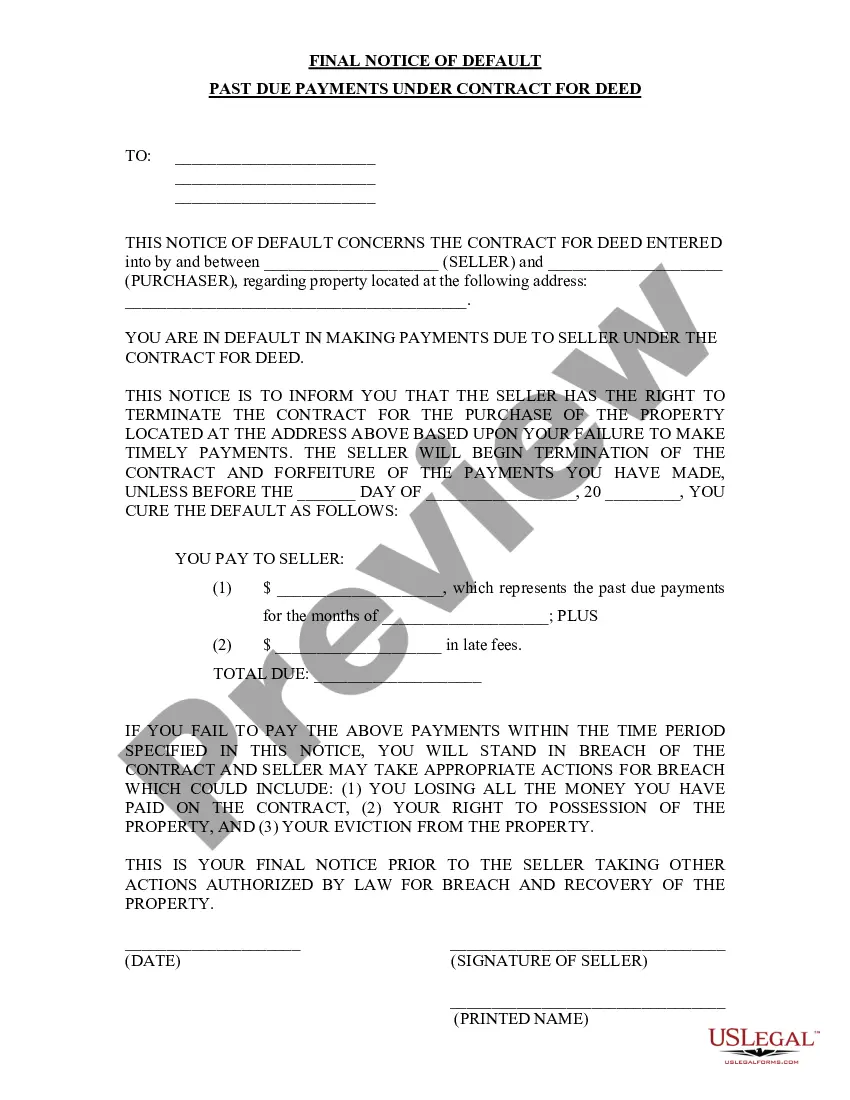

The Charlotte, North Carolina Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that serves as a final warning to individuals or entities who have failed to make timely payments as agreed upon in a Contract for Deed (also known as an installment land contract or a bond for title). This notice is a crucial step in the enforcement of the contract and ultimately aims to protect the rights of the seller or the financing entity. The notice outlines the relevant details of the default, including the specific payment(s) that are past due, the total amount owed, and the due date(s) of those missed payments. It emphasizes the contractual obligation of the buyer to pay the agreed-upon amount within a given timeframe, as specified in the contract terms. This notice also reiterates the potential consequences for continued non-payment, which may include legal action, foreclosure, or repossession of the property. In Charlotte, North Carolina, there may be different types of Final Notices of Default for Past Due Payments in connection with a Contract for Deed, depending on the specific circumstances or terms of the contract. These may include: 1. Standard Final Notice of Default: This common type of notice is typically issued when the buyer fails to make one or more installment payments on time. It outlines the missed payments, the total amount in arrears, and the exact terms of the contract that have been violated. It usually provides the buyer with a specific period, known as a "cure period," within which they must rectify the default by making the outstanding payments. 2. Acceleration Notice of Default: This notice is distinct from the standard final notice, as it serves as a demand for immediate payment of the entire outstanding balance rather than just the missed payments. It is usually issued when the buyer has committed a serious breach of the contract or has persistently failed to make payments over an extended period. The acceleration notice signifies the intent of the seller or financing entity to enforce the contract fully and promptly. 3. Cure Notice of Default: This notice is issued when the buyer has violated a non-payment related term of the contract, such as failure to maintain insurance coverage on the property or to pay property taxes. The cure notice provides the buyer with a specific timeframe to remedy the violation or breach to avoid further consequences. 4. Notice of Intent to Foreclose: If the default remains unresolved despite the issuance of previous notices, a Notice of Intent to Foreclose can be sent. This notice notifies the buyer that unless the past-due payments are brought current within a specified timeframe, the seller or financing entity intends to initiate a foreclosure action against the property, leading to potential loss of ownership for the defaulted buyer. It is important to note that the specific requirements, format, and contents of these notices may vary based on relevant state laws and the contractual provisions outlined in each individual Contract for Deed. Individuals or entities dealing with a Final Notice of Default for Past Due Payments in connection with a Contract for Deed in Charlotte, North Carolina, should seek legal advice to understand their rights and obligations fully.

Charlotte North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Charlotte North Carolina Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

Do you need a trustworthy and affordable legal forms provider to buy the Charlotte North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed? US Legal Forms is your go-to option.

Whether you require a basic agreement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Charlotte North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Start the search over if the form isn’t good for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Charlotte North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed in any provided format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.