Title: Mecklenburg, North Carolina Final Notice of Default for Past Due Payments in Connection with Contract for Deed: Understanding the Process Introduction: In Mecklenburg, North Carolina, a Final Notice of Default for Past Due Payments in connection with Contract for Deed serves as an important legal document that highlights non-compliance with payment obligations outlined in a contractual agreement. This article aims to provide you with a detailed description of what this notice entails, including its purpose, consequences, and potential resolutions. I. Understanding the Final Notice of Default for Past Due Payments in connection with Contract for Deed: The Final Notice of Default for Past Due Payments in connection with Contract for Deed is a legal notice that alerts the parties involved in a contract for deed of the defaulting party's failure to meet their payment obligations as specified in the agreement. This notice serves as a formal notification of the non-compliant party's default status, initiating the next steps towards resolution. II. Purpose of the Final Notice of Default for Past Due Payments: The primary purpose of issuing a Final Notice of Default for Past Due Payments is to prompt the defaulting party to rectify their payment default and bring the contract for deed back into compliance. Depending on the specific terms outlined in the contract, this notice serves as a final opportunity for the defaulting party to fulfill their obligations before more serious actions are taken. III. Consequences of Default: If the defaulting party fails to respond or rectify the payment default within the stipulated time period mentioned in the Final Notice of Default, the non-defaulting party may have the right to take legal action. Potential consequences may include additional fees, interest, a negative impact on their credit score, and, in extreme cases, foreclosure of the property under the contract. IV. Potential Resolutions: To avoid further legal actions and potential foreclosure, the defaulting party must promptly address the payment default. Potential resolutions might include: 1. Paying the Outstanding Balance: The defaulting party can rectify the default by paying the outstanding balance, including any associated charges, as mentioned in the Final Notice of Default. 2. Negotiating a Repayment Plan: The parties can consider negotiating a repayment plan that allows the defaulting party to catch up on missed payments over a set period of time, keeping the contract for deed intact. 3. Seeking Mediation: In some cases, engaging in mediation between the involved parties can help facilitate a resolution that satisfies both sides and avoids further legal action. 4. Transferring or Selling the Property: Depending on the terms of the contract, the defaulting party may have the option to transfer or sell the property under certain conditions, enabling them to fulfill their payment obligations and avoid foreclosure. Types of Final Notice of Default for Past Due Payments: 1. Mecklenburg, North Carolina Final Notice of Default for Past Due Payments — Residential Contract for Deed: Pertaining to residential properties governed by a contract for deed agreement. 2. Mecklenburg, North Carolina Final Notice of Default for Past Due Payments — Commercial Contract for Deed: Applicable to commercial properties for which a contract for deed agreement is in place. Conclusion: Understanding the implications of a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for both the defaulting and non-defaulting parties involved. It is essential to promptly address the defaults and explore potential resolutions to avoid further legal repercussions and potential foreclosure. Seek professional legal advice for specific circumstances related to your Mecklenburg contract for deed.

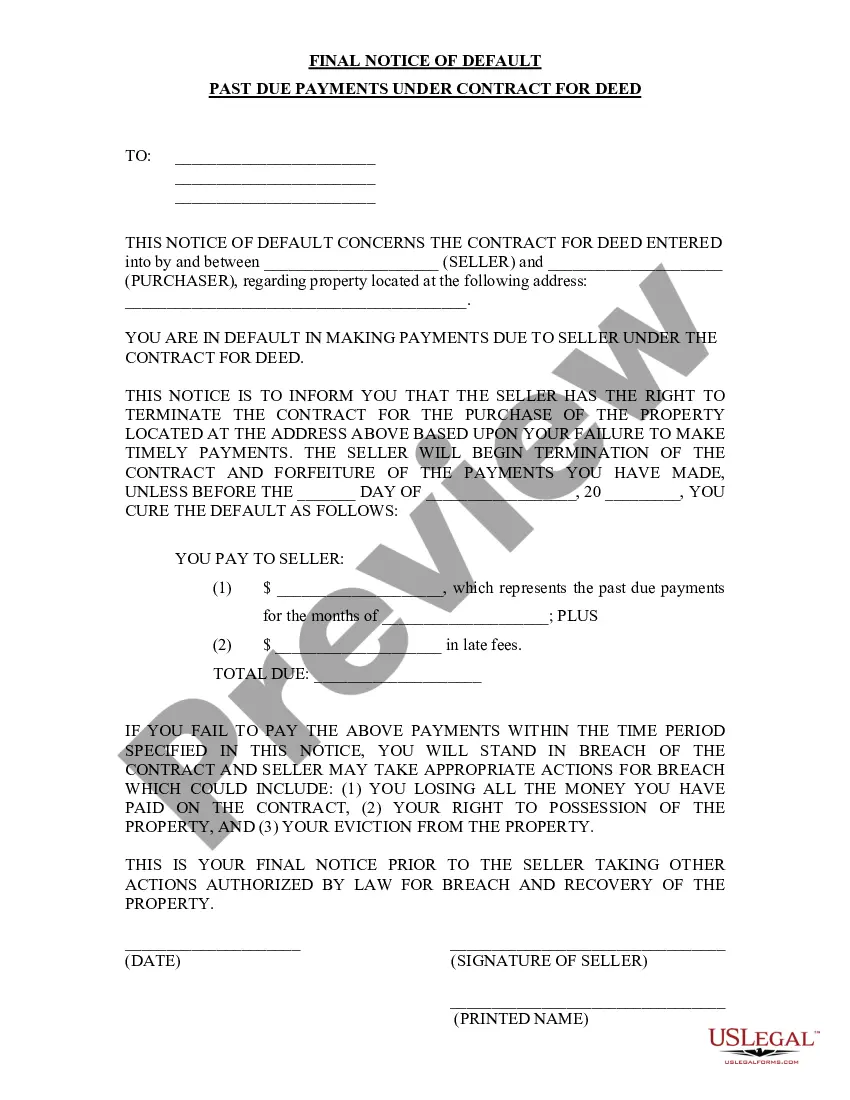

Mecklenburg North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Mecklenburg North Carolina Final Notice Of Default For Past Due Payments In Connection With Contract For Deed?

We always strive to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for attorney services that, usually, are extremely expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Mecklenburg North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Mecklenburg North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Mecklenburg North Carolina Final Notice of Default for Past Due Payments in connection with Contract for Deed would work for your case, you can pick the subscription plan and make a payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!