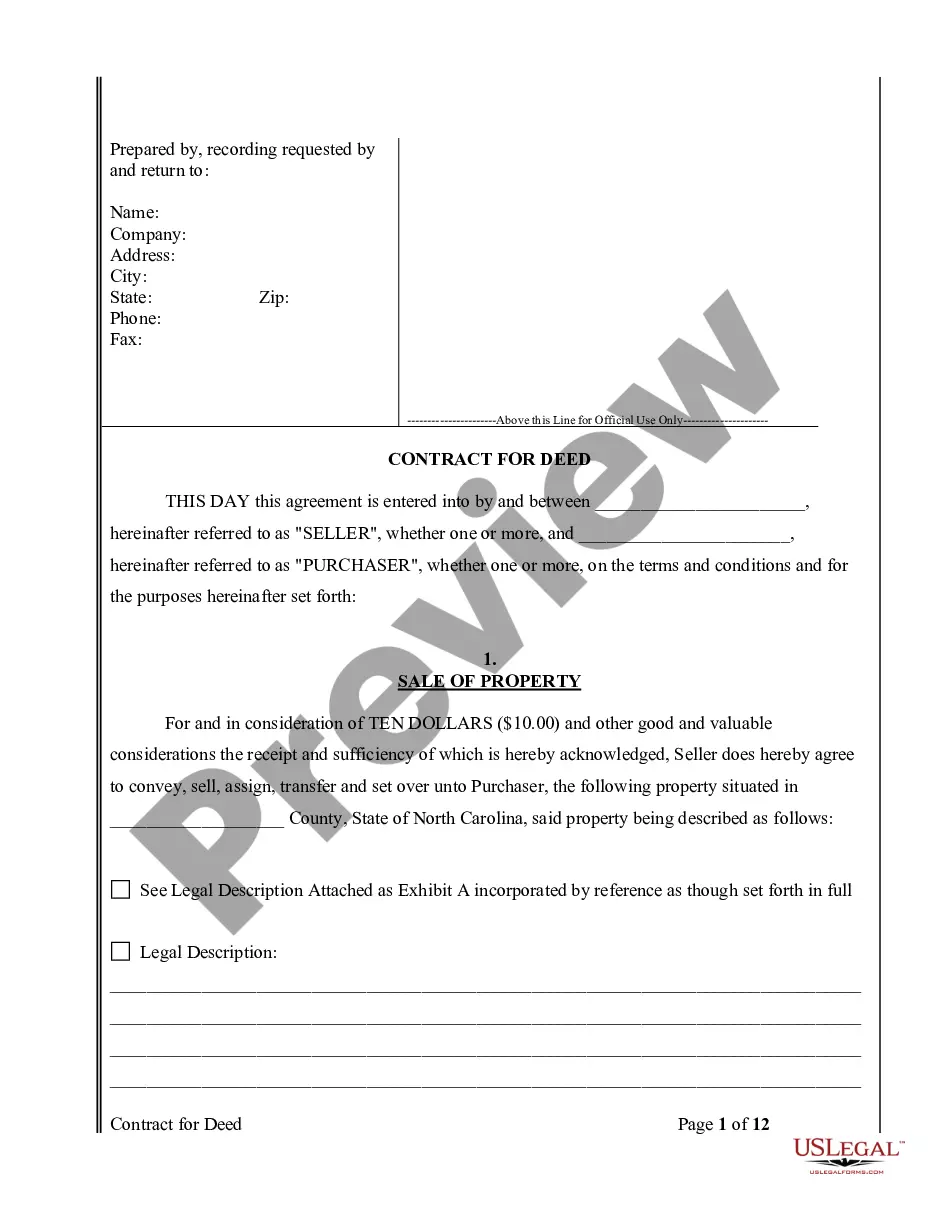

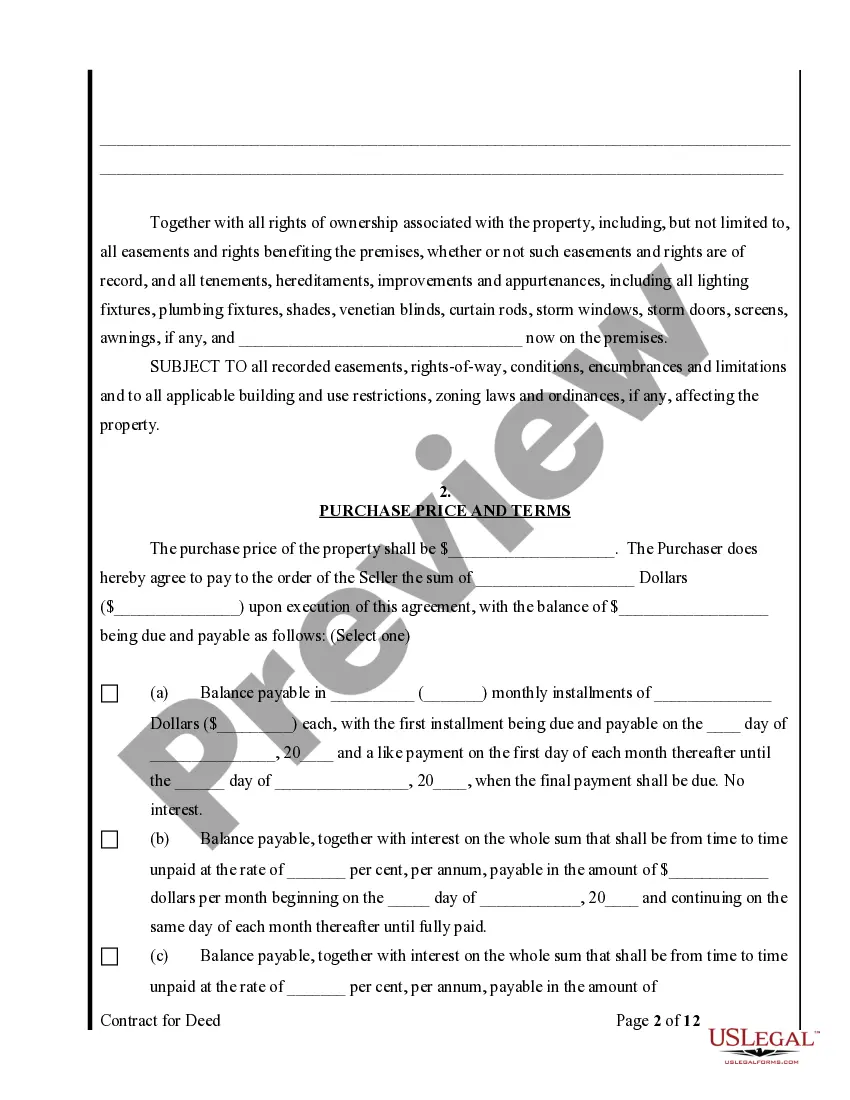

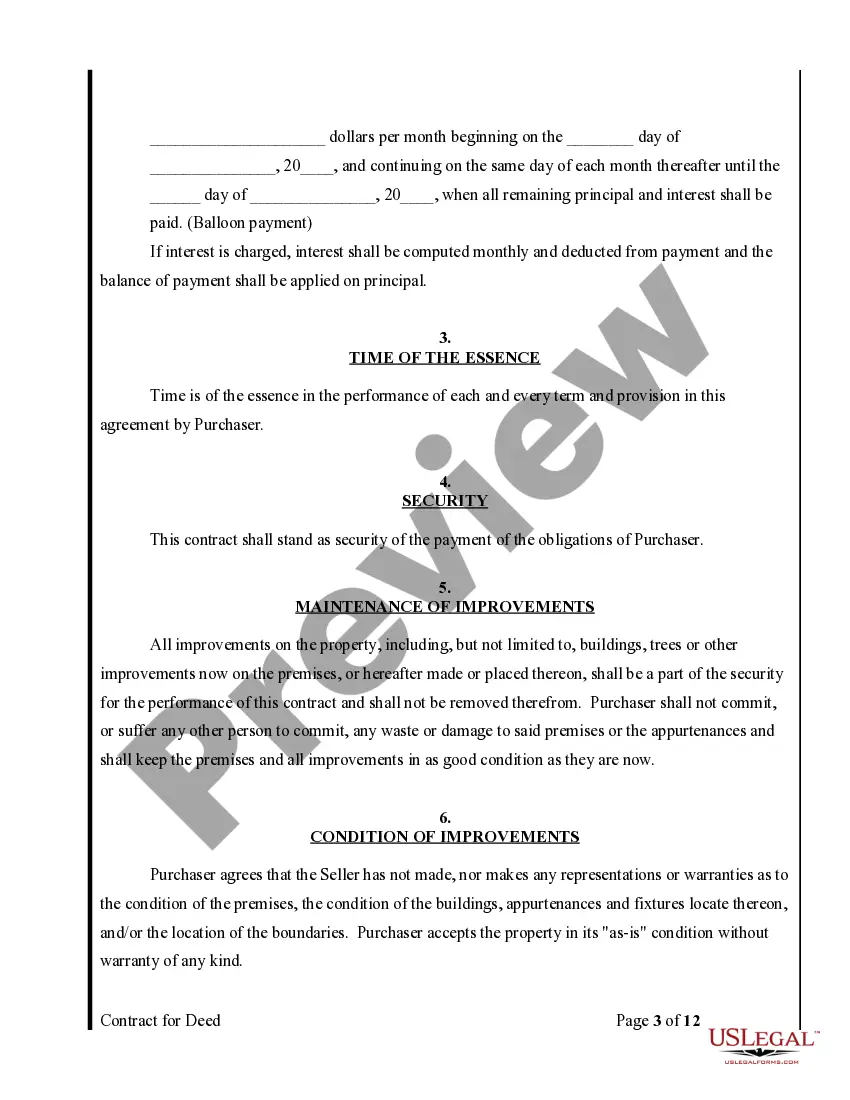

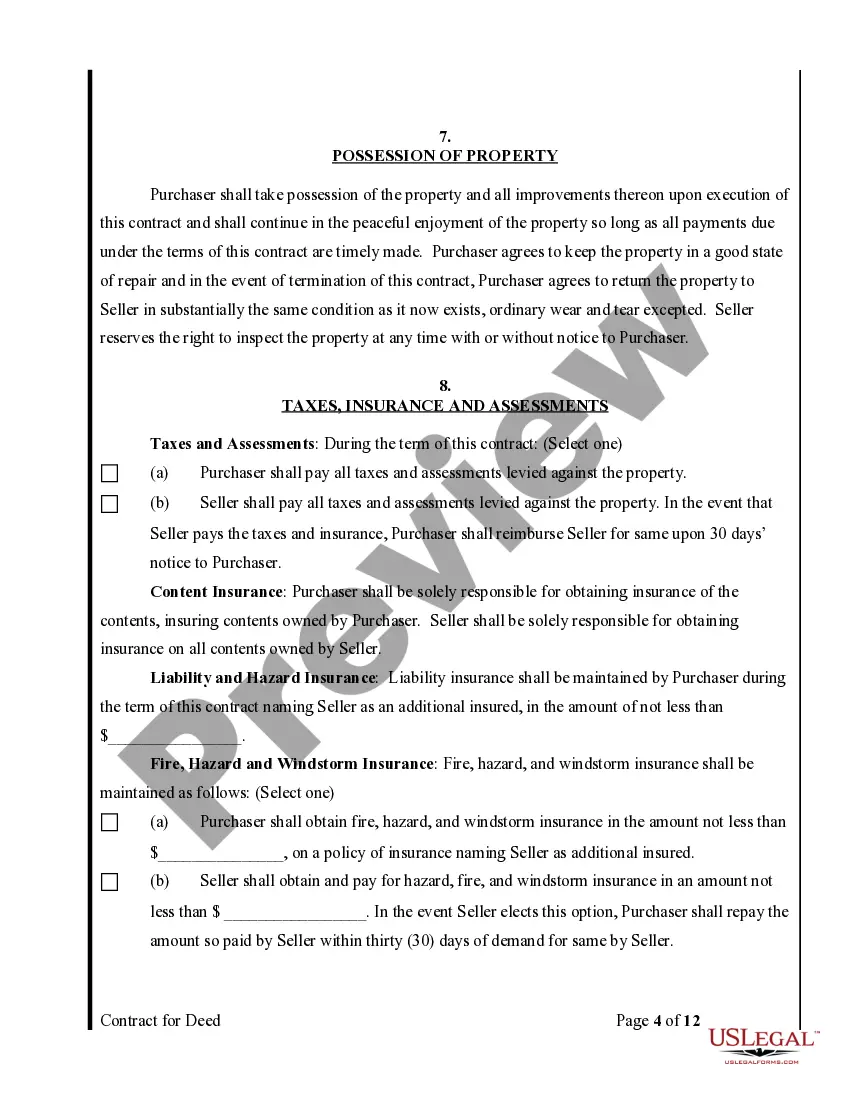

The Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate, also known as Land or Executory Contract, is a legally binding document that outlines the terms and conditions of a property sale between a buyer and a seller. This agreement serves as an alternative to traditional mortgage financing, allowing individuals or businesses to purchase real estate without the need for immediate full payment. The Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate is designed to protect the interests of both the buyer and the seller. It lays out the specific terms of the agreement, including the purchase price, payment schedule, interest rates, and other relevant details. This contract also specifies the rights and obligations of both parties during the transaction period. In Mecklenburg County, North Carolina, there are different types of Agreement or Contract for Deed for Sale and Purchase of Real Estate. Some common variations include: 1. Residential Contract for Deed: This type of contract is used when the property being purchased is intended for residential purposes, such as a house, townhouse, or condominium. The terms and conditions will vary based on the specifics of the property and the preferences of the buyer and seller. 2. Commercial Contract for Deed: Commercial properties, such as office buildings, retail spaces, or industrial facilities, require specific terms and conditions tailored to commercial real estate transactions. The Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate can be customized to meet the unique requirements of commercial buyers and sellers. 3. Land Contract for Deed: In cases where the buyer intends to purchase vacant land or a plot of land without any structures, a specialized Land Contract for Deed can be utilized. This contract will outline the terms for the purchase of land, including any zoning restrictions or development plans. Mecklenburg County, located in North Carolina, follows specific legal guidelines and regulations when it comes to Agreement or Contract for Deed for Sale and Purchase of Real Estate. Therefore, it is crucial for both buyers and sellers to consult with legal professionals who are experienced in real estate transactions to ensure compliance with local laws and regulations.

- US Legal Forms

- Localized Forms

- North Carolina

- Mecklenburg

-

North Carolina Agreement or Contract for Deed for Sale and Purchase of...

Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Description

Related forms

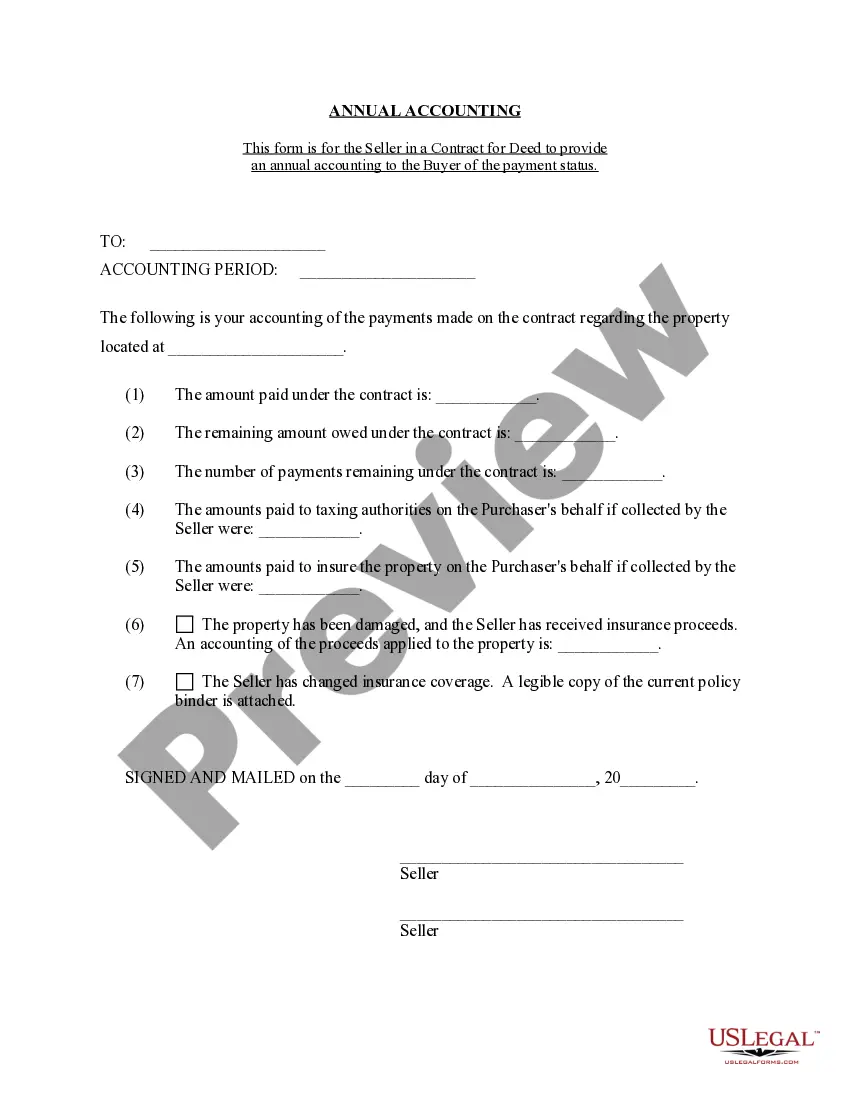

View Buyer's Request for Accounting from Seller under Contract for Deed

View Contract for Deed Seller's Annual Accounting Statement

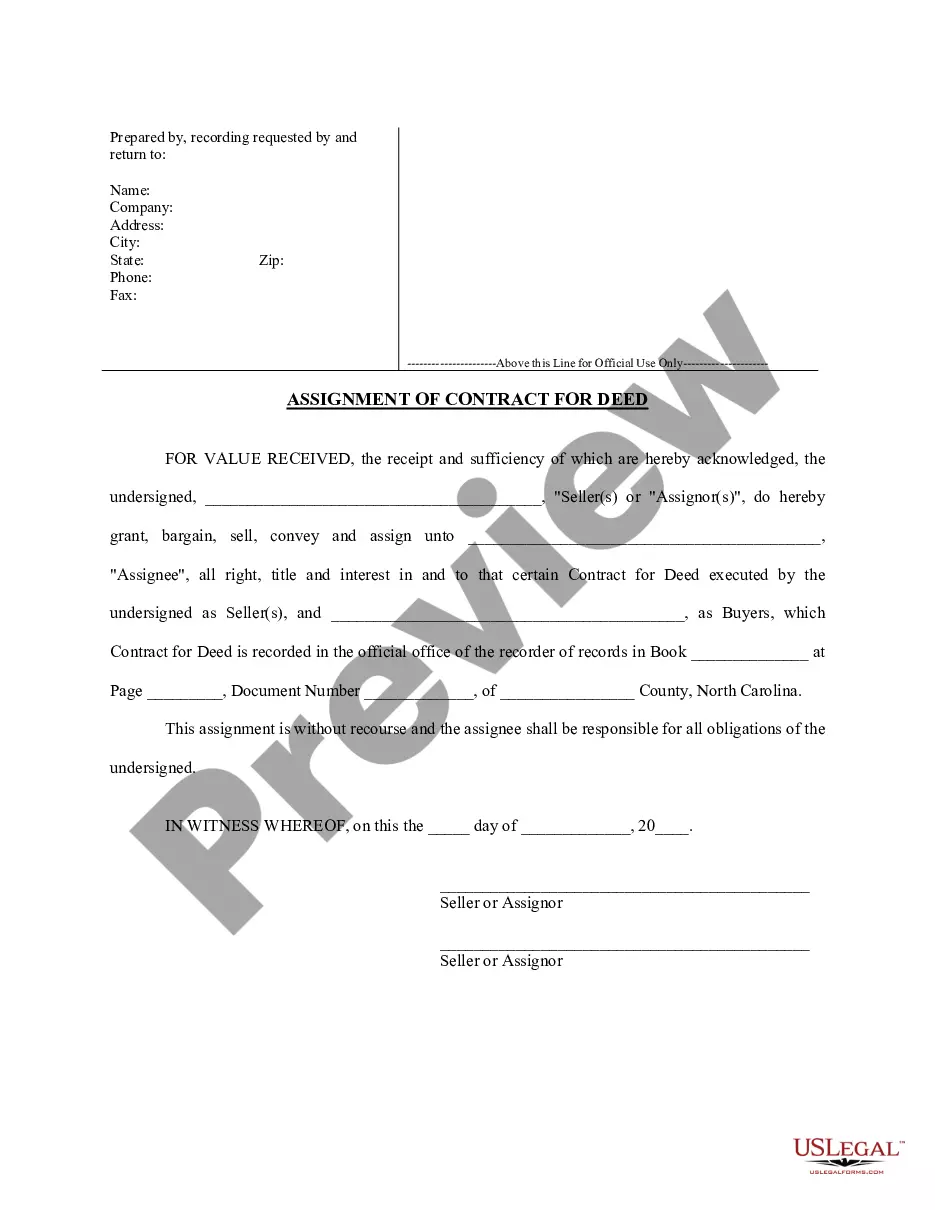

View Assignment of Contract for Deed by Seller

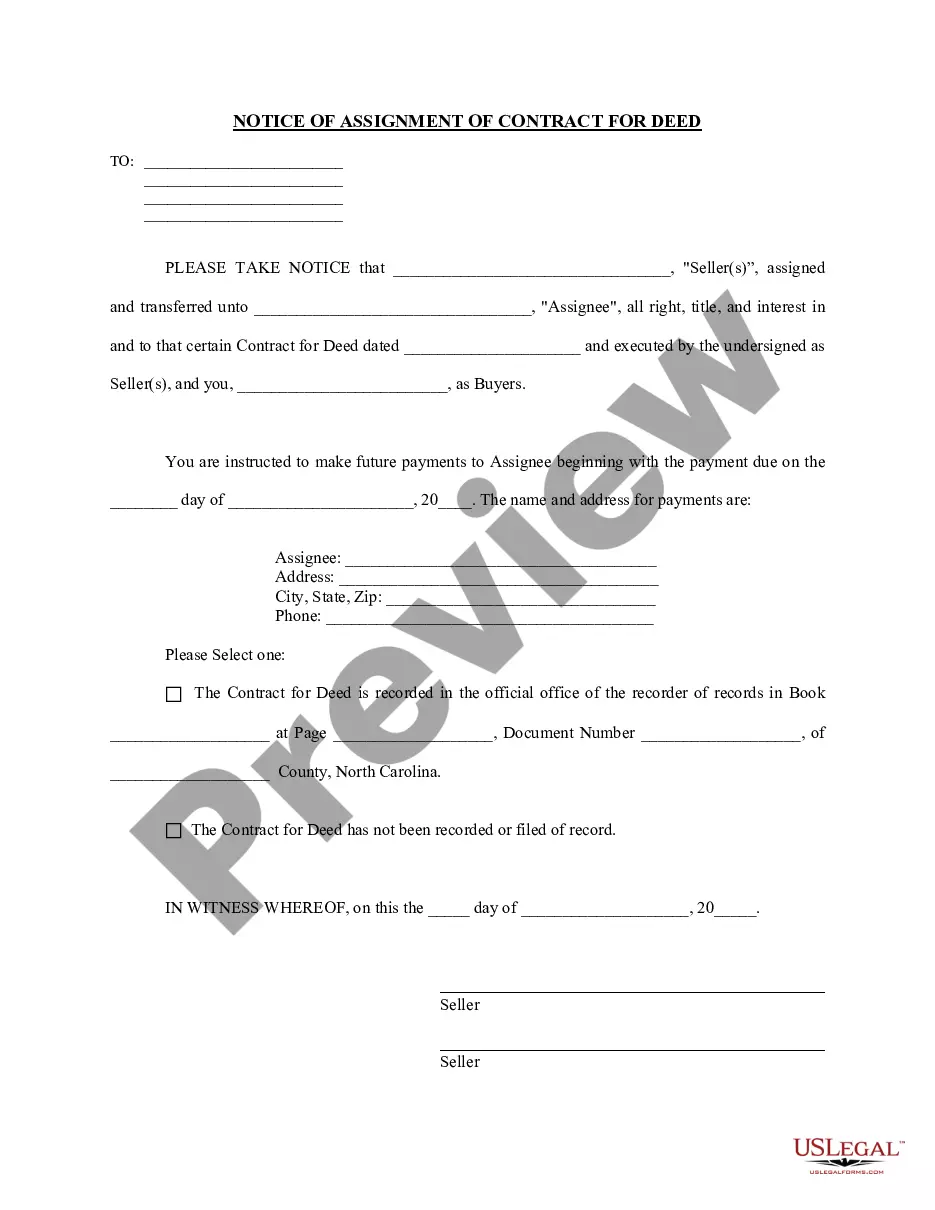

View Notice of Assignment of Contract for Deed

View Residential Real Estate Sales Disclosure Statement

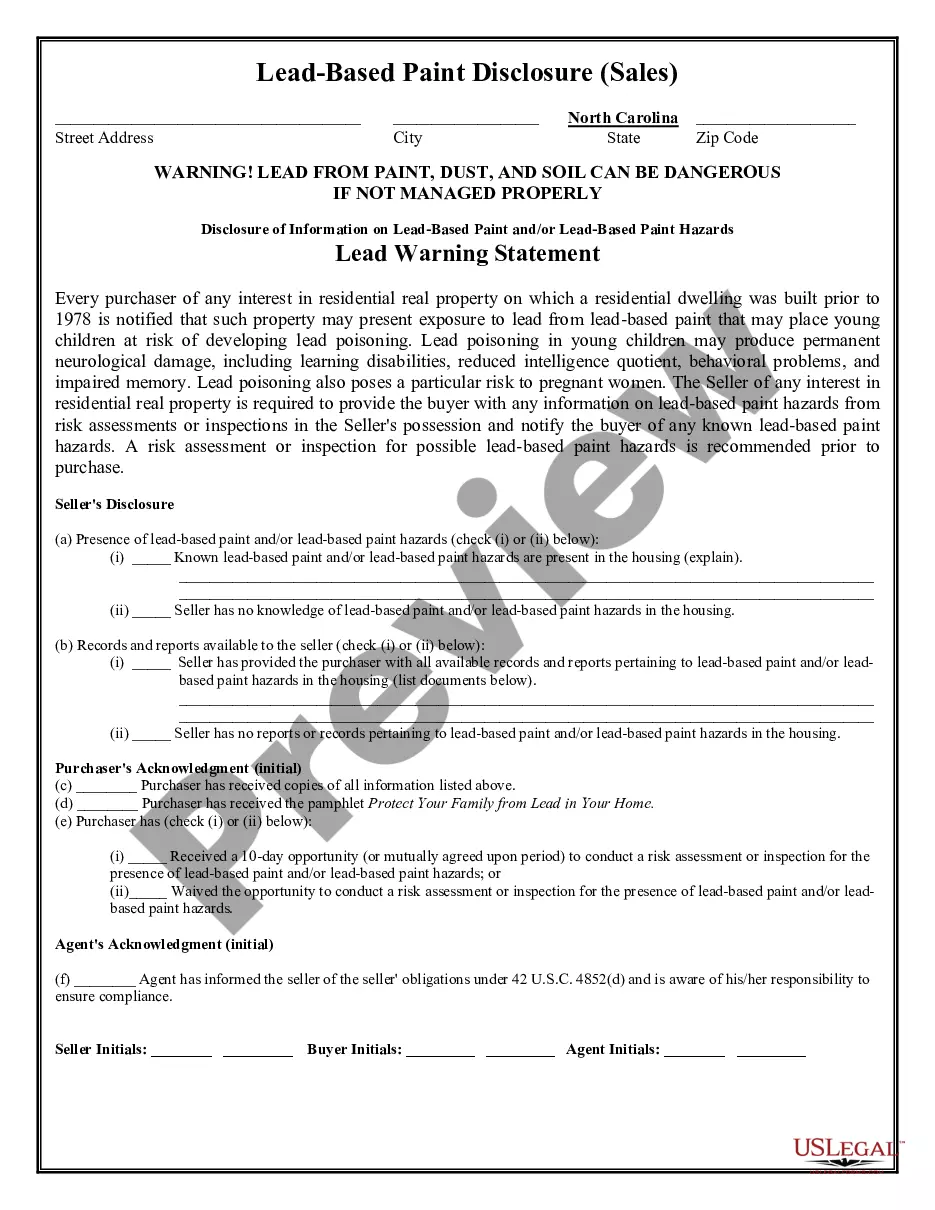

View Lead Based Paint Disclosure for Sales Transaction

View Gilbert Cronograma de Apoyo al Balance de Cuentas por Cobrar

View Orlando Acuerdo para formar una sociedad condicionada a un evento específico

View Albuquerque Solicitud de Empleo para Sastre

View Greensboro Ejemplo de carta de disculpa por exceso de envío

View Jersey City Acuerdo y liberación con respecto a la terminación del empleo

Related legal definitions

How to fill out Mecklenburg North Carolina Agreement Or Contract For Deed For Sale And Purchase Of Real Estate A/k/a Land Or Executory Contract?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form Rating

Form popularity

FAQ

What is one advantage of a contract for deed? Gives the seller certain tax benefits.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

A North Carolina land contract documents the terms of a vacant land purchase and sale agreement between two parties. The buying and selling parties must create this contract through negotiating offers, ultimately reaching mutual terms such as the agreed-upon purchase price and any financial contingencies.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Mecklenburg North Carolina Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract Related Searches

-

agreement contract to buy and sell real estate residential

-

what should be in a purchase and sale agreement

-

for sale by owner real estate contract

-

nova lf120 agreement to sell real estate

-

montana buy sell agreement no broker

-

standard agreement for the sale of real estate pennsylvania 2021 pdf

-

contract to sell real estate

-

one page purchase and sale agreement

-

north carolina offer to purchase and contract pdf

-

how to fill out offer to purchase and contract nc

Interesting Questions

The Mecklenburg Agreement or Contract for Deed is a legal agreement used for buying and selling real estate, also known as land or executory contract.

The Mecklenburg Agreement allows the buyer to make payments to the seller over time, typically without involving traditional mortgage lenders.

The Mecklenburg Agreement can be beneficial for buyers who may not qualify for a traditional mortgage or prefer a more flexible payment arrangement.

The advantages of the Mecklenburg Agreement include potentially lower closing costs, faster transaction process, flexible payment terms, and opportunities for buyers with limited credit history or financial resources.

Risks of the Mecklenburg Agreement may include potential forfeiture of payments if the buyer defaults, higher overall purchase price due to interest or fees, and lack of legal protection compared to traditional mortgages.

Yes, the Mecklenburg Agreement is a legally binding contract that outlines the terms and conditions of the sale and purchase of real estate.

More info

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

North Carolina

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

CHAPTER 39. CONVEYANCES.

ARTICLE 1. CONSTRUCTION AND SUFFICIENCY.

§ 39-1. Fee presumed, though word "heirs" omitted.

When real estate is conveyed to any person, the same shall be held and construed to be a conveyance in fee, whether the word "heir" is used or not, unless such conveyance in plain and express words shows, or it is plainly intended by the conveyance or some part thereof, that the grantor meant to convey an estate of less dignity. (1879, c. 148; Code, s. 1280; Rev., s. 946; C.S., s. 991.)

§ 39-1.1. In construing conveyances court shall give effect to intent of the parties.

(a) In construing a conveyance executed after January 1, 1968, in which there are inconsistent clauses, the courts shall determine the effect of the instrument on the basis of the intent of the parties as it appears from all of the provisions of the instrument.

(b) The provisions of subsection (a) of this section shall not prevent the application of the rule in Shelley's case. (1967, c. 1182.)

§ 39-2. Vagueness of description not to invalidate.

No deed or other writing purporting to convey land or an interest in land shall be declared void for vagueness in the description of the thing intended to be granted by reason of the use of the word "adjoining" instead of the words "bounded by," or for the reason that the boundaries given do not go entirely around the land described: Provided, it can be made to appear to the satisfaction of the jury that the grantor owned at the time of the execution of such deed or paper-writing no other land which at all corresponded to the description contained in such deed or paper-writing. (1891, c. 465, s. 2; Rev., s. 948; C.S., s. 992.)

§ 39-4. Conveyances by infant trustees.

When an infant is seized or possessed of any estate in trust, whether by way of mortgage or otherwise, for another person who may be entitled in law to have a conveyance of such estate, or may be declared to be seized or possessed, in the course of any proceeding in the superior court, the court may decree that the infant shall convey and assure such estate, in such manner as it may direct, to such other person; and every conveyance and assurance made in pursuance of such decree shall be as effectual in law as if made by a person of full age. (1821, c. 1116, ss. 1, 2; R.C., c. 37, s. 27; Code, s. 1265; Rev., s. 1036; C.S., s. 994.)

§ 39-5. Official deed, when official selling or empowered to sell is not in office.

When a sheriff, coroner, or tax collector, in virtue of his office, sells any real or personal property and goes out of office before executing a proper deed therefor, he may execute the same after his term of office has expired; and when he dies or removes from the State before executing the deed, his successor in office shall execute it. When a sheriff or tax collector dies having a tax list in his hands for collection, and his personal representative or surety, in collecting the taxes, makes sale according to law, his successor in office shall execute the conveyance for the property to the person entitled. (R.C., c. 37, s. 30; Code, s. 1267; 1891, c. 242; Rev., ss. 950, 951; C.S., s. 995; 1971, c. 528, s. 36.)

§ 39-6. Revocation of deeds of future interests made to persons not in esse.

The grantor in any voluntary conveyance in which some future interest in real estate is conveyed or limited to a person not in esse may, at any time before he comes into being, revoke by deed such interest so conveyed or limited. This deed of revocation shall be registered as other deeds; and the grantor of like interest for a valuable consideration may, with the joinder of the person from whom the consideration moved, revoke said interest in like manner. The grantor, maker or trustor who has heretofore created or may hereafter create a voluntary trust estate in real or personal property for the use and benefit of himself or of any other person or persons in esse with a future contingent interest to some person or persons not in esse or not determined until the happening of a future event may at any time, prior to the happening of the contingency vesting the future estates, revoke the grant of the interest to such person or persons not in esse or not determined by a proper instrument to that effect; and the grantor of like interest for a valuable consideration may, with the joinder of the person from whom the consideration moved, revoke said interest in like manner: Provided, that in the event the instrument creating such estate has been recorded, then the deed of revocation of such estate shall be likewise recorded before it becomes effective: Provided, further, that this section shall not apply to any instrument hereafter executed creating such a future contingent interest when said instrument shall expressly state in effect that the grantor, maker, or trustor may not revoke such interest: Provided, further, that this section shall not apply to any instrument heretofore executed whether or not such instrument contains express provisions that it is irrevocable unless the grantor, maker, or trustor shall within six months after the effective date of this proviso either revoke such future interest, or file with the trustee an instrument stating or declaring that it is his intention to retain the power to revoke under this section: Provided, further, that in the event the instrument creating such estate has been recorded, then the revocation or declaration shall likewise be recorded before it becomes effective. (1893, c. 498; Rev., s. 1045; C.S., s. 996; 1929, c. 305; 1941, c. 264; 1943, c. 437.)

§ 39-6.1. Validation of deeds of revocation of conveyances of future interests to persons not in esse.

All deeds or instruments heretofore executed, revoking any conveyance of future interest made to persons not in esse, are hereby validated insofar as any such deed of revocation may be in conflict with the provisions of G.S. 39-6.

All such deeds of revocation heretofore executed are hereby validated and no such deed of revocation shall be held to be invalid by reason of not having been executed within the six-month period prescribed in the third proviso of G.S. 39-6. (1947, c. 62.)

§ 39-6.2. Creation of interest or estate in personal property.

Any interest or estate in personal property which may be created by last will and testament may also be created by a written instrument of transfer. (1953, c. 198.)

§ 39-6.3. Inter vivos and testamentary conveyances of future interests permitted.

(a) The conveyance, by deed or will, of an existing future interest shall not be ineffective on the sole ground that the interest so conveyed is future or contingent. All future interests in real or personal property, including all reversions, executory interests, vested and contingent remainders, rights of entry both before and after breach of condition and possibilities of reverter may be conveyed by the owner thereof, by an otherwise legally effective conveyance, inter vivos or testamentary, subject, however, to all conditions and limitations to which such future interest is subject.

(b) The power to convey as provided in subsection (a), can be exercised by any form of conveyance, inter vivos or testamentary, which is otherwise legally effective in this State at the date of such conveyance to transfer a present estate of the same duration in the property.

(c) This section shall apply only to conveyances which become operative to transfer title on or after October 1, 1961. (1961, c. 435.)

§ 39-6.4. Creation of easements, restrictions, and conditions.

(a) The holder of legal or equitable title of an interest in real property may create, grant, reserve, or declare valid easements, restrictions, or conditions of record burdening or benefiting the same interest in real property.

(b) Subsection (a) of this section shall not affect the application of the doctrine of merger after the severance and subsequent reunification of title to all of the benefited or burdened real property or interests therein. (1997-333, s. 1.)<br />

<br />

§ 39-6.5. Elimination of seal.<br />

<br />

The seal of the signatory shall not be necessary to effect a valid conveyance of an interest in real property; provided, that this section shall not affect the requirement for affixing a seal of the officer taking an acknowledgment of the instrument. (1999-221, s. 2.)<br />

<br />

§ 39-6.6. Subordination agreements.<br />

<br />

(a) A subordination agreement shall be given effect in accordance with its terms and is not required to state any interest rate, principal amount secured, or other financial terms.<br />

<br />

(b) The trustee of a deed of trust shall not be a necessary party to a subordination agreement unless the deed of trust provides otherwise.<br />

<br />

(c) For purposes of G.S. 1-47, a subordination agreement is deemed a conveyance of an interest in real property.<br />

<br />

(d) This section is not exclusive. No subordination agreement that is otherwise valid shall be invalidated by this section.<br />

<br />

(e) This section applies to a subordination agreement regardless of when the agreement was signed by the party or parties thereto, except that this section does not apply to an agreement that (i) is the subject of litigation pending on the effective date of this subsection, and (ii) was filed or recorded before October 1, 2003.<br />

<br />

(f) In this section:<br />

<br />

(1) “Interest in real property” includes all rights, title, and interest in and to land, buildings, and other improvements of an owner, tenant, subtenant, secured lender, materialman, judgment creditor, lienholder, or other person, whether the interest in real property is evidenced by a deed, easement, lease, sublease, deed of trust, mortgage, assignment of leases and rents, judgment, claim of lien, or any other record, instrument, document, or entry of court.<br />

<br />

(2) “Subordination agreement” means a written commitment or agreement to subordinate or that subordinates an interest in real property signed by a person entitled to priority. (2003-219, s. 1; 2005-212, s. 1.)<br />

<br />

NORTH CAROLINA GENERAL STATUTES<br />

CHAPTER 39. CONVEYANCES.<br />

ARTICLE 2. CONVEYANCES BY HUSBAND AND WIFE.<br />

<br />

§ 39-7. Instruments affecting married person’s title; joinder of spouse; exceptions.<br />

<br />

(a) In order to waive the elective life estate of either husband or wife as provided for in G.S. 29-30, every conveyance or other instrument affecting the estate, right or title of any married person in lands, tenements or hereditaments must be executed by such husband or wife, and due proof or acknowledgment thereof must be made and certified as provided by law.<br />

<br />

(b) A married person may bargain, sell, lease, mortgage, transfer and convey any of his or her separate real estate without joinder or other waiver by his or her spouse if such spouse is incompetent and a guardian or trustee has been appointed as provided by the laws of North Carolina, and if the appropriate instrument is executed by the married person and the guardian or trustee of the incompetent spouse and is probated and registered in accordance with law, it shall convey all the estate and interest as therein intended of the married person in the land conveyed, free and exempt from the elective life estate as provided in G.S. 29-30 and all other interests of the incompetent spouse.<br />

<br />

(c) Subsection (a) shall not be construed to require the spouse’s joinder or other waiver of the elective life estate of such spouse as provided for in G.S. 29-30 where a different provision is made or provided for in the General Statutes including, but not limited to, G.S. 39-13, 39-13.3, 39-13.4, 31A-1(d), and 52-10. (C.C.P., s. 429; subsec. 6; 1868-9, c. 277, s. 15; Code, s. 1256; 1899, c. 235, s. 9; Rev., s. 952; C.S., s. 997; 1945, c. 73, s. 4; 1957, c. 598, s. 3; 1965, c. 855.)<br />

<br />

§ 39-7.1. Certain instruments affecting married woman’s title not executed by husband validated.<br />

<br />

No conveyance, power of attorney, or other instrument affecting the estate, right or title of any married woman in lands, tenements or hereditaments which was executed by such married woman prior to June 8, 1965, shall be invalid for the reason that the instrument was not also executed by the husband of such married woman. (1965, c. 857; 1973, c. 853, s. 1.)<br />

<br />

§ 39-8. Acknowledgment at different times and places; before different officers; order immaterial.<br />

<br />

In all cases of deeds, or other instruments executed by husband and wife and requiring registration, the probate of such instruments as to the husband and due proof or acknowledgment of the wife may be taken before different officers authorized by law to taken probate of deeds, and at different times and places, whether both of said officials reside in this State or only one in this State and the other in another state or country. And in taking the probate of such instruments executed by husband and wife, it is immaterial whether the execution of the instrument was proven as to or acknowledged by the husband before or after due proof as to or acknowledgment of the wife. (1895, c. 136; 1899, c. 235, s. 9; Rev., s. 953; C.S., s. 998; 1945, c. 73, s. 5.)<br />

<br />

§ 39-9. Absence of wife’s acknowledgment does not affect deed as to husband.<br />

<br />

When an instrument purports to be signed by a husband and wife the instrument may be ordered registered, if the acknowledgment of the husband is duly taken, but no such instrument shall be the act or deed of the wife unless proven or acknowledged by her according to law. (1889, c. 235, s. 8; 1901, c. 637; Rev., s. 954; C.S., s. 999; 1945, c. 73, s. 6.)<br />

<br />

§ 39-11. Certain conveyances not affected by fraud if acknowledgment or privy examination regular.<br />

<br />

No deed conveying lands nor any instrument required or allowed by law to be registered, executed by husband and wife since the eleventh of March, 1889, if the acknowledgment or private examination of the wife is thereto certified as prescribed by law, shall be invalid because its execution or acknowledgment was procured by fraud, duress or undue influence, unless it is shown that the grantee or person to whom the instrument was made participated in the fraud, duress or undue influence, or had notice thereof before the delivery of the instrument. Where such participation or notice is shown, an innocent purchaser for value under the grantee or person to whom the instrument was made shall not be affected by such fraud, duress or undue influence. (1889, c. 389; 1899, c. 235, s. 10; Rev., s. 956; C.S., s. 1001; 1945, c. 73, s. 7.)<br />

<br />

§ 39-12. Power of attorney of married person.<br />

<br />

Every competent married person of lawful age is authorized to execute, without the joinder of his or her spouse, instruments creating powers of attorney affecting the real and personal property of such married person naming either third parties or, subject to the provisions of G.S. 52-10 or 52-10.1, his or her spouse as attorney-in-fact. When such a married person executes a power of attorney authorized by the preceding sentence naming his or her spouse as attorney in fact the acknowledgment by the spouse of the grantor is not necessary. Such instruments may confer upon the attorney, and the attorney may exercise, any and all powers which lawfully can be conferred upon an attorney-in-fact, including, but not limited to, the authority to join in conveyances of real property for the purpose of waiving or quitclaiming any rights which may be acquired as a surviving spouse under the provisions of G.S. 29-30. (1798, c. 510; R.C., c. 37, s. 11; Code, s. 1257; Rev., s. 957; C.S., s. 1002; 1965, c. 856; 1977, c. 375, s. 7; 1979, c. 528, s. 8.)<br />

<br />

§ 39-13. Spouse need not join in purchase-money mortgage.<br />

<br />

The purchaser of real estate who does not pay the whole of the purchase money at the time when he or she takes a deed for title may make a mortgage or deed of trust for securing the payment of such purchase money, or such part thereof as may remain unpaid, which shall be good and effectual against his or her spouse as well as the purchaser, without requiring the spouse to join in the execution of such mortgage or deed of trust. (1868-9, c. 204; Code, s. 1272; Rev., s. 958; 1907, c. 12; C.S., s. 1003; 1965, c. 852.)<br />

<br />

§ 39-13.1. Validation of certain deeds, etc., executed by married women without private examination.<br />

<br />

(a) No deed, contract, conveyance, leasehold or other instrument executed since the seventh day of November, 1944, shall be declared invalid because of the failure to take the private examination of any married woman who was a party to such deed, contract, conveyance, leasehold or other instrument.<br />

<br />

(b) Any deed, contract, conveyance, lease or other instrument executed prior to February 7, 1945, which is in all other respects regular except for the failure to take the private examination of a married woman who is a party to such deed, contract, conveyance, lease or other instrument is hereby validated and confirmed to the same extent as if such private examination had been taken, provided that this section shall not apply to any instruments now involved in any pending litigation. (1945, c. 73, s. 21 1/2; 1969, c. 1008, s. 1.)<br />

<br />

§ 39-13.2. Married persons under 18 made competent as to certain transactions; certain transactions validated.<br />

<br />

(a) Any married person under 18 years of age is authorized and empowered and shall have the same privileges as are conferred upon married persons 18 years of age or older to:<br />

<br />

(1) Waive, release or renounce by deed or other written instrument any right or interest which he or she may have in the real or personal property (tangible or intangible) of the other spouse; or<br />

<br />

(2) Jointly execute with his or her spouse, if such spouse is 18 years of age or older, any note, contract of insurance, deed, deed of trust, mortgage, lien of whatever nature or other instrument with respect to real or personal property (tangible or intangible) held with such other spouse either as tenants by the entirety, joint tenants, tenants in common, or in any other manner.<br />

<br />

(b) Any transaction between a husband and wife pursuant to this section shall be subject to the provisions of G.S. 52-10 or 52-10.1 whenever applicable.<br />

<br />

(c) No renunciation of dower or curtesy or of rights under G.S. 29-30(a) by a married person under the age of 21 years after June 30, 1960, and until April 7, 1961, shall be invalid because such person was under such age. No written assent by a husband under the age of 21 years to a conveyance of the real property of his wife after June 30, 1960, and until April 7, 1961, shall be invalid because such husband was under such age. (1951, c. 934, s. 1; 1955, c. 376; 1961, c. 184; 1965, c. 851; c. 878, s. 2; 1971, c. 1231, s. 1; 1977, c. 375, s. 8.)<br />

<br />

§ 39-13.3. Conveyances between husband and wife.<br />

<br />

(a) A conveyance from a husband or wife to the other spouse of real property or any interest therein owned by the grantor alone vests such property or interest in the grantee.<br />

<br />

(b) A conveyance of real property, or any interest therein, by a husband or a wife to such husband and wife vests the same in the husband and wife as tenants by the entirety unless a contrary intention is expressed in the conveyance.<br />

<br />

(c) A conveyance from a husband or a wife to the other spouse of real property, or any interest therein, held by such husband and wife as tenants by the entirety dissolves such tenancy in the property or interest conveyed and vests such property or interest formerly held by the entirety in the grantee.<br />

<br />

(d) The joinder of the spouse of the grantor in any conveyance made by a husband or a wife pursuant to the foregoing provisions of this section is not necessary.<br />

<br />

(e) Any conveyance authorized by this section is subject to the provisions of G.S. 52-10 or 52-10.1, except that acknowledgment by the spouse of the grantor is not necessary. (1957, c. 598, s. 1; 1965, c. 878, s. 3; 1977, c. 375, s. 9.)<br />

<br />

§ 39-13.4. Conveyances by husband or wife under deed of separation.<br />

<br />

Any conveyance of real property, or any interest therein, by the husband or wife who have previously executed a valid and lawful deed of separation which authorizes said husband or wife to convey real property or any interest therein without the consent and joinder of the other and which deed of separation or a memorandum of the deed of separation setting forth such authorization is recorded in the county where the land lies, shall be valid to pass such title as the conveying spouse may have to his or her grantee and shall pass such title free and clear of all rights in such property and free and clear of such interest in property that the other spouse might acquire solely as a result of the marriage, including any rights arising under G.S. 29-30, unless an instrument in writing canceling the deed of separation or memorandum thereof and properly executed and acknowledged by said husband and wife is recorded in the office of said register of deeds. The instrument which is registered under this section to authorize the conveyance of an interest in real property or the cancellation of the deed of separation or memorandum thereof shall comply with the provisions of G.S. 52-10 or 52-10.1.<br />

<br />

All conveyances of any interest in real property by a spouse who had previously executed a valid and lawful deed of separation, or separation agreement, or property settlement, which authorized the parties thereto to convey real property or any interest therein without the consent and joinder of the other, when said deed of separation, separation agreement, or property settlement, or a memorandum of the deed of separation, separation agreement, property settlement, setting forth such authorization, had been previously recorded in the county where the property is located, and when such conveyances were executed before October 1, 1981, shall be valid to pass such title as the conveying spouse may have to his or her grantee, and shall pass such to him free and clear of rights in such property and free and clear of such interest in such property that the other spouse might acquire solely as a result of the marriage, including any rights arising under G.S. 29-30, unless an instrument in writing canceling the deed of separation, separation agreement, or property settlement, or memorandum thereof, properly executed and acknowledged by said husband and wife, is recorded in the office of said register of deeds. The instrument which is registered under this section to authorize the conveyance of an interest in real property or the cancellation of the deed of separation, separation agreement, property settlement, or memorandum thereof shall comply with G.S. 52-10 or 52-10.1. (1959, c. 512; 1973, c. 133; 1977, c. 375, s. 10; 1981, c. 599, ss. 10, 11.)<br />

<br />

§ 39-13.5. Creation of tenancy by entirety in partition of real property.<br />

<br />

When either a husband or a wife owns an undivided interest in real property as a tenant in common with some person or persons other than his or her spouse and there occurs an actual partition of the property, a tenancy by the entirety may be created in the husband or wife who owned the undivided interest and his or her spouse in the manner hereinafter provided:<br />

<br />

(1) In a division by cross-deed or deeds, between or among the tenants in common provided that the intent of the tenant in common to create a tenancy by the entirety with his or her spouse in this exchange of deeds must be clearly stated in the granting clause of the deed or deeds to such tenant and his or her spouse, and further provided that the deed or deeds to such tenant in common and his or her spouse is signed by such tenant in common and is acknowledged before a certifying officer in accordance with G.S. 52-10;<br />

<br />

(2) In a judicial proceeding for partition. In such proceeding, both spouses have the right to become parties to the proceeding and to have their pleadings state that the intent of the tenant in common is to create a tenancy by the entirety with his or her spouse. The order of partition shall provide that the real property assigned to such tenant and his or her spouse shall be owned by them as tenants by the entirety. (1969, c. 748, s. 1; 1977, c. 375, s. 11.)<br />

<br />

§ 39-13.6. Control of real property held in tenancy by the entirety.<br />

<br />

(a) A husband and wife shall have an equal right to the control, use, possession, rents, income, and profits of real property held by them in tenancy by the entirety. Neither spouse may bargain, sell, lease, mortgage, transfer, convey or in any manner encumber any property so held without the written joinder of the other spouse. This section shall not be construed to require the spouse’s joinder where a different provision is made under G.S. 39-13, G.S. 39-13.3, G.S. 39-13.4, or G.S. 52-10.<br />

<br />

(b) A conveyance of real property, or any interest therein, to a husband and wife vests title in them as tenants by the entirety when the conveyance is to:<br />

<br />

(1) A named man “and wife,” or<br />

<br />

(2) A named woman “and husband,” or<br />

<br />

(3) Two named persons, whether or not identified in the conveyance as husband and wife, if at the time of conveyance they are legallymarried;<br />

<br />

unless a contrary intention is expressed in the conveyance.<br />

<br />

(c) For income tax purposes, each spouse is considered to have received one-half (1/2) the income or loss from property owned by the couple as tenants by the entirety. (1981 (Reg. Sess., 1982), c. 1245, s. 1; 1983, c. 449, ss. 1, 2.)<br />

<br />

NORTH CAROLINA GENERAL STATUTES<br />

CHAPTER 39. CONVEYANCES.<br />

ARTICLE 9. DISCLOSURE.<br />

<br />

§ 39-50. Death, illness, or conviction of certain crimes not a material fact.<br />

<br />

In offering real property for sale it shall not be deemed a material fact that the real property was occupied previously by a person who died or had a serious illness while occupying the property or that a person convicted of any crime for which registration is required by Article 27A of Chapter 14 of the General Statutes occupies, occupied, or resides near the property; provided, however, that no seller may knowingly make a false statement regarding any such fact. (1989, c. 592, s. 1; 1998-212, s. 17.16A(a).)<br />

<br />

NORTH CAROLINA CASE LAW<br />

<br />

An installment land contract is a type of contract by which a buyer is required to make periodic payments towards the purchase price of land and only on the last payment is the seller required to deliver a deed. Such a contract is also called a “contract for deed” or “long-term land contract.”<br />

Boyd v. Watts, 316 N.C. 622 (1986)<br />

<br />

A long-term contract for the sale of land is a financing device in addition to being a contract dealing with the necessary details of the sale and purchase. Although possession of the property remains in the vendor if the long-term contract is silent on the subject, the vast majority of long-term contracts transfer possession to the vendee at the beginning of the payment period. Legal title remains in the vendor as security for payment of the purchase price. The purchaser generally agrees to pay taxes, insurance, and to maintain the property. Id.<br />

<br />

The relation between vendor and vendee in an executory agreement for the sale and purchase of land is substantially that subsisting between mortgagee and mortgagor, and governed by the same rules. The vendor may treat the default as a breach, thus making available to him various remedies. The vendor, inter alia, may bring an action to quiet title, accept the noncompliance as a forfeiture of the contract, or bring an action to declare it at an end. Id.

CHAPTER 39. CONVEYANCES.

ARTICLE 1. CONSTRUCTION AND SUFFICIENCY.

§ 39-1. Fee presumed, though word "heirs" omitted.

When real estate is conveyed to any person, the same shall be held and construed to be a conveyance in fee, whether the word "heir" is used or not, unless such conveyance in plain and express words shows, or it is plainly intended by the conveyance or some part thereof, that the grantor meant to convey an estate of less dignity. (1879, c. 148; Code, s. 1280; Rev., s. 946; C.S., s. 991.)

§ 39-1.1. In construing conveyances court shall give effect to intent of the parties.

(a) In construing a conveyance executed after January 1, 1968, in which there are inconsistent clauses, the courts shall determine the effect of the instrument on the basis of the intent of the parties as it appears from all of the provisions of the instrument.

(b) The provisions of subsection (a) of this section shall not prevent the application of the rule in Shelley's case. (1967, c. 1182.)

§ 39-2. Vagueness of description not to invalidate.

No deed or other writing purporting to convey land or an interest in land shall be declared void for vagueness in the description of the thing intended to be granted by reason of the use of the word "adjoining" instead of the words "bounded by," or for the reason that the boundaries given do not go entirely around the land described: Provided, it can be made to appear to the satisfaction of the jury that the grantor owned at the time of the execution of such deed or paper-writing no other land which at all corresponded to the description contained in such deed or paper-writing. (1891, c. 465, s. 2; Rev., s. 948; C.S., s. 992.)

§ 39-4. Conveyances by infant trustees.

When an infant is seized or possessed of any estate in trust, whether by way of mortgage or otherwise, for another person who may be entitled in law to have a conveyance of such estate, or may be declared to be seized or possessed, in the course of any proceeding in the superior court, the court may decree that the infant shall convey and assure such estate, in such manner as it may direct, to such other person; and every conveyance and assurance made in pursuance of such decree shall be as effectual in law as if made by a person of full age. (1821, c. 1116, ss. 1, 2; R.C., c. 37, s. 27; Code, s. 1265; Rev., s. 1036; C.S., s. 994.)

§ 39-5. Official deed, when official selling or empowered to sell is not in office.

When a sheriff, coroner, or tax collector, in virtue of his office, sells any real or personal property and goes out of office before executing a proper deed therefor, he may execute the same after his term of office has expired; and when he dies or removes from the State before executing the deed, his successor in office shall execute it. When a sheriff or tax collector dies having a tax list in his hands for collection, and his personal representative or surety, in collecting the taxes, makes sale according to law, his successor in office shall execute the conveyance for the property to the person entitled. (R.C., c. 37, s. 30; Code, s. 1267; 1891, c. 242; Rev., ss. 950, 951; C.S., s. 995; 1971, c. 528, s. 36.)

§ 39-6. Revocation of deeds of future interests made to persons not in esse.

The grantor in any voluntary conveyance in which some future interest in real estate is conveyed or limited to a person not in esse may, at any time before he comes into being, revoke by deed such interest so conveyed or limited. This deed of revocation shall be registered as other deeds; and the grantor of like interest for a valuable consideration may, with the joinder of the person from whom the consideration moved, revoke said interest in like manner. The grantor, maker or trustor who has heretofore created or may hereafter create a voluntary trust estate in real or personal property for the use and benefit of himself or of any other person or persons in esse with a future contingent interest to some person or persons not in esse or not determined until the happening of a future event may at any time, prior to the happening of the contingency vesting the future estates, revoke the grant of the interest to such person or persons not in esse or not determined by a proper instrument to that effect; and the grantor of like interest for a valuable consideration may, with the joinder of the person from whom the consideration moved, revoke said interest in like manner: Provided, that in the event the instrument creating such estate has been recorded, then the deed of revocation of such estate shall be likewise recorded before it becomes effective: Provided, further, that this section shall not apply to any instrument hereafter executed creating such a future contingent interest when said instrument shall expressly state in effect that the grantor, maker, or trustor may not revoke such interest: Provided, further, that this section shall not apply to any instrument heretofore executed whether or not such instrument contains express provisions that it is irrevocable unless the grantor, maker, or trustor shall within six months after the effective date of this proviso either revoke such future interest, or file with the trustee an instrument stating or declaring that it is his intention to retain the power to revoke under this section: Provided, further, that in the event the instrument creating such estate has been recorded, then the revocation or declaration shall likewise be recorded before it becomes effective. (1893, c. 498; Rev., s. 1045; C.S., s. 996; 1929, c. 305; 1941, c. 264; 1943, c. 437.)

§ 39-6.1. Validation of deeds of revocation of conveyances of future interests to persons not in esse.

All deeds or instruments heretofore executed, revoking any conveyance of future interest made to persons not in esse, are hereby validated insofar as any such deed of revocation may be in conflict with the provisions of G.S. 39-6.

All such deeds of revocation heretofore executed are hereby validated and no such deed of revocation shall be held to be invalid by reason of not having been executed within the six-month period prescribed in the third proviso of G.S. 39-6. (1947, c. 62.)

§ 39-6.2. Creation of interest or estate in personal property.

Any interest or estate in personal property which may be created by last will and testament may also be created by a written instrument of transfer. (1953, c. 198.)

§ 39-6.3. Inter vivos and testamentary conveyances of future interests permitted.

(a) The conveyance, by deed or will, of an existing future interest shall not be ineffective on the sole ground that the interest so conveyed is future or contingent. All future interests in real or personal property, including all reversions, executory interests, vested and contingent remainders, rights of entry both before and after breach of condition and possibilities of reverter may be conveyed by the owner thereof, by an otherwise legally effective conveyance, inter vivos or testamentary, subject, however, to all conditions and limitations to which such future interest is subject.

(b) The power to convey as provided in subsection (a), can be exercised by any form of conveyance, inter vivos or testamentary, which is otherwise legally effective in this State at the date of such conveyance to transfer a present estate of the same duration in the property.

(c) This section shall apply only to conveyances which become operative to transfer title on or after October 1, 1961. (1961, c. 435.)

§ 39-6.4. Creation of easements, restrictions, and conditions.

(a) The holder of legal or equitable title of an interest in real property may create, grant, reserve, or declare valid easements, restrictions, or conditions of record burdening or benefiting the same interest in real property.

(b) Subsection (a) of this section shall not affect the application of the doctrine of merger after the severance and subsequent reunification of title to all of the benefited or burdened real property or interests therein. (1997-333, s. 1.)<br />

<br />

§ 39-6.5. Elimination of seal.<br />

<br />

The seal of the signatory shall not be necessary to effect a valid conveyance of an interest in real property; provided, that this section shall not affect the requirement for affixing a seal of the officer taking an acknowledgment of the instrument. (1999-221, s. 2.)<br />

<br />

§ 39-6.6. Subordination agreements.<br />

<br />

(a) A subordination agreement shall be given effect in accordance with its terms and is not required to state any interest rate, principal amount secured, or other financial terms.<br />

<br />

(b) The trustee of a deed of trust shall not be a necessary party to a subordination agreement unless the deed of trust provides otherwise.<br />

<br />

(c) For purposes of G.S. 1-47, a subordination agreement is deemed a conveyance of an interest in real property.<br />

<br />

(d) This section is not exclusive. No subordination agreement that is otherwise valid shall be invalidated by this section.<br />

<br />

(e) This section applies to a subordination agreement regardless of when the agreement was signed by the party or parties thereto, except that this section does not apply to an agreement that (i) is the subject of litigation pending on the effective date of this subsection, and (ii) was filed or recorded before October 1, 2003.<br />

<br />

(f) In this section:<br />

<br />

(1) “Interest in real property” includes all rights, title, and interest in and to land, buildings, and other improvements of an owner, tenant, subtenant, secured lender, materialman, judgment creditor, lienholder, or other person, whether the interest in real property is evidenced by a deed, easement, lease, sublease, deed of trust, mortgage, assignment of leases and rents, judgment, claim of lien, or any other record, instrument, document, or entry of court.<br />

<br />

(2) “Subordination agreement” means a written commitment or agreement to subordinate or that subordinates an interest in real property signed by a person entitled to priority. (2003-219, s. 1; 2005-212, s. 1.)<br />

<br />

NORTH CAROLINA GENERAL STATUTES<br />

CHAPTER 39. CONVEYANCES.<br />

ARTICLE 2. CONVEYANCES BY HUSBAND AND WIFE.<br />

<br />

§ 39-7. Instruments affecting married person’s title; joinder of spouse; exceptions.<br />

<br />

(a) In order to waive the elective life estate of either husband or wife as provided for in G.S. 29-30, every conveyance or other instrument affecting the estate, right or title of any married person in lands, tenements or hereditaments must be executed by such husband or wife, and due proof or acknowledgment thereof must be made and certified as provided by law.<br />

<br />

(b) A married person may bargain, sell, lease, mortgage, transfer and convey any of his or her separate real estate without joinder or other waiver by his or her spouse if such spouse is incompetent and a guardian or trustee has been appointed as provided by the laws of North Carolina, and if the appropriate instrument is executed by the married person and the guardian or trustee of the incompetent spouse and is probated and registered in accordance with law, it shall convey all the estate and interest as therein intended of the married person in the land conveyed, free and exempt from the elective life estate as provided in G.S. 29-30 and all other interests of the incompetent spouse.<br />

<br />

(c) Subsection (a) shall not be construed to require the spouse’s joinder or other waiver of the elective life estate of such spouse as provided for in G.S. 29-30 where a different provision is made or provided for in the General Statutes including, but not limited to, G.S. 39-13, 39-13.3, 39-13.4, 31A-1(d), and 52-10. (C.C.P., s. 429; subsec. 6; 1868-9, c. 277, s. 15; Code, s. 1256; 1899, c. 235, s. 9; Rev., s. 952; C.S., s. 997; 1945, c. 73, s. 4; 1957, c. 598, s. 3; 1965, c. 855.)<br />

<br />

§ 39-7.1. Certain instruments affecting married woman’s title not executed by husband validated.<br />

<br />

No conveyance, power of attorney, or other instrument affecting the estate, right or title of any married woman in lands, tenements or hereditaments which was executed by such married woman prior to June 8, 1965, shall be invalid for the reason that the instrument was not also executed by the husband of such married woman. (1965, c. 857; 1973, c. 853, s. 1.)<br />

<br />

§ 39-8. Acknowledgment at different times and places; before different officers; order immaterial.<br />

<br />

In all cases of deeds, or other instruments executed by husband and wife and requiring registration, the probate of such instruments as to the husband and due proof or acknowledgment of the wife may be taken before different officers authorized by law to taken probate of deeds, and at different times and places, whether both of said officials reside in this State or only one in this State and the other in another state or country. And in taking the probate of such instruments executed by husband and wife, it is immaterial whether the execution of the instrument was proven as to or acknowledged by the husband before or after due proof as to or acknowledgment of the wife. (1895, c. 136; 1899, c. 235, s. 9; Rev., s. 953; C.S., s. 998; 1945, c. 73, s. 5.)<br />

<br />

§ 39-9. Absence of wife’s acknowledgment does not affect deed as to husband.<br />

<br />

When an instrument purports to be signed by a husband and wife the instrument may be ordered registered, if the acknowledgment of the husband is duly taken, but no such instrument shall be the act or deed of the wife unless proven or acknowledged by her according to law. (1889, c. 235, s. 8; 1901, c. 637; Rev., s. 954; C.S., s. 999; 1945, c. 73, s. 6.)<br />

<br />

§ 39-11. Certain conveyances not affected by fraud if acknowledgment or privy examination regular.<br />

<br />

No deed conveying lands nor any instrument required or allowed by law to be registered, executed by husband and wife since the eleventh of March, 1889, if the acknowledgment or private examination of the wife is thereto certified as prescribed by law, shall be invalid because its execution or acknowledgment was procured by fraud, duress or undue influence, unless it is shown that the grantee or person to whom the instrument was made participated in the fraud, duress or undue influence, or had notice thereof before the delivery of the instrument. Where such participation or notice is shown, an innocent purchaser for value under the grantee or person to whom the instrument was made shall not be affected by such fraud, duress or undue influence. (1889, c. 389; 1899, c. 235, s. 10; Rev., s. 956; C.S., s. 1001; 1945, c. 73, s. 7.)<br />

<br />

§ 39-12. Power of attorney of married person.<br />

<br />

Every competent married person of lawful age is authorized to execute, without the joinder of his or her spouse, instruments creating powers of attorney affecting the real and personal property of such married person naming either third parties or, subject to the provisions of G.S. 52-10 or 52-10.1, his or her spouse as attorney-in-fact. When such a married person executes a power of attorney authorized by the preceding sentence naming his or her spouse as attorney in fact the acknowledgment by the spouse of the grantor is not necessary. Such instruments may confer upon the attorney, and the attorney may exercise, any and all powers which lawfully can be conferred upon an attorney-in-fact, including, but not limited to, the authority to join in conveyances of real property for the purpose of waiving or quitclaiming any rights which may be acquired as a surviving spouse under the provisions of G.S. 29-30. (1798, c. 510; R.C., c. 37, s. 11; Code, s. 1257; Rev., s. 957; C.S., s. 1002; 1965, c. 856; 1977, c. 375, s. 7; 1979, c. 528, s. 8.)<br />

<br />

§ 39-13. Spouse need not join in purchase-money mortgage.<br />

<br />

The purchaser of real estate who does not pay the whole of the purchase money at the time when he or she takes a deed for title may make a mortgage or deed of trust for securing the payment of such purchase money, or such part thereof as may remain unpaid, which shall be good and effectual against his or her spouse as well as the purchaser, without requiring the spouse to join in the execution of such mortgage or deed of trust. (1868-9, c. 204; Code, s. 1272; Rev., s. 958; 1907, c. 12; C.S., s. 1003; 1965, c. 852.)<br />

<br />

§ 39-13.1. Validation of certain deeds, etc., executed by married women without private examination.<br />

<br />

(a) No deed, contract, conveyance, leasehold or other instrument executed since the seventh day of November, 1944, shall be declared invalid because of the failure to take the private examination of any married woman who was a party to such deed, contract, conveyance, leasehold or other instrument.<br />

<br />

(b) Any deed, contract, conveyance, lease or other instrument executed prior to February 7, 1945, which is in all other respects regular except for the failure to take the private examination of a married woman who is a party to such deed, contract, conveyance, lease or other instrument is hereby validated and confirmed to the same extent as if such private examination had been taken, provided that this section shall not apply to any instruments now involved in any pending litigation. (1945, c. 73, s. 21 1/2; 1969, c. 1008, s. 1.)<br />

<br />

§ 39-13.2. Married persons under 18 made competent as to certain transactions; certain transactions validated.<br />

<br />

(a) Any married person under 18 years of age is authorized and empowered and shall have the same privileges as are conferred upon married persons 18 years of age or older to:<br />

<br />

(1) Waive, release or renounce by deed or other written instrument any right or interest which he or she may have in the real or personal property (tangible or intangible) of the other spouse; or<br />

<br />

(2) Jointly execute with his or her spouse, if such spouse is 18 years of age or older, any note, contract of insurance, deed, deed of trust, mortgage, lien of whatever nature or other instrument with respect to real or personal property (tangible or intangible) held with such other spouse either as tenants by the entirety, joint tenants, tenants in common, or in any other manner.<br />

<br />

(b) Any transaction between a husband and wife pursuant to this section shall be subject to the provisions of G.S. 52-10 or 52-10.1 whenever applicable.<br />

<br />

(c) No renunciation of dower or curtesy or of rights under G.S. 29-30(a) by a married person under the age of 21 years after June 30, 1960, and until April 7, 1961, shall be invalid because such person was under such age. No written assent by a husband under the age of 21 years to a conveyance of the real property of his wife after June 30, 1960, and until April 7, 1961, shall be invalid because such husband was under such age. (1951, c. 934, s. 1; 1955, c. 376; 1961, c. 184; 1965, c. 851; c. 878, s. 2; 1971, c. 1231, s. 1; 1977, c. 375, s. 8.)<br />

<br />

§ 39-13.3. Conveyances between husband and wife.<br />

<br />

(a) A conveyance from a husband or wife to the other spouse of real property or any interest therein owned by the grantor alone vests such property or interest in the grantee.<br />

<br />

(b) A conveyance of real property, or any interest therein, by a husband or a wife to such husband and wife vests the same in the husband and wife as tenants by the entirety unless a contrary intention is expressed in the conveyance.<br />

<br />

(c) A conveyance from a husband or a wife to the other spouse of real property, or any interest therein, held by such husband and wife as tenants by the entirety dissolves such tenancy in the property or interest conveyed and vests such property or interest formerly held by the entirety in the grantee.<br />

<br />

(d) The joinder of the spouse of the grantor in any conveyance made by a husband or a wife pursuant to the foregoing provisions of this section is not necessary.<br />

<br />

(e) Any conveyance authorized by this section is subject to the provisions of G.S. 52-10 or 52-10.1, except that acknowledgment by the spouse of the grantor is not necessary. (1957, c. 598, s. 1; 1965, c. 878, s. 3; 1977, c. 375, s. 9.)<br />

<br />

§ 39-13.4. Conveyances by husband or wife under deed of separation.<br />

<br />

Any conveyance of real property, or any interest therein, by the husband or wife who have previously executed a valid and lawful deed of separation which authorizes said husband or wife to convey real property or any interest therein without the consent and joinder of the other and which deed of separation or a memorandum of the deed of separation setting forth such authorization is recorded in the county where the land lies, shall be valid to pass such title as the conveying spouse may have to his or her grantee and shall pass such title free and clear of all rights in such property and free and clear of such interest in property that the other spouse might acquire solely as a result of the marriage, including any rights arising under G.S. 29-30, unless an instrument in writing canceling the deed of separation or memorandum thereof and properly executed and acknowledged by said husband and wife is recorded in the office of said register of deeds. The instrument which is registered under this section to authorize the conveyance of an interest in real property or the cancellation of the deed of separation or memorandum thereof shall comply with the provisions of G.S. 52-10 or 52-10.1.<br />

<br />

All conveyances of any interest in real property by a spouse who had previously executed a valid and lawful deed of separation, or separation agreement, or property settlement, which authorized the parties thereto to convey real property or any interest therein without the consent and joinder of the other, when said deed of separation, separation agreement, or property settlement, or a memorandum of the deed of separation, separation agreement, property settlement, setting forth such authorization, had been previously recorded in the county where the property is located, and when such conveyances were executed before October 1, 1981, shall be valid to pass such title as the conveying spouse may have to his or her grantee, and shall pass such to him free and clear of rights in such property and free and clear of such interest in such property that the other spouse might acquire solely as a result of the marriage, including any rights arising under G.S. 29-30, unless an instrument in writing canceling the deed of separation, separation agreement, or property settlement, or memorandum thereof, properly executed and acknowledged by said husband and wife, is recorded in the office of said register of deeds. The instrument which is registered under this section to authorize the conveyance of an interest in real property or the cancellation of the deed of separation, separation agreement, property settlement, or memorandum thereof shall comply with G.S. 52-10 or 52-10.1. (1959, c. 512; 1973, c. 133; 1977, c. 375, s. 10; 1981, c. 599, ss. 10, 11.)<br />

<br />

§ 39-13.5. Creation of tenancy by entirety in partition of real property.<br />

<br />

When either a husband or a wife owns an undivided interest in real property as a tenant in common with some person or persons other than his or her spouse and there occurs an actual partition of the property, a tenancy by the entirety may be created in the husband or wife who owned the undivided interest and his or her spouse in the manner hereinafter provided:<br />

<br />

(1) In a division by cross-deed or deeds, between or among the tenants in common provided that the intent of the tenant in common to create a tenancy by the entirety with his or her spouse in this exchange of deeds must be clearly stated in the granting clause of the deed or deeds to such tenant and his or her spouse, and further provided that the deed or deeds to such tenant in common and his or her spouse is signed by such tenant in common and is acknowledged before a certifying officer in accordance with G.S. 52-10;<br />

<br />

(2) In a judicial proceeding for partition. In such proceeding, both spouses have the right to become parties to the proceeding and to have their pleadings state that the intent of the tenant in common is to create a tenancy by the entirety with his or her spouse. The order of partition shall provide that the real property assigned to such tenant and his or her spouse shall be owned by them as tenants by the entirety. (1969, c. 748, s. 1; 1977, c. 375, s. 11.)<br />

<br />

§ 39-13.6. Control of real property held in tenancy by the entirety.<br />

<br />

(a) A husband and wife shall have an equal right to the control, use, possession, rents, income, and profits of real property held by them in tenancy by the entirety. Neither spouse may bargain, sell, lease, mortgage, transfer, convey or in any manner encumber any property so held without the written joinder of the other spouse. This section shall not be construed to require the spouse’s joinder where a different provision is made under G.S. 39-13, G.S. 39-13.3, G.S. 39-13.4, or G.S. 52-10.<br />

<br />

(b) A conveyance of real property, or any interest therein, to a husband and wife vests title in them as tenants by the entirety when the conveyance is to:<br />

<br />

(1) A named man “and wife,” or<br />

<br />

(2) A named woman “and husband,” or<br />

<br />

(3) Two named persons, whether or not identified in the conveyance as husband and wife, if at the time of conveyance they are legallymarried;<br />

<br />

unless a contrary intention is expressed in the conveyance.<br />

<br />

(c) For income tax purposes, each spouse is considered to have received one-half (1/2) the income or loss from property owned by the couple as tenants by the entirety. (1981 (Reg. Sess., 1982), c. 1245, s. 1; 1983, c. 449, ss. 1, 2.)<br />

<br />

NORTH CAROLINA GENERAL STATUTES<br />

CHAPTER 39. CONVEYANCES.<br />

ARTICLE 9. DISCLOSURE.<br />

<br />

§ 39-50. Death, illness, or conviction of certain crimes not a material fact.<br />

<br />

In offering real property for sale it shall not be deemed a material fact that the real property was occupied previously by a person who died or had a serious illness while occupying the property or that a person convicted of any crime for which registration is required by Article 27A of Chapter 14 of the General Statutes occupies, occupied, or resides near the property; provided, however, that no seller may knowingly make a false statement regarding any such fact. (1989, c. 592, s. 1; 1998-212, s. 17.16A(a).)<br />

<br />

NORTH CAROLINA CASE LAW<br />

<br />

An installment land contract is a type of contract by which a buyer is required to make periodic payments towards the purchase price of land and only on the last payment is the seller required to deliver a deed. Such a contract is also called a “contract for deed” or “long-term land contract.”<br />

Boyd v. Watts, 316 N.C. 622 (1986)<br />

<br />

A long-term contract for the sale of land is a financing device in addition to being a contract dealing with the necessary details of the sale and purchase. Although possession of the property remains in the vendor if the long-term contract is silent on the subject, the vast majority of long-term contracts transfer possession to the vendee at the beginning of the payment period. Legal title remains in the vendor as security for payment of the purchase price. The purchaser generally agrees to pay taxes, insurance, and to maintain the property. Id.<br />

<br />

The relation between vendor and vendee in an executory agreement for the sale and purchase of land is substantially that subsisting between mortgagee and mortgagor, and governed by the same rules. The vendor may treat the default as a breach, thus making available to him various remedies. The vendor, inter alia, may bring an action to quiet title, accept the noncompliance as a forfeiture of the contract, or bring an action to declare it at an end. Id.