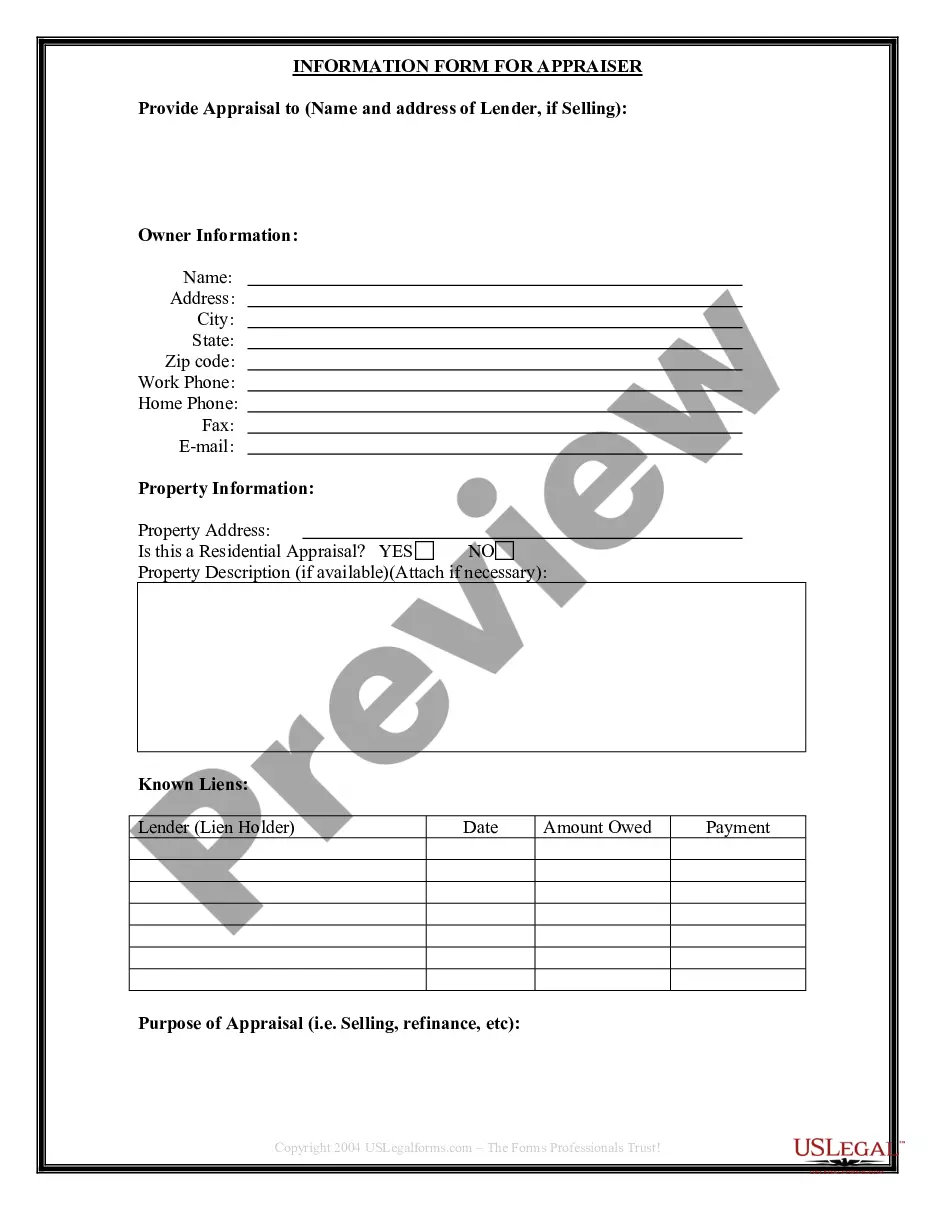

Cary North Carolina Seller's Information for Appraiser is a comprehensive document provided by sellers to appraisers to help evaluate the value of a property. This information holds significant importance for buyers as it assists them in making informed decisions before purchasing a property in Cary, North Carolina. Several types of essential information are included in this document, such as: 1. Property Details: This section provides a detailed description of the property, including its address, size, lot dimensions, and the type of property (single-family home, townhouse, condominium, etc.). It may also include information about any additional structures, such as garages or sheds, present on the premises. 2. Property Features: Here, sellers outline the notable features and upgrades of the property. They can include details about the number of bedrooms and bathrooms, flooring materials, energy-saving features, fireplaces, or any other amenities that could potentially add value to the property. 3. Renovations and Improvements: Sellers provide information about any recent renovations or improvements made to the property. This may include upgrades to the kitchen or bathrooms, installation of new appliances, flooring replacements, or repairs to the roof, HVAC system, or plumbing. 4. Maintenance History: In this section, sellers outline the maintenance history of the property. They may include details about routine maintenance activities, such as regular servicing of the HVAC system, pest control treatments, landscaping, or any repairs made to the property over the years. 5. Property Tax Information: Sellers provide the property tax details, including the assessed value, annual tax amount, and any pending tax assessments. This information is crucial for appraisers as it helps them determine the property's current and future tax liabilities. 6. Homeowners Association (HOA) Information: If the property is part of an HOA, sellers provide details about the association, including its name, contact information, membership fees, and any rules and regulations that apply to the property. This information is valuable to appraisers as it affects the property's overall value and desirability to potential buyers. 7. Comparable Sales: To further assist appraisers, sellers may provide information on recent comparable sales in the area. This helps appraisers evaluate the property's value in relation to similar properties in the Cary, North Carolina market. By providing the Cary North Carolina Seller's Information for Appraiser, sellers enable appraisers to assess the property's fair market value accurately. This mutually beneficial information exchange helps buyers make well-informed decisions about their potential investment in Cary's real estate market.

Cary North Carolina Seller's Information for Appraiser provided to Buyer

Description

How to fill out Cary North Carolina Seller's Information For Appraiser Provided To Buyer?

Do you require a reliable and economical supplier of legal documents to purchase the Cary North Carolina Seller's Information for Appraiser given to Buyer? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your separation or divorce in court, we have you covered. Our site offers over 85,000 updated legal document templates for both personal and business needs. All templates we provide are not generic and are tailored based on the laws of specific states and regions.

To obtain the form, you must Log Into your account, locate the needed form, and click the Download button adjacent to it. Please remember that you can access your previously acquired document templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can create an account quickly, but before that, make sure to do the following.

Now you can register your account. Then select the subscription option and continue to payment. Once the payment is finalized, download the Cary North Carolina Seller's Information for Appraiser provided to Buyer in any available file format. You can revisit the website whenever you wish and redownload the form at no additional cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online for good.

- Check if the Cary North Carolina Seller's Information for Appraiser provided to Buyer complies with the regulations of your state and local jurisdiction.

- Review the details of the form (if available) to understand who and what the form is meant for.

- Start the search anew if the form is not suitable for your particular situation.

Form popularity

FAQ

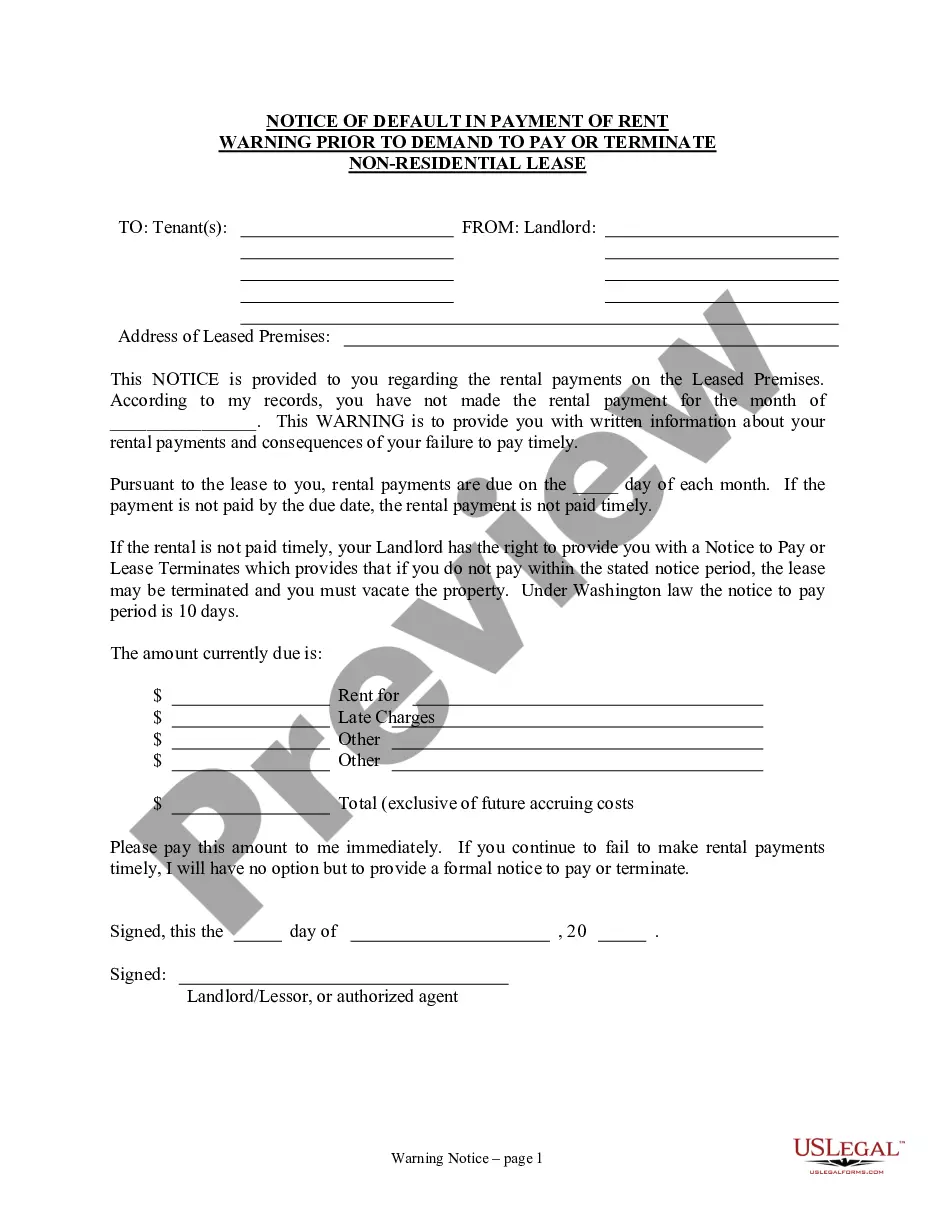

Just keep your communication to the appraiser about the facts of the home and neighborhood, how you priced the house, and any other relevant information you think the appraiser should know. And remember, don't discuss value. Don't pressure the appraiser to 'hit the value' and you'll be fine.

An appraiser must not engage in criminal conduct. An appraiser must perform assignments without partiality. He or she must have objectivity and independence, and be without accommodation of personal interest. In appraisal practice, an appraiser must not perform as an advocate for any party or issue.

While neither due diligence money nor earnest money is mandatory in North Carolina, most contracts negotiate to include both. Due diligence money is non-refundable, whereas earnest money is refundable if the buyer decides not to buy the home within the due diligence period.

Can a seller back out after a low home appraisal? Only the buyer can back out of a contract if the home's appraisal comes in too low. This also is dependent on the buyer having an appraisal clause in their purchase agreement.

4) CALIFORNIA (b) Subdivision (a) does not prohibit a person with an interest in a real estate transaction from asking an appraiser to do any of the following: (1) Consider additional, appropriate property information. (2) Provide further detail, substantiation, or explanation for the appraiser's value conclusion.

If an appraisal comes back low, a buyer can go back to the seller and negotiate a lower sale price or walk away from the sale entirely. For the buyer and seller to both get what they want ? a home that sells ? the seller may seriously consider lowering the price.

Your lender leverages the appraisal to determine how much money it is willing to provide to finance your home. If the appraisal on the home comes in significantly lower than what you offered, you could be on the hook to make up the difference or risk losing the home.

Can A Seller Back Out If The Appraisal Is Too Low? While an appraisal contingency allows a buyer to walk away from a sale if they're not happy with the appraisal, sellers who are put into this position are also able to back out.

Lenders are not allowed to initiate dialogue with an appraiser at any time or discuss appraisal after receipt of report. during the assignment, the appraisal department must be aware in advance of all communication between the loan officer and the appraiser.

Can I speak to the appraiser? Yes! Regulations allow real estate agents, or other persons with an interest in the real estate transaction, to communicate with the appraiser and provide additional property information, including a copy of the sales contract.