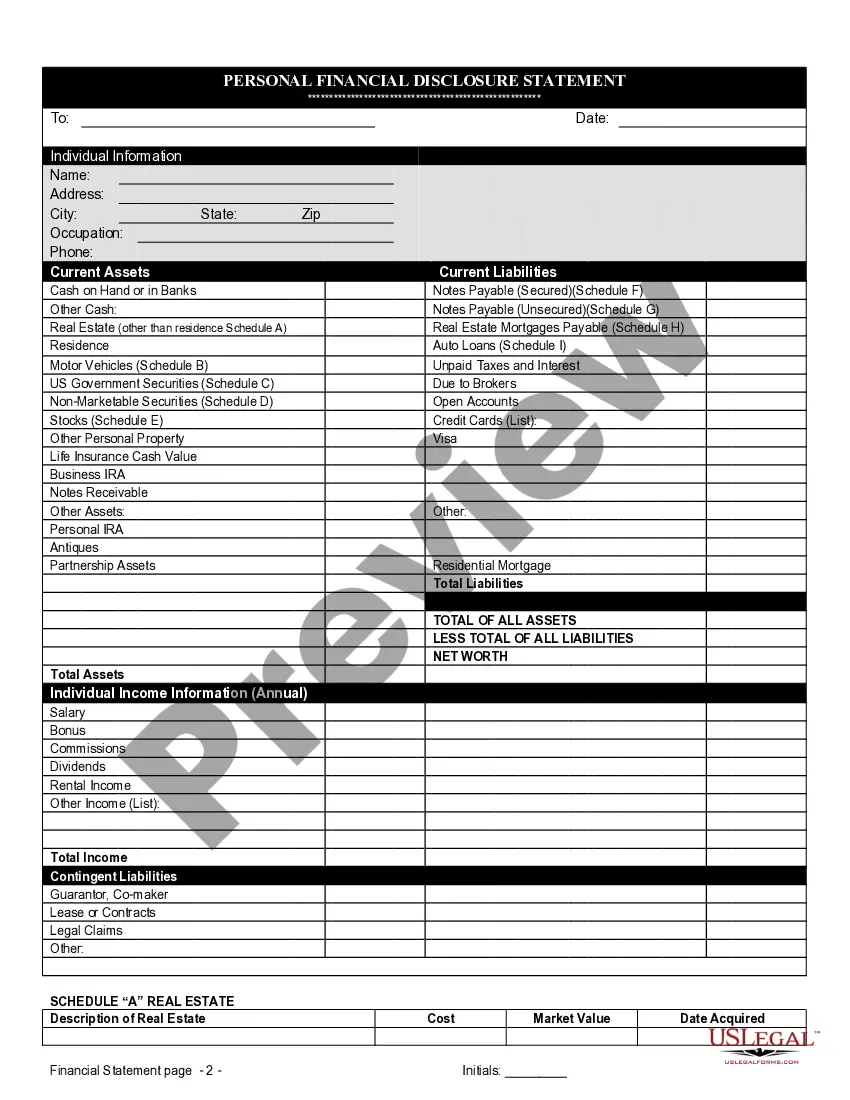

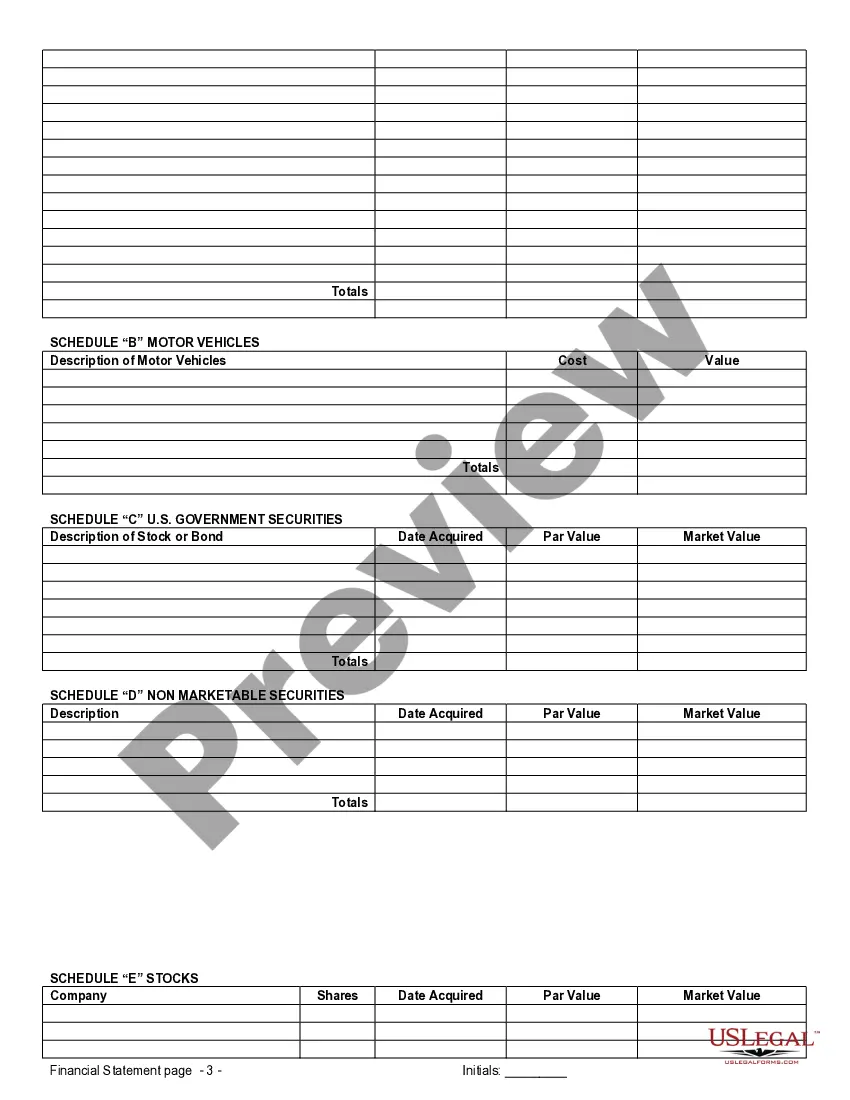

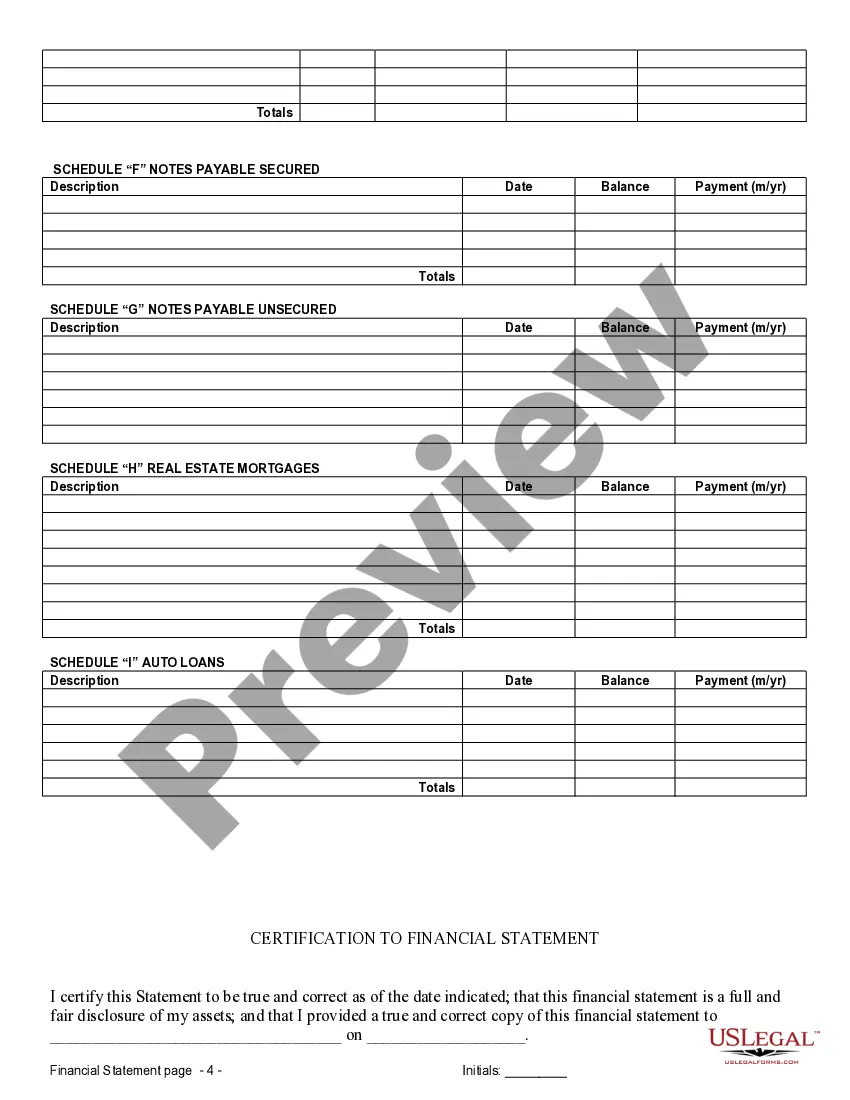

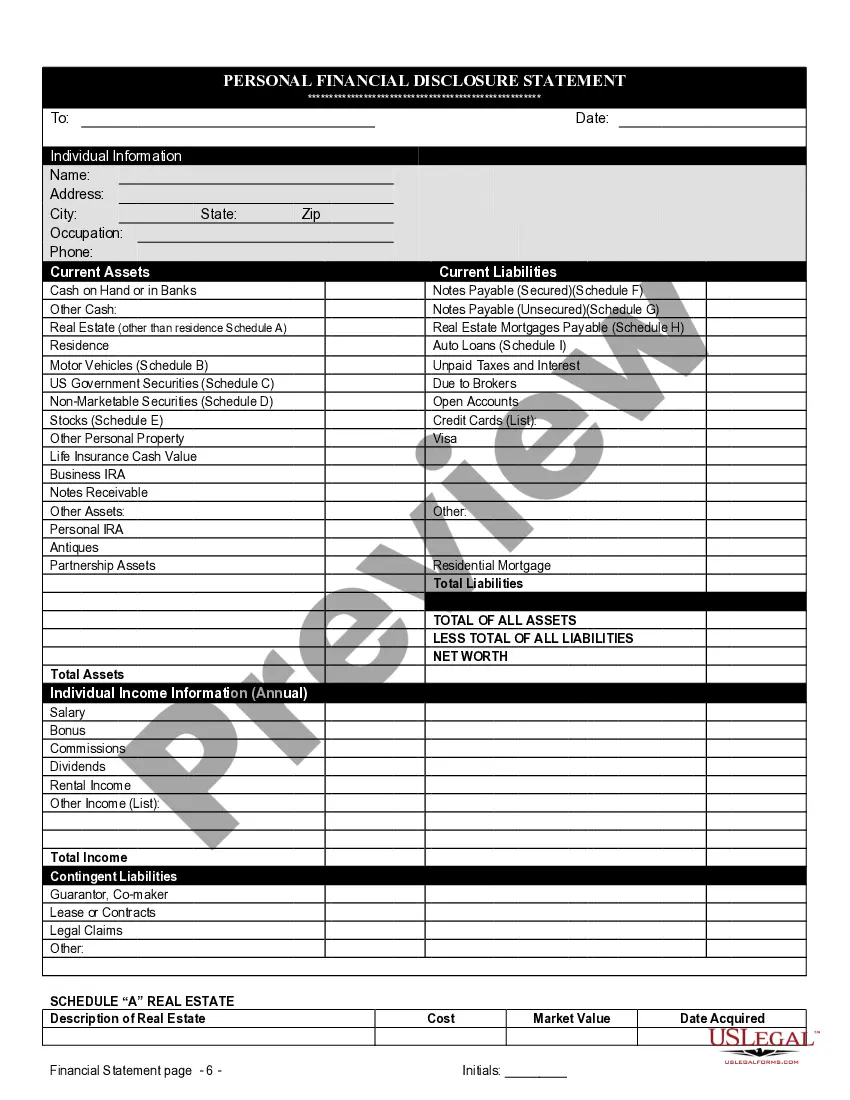

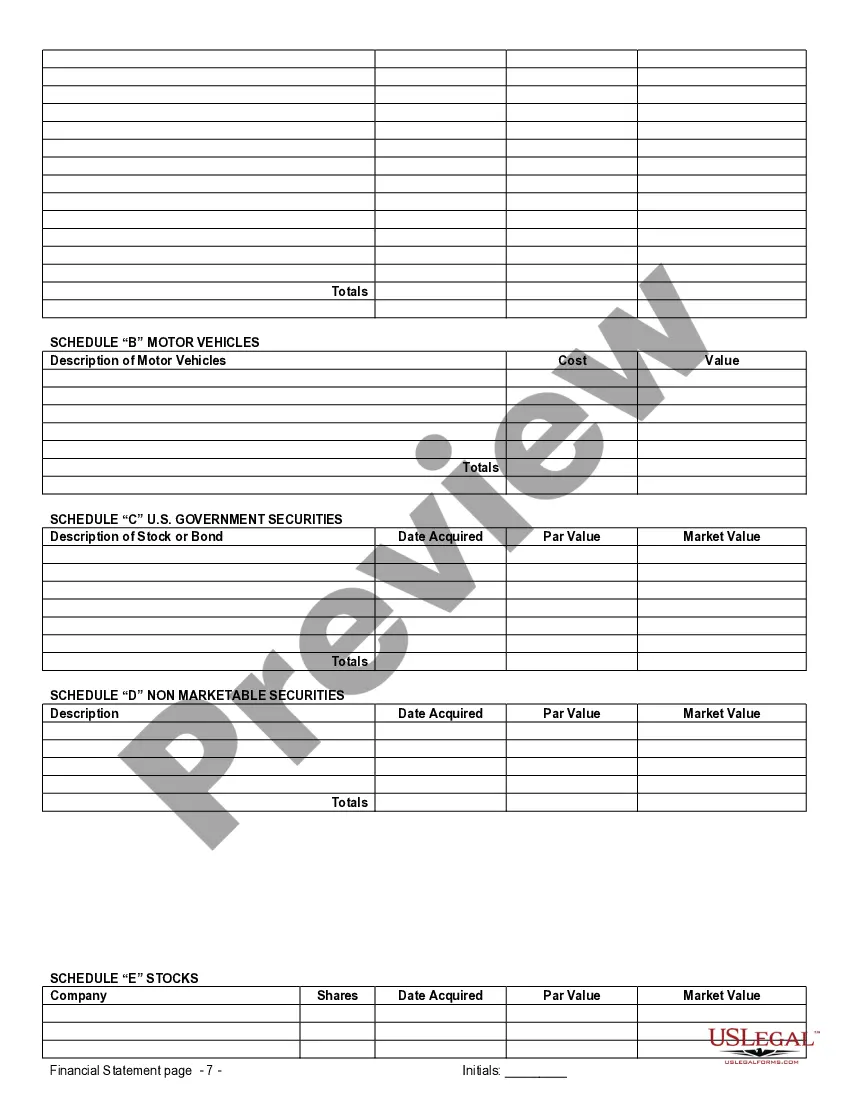

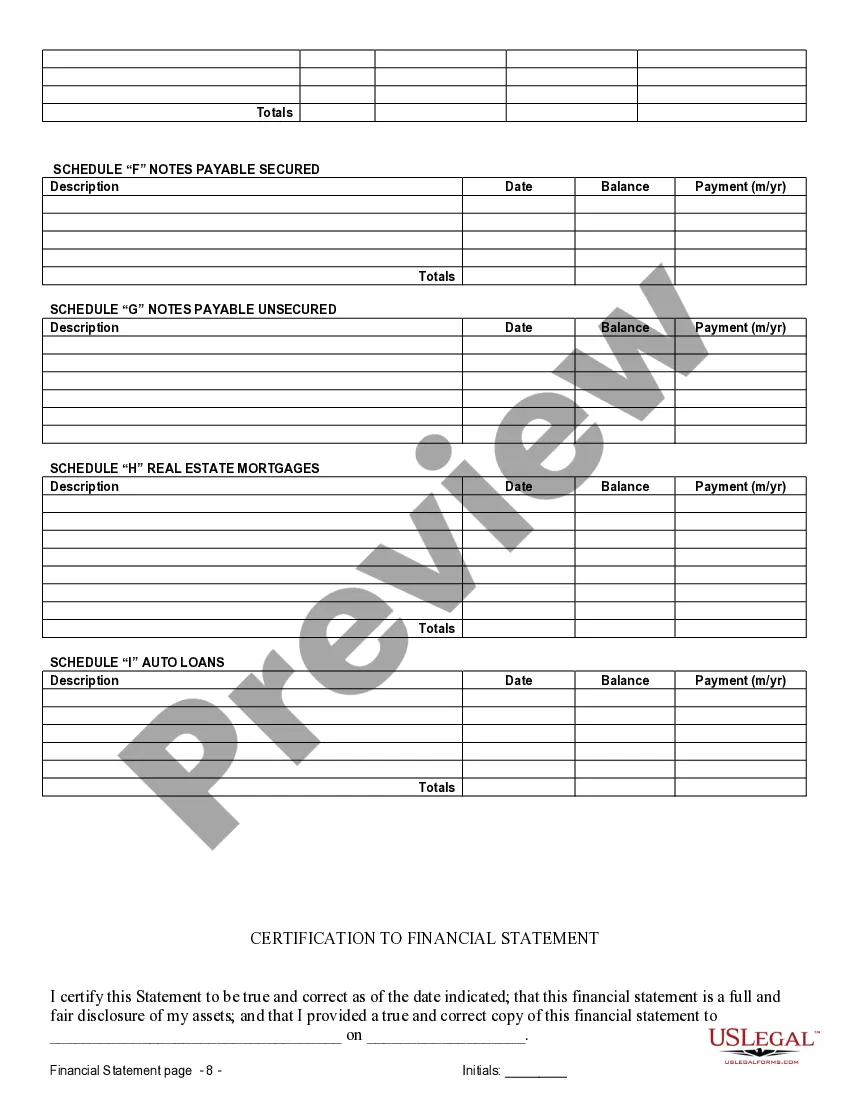

Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement is a crucial aspect of legal documentation necessary for couples planning to enter into a marital agreement. These financial statements provide a comprehensive snapshot of each individual's financial situation, assets, liabilities, and income to ensure transparency and facilitate fair decision-making in the event of a divorce or separation. Here are some key details related to Cary North Carolina Financial Statements in connection with prenuptial or premarital agreements: 1. What are Cary North Carolina Financial Statements? Cary North Carolina Financial Statements are official documents that outline detailed information about an individual's financial status, including income, expenses, assets, and liabilities. These statements provide a clear understanding of each party's financial situation, helping to establish a foundation for fair and equitable prenuptial or premarital agreements. 2. Importance of Cary North Carolina Financial Statements in Prenuptial Agreements Financial statements play a vital role in prenuptial or premarital agreements, as they help both parties disclose their financial positions transparently. These statements allow individuals to outline their separate assets, debts, and income accurately, mitigating potential disputes related to the distribution of property or alimony in case of a divorce. 3. Types of Cary North Carolina Financial Statements There are several types of financial statements relevant to Cary, North Carolina, prenuptial or premarital agreements. These may include: a) Personal Income Statements: These statements outline an individual's personal income, including salary, commissions, bonuses, and other sources of earnings. b) Personal Balance Sheets: Personal balance sheets enumerate an individual's assets, such as real estate, bank accounts, investments, vehicles, and personal belongings, along with liabilities like mortgages, loans, and credit card debts. c) Business Financial Statements: In cases where one or both parties own a business, additional financial statements related to the business may be required. These can include business income statements, balance sheets, and cash flow statements, among others. d) Tax Returns: Copies of recent tax returns are often required as supporting documents to verify an individual's income and financial situation. 4. Guidelines for Preparing Cary North Carolina Financial Statements When preparing financial statements in connection with prenuptial or premarital agreements in Cary, North Carolina, individuals must follow certain guidelines: a) Provide accurate and up-to-date information. b) Include all relevant financial documents, such as bank statements, investment portfolios, and tax returns. c) Seek professional guidance, such as that of an attorney or financial planner, to ensure compliance with local laws and regulations. In conclusion, Cary North Carolina Financial Statements in connection with prenuptial or premarital agreements are essential documents designed to foster transparency and promote fair decision-making regarding property division, alimony, and other financial matters in the event of a divorce. It is crucial for individuals to adhere to the legal guidelines and seek professional assistance to ensure that these statements accurately reflect their financial positions.

Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Cary North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve chosen the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!