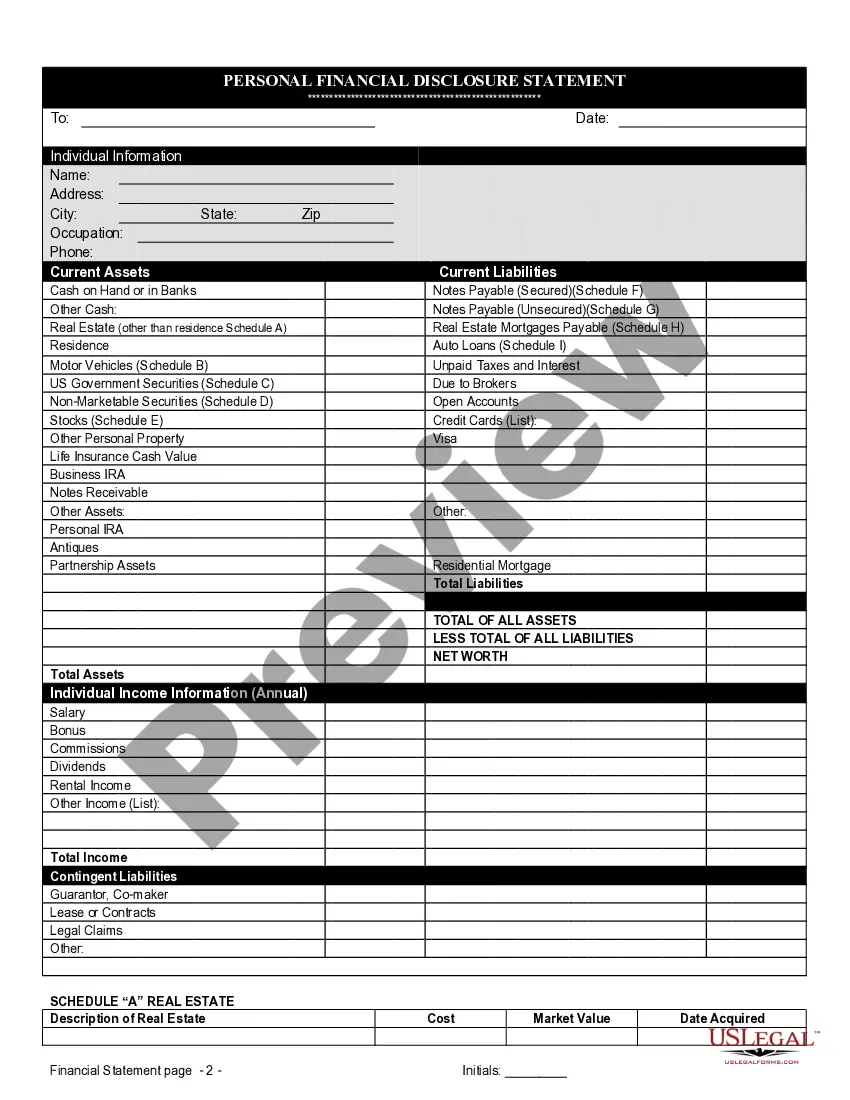

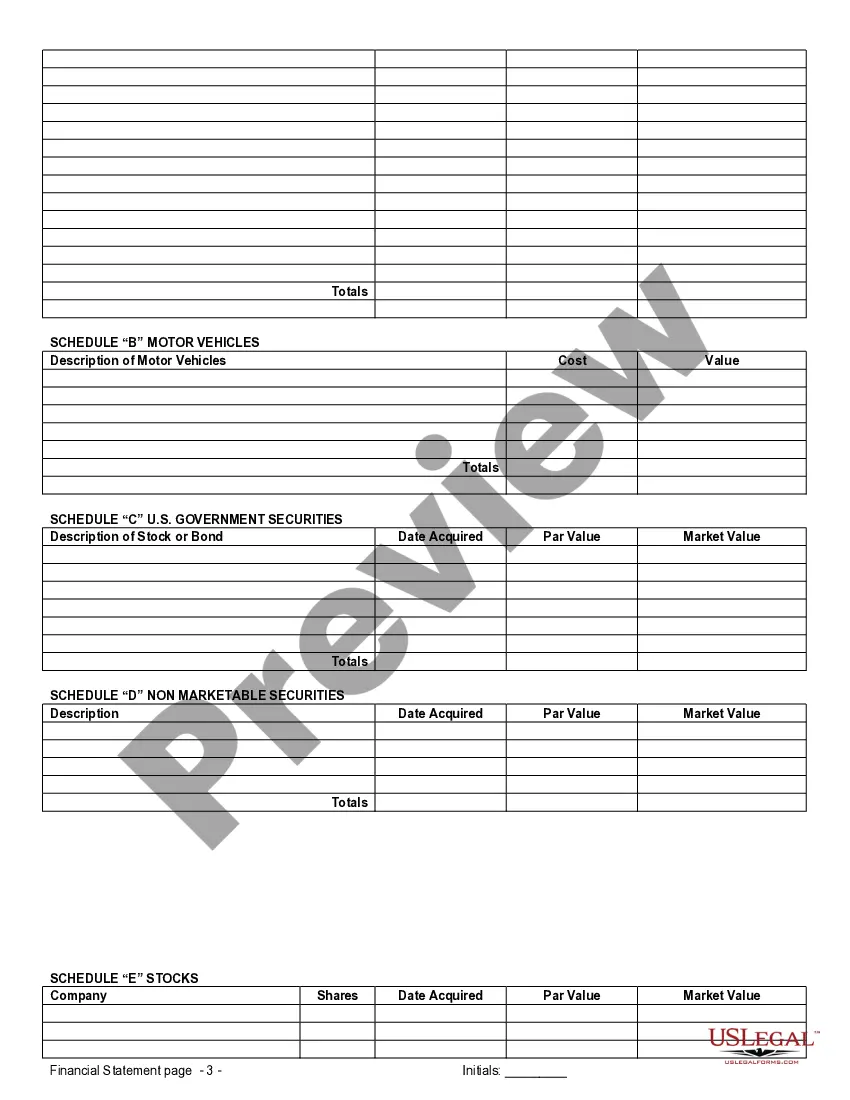

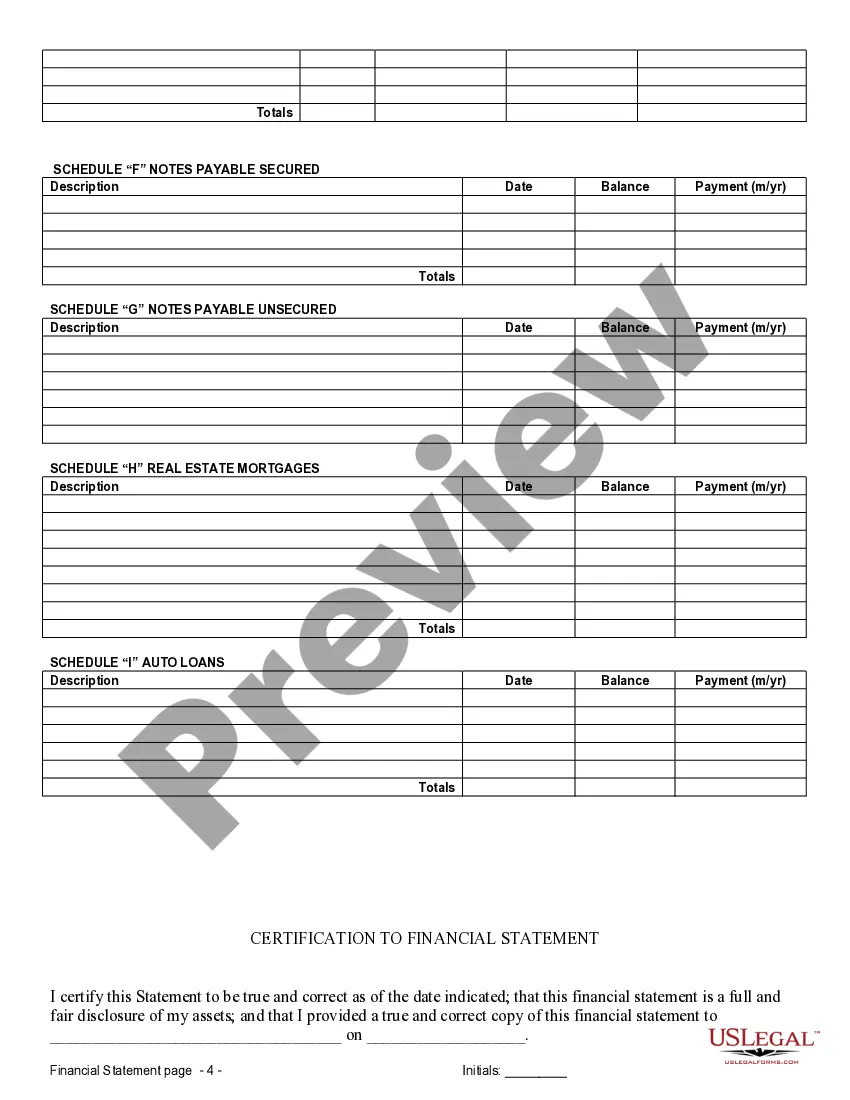

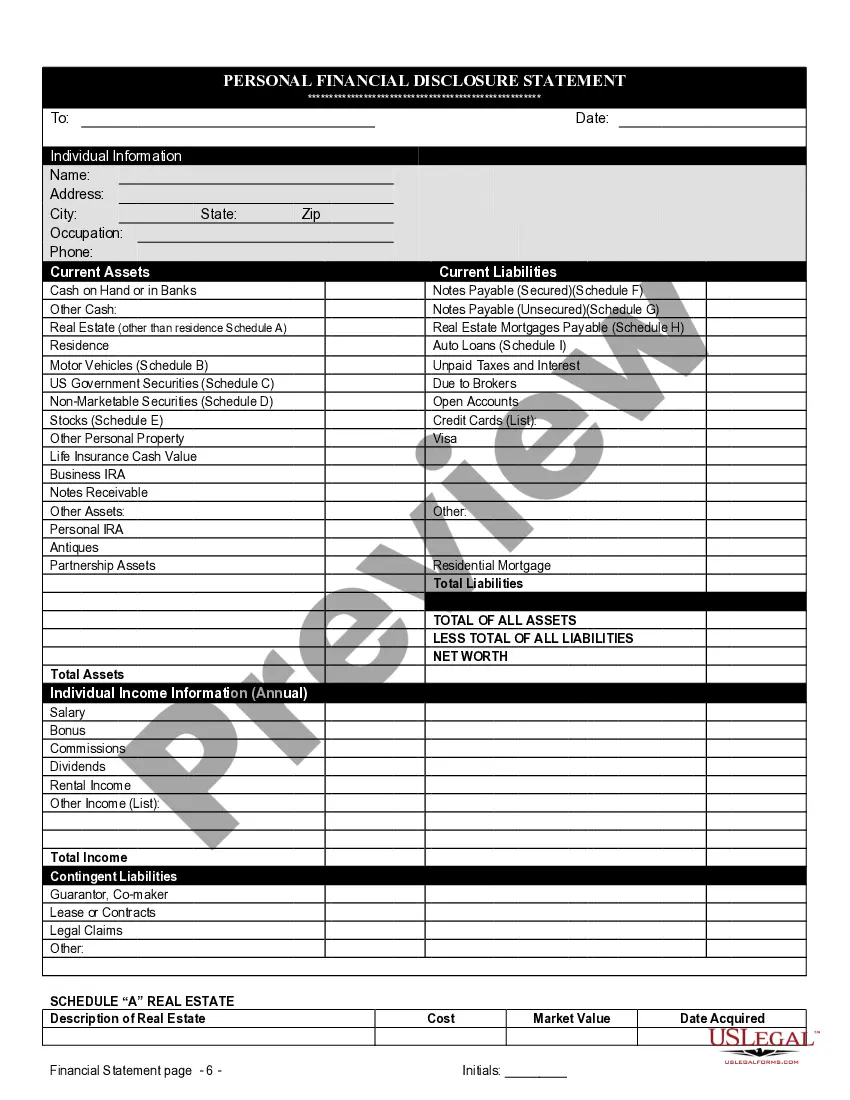

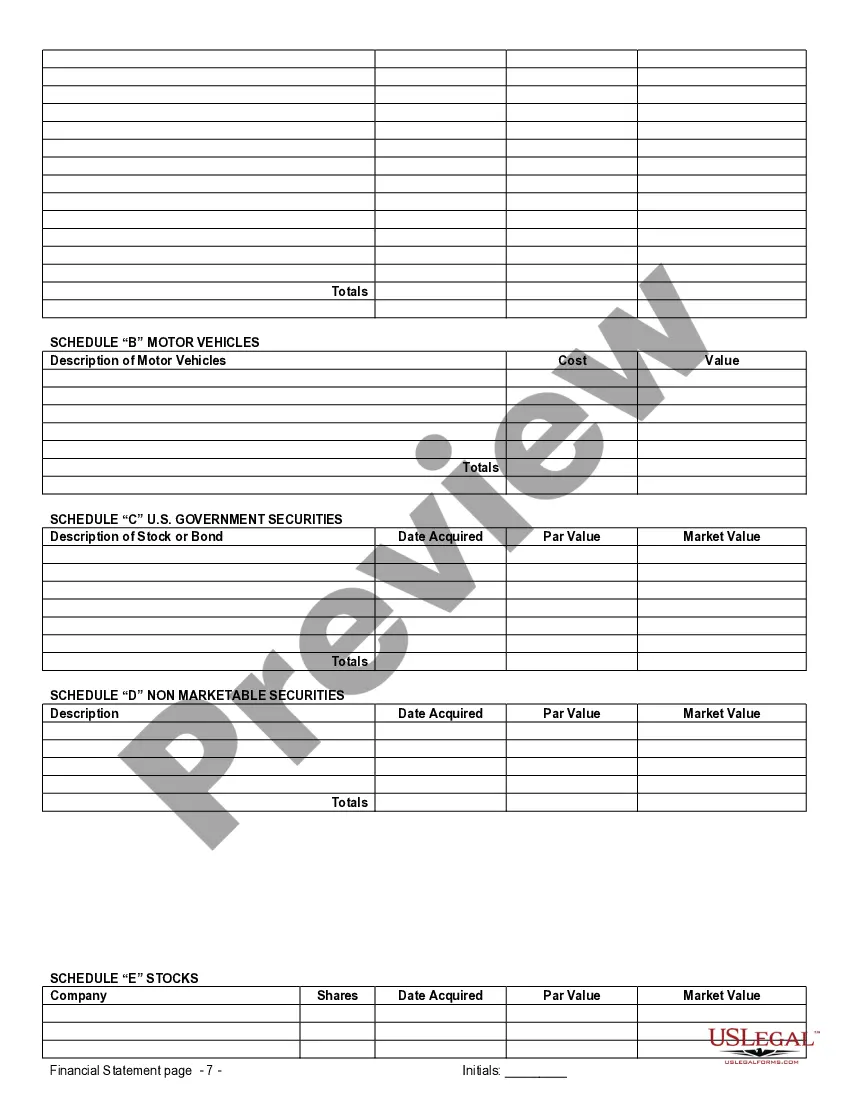

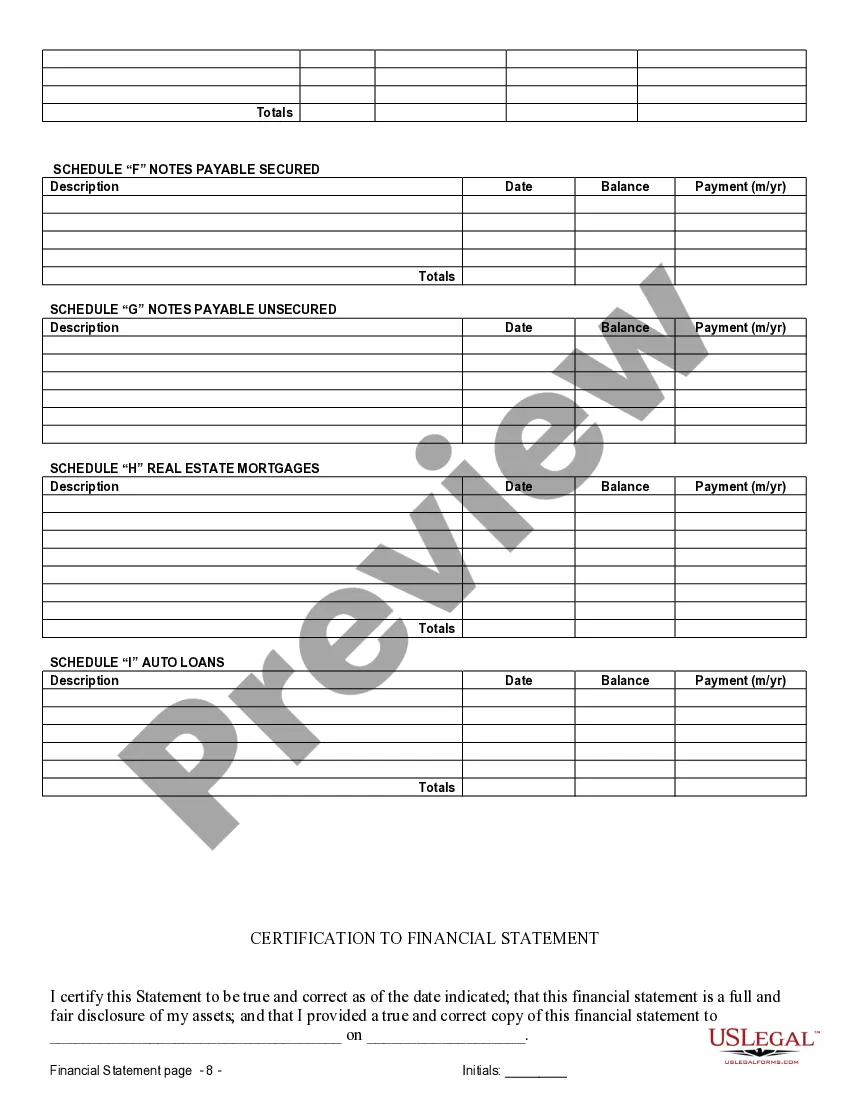

Charlotte North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement refer to the detailed documentation of an individual or couple's financial status when entering into a prenuptial agreement. Prenuptial agreements are legal contracts created by couples prior to marriage, outlining the division of assets, debts, and financial responsibilities in the event of divorce, separation, or death. There are several types of financial statements that can be included in a prenuptial agreement in Charlotte, North Carolina. These statements are essential to provide a comprehensive overview of each party's financial situation. The type of financial statement utilized may vary depending on the complexity of the individual or couple's financial affairs. 1. Income Statements: Also known as profit and loss statements, income statements provide a summary of the individual or couple's income, expenses, and net profit or loss over a specified time period. This statement includes details regarding sources of income such as salary, investments, dividends, rental income, and any other revenue streams. 2. Balance Sheets: Balance sheets provide a snapshot of an individual or couple's financial position by summarizing their assets, liabilities, and net worth at a specific point in time. Key components of a balance sheet may include real estate properties, vehicles, bank accounts, retirement accounts, investments, loans, and debts. 3. Tax Returns: Copies of recent tax returns, including both federal and state filings, are commonly included in financial statements for prenuptial agreements. Tax returns furnish crucial information about the individual or couple's income, deductions, credits, and tax liabilities. These documents help establish the parties' financial obligations and potential tax considerations. 4. Bank Statements: Bank statements provide an overview of an individual or couple's cash flow by documenting deposits, withdrawals, and transactions in their bank accounts over a specified period. This statement helps provide clarity on spending habits, cash reserves, and existing financial obligations. 5. Investment Statements: Investment statements provide detailed information about an individual or couple's investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and other financial assets. These statements outline the market value of investments, interest or dividend income, and any realized or unrealized gains or losses. 6. Debt Statements: Debt statements detail any outstanding debts, such as credit card balances, mortgages, car loans, student loans, or personal loans. This statement provides a comprehensive view of the individual or couple's liabilities and any existing financial obligations. It is important to note that the specific types of financial statements included in a prenuptial agreement may vary based on the circumstances and preferences of the parties involved. Consulting with an attorney or financial advisor experienced in family law and prenuptial agreements can help determine the necessary financial statements required for an agreement in Charlotte, North Carolina.

Charlotte North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

North Carolina

City:

Charlotte

Control #:

NC-00590-D

Format:

Word;

Rich Text

Instant download

Description

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Charlotte North Carolina Financial Statements in Connection with Prenuptial Premarital Agreement refer to the detailed documentation of an individual or couple's financial status when entering into a prenuptial agreement. Prenuptial agreements are legal contracts created by couples prior to marriage, outlining the division of assets, debts, and financial responsibilities in the event of divorce, separation, or death. There are several types of financial statements that can be included in a prenuptial agreement in Charlotte, North Carolina. These statements are essential to provide a comprehensive overview of each party's financial situation. The type of financial statement utilized may vary depending on the complexity of the individual or couple's financial affairs. 1. Income Statements: Also known as profit and loss statements, income statements provide a summary of the individual or couple's income, expenses, and net profit or loss over a specified time period. This statement includes details regarding sources of income such as salary, investments, dividends, rental income, and any other revenue streams. 2. Balance Sheets: Balance sheets provide a snapshot of an individual or couple's financial position by summarizing their assets, liabilities, and net worth at a specific point in time. Key components of a balance sheet may include real estate properties, vehicles, bank accounts, retirement accounts, investments, loans, and debts. 3. Tax Returns: Copies of recent tax returns, including both federal and state filings, are commonly included in financial statements for prenuptial agreements. Tax returns furnish crucial information about the individual or couple's income, deductions, credits, and tax liabilities. These documents help establish the parties' financial obligations and potential tax considerations. 4. Bank Statements: Bank statements provide an overview of an individual or couple's cash flow by documenting deposits, withdrawals, and transactions in their bank accounts over a specified period. This statement helps provide clarity on spending habits, cash reserves, and existing financial obligations. 5. Investment Statements: Investment statements provide detailed information about an individual or couple's investment portfolio, including stocks, bonds, mutual funds, retirement accounts, and other financial assets. These statements outline the market value of investments, interest or dividend income, and any realized or unrealized gains or losses. 6. Debt Statements: Debt statements detail any outstanding debts, such as credit card balances, mortgages, car loans, student loans, or personal loans. This statement provides a comprehensive view of the individual or couple's liabilities and any existing financial obligations. It is important to note that the specific types of financial statements included in a prenuptial agreement may vary based on the circumstances and preferences of the parties involved. Consulting with an attorney or financial advisor experienced in family law and prenuptial agreements can help determine the necessary financial statements required for an agreement in Charlotte, North Carolina.

Free preview

How to fill out Charlotte North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the records are correctly organized by category of use and jurisdictional regions, making the search for the Charlotte North Carolina Financial Statements related to Prenuptial Premarital Agreement as quick and effortless as pie.

Maintaining documents organized and compliant with legal stipulations is critically important. Utilize the US Legal Forms library to have essential document templates readily available for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the appropriate one that satisfies your requirements and fully aligns with your local jurisdiction standards.

- Search for another template, if necessary.

- If you notice any discrepancies, make use of the Search tab above to find the correct one.

- If it meets your needs, proceed to the subsequent step.