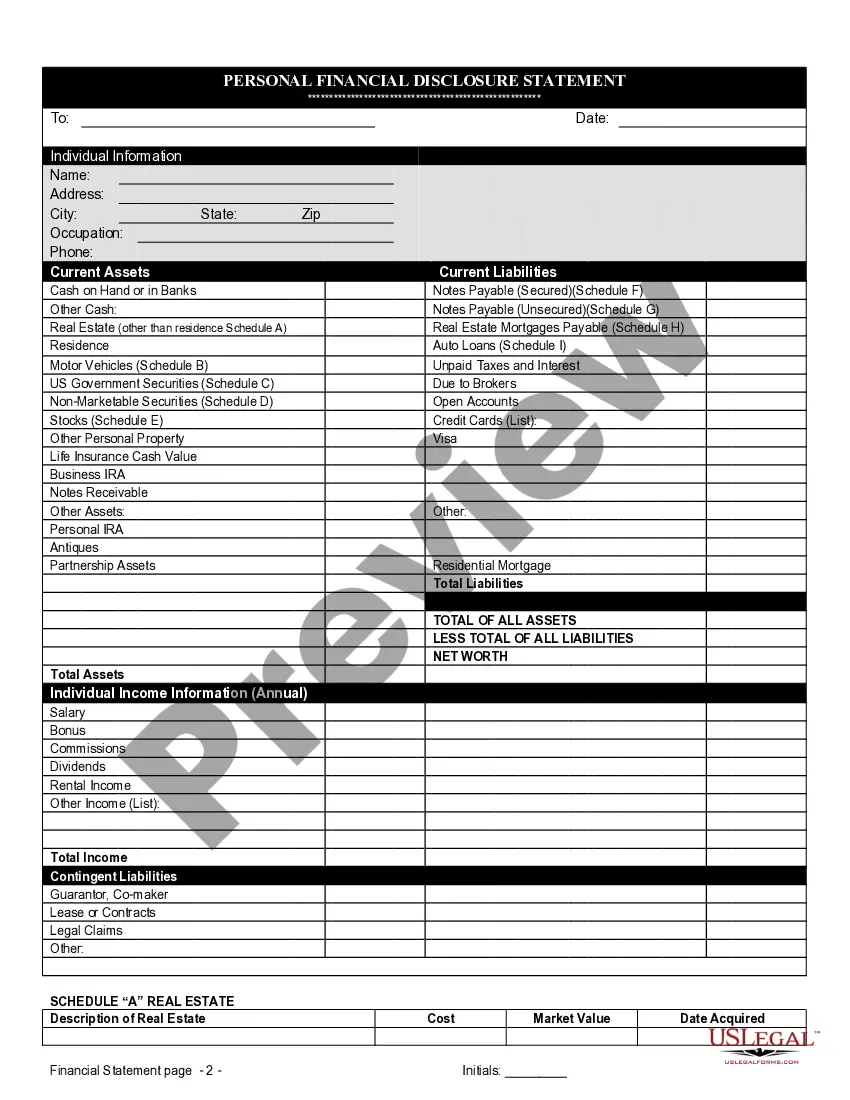

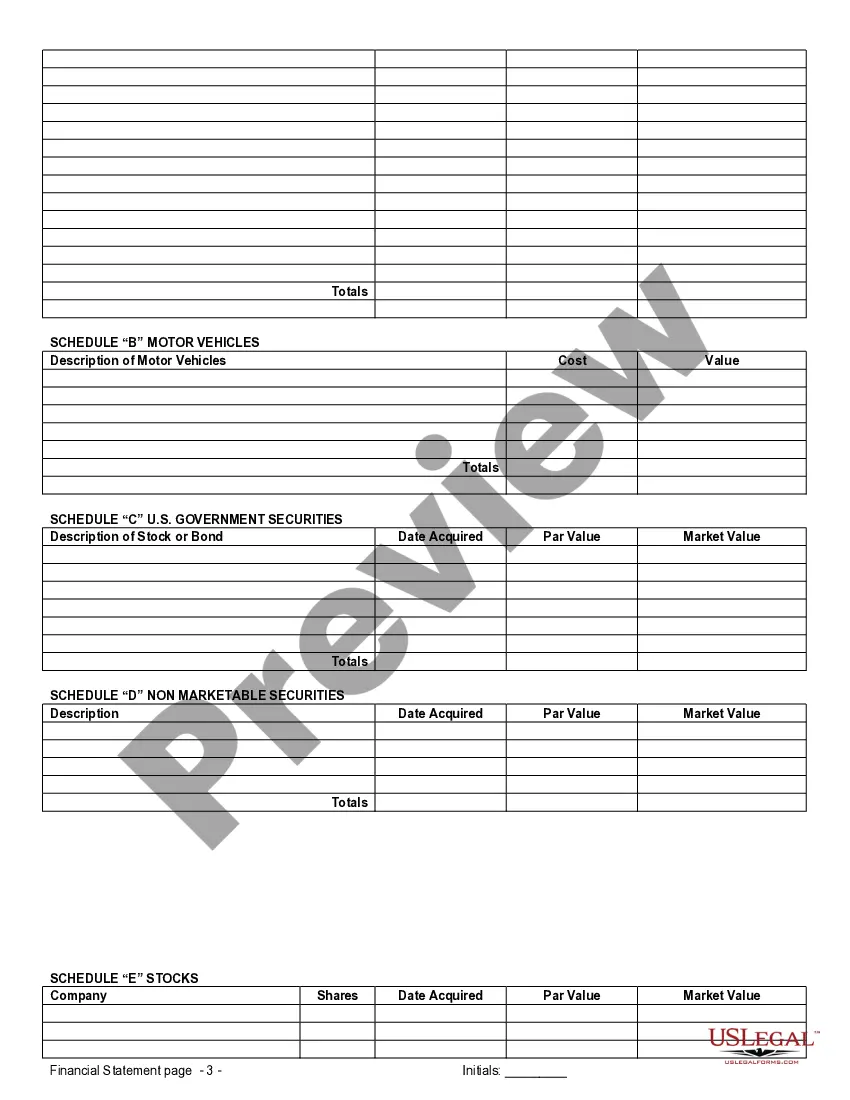

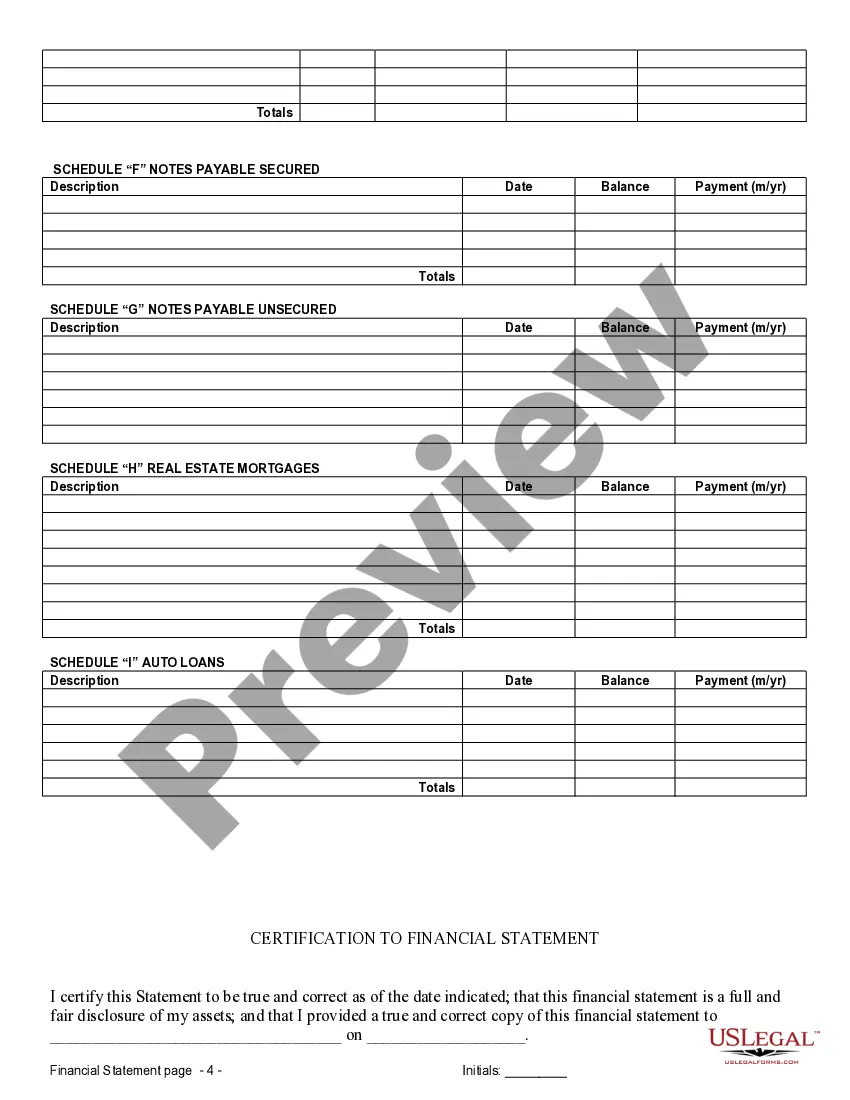

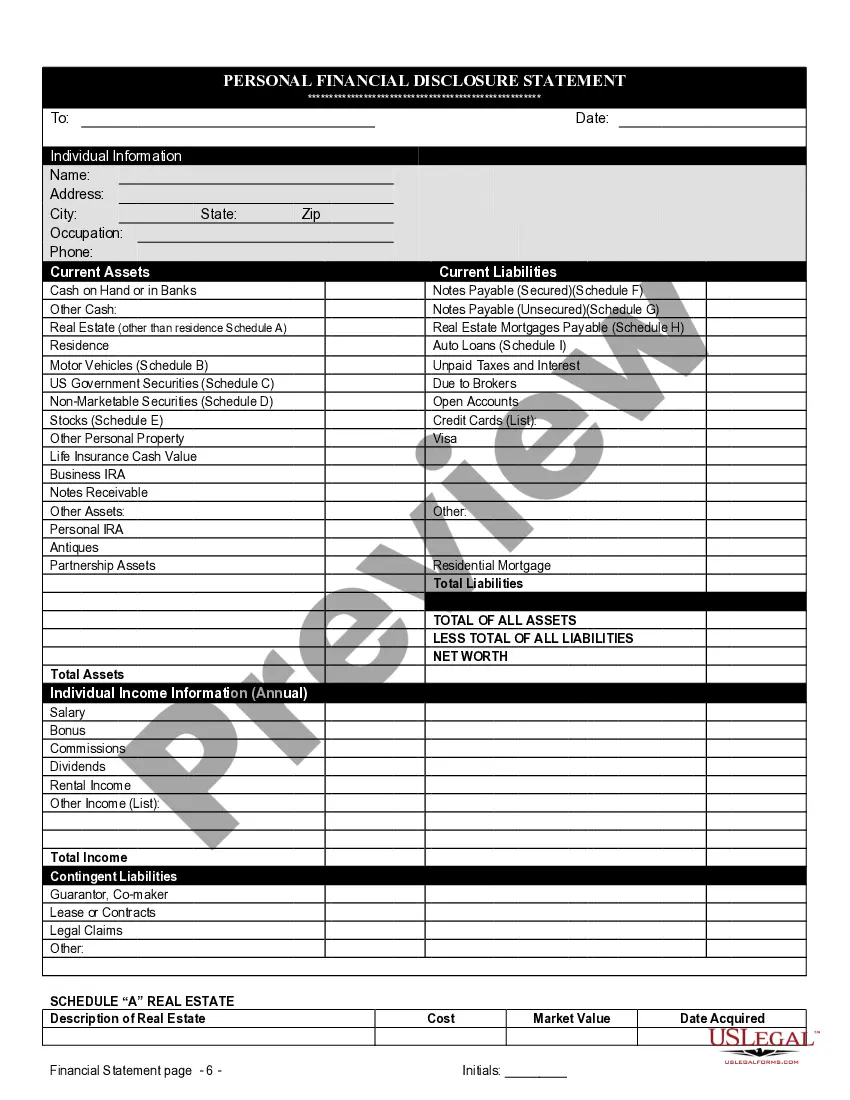

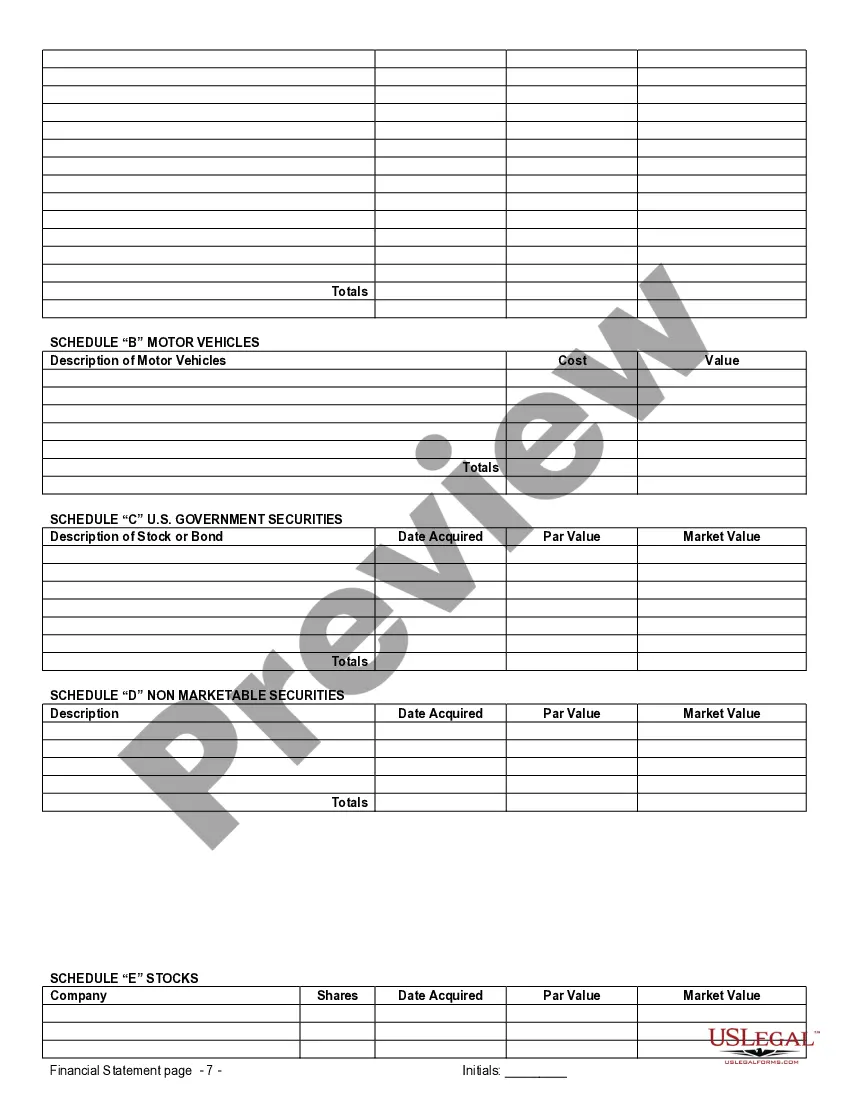

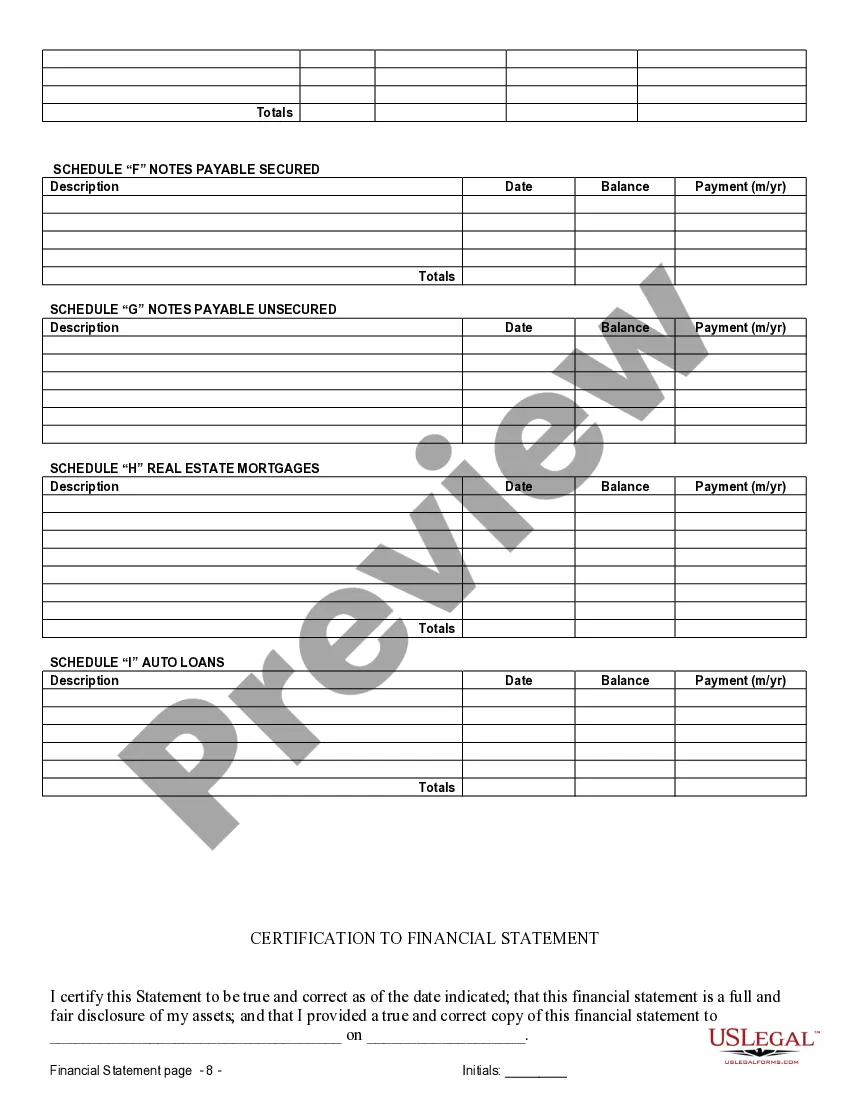

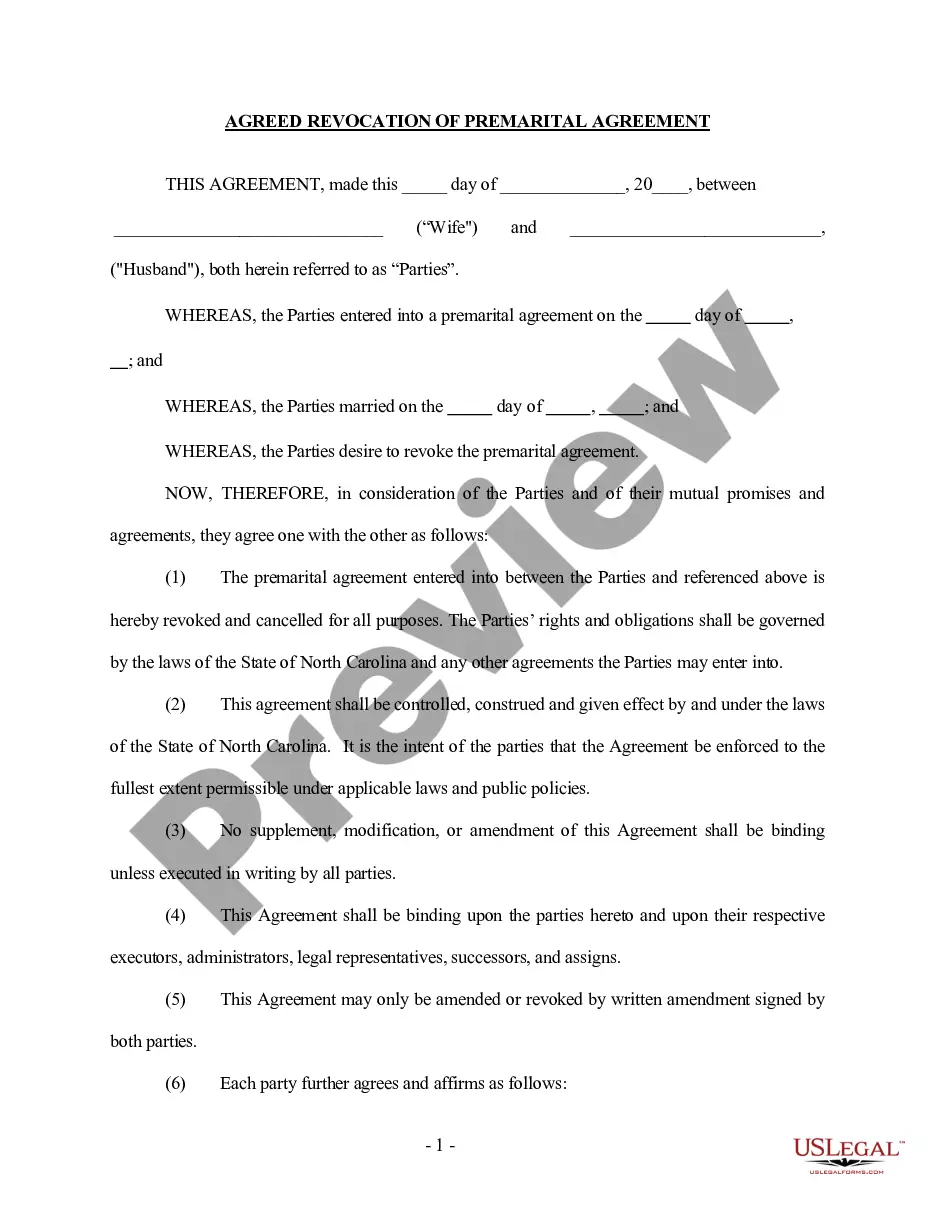

In Fayetteville, North Carolina, financial statements play a crucial role when considering a prenuptial or premarital agreement. These statements serve as a comprehensive snapshot of each party's financial standing prior to entering into the marital union. By including relevant keywords, we can delve into the meaning and types of financial statements used in connection with prenuptial or premarital agreements in Fayetteville. 1. Definition of Fayetteville, North Carolina Financial Statements in connection with Prenuptial Premarital Agreements: Financial statements in Fayetteville, North Carolina, are comprehensive documents used to outline the assets, debts, income, and expenses of individuals who are considering entering into a prenuptial or premarital agreement. These statements are carefully prepared and analyzed to ensure both parties have a clear understanding of each other's financial positions before entering into a legal contract. 2. Keyword 1: Prenuptial Agreement A prenuptial agreement, also known as a premarital agreement, is a legally binding contract entered into by a couple before getting married. It addresses various aspects of the marriage, including the division of assets and debts in the event of divorce, spousal support, and inheritance rights. In Fayetteville, North Carolina, financial statements play a vital role in creating a fair prenuptial agreement. 3. Keyword 2: Assets refer to any valuable possessions or property owned by either individual entering into a prenuptial agreement. It includes, but is not limited to, real estate, vehicles, investments, business ownership, bank accounts, and personal belongings. Fayetteville, North Carolina financial statements help disclose the value and ownership of these assets, laying the groundwork for equitable division if needed. 4. Keyword 3: Debts encompass any outstanding obligations owed by an individual before entering into the prenuptial agreement. This could include mortgages, loans from financial institutions, credit card debt, or obligations related to businesses. Including debts in Fayetteville's financial statements provides transparency, making it easier to determine which party will be responsible for these obligations in the event of divorce. 5. Keyword 4: Income refers to the regular monetary flow received by an individual, including salary, wages, bonuses, dividends, rental income, or profits from investments. Fayetteville financial statements highlight income sources, allowing both parties to understand their respective earnings and any potential disparities. 6. Keyword 5: Expenses encompass all individual expenditures, such as monthly bills, loan payments, living expenses, and personal spending. By documenting expenses in Fayetteville financial statements, both parties gain insight into the financial responsibilities and spending habits of each other. Different types of financial statements may be utilized in Fayetteville, North Carolina in connection with prenuptial or premarital agreements, including: — Personal Balance Sheets: These statements provide an overview of an individual's assets, liabilities, and net worth. They include a list of owned properties, investments, bank accounts, and outstanding debts. — Income Statements: Also known as profit and loss statements, these documents outline an individual's revenue, expenses, and net income over a specific period. They are particularly essential when determining spousal support or alimony in the case of divorce. — Bank Statements: These statements reflect the record of transactions and balances in a person's bank account over a particular period. They offer a detailed look at income, expenses, and saving habits, validating the accuracy of financial claims made in the prenuptial agreement. It is important to consult with legal professionals in Fayetteville, North Carolina, when drafting and reviewing financial statements in connection with prenuptial or premarital agreements. These experts can ensure the accuracy, legality, and fairness of the documents to protect the interests of both parties involved.

In Fayetteville, North Carolina, financial statements play a crucial role when considering a prenuptial or premarital agreement. These statements serve as a comprehensive snapshot of each party's financial standing prior to entering into the marital union. By including relevant keywords, we can delve into the meaning and types of financial statements used in connection with prenuptial or premarital agreements in Fayetteville. 1. Definition of Fayetteville, North Carolina Financial Statements in connection with Prenuptial Premarital Agreements: Financial statements in Fayetteville, North Carolina, are comprehensive documents used to outline the assets, debts, income, and expenses of individuals who are considering entering into a prenuptial or premarital agreement. These statements are carefully prepared and analyzed to ensure both parties have a clear understanding of each other's financial positions before entering into a legal contract. 2. Keyword 1: Prenuptial Agreement A prenuptial agreement, also known as a premarital agreement, is a legally binding contract entered into by a couple before getting married. It addresses various aspects of the marriage, including the division of assets and debts in the event of divorce, spousal support, and inheritance rights. In Fayetteville, North Carolina, financial statements play a vital role in creating a fair prenuptial agreement. 3. Keyword 2: Assets refer to any valuable possessions or property owned by either individual entering into a prenuptial agreement. It includes, but is not limited to, real estate, vehicles, investments, business ownership, bank accounts, and personal belongings. Fayetteville, North Carolina financial statements help disclose the value and ownership of these assets, laying the groundwork for equitable division if needed. 4. Keyword 3: Debts encompass any outstanding obligations owed by an individual before entering into the prenuptial agreement. This could include mortgages, loans from financial institutions, credit card debt, or obligations related to businesses. Including debts in Fayetteville's financial statements provides transparency, making it easier to determine which party will be responsible for these obligations in the event of divorce. 5. Keyword 4: Income refers to the regular monetary flow received by an individual, including salary, wages, bonuses, dividends, rental income, or profits from investments. Fayetteville financial statements highlight income sources, allowing both parties to understand their respective earnings and any potential disparities. 6. Keyword 5: Expenses encompass all individual expenditures, such as monthly bills, loan payments, living expenses, and personal spending. By documenting expenses in Fayetteville financial statements, both parties gain insight into the financial responsibilities and spending habits of each other. Different types of financial statements may be utilized in Fayetteville, North Carolina in connection with prenuptial or premarital agreements, including: — Personal Balance Sheets: These statements provide an overview of an individual's assets, liabilities, and net worth. They include a list of owned properties, investments, bank accounts, and outstanding debts. — Income Statements: Also known as profit and loss statements, these documents outline an individual's revenue, expenses, and net income over a specific period. They are particularly essential when determining spousal support or alimony in the case of divorce. — Bank Statements: These statements reflect the record of transactions and balances in a person's bank account over a particular period. They offer a detailed look at income, expenses, and saving habits, validating the accuracy of financial claims made in the prenuptial agreement. It is important to consult with legal professionals in Fayetteville, North Carolina, when drafting and reviewing financial statements in connection with prenuptial or premarital agreements. These experts can ensure the accuracy, legality, and fairness of the documents to protect the interests of both parties involved.