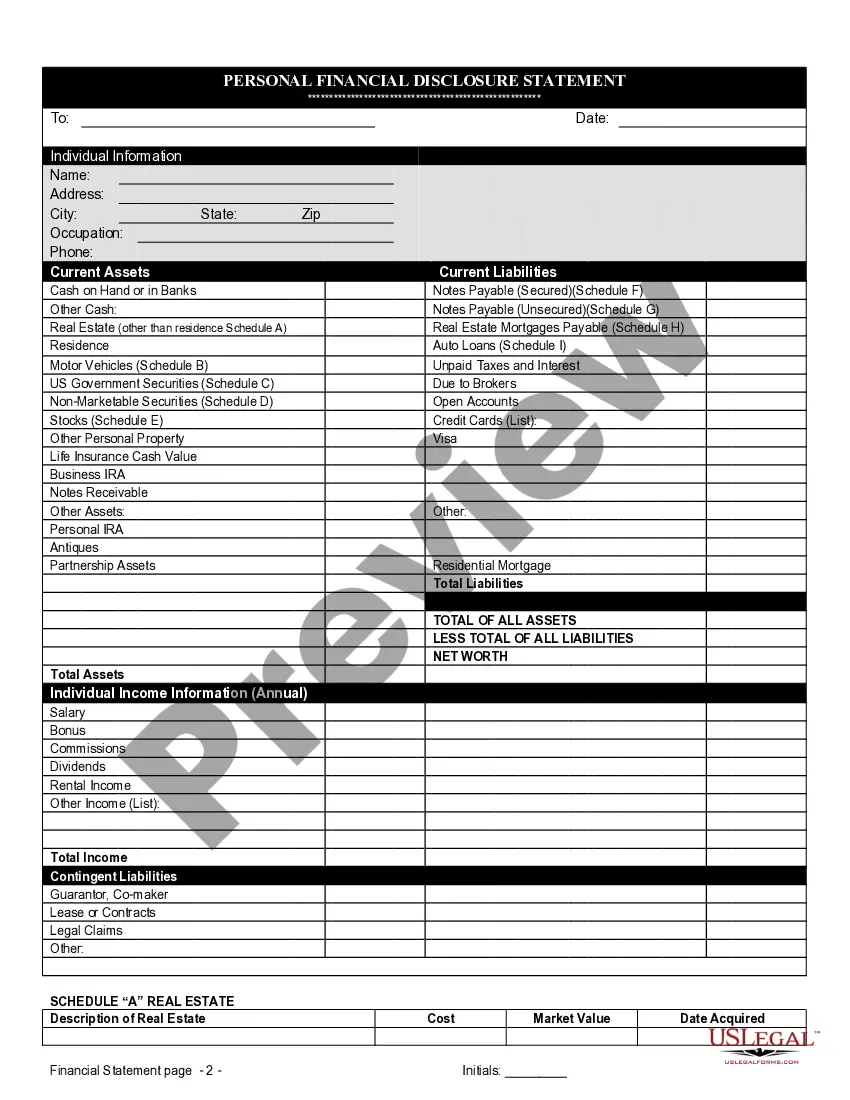

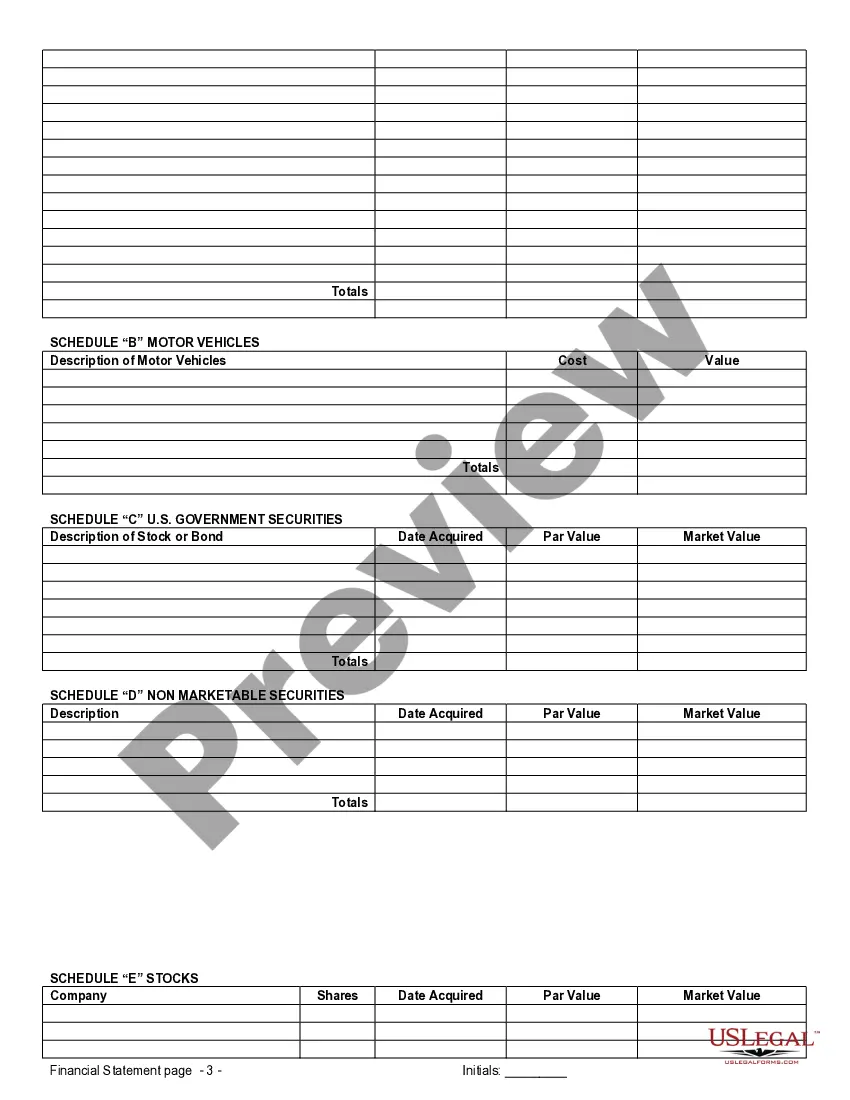

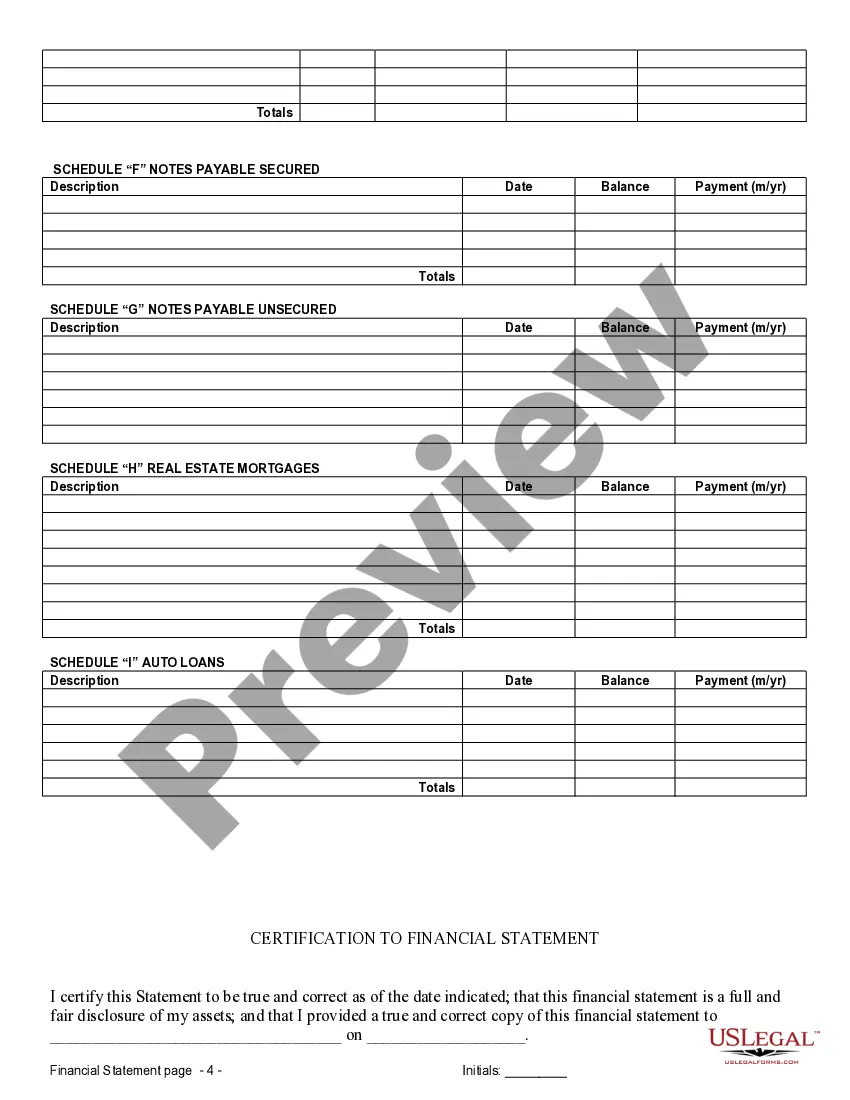

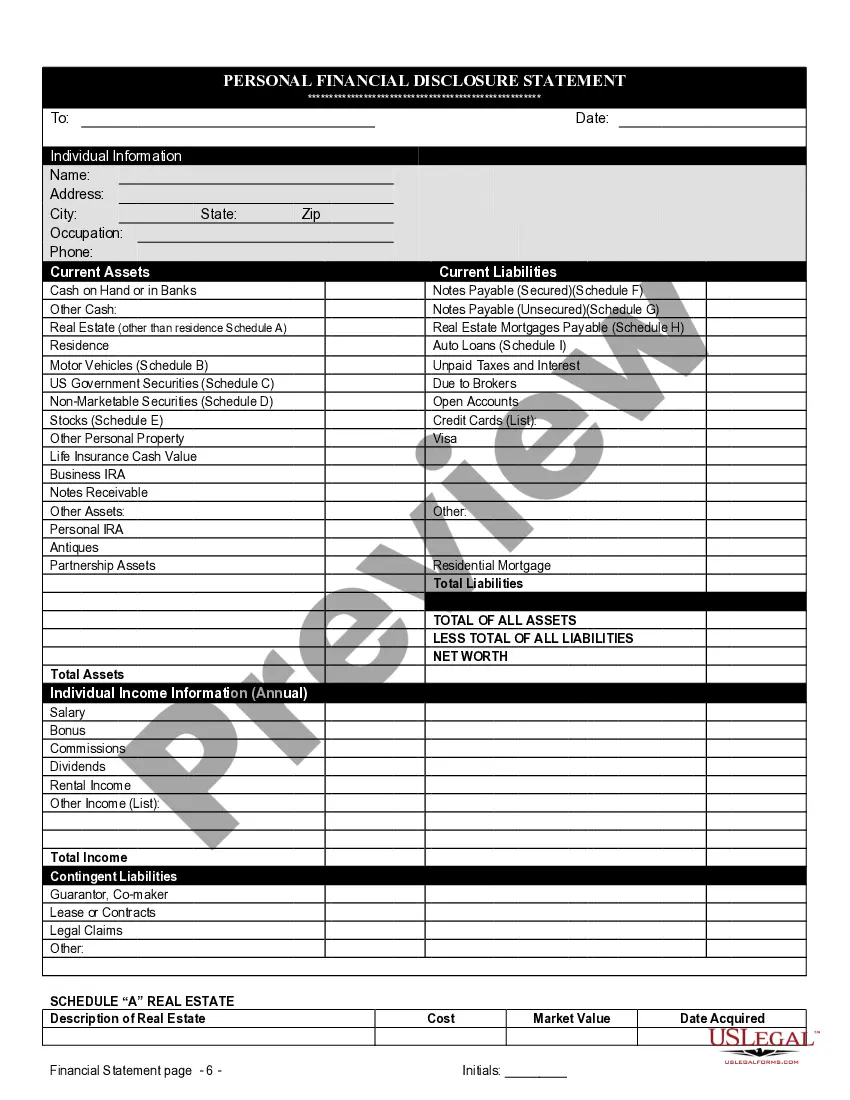

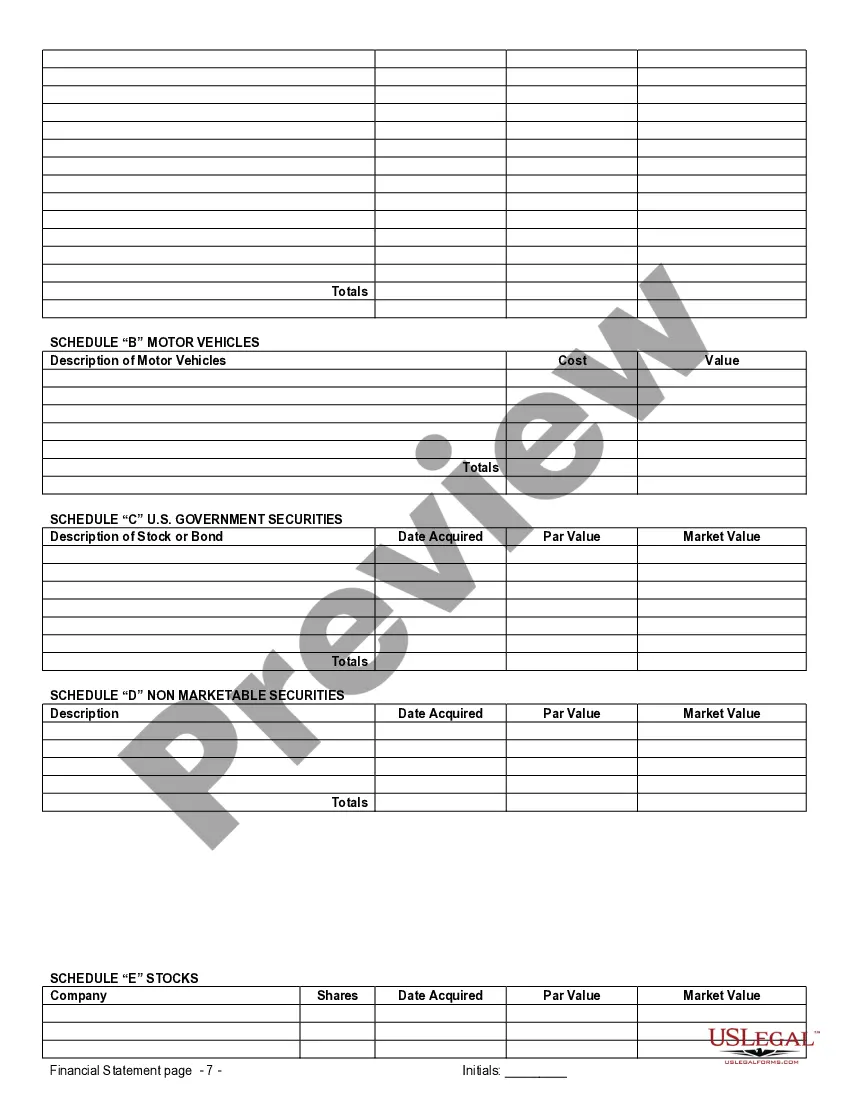

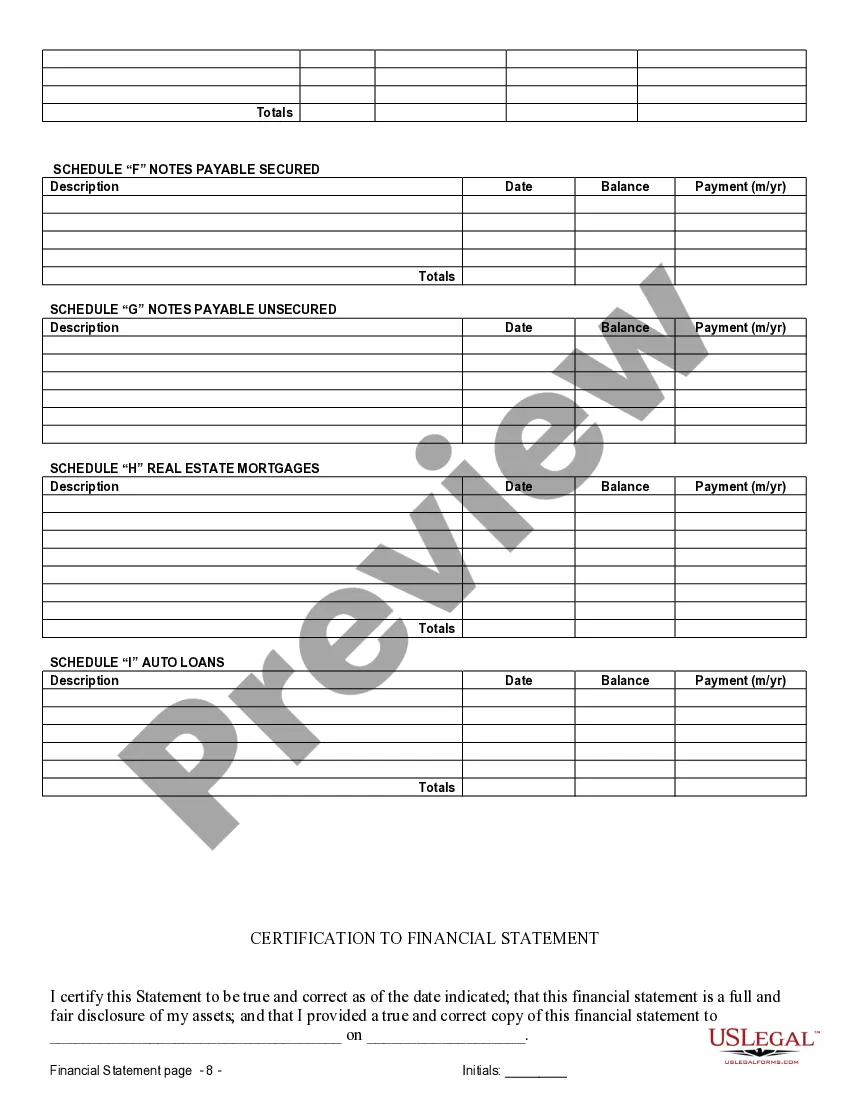

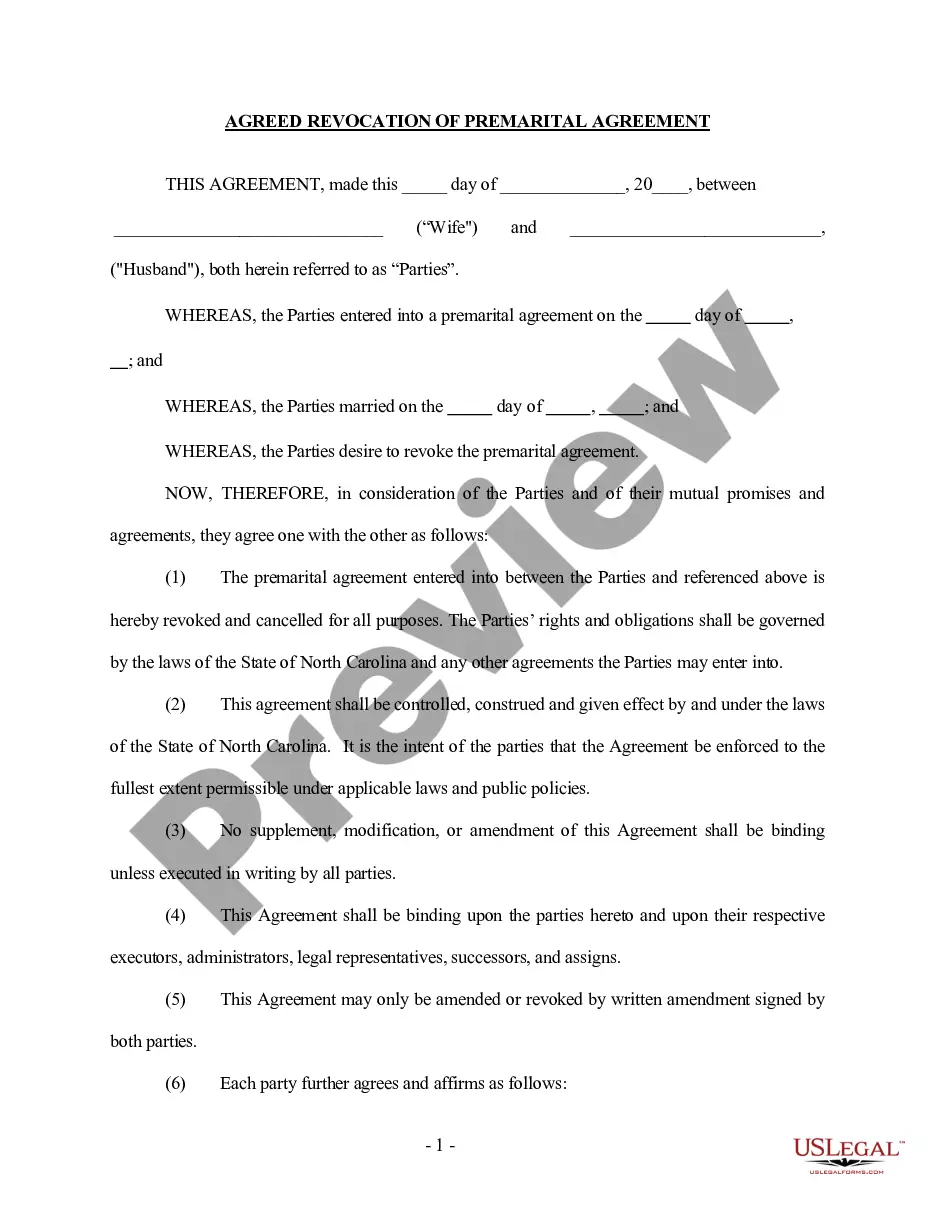

Greensboro North Carolina Financial Statements, when used in connection with a prenuptial or premarital agreement, are essential documents that provide a detailed overview of an individual's financial situation. These statements outline one's assets, liabilities, income, and expenses, helping establish a comprehensive understanding of their financial standing before entering into marriage. There are several types of Greensboro North Carolina Financial Statements commonly used in connection with a prenuptial or premarital agreement: 1. Personal Financial Statement: This document provides a holistic picture of an individual's financial situation, including their income, savings, investments, real estate holdings, outstanding debts, and monthly expenses. It is typically used to assess an individual's net worth and financial stability. 2. Business Financial Statement: In cases where one or both parties own a business, this statement presents a detailed overview of the company's financial health. It includes information regarding assets, liabilities, cash flow, revenue, and expenses. A business financial statement helps determine the value of the venture and the contribution it may have on the couple's overall financial arrangement. 3. Bank Statements: These documents reflect an individual's monthly transactions, including deposits, withdrawals, and account balances. Bank statements play a crucial role in verifying the accuracy of financial information provided in other statements and ensure transparency during the prenuptial agreement process. 4. Investment Statements: If either party owns investments such as stocks, bonds, or mutual funds, investment statements provide relevant information such as portfolio holdings, valuation, returns, and any associated income or expenses. These statements assist in evaluating the potential growth and risk involved with the investments. 5. Retirement Account Statements: These documents detail an individual's retirement savings and include information about individual retirement accounts (IRAs), 401(k) plans, pensions, and other retirement vehicles. Retirement account statements help determine each party's future financial security and assist in devising fair division of assets or planning for spousal support. 6. Real Estate Documents: If either party owns real estate properties, relevant documents like deeds, mortgage statements, and property appraisals assist in accurately assessing the value and equity of the properties. These statements play a critical role in determining the division of real estate assets in the event of a divorce. Properly preparing Greensboro North Carolina Financial Statements in connection with a prenuptial or premarital agreement is crucial, as they establish a clear understanding of each party's financial position and protect their respective rights. It is advisable to seek the assistance of a qualified attorney or financial professional to ensure completeness and accuracy when preparing these statements.

Greensboro North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

North Carolina

City:

Greensboro

Control #:

NC-00590-D

Format:

Word;

Rich Text

Instant download

Description

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Greensboro North Carolina Financial Statements, when used in connection with a prenuptial or premarital agreement, are essential documents that provide a detailed overview of an individual's financial situation. These statements outline one's assets, liabilities, income, and expenses, helping establish a comprehensive understanding of their financial standing before entering into marriage. There are several types of Greensboro North Carolina Financial Statements commonly used in connection with a prenuptial or premarital agreement: 1. Personal Financial Statement: This document provides a holistic picture of an individual's financial situation, including their income, savings, investments, real estate holdings, outstanding debts, and monthly expenses. It is typically used to assess an individual's net worth and financial stability. 2. Business Financial Statement: In cases where one or both parties own a business, this statement presents a detailed overview of the company's financial health. It includes information regarding assets, liabilities, cash flow, revenue, and expenses. A business financial statement helps determine the value of the venture and the contribution it may have on the couple's overall financial arrangement. 3. Bank Statements: These documents reflect an individual's monthly transactions, including deposits, withdrawals, and account balances. Bank statements play a crucial role in verifying the accuracy of financial information provided in other statements and ensure transparency during the prenuptial agreement process. 4. Investment Statements: If either party owns investments such as stocks, bonds, or mutual funds, investment statements provide relevant information such as portfolio holdings, valuation, returns, and any associated income or expenses. These statements assist in evaluating the potential growth and risk involved with the investments. 5. Retirement Account Statements: These documents detail an individual's retirement savings and include information about individual retirement accounts (IRAs), 401(k) plans, pensions, and other retirement vehicles. Retirement account statements help determine each party's future financial security and assist in devising fair division of assets or planning for spousal support. 6. Real Estate Documents: If either party owns real estate properties, relevant documents like deeds, mortgage statements, and property appraisals assist in accurately assessing the value and equity of the properties. These statements play a critical role in determining the division of real estate assets in the event of a divorce. Properly preparing Greensboro North Carolina Financial Statements in connection with a prenuptial or premarital agreement is crucial, as they establish a clear understanding of each party's financial position and protect their respective rights. It is advisable to seek the assistance of a qualified attorney or financial professional to ensure completeness and accuracy when preparing these statements.

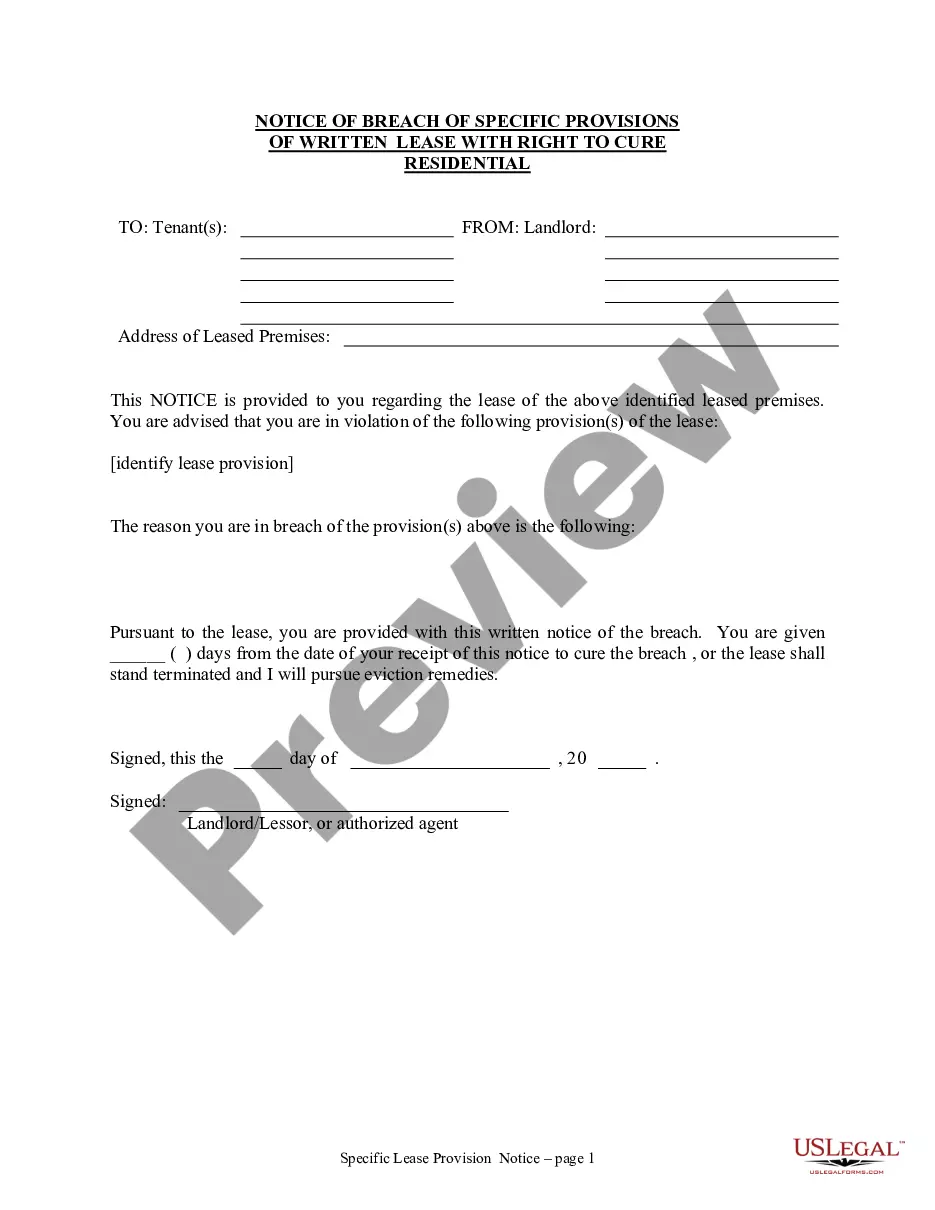

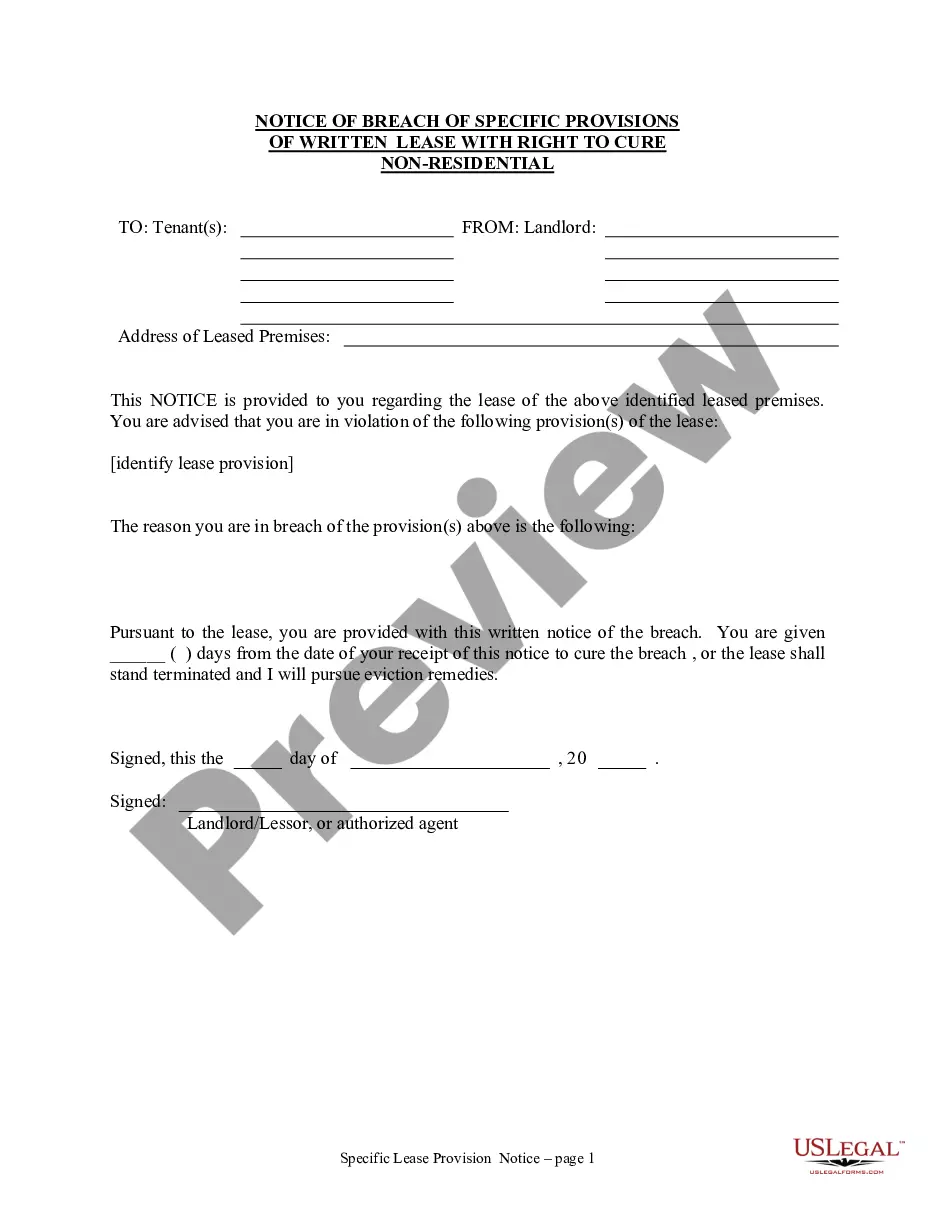

Free preview

How to fill out Greensboro North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you’ve already used our service before, log in to your account and save the Greensboro North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Greensboro North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!